Global Direct Reduced Iron Market Size To Exceed USD 92.36 Billion By 2033

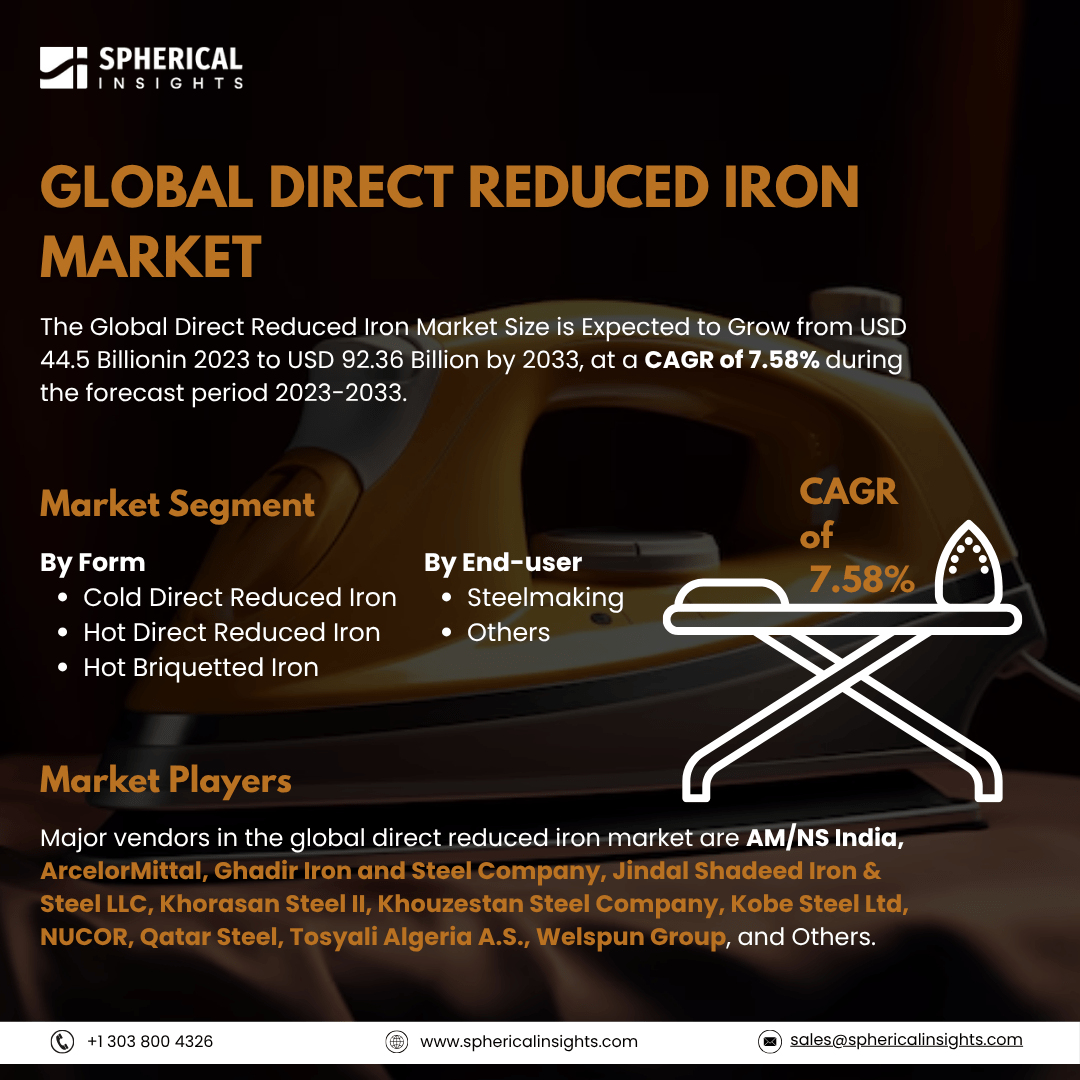

According to a research report published by Spherical Insights & Consulting, The Global Direct Reduced Iron Market Size is Expected to Grow from USD 44.5 Billion in 2023 to USD 92.36 Billion by 2033, at a CAGR of 7.58% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Direct Reduced Iron Market Size, Share, and COVID-19 Impact Analysis, By Form (Cold Direct Reduced Iron, Hot Direct Reduced Iron, and Hot Briquetted Iron), End-user (Steelmaking and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The global direct reduced iron market refers to the industry that focuses on producing iron by reducing iron ore with gases like carbon monoxide or hydrogen instead of smelting it in blast furnaces, as is the conventional method. DRI, which has attributes including less environmental impact and more energy efficiency, is an essential raw material for the production of steel. Key driving factors for the growth of the direct reduced iron market include the increasing environmental concerns, the need for sustainable steel production, and the transition to cleaner technology. DRI is an appealing replacement for conventional blast furnace techniques in the production of steel because of the decreased carbon footprint and energy efficiency. However, high initial investment costs, restricted natural gas supplies in certain regions, and technical difficulties impede broad adoption and expansion, especially in developing countries.

The cold direct reduced iron segment accounted for the largest revenue share in 2023 and is projected to grow at a significant CAGR during the forecast period.

On the basis of form, the global direct reduced iron market is divided into cold direct reduced iron, hot direct reduced iron, and hot briquetted iron. Among these, the cold direct reduced iron segment accounted for the largest revenue share in 2023 and is projected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the increasing emphasis on minimizing steel production's carbon emissions. Demand and acceptance are increased by CDRI's lower greenhouse gas emissions when compared to conventional blast furnace techniques.

The steelmaking segment accounted for the highest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of end-user, the global direct reduced iron market is divided into steelmaking and others. Among these, the steelmaking segment accounted for the highest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segment growth is driven because of the increase in global infrastructure projects, the demand from the construction and automotive industries, and the move to more environmentally friendly production techniques including direct-reduction iron electric arc furnaces.

North America is anticipated to hold the largest share of the global direct reduced iron market over the predicted timeframe.

North America is anticipated to hold the largest share of the global direct reduced iron market over the predicted timeframe. The regional market growth can be attributed to increased investments in infrastructure, growing demand for steel, and a strong trend toward more environmentally friendly production techniques. As the largest supplier of DRI in the region, the US continues to drive this expansion by implementing DRI technology to effectively decarbonize steel production while accomplishing goals for sustainability.

Asia Pacific is expected to grow at the fastest CAGR in the global direct reduced iron market during the forecast period. The regional market growth is driven by the rapid growth of infrastructure, urbanization, and industry in nations like China and India. The region's continuing market expansion is primarily due to rising steel demand and India's dominance in DRI production.

Company Profiling

Major vendors in the global direct reduced iron market are AM/NS India, ArcelorMittal, Ghadir Iron and Steel Company, Jindal Shadeed Iron & Steel LLC, Khorasan Steel II, Khouzestan Steel Company, Kobe Steel Ltd, NUCOR, Qatar Steel, Tosyali Algeria A.S., Welspun Group, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, Vale and Midrex have announced a cooperation to utilize iron ore briquettes in direct reduction plants. This initiative aims to enhance DRI production efficiency and reduce carbon emissions by enabling the use of a wider variety of iron ores as feedstock.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global direct reduced iron market based on the below-mentioned segments:

Global Direct Reduced Iron Market, By Form

- Cold Direct Reduced Iron

- Hot Direct Reduced Iron

- Hot Briquetted Iron

Global Direct Reduced Iron Market, By End-user

Global Direct Reduced Iron Market, By Regional Analysis

- North America

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa