Global Digital Trust Market Insights Forecasts to 2035

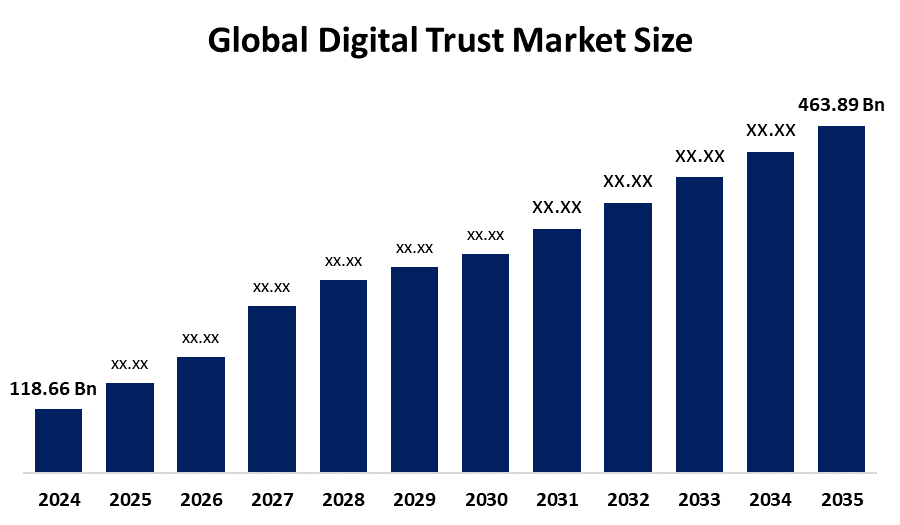

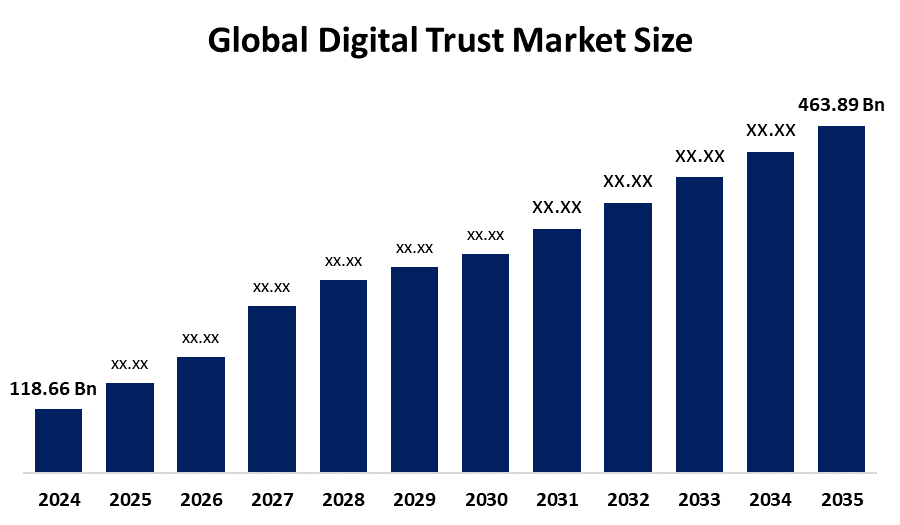

- The Global Digital Trust Market Size Was Estimated at USD 118.66 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.2% from 2025 to 2035

- The Worldwide Digital Trust Market Size is Expected to Reach USD 463.89 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Digital Trust Market

The global digital trust market revolves around technologies and solutions that ensure digital interactions' security, privacy, and integrity, fostering confidence in online transactions and data sharing. Digital trust encompasses identity verification, cybersecurity, data encryption, and blockchain, enabling businesses and consumers to operate safely in the digital economy. Governments worldwide actively promote digital trust through initiatives like the EU’s GDPR for data protection, the U.S. National Cybersecurity Strategy, and India’s Digital India campaign, which emphasize secure digital infrastructure and privacy standards. Increasing cyber threats, regulatory compliance needs, and the surge in digital transformation across industries drive market growth. The market includes key players offering identity management, secure access, and threat detection services. As organizations prioritize safeguarding sensitive data and enhancing customer trust, demand for digital trust solutions continues to rise, making it a critical component of the modern digital ecosystem.

Attractive Opportunities in the Digital Trust Market

- As businesses increasingly adopt digital platforms, there is growing demand for secure, transparent, and trustworthy systems. This drives adoption of digital trust technologies across sectors like finance, healthcare, retail, and government.

- Innovations such as blockchain, artificial intelligence (AI), and zero-trust security architectures offer new, effective ways to strengthen digital trust frameworks, creating fresh market opportunities.

- Increasing regulations like GDPR and CCPA, alongside rising consumer awareness about data security and ethical technology use, encourage organizations to invest in robust digital trust solutions to meet compliance and build customer confidence.

Global Digital Trust Market Dynamics

DRIVER: Growing digital transformation across industries such as finance

Key growth factors driving the global digital trust market include rising cyber threats and data breaches, which increase the demand for robust security solutions. Growing digital transformation across industries such as finance, healthcare, and retail requires secure online transactions and data protection. Regulatory compliance like GDPR and CCPA pushes organizations to adopt digital trust technologies. Increasing consumer awareness about privacy and security fuels demand for trusted digital services. Advancements in AI, blockchain, and biometric authentication enhance digital trust capabilities, making solutions more effective. Additionally, government initiatives promoting secure digital infrastructure and smart city projects further accelerate market growth worldwide.

RESTRAINT: High implementation costs and the complexity of integrating trust solutions with existing systems also pose barriers

Key challenges include data privacy concerns, regulatory complexities, and the lack of standardized frameworks across regions. High implementation costs and the complexity of integrating trust solutions with existing systems also pose barriers. Additionally, the increasing sophistication of cyber threats undermines trust in digital platforms. Limited awareness and understanding of digital trust concepts among organizations further slow adoption. Inconsistent enforcement of cybersecurity regulations globally creates fragmented trust environments. These factors collectively restrict the widespread deployment and effectiveness of digital trust solutions, especially among small and medium-sized enterprises (SMEs).

OPPORTUNITY: Emerging technologies like blockchain

The global digital trust market presents significant opportunities driven by the accelerating pace of digital transformation across industries. As organizations increasingly rely on digital platforms, the demand for secure, transparent, and trustworthy systems is rising. Emerging technologies like blockchain, AI, and zero-trust architectures offer innovative ways to enhance digital trust. The growing emphasis on data privacy and regulatory compliance, such as GDPR and CCPA, further fuels market growth. Expanding cloud adoption, remote work models, and the proliferation of IoT devices create new avenues for digital trust solutions. Additionally, rising consumer awareness about data security and ethical technology use encourages organizations to invest in digital trust frameworks. These trends create substantial opportunities, particularly in sectors like finance, healthcare, and e-commerce.

CHALLENGES: Lack of universally accepted standards and frameworks

A major issue is the lack of universally accepted standards and frameworks, leading to inconsistent implementation across industries and regions. The rapidly evolving threat landscape, including sophisticated cyberattacks and data breaches, makes it difficult for organizations to maintain trust. High costs and technical complexity of deploying digital trust solutions deter smaller enterprises. Additionally, resistance to change and limited awareness among stakeholders about the value of digital trust create adoption barriers. Ensuring compliance with varying global data protection regulations adds further complexity. Interoperability issues between legacy systems and modern trust technologies also slow integration. These challenges must be addressed to build and sustain user confidence in digital ecosystems.

Global Digital Trust Market Ecosystem Analysis

The global digital trust market ecosystem includes technology providers, enterprises, consumers, regulators, and cloud service providers. Key components are cybersecurity, identity and access management, data privacy tools, and trust-enabling technologies like AI and blockchain. Regulatory frameworks such as GDPR and CCPA drive compliance and adoption. Consulting firms and academic institutions support innovation and implementation. Market growth is fueled by rising cyber threats, digital transformation, and consumer demand for secure, transparent interactions, making digital trust essential across finance, healthcare, government, and e-commerce sectors.

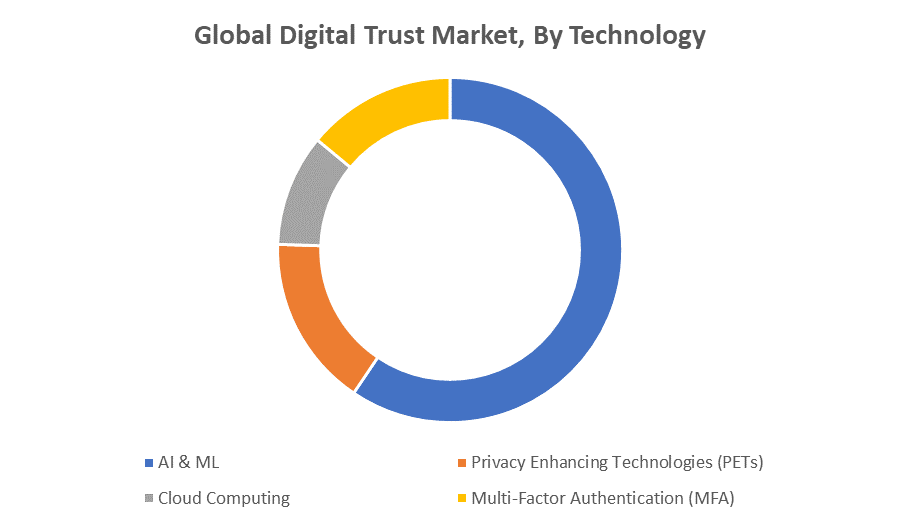

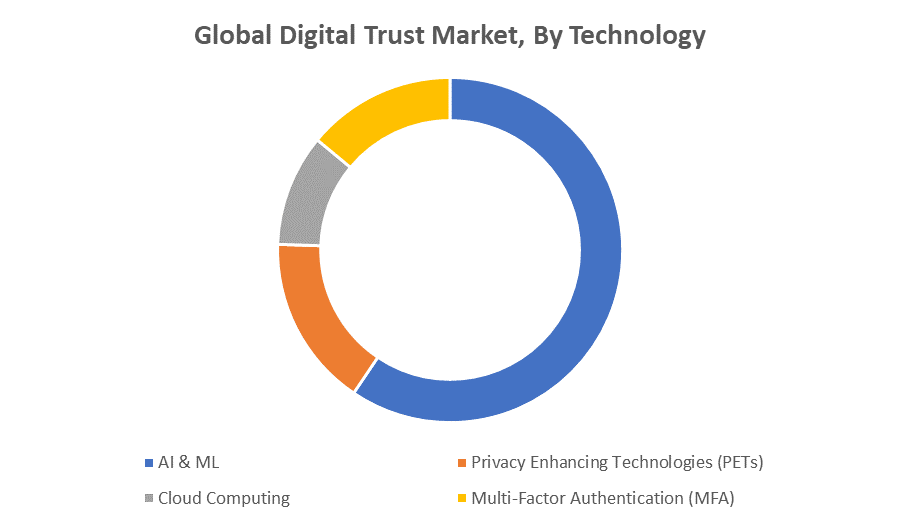

Based on the technology, the AI & ML segment accounted for the largest market revenue share over the forecast period

The Artificial Intelligence (AI) and Machine Learning (ML) segment accounted for the largest market revenue share over the forecast period. This dominance is driven by the increasing use of AI/ML in identifying and mitigating security threats in real time, enhancing fraud detection, automating risk assessment, and enabling predictive analytics. These technologies help organizations build proactive and adaptive trust frameworks, making them integral to digital trust solutions across industries such as finance, healthcare, and e-commerce.

Based on the end use, the banking, financial services, and insurance (BFSI) segment accounted for the largest market revenue share during the forecast period

The banking, financial services, and insurance (BFSI) segment accounted for the largest market revenue share during the forecast period. This is attributed to the sector's high demand for secure digital transactions, robust identity verification, fraud prevention, and compliance with stringent regulatory standards. As digital banking and fintech services expand, the need to establish trust with customers through advanced cybersecurity, data privacy, and AI-driven risk management solutions becomes critical, making BFSI a key driver of the digital trust market.

North America is anticipated to hold the largest market share of the digital trust market during the forecast period

North America is anticipated to hold the largest market share of the digital trust market during the forecast period. This dominance is driven by the region's advanced digital infrastructure, high cybersecurity awareness, and strong regulatory environment, including frameworks like HIPAA and CCPA. The presence of major technology providers and widespread adoption of AI, ML, and zero-trust architectures further supports growth. Additionally, sectors like BFSI, healthcare, and government in North America heavily invest in digital trust solutions to ensure secure and compliant digital interactions.

Asia Pacific is expected to grow at the fastest CAGR in the digital trust market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the digital trust market during the forecast period. This rapid growth is driven by increasing digital transformation across emerging economies, rising cyber threats, and growing awareness of data privacy. Government initiatives promoting digital identities and smart infrastructure, along with the expansion of fintech, e-commerce, and cloud adoption, are boosting demand for digital trust solutions. Countries like China, India, and Singapore are leading investments in cybersecurity and regulatory compliance, fueling market expansion in the region.

Recent Development

- In February 2025, Sri Lankan Government launched GovPay, a centralized digital payment platform designed to facilitate secure, transparent, and efficient payments for various government services such as online traffic fines and expressway tolls. This initiative aims to enhance trust and streamline citizen-government digital interactions.

Key Market Players

KEY PLAYERS IN THE DIGITAL TRUST MARKET INCLUDE

- IBM Corporation

- Microsoft Corporation

- Cisco Systems, Inc.

- Okta, Inc.

- Entrust Corporation

- OneSpan Inc.

- Ping Identity Corporation

- Thales Group

- CyberArk Software Ltd.

- 1Kosmos

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the digital trust market based on the below-mentioned segments:

Global Digital Trust Market, By Technology

- AI & ML

- Privacy Enhancing Technologies (PETs)

- Cloud Computing

- Multi-Factor Authentication (MFA)

Global Digital Trust Market, By End Use

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Life Sciences

- Retail and E-commerce

- IT and Telecommunications

- Government Sector

Global Digital Trust Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa