Discovery Bioanalysis Market Summary, Size & Emerging Trends

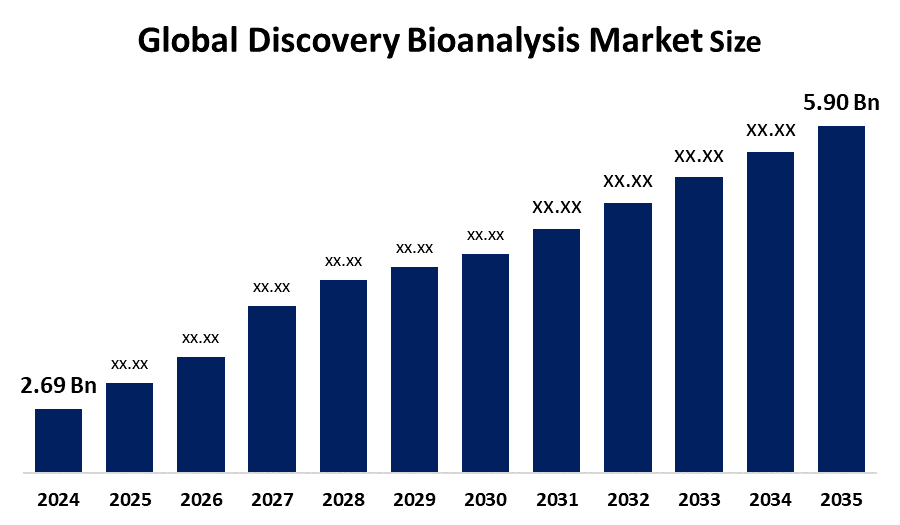

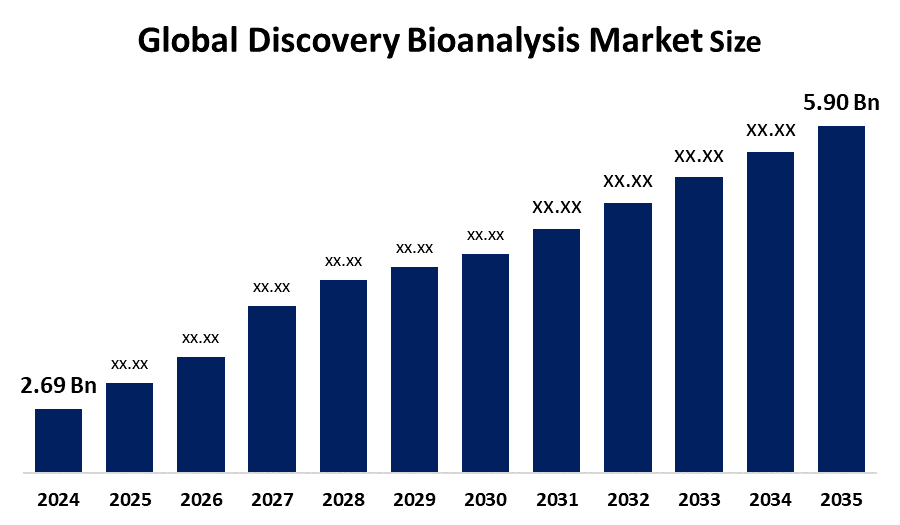

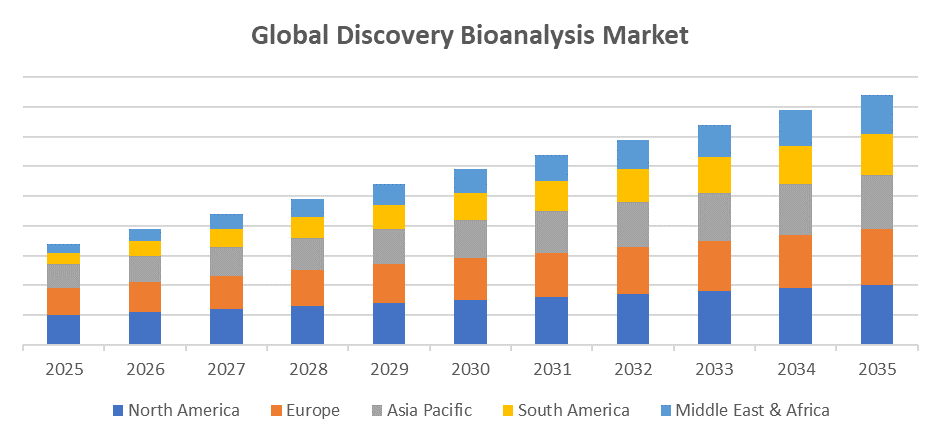

According to Spherical Insights, the Global Discovery Bioanalysis Market Size is Expected To Grow from USD 2.69 Billion in 2024 to USD 5.90 Billion by 2035, at a CAGR of 7.4% during the forecast period 2025-2035. The market is expanding due to increasing investments in pharmaceutical research and development.

Key Market Insights

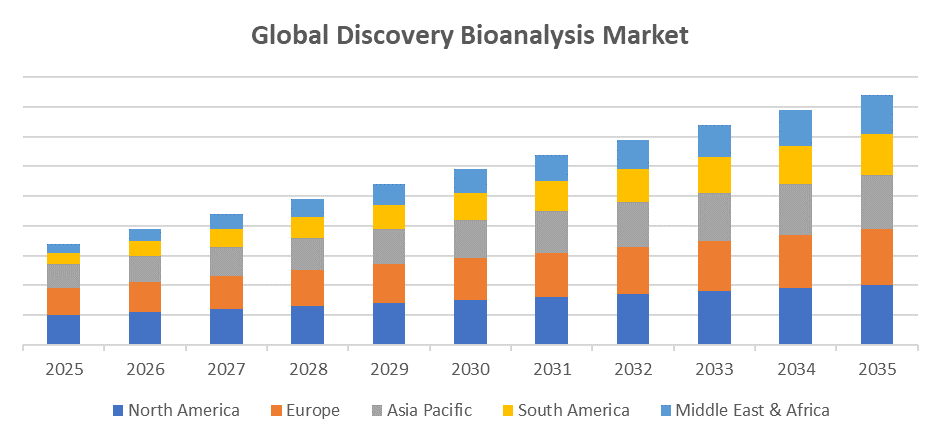

- North America is expected to account for the largest share in the discovery bioanalysis market during the forecast period.

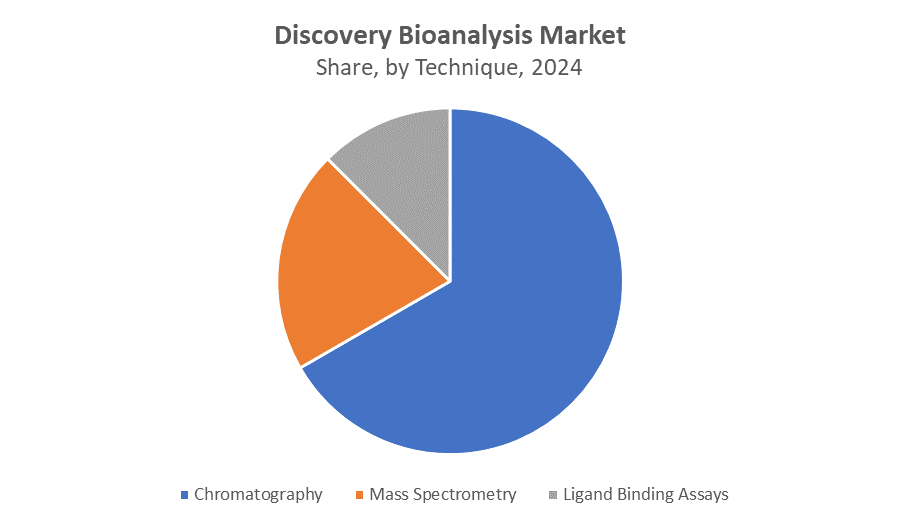

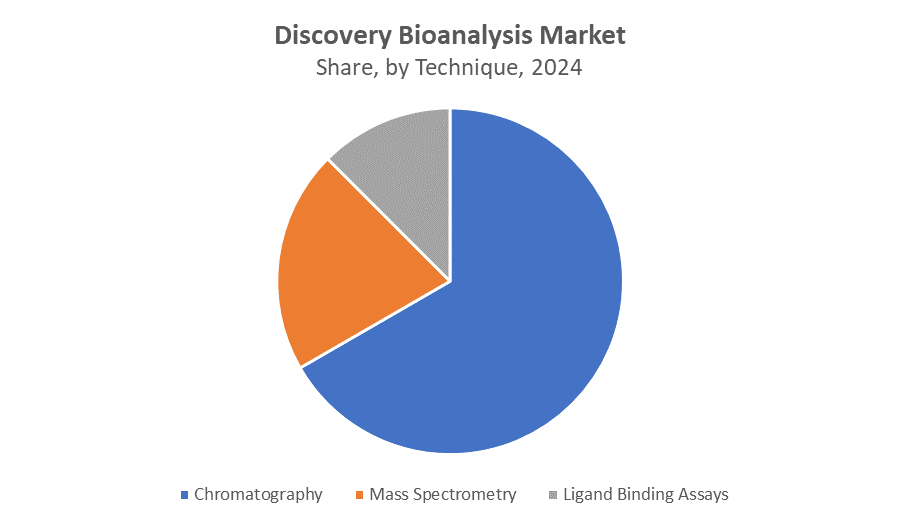

- In terms of technique, the chromatography segment is projected to lead the discovery bioanalysis market throughout the forecast period

- In terms of end-user, the pharmaceutical and biotechnology companies segment captured the largest portion of the discovery bioanalysis market

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.69 Billion

- 2035 Projected Market Size: USD 5.90 Billion

- CAGR (2025-2035): 7.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Discovery Bioanalysis Market

The global discovery bioanalysis market involves analyzing biological samples to support drug discovery and development processes. It is essential for identifying drug candidates, understanding pharmacokinetics, and ensuring drug safety and efficacy. The market is expanding due to increasing investments in pharmaceutical research and development, the rise of personalized medicine, and advancements in analytical techniques like liquid chromatography-mass spectrometry (LC-MS/MS). Government initiatives play a significant role in market growth, with agencies such as the U.S. FDA and European Medicines Agency providing guidelines to standardize bioanalytical methods. Additionally, funding programs from institutions like the National Institutes of Health (NIH) support innovation in bioanalysis and translational research. The increasing prevalence of chronic diseases worldwide also drives demand for new therapies, boosting the need for advanced bioanalytical services. Overall, the discovery bioanalysis market is growing rapidly, offering vital support to pharmaceutical and biotechnology companies in developing safer and more effective drugs globally.

Discovery Bioanalysis Market Trends

- Increasing use of high-resolution mass spectrometry, liquid chromatography-tandem mass spectrometry (LC-MS/MS), and nuclear magnetic resonance (NMR) to improve sensitivity, accuracy, and throughput in bioanalysis.

- Growing focus on precision medicine drives demand for tailored bioanalytical methods to analyze biomarkers and individual patient responses, enabling customized drug therapies.

- Pharmaceutical companies are increasingly outsourcing bioanalytical testing to CROs for cost-efficiency, faster turnaround, and access to specialized expertise.

- Stricter global regulatory frameworks and harmonized bioanalytical method validation guidelines ensure consistent, high-quality data supporting drug approvals and market access worldwide.

Discovery Bioanalysis Market Dynamics

Driving Factors: The growing prevalence of chronic diseases is driving demand in the discovery bioanalysis market

Rising demand for personalized medicine and biomarker identification fuels the need for advanced bioanalytical techniques. Technological advancements, such as enhanced mass spectrometry and automation, improve accuracy and efficiency. Government funding and supportive regulatory frameworks worldwide encourage innovation and method standardization. Additionally, the growing prevalence of chronic diseases and complex therapies, including biologics and gene therapies, creates a higher demand for precise bioanalysis. Expansion of contract research organizations (CROs) also supports market growth by offering specialized and scalable services.

Restrain Factors: Bioanalytical method development in the discovery bioanalysis market can delay timelines

Restraining factors in the discovery bioanalysis market include the high costs associated with advanced analytical instruments and skilled personnel, limiting accessibility for smaller companies. Complex and time-consuming bioanalytical method development can delay project timelines. Regulatory compliance requirements vary globally, adding complexity and increasing the risk of non-compliance. Additionally, data management and integration challenges arise due to large volumes of bioanalytical data. Limited standardization in emerging techniques may hinder widespread adoption. Finally, the risk of sample variability and the need for highly sensitive methods to detect low-concentration biomarkers can complicate bioanalysis, potentially slowing market growth.

Opportunity: Biosimilars and new delivery systems boost demand in the discovery bioanalysis market

The discovery bioanalysis market presents significant opportunities driven by advancements in biologics, gene therapies, and personalized medicine. As drug development shifts toward complex molecules and targeted therapies, there is growing demand for sensitive and specialized bioanalytical methods. Emerging markets, particularly in Asia-Pacific and Latin America, offer untapped potential due to increasing healthcare investments and expanding pharmaceutical sectors. The integration of artificial intelligence (AI) and machine learning (ML) in data analysis can enhance accuracy and streamline workflows. Additionally, the expansion of biosimilars and novel drug delivery systems creates further demand for innovative bioanalysis solutions. Strategic collaborations between pharma companies and contract research organizations (CROs) also open new avenues for growth by enhancing capabilities, reducing costs, and accelerating drug discovery timelines.

Challenges: Sample variability limits accuracy in the discovery bioanalysis market

Variability in biological samples and complex matrices can hinder accurate analysis. Regulatory inconsistencies across regions complicate method validation and approval processes. Managing and interpreting large datasets from high-throughput analyses also poses difficulties. Additionally, rapid technological changes require continuous investment in training and infrastructure, which can be burdensome for smaller organizations and slow overall adoption.

Global Discovery Bioanalysis Market Ecosystem Analysis

The discovery bioanalysis market ecosystem includes core service providers like CROs (Charles River, WuXi), instrument suppliers (Molecular Devices), and pharmaceutical and biotech end-users. Regulatory bodies such as the FDA and EMA set compliance standards, supported by forums like the European Bioanalysis Forum. Emerging tech players integrate AI and machine learning to enhance analysis. Key regional enablers include growing markets in Asia-Pacific and Latin America, driven by skilled workforces and regulatory reforms. This interconnected network drives innovation and market growth globally.

Global Discovery Bioanalysis Market, By Technique

The chromatography segment, accounting for approximately 67% of the market, is projected to lead the discovery bioanalysis market throughout the forecast period. This dominance is driven by chromatography’s ability to provide highly sensitive, precise, and reliable separation and quantification of complex biological molecules. Techniques like liquid chromatography (LC) and gas chromatography (GC) are widely used for pharmacokinetic and biomarker analyses in drug discovery. Additionally, continuous technological advancements in chromatography instrumentation and automation are enhancing efficiency, throughput, and data accuracy, making it indispensable in bioanalytical laboratories globally.

The mass spectrometry segment, representing about 21% of the market, is expected to account for substantial growth in the discovery bioanalysis market. This growth is driven by mass spectrometry’s exceptional sensitivity, specificity, and ability to analyze complex biological samples at a molecular level. Its applications in drug metabolism studies, biomarker identification, and pharmacokinetics are expanding rapidly. Furthermore, advancements such as high-resolution mass spectrometry and integration with chromatographic techniques are enhancing its capabilities, making it a crucial tool for bioanalytical research and drug discovery.

Global Discovery Bioanalysis Market, By End-User

The pharmaceutical and biotechnology companies segment has led the discovery bioanalysis market with the highest revenue share and is expected to maintain this dominance throughout the forecast period. This leadership is primarily due to these companies’ substantial investments in research and development aimed at discovering new drugs and therapies. As they focus on personalized medicine, biologics, and complex molecules, the need for advanced bioanalytical techniques to analyze drug candidates and biomarkers increases. Additionally, the growing prevalence of chronic diseases and demand for faster drug development timelines further drive the reliance on bioanalysis services within this segment.

The contract research organizations (cros) segment held the largest revenue share in the discovery bioanalysis market during the forecast period. CROs are increasingly preferred by pharmaceutical and biotechnology companies to outsource bioanalytical testing due to their specialized expertise, cost-effectiveness, and ability to accelerate drug development timelines. With expanding service portfolios and advanced technological capabilities, CROs provide scalable and flexible bioanalysis solutions, meeting the growing demand for efficient and high-quality testing. This trend is expected to continue, reinforcing their dominant position in the market.

North America is expected to account for the largest share of the discovery bioanalysis market during the forecast period, holding 42% of the global market, driven by its strong pharmaceutical and biotechnology sectors, significant R&D investments, advanced healthcare infrastructure, and stringent regulatory environment. Additionally, government support and the rising prevalence of chronic diseases contribute to the high demand for bioanalytical services and technologies across the region.

The United States is experiencing the most significant growth in the discovery bioanalysis market, with a projected CAGR of 8.5% over the forecast period, driven by strong pharmaceutical and biotechnology sectors, substantial R&D investments exceeding $150 billion annually, and robust regulatory support from the FDA. Increasing adoption of advanced bioanalytical technologies and a rising prevalence of chronic diseases further boost demand, positioning the U.S. as a key market contributor globally.

Asia Pacific is expected to grow at the fastest CAGR of 10.2% in the discovery bioanalysis market during the forecast period. This rapid growth is driven by expanding pharmaceutical and biotechnology industries, increasing R&D investments, and a growing focus on healthcare infrastructure development. Additionally, favorable government initiatives, cost-effective clinical trials, and rising prevalence of chronic diseases contribute to the region’s accelerating demand for bioanalytical services.

Australia is rapidly expanding in the discovery bioanalysis market, with a projected CAGR of 9.5% over the forecast period, driven by rising investments in pharmaceutical research and development, supported by government initiatives that promote innovation in healthcare and biotechnology. The country’s well-established regulatory environment ensures high-quality standards, encouraging both local and international companies to adopt advanced bioanalytical technologies. Additionally, Australia's growing biotech sector and focus on precision medicine are increasing demand for bioanalysis services, positioning the country as a key emerging player in the global market.

WORLDWIDE TOP KEY PLAYERS IN THE DISCOVERY BIOANALYSIS MARKET INCLUDE

- Charles River Laboratories International, Inc.

- WuXi AppTec Co., Ltd.

- Eurofins Scientific SE

- Covance Inc. (Labcorp Drug Development)

- ICON plc

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- SGS S.A.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the discovery bioanalysis market based on the below-mentioned segments:

Global Discovery Bioanalysis Market, By Technique

- Chromatography

- Mass Spectrometry

- Ligand Binding Assays

Global Discovery Bioanalysis Market, By End-User

- Pharmaceutical and Biotechnology Companies

- Contract Research Organizations

- Academic and Research Institutes

Global Discovery Bioanalysis Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What is the market size of the Global Discovery Bioanalysis Market in 2024?

A: The Global Discovery Bioanalysis Market size was estimated at USD 2.69 billion in 2024.

Q: What is the forecasted CAGR of the Global Discovery Bioanalysis Market from 2025 to 2035?

A: The market is expected to grow at a CAGR of 7.4% during the period 2025–2035.

Q: What is the projected market size of the Global Discovery Bioanalysis Market by 2035?

A: The market size is projected to reach USD 5.90 billion by 2035.

Q: Which region holds the largest share in the Discovery Bioanalysis Market?

A: North America is expected to account for the largest share during the forecast period.

Q: Which region is expected to grow the fastest in the Discovery Bioanalysis Market?

A: Asia-Pacific is projected to be the fastest-growing market with a CAGR of 10.2%.

Q: What is the leading technique segment in the Discovery Bioanalysis Market?

A: The chromatography segment is projected to lead the market throughout the forecast period, accounting for approximately 67% of the market.

Q: Who are the major end-users of the Discovery Bioanalysis Market?

A: Pharmaceutical and biotechnology companies are the largest end-user segment, followed by contract research organizations (CROs).

Q: What are the key factors driving growth in the Discovery Bioanalysis Market?

A: Growth is driven by increasing prevalence of chronic diseases, rising investments in pharmaceutical R&D, demand for personalized medicine, and advancements in bioanalytical techniques.

Q: What challenges are impacting the Discovery Bioanalysis Market?

A: Challenges include high costs of advanced instruments, complex method development, regulatory compliance variations, and sample variability affecting accuracy.

Q: Who are the top companies operating in the Global Discovery Bioanalysis Market?

A: Key players include Charles River Laboratories International, WuXi AppTec, Eurofins Scientific, Covance (Labcorp Drug Development), ICON plc, Thermo Fisher Scientific, Agilent Technologies, PerkinElmer, and Bio-Rad Laboratories.