Desalination Chemicals Market Summary

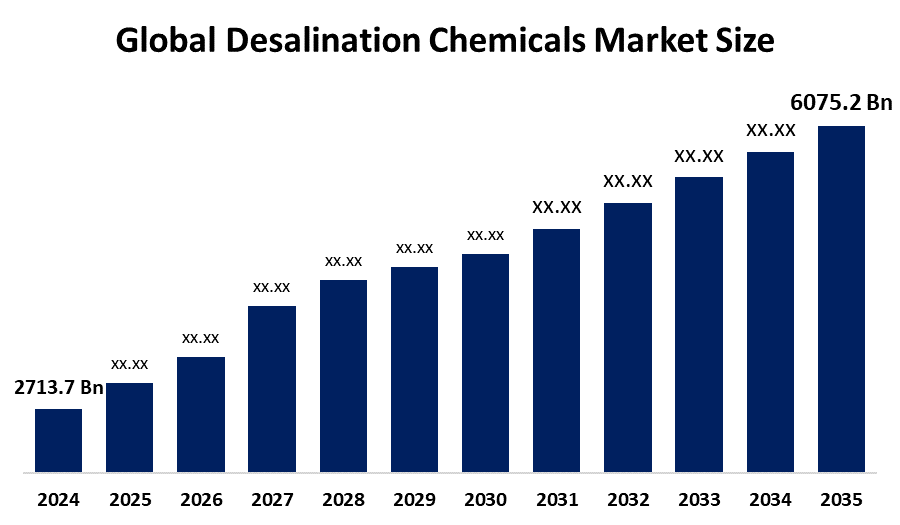

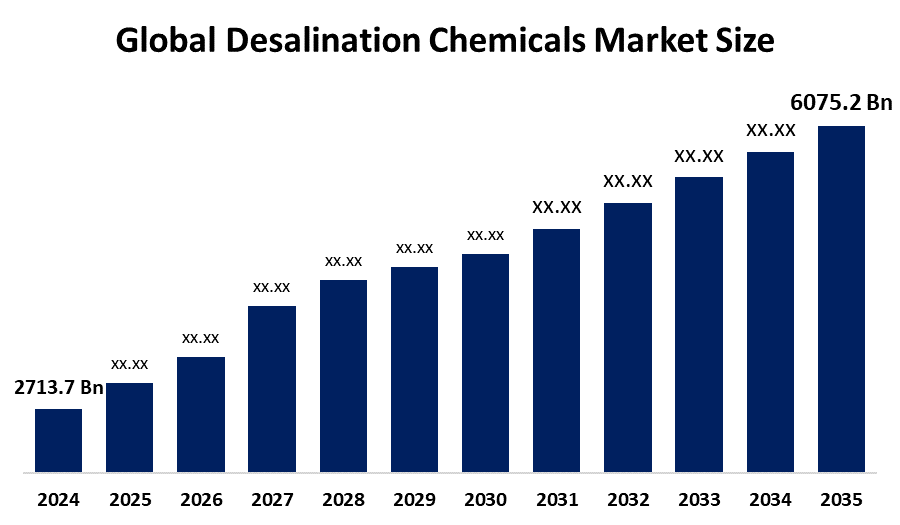

The Global Desalination Chemicals Market Size Was Estimated at USD 2713.7 Million in 2024 and is Projected to Reach USD 6075.2 Million by 2035, Growing at a CAGR of 7.6% from 2025 to 2035. The need for effective water treatment, increased desalination plant installations, technological advancements, regulatory support, and the requirement for corrosion control, scale prevention, and optimised membrane performance in water purification processes are all driving growth in the desalination chemicals market

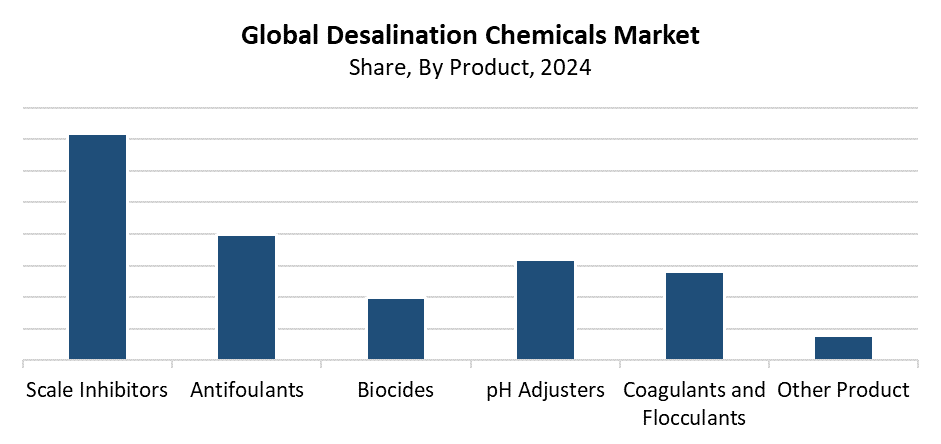

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific desalination chemicals market size held the largest revenue share of 40.3% and dominated the global market.

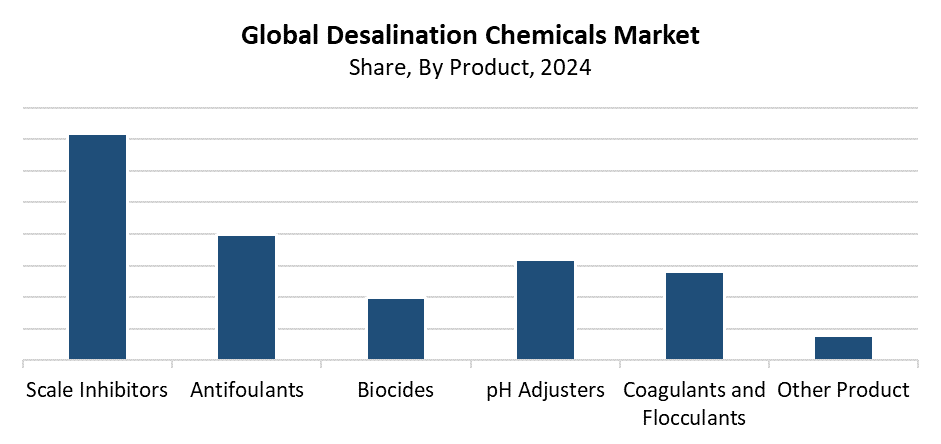

- In 2024, the scale inhibitors segment held the highest revenue share of 36.8% and dominated the global market by product.

- With the biggest revenue share of 53.5% in 2024, the municipal water treatment segment led the worldwide desalination chemicals market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2713.7 Million

- 2035 Projected Market Size: USD 6075.2 Million

- CAGR (2025-2035): 7.6%

- Asia Pacific: Largest market in 2024

The Desalination Chemicals Market Size includes chemicals which serve to protect equipment and boost operational efficiency while enhancing water quality. The chemicals used in desalination facilities to prevent scaling, fouling, microbial growth, and corrosion include antiscalants, coagulants, biocides, corrosion inhibitors, pH adjusters, and cleaning agents. Market growth depends on three main factors, which consist of urban population growth, expanding water needs in drought-prone areas, and increasing worldwide water shortages. The growing number of desalination plants across North America, and Asia Pacific, and the Middle East drives the need for high-performance chemicals. The global market adopts sustainable water management solutions because of rising industrial water consumption, increasing water quality regulations, and expanding requirements for environmentally friendly water management.

The applications of desalination chemicals have become more sustainable and efficient because of technological progress. Advanced monitoring techniques, automated dosing systems, and environmentally friendly low-dosage chemicals improve water treatment operations through reduced chemical usage and extended membrane operational life. Governments from different nations provide financial backing, create supportive policies, and offer incentives to promote desalination projects. These ensure a safe water supply. The worldwide market for desalination chemicals experiences rapid growth because chemical manufacturers unite with water service providers and technology suppliers to develop new products and boost their market share.

Product Insights

The scale inhibitors segment led the desalination chemicals market in 2024 with the largest revenue share of 36.8%. The operation of desalination facilities requires scale inhibitors to stop mineral deposits from forming. These include calcium carbonate and sulfate scales because these deposits reduce operational efficiency and cause damage to pipes and membranes. The segment leads because more desalination facilities appear in water-scarce regions, while equipment needs to function effectively for longer periods. The performance of ecologically friendly and low-dosage scale inhibitors has improved because of better chemical usage efficiency. Scale inhibitors continue to hold their dominant position in the global market due to rising industrial and municipal water demands.

The antifoulants segment is expected to grow at the fastest CAGR during the forecast period because desalination plants require biofouling prevention solutions. Biofouling occurs when microbes develop on membranes and equipment, which leads to reduced system performance, shortened equipment lifespan and higher power usage. Antifoulants protect systems from biological contamination. This results in better system performance and lower maintenance needs. The fast expansion of desalination plants in water-scarce regions, including the Middle East, Asia Pacific, and North America, drives the need for advanced antifouling solutions. The market segment experiences accelerated global adoption because high-performance, environmentally friendly antifoulants combine with water quality and environmental regulations that have become stricter.

Application Insights

The municipal water treatment segment led the desalination chemicals market during 2024 with the largest revenue share of 53.5%. The increasing demand for reliable and safe drinking water in countries with limited water resources and fast-growing urban areas drives this trend. The operation of municipal desalination plants requires multiple chemicals, including scale inhibitors, antifoulants, biocides, and pH adjusters, to protect membranes and pipelines and maintain water quality and plant functionality. The development of municipal desalination infrastructure receives support from industrial growth, population expansion, and mandatory compliance with water quality standards. The worldwide desalination chemicals market continues to be led by municipal water treatment because of new chemical formulation developments and improved dosing systems. These boost treatment performance.

The industrial water treatment segment is expected to grow at the fastest CAGR during the forecast period because industrial expansion drives up the requirement for process water in manufacturing, chemical operations, oil and gas production, and power generation. Industrial desalination plants need high-performance chemicals, including scale inhibitors, antifoulants, corrosion inhibitors, and biocides, to achieve maximum equipment efficiency while preventing scaling and fouling and maintaining water quality. The growth of energy-intensive businesses, together with stricter environmental and water treatment regulations, has driven up the usage of advanced desalination chemicals. The industrial water treatment segment experiences worldwide market expansion because of technological progress in chemical formulations, automated dosing systems, and monitoring solutions. These enhance operational efficiency.

Regional Insights

The North American desalination chemicals market is anticipated to experience substantial growth throughout the forecast period because industrial development and water scarcity create a need for sustainable freshwater solutions. The region now directs its investments toward desalination plant construction to fulfil urban and industrial water requirements with particular emphasis on United States and Mexican facilities. The operational efficiency and membrane lifespan receive advantages from modern technology applications, which have become common practice. The technologies operate through automated dosing systems, eco-friendly chemical solutions, monitoring solutions, and low-dosage systems. The market growth receives support from government initiatives, which promote sustainable water resource management. These come from rigorous environmental protection regulations. North America functions as a leading global expansion region because of its growing urban areas, industrial development, and increasing needs for water purification systems.

Asia Pacific Desalination Chemicals Market Trends

The Asia Pacific desalination chemicals market led globally in 2024 by holding the largest revenue share of 40.3%. The region maintains its position as a leader because of its critical water shortage, combined with fast urban growth and industrial development in countries such as China and India, and throughout the Middle East. The increasing number of desalination plants for urban and industrial water supply has led to higher usage of chemicals such as scale inhibitors, antifoulants, corrosion inhibitors, and biocides. High-performance and eco-friendly chemical formulas have advanced to protect water quality, extend equipment lifespan, and enhance operational efficiency. The Asia Pacific region maintains its position as the global leader in desalination chemicals because of its strong infrastructure development and supportive government initiatives. Water treatment regulations also contribute to this standing.

Europe Desalination Chemicals Market Trends

The European market for desalination chemicals experiences significant growth because both industrial and municipal sectors need environmentally responsible water treatment solutions. The nations of Spain, Italy, and France have established desalination infrastructure because their industrial operations need water during times of drought and water shortages. The market growth stems from strict environmental regulations and water quality standards, which demand efficient chemical solutions, including scale inhibitors, antifoulants, corrosion inhibitors, and biocides, to protect operational safety and effectiveness. The combination of chemical formulation advancements, automated dosing systems, and monitoring solutions has resulted in performance enhancements and reduced operating expenses. The market continues its expansion across Europe because governments support sustainable water management programs.

Key Desalination Chemicals Companies:

The following are the leading companies in the desalination chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Italmatch Chemicals

- Dow Chemical Company

- Omya International AG

- Solenis LLC

- Veolia Environnement SA

- Kurita Water Industries Ltd.

- Ecolab Inc.

- American Water Chemicals, Inc.

- Genesys International Ltd.

- BASF SE

- Others

Recent Developments

- In October 2025, A memorandum of understanding was signed by Veolia and TotalEnergies to strengthen cooperation in energy transition and circular economy projects. Through collaborative efforts in methane reduction, water reuse, and sustainable desalination, the alliance seeks to lower greenhouse gas emissions and the water footprint.

- In August 2025, in Australia, New Zealand, and the Pacific Islands, Bluemont was appointed as the sole distributor of Elemental Water Makers' solar desalination equipment. The objective of this collaboration is to offer off-grid, chemical-free, sustainable water solutions to isolated and climate-vulnerable populations.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the desalination chemicals market based on the below-mentioned segments:

Global Desalination Chemicals Market, By Product

- Scale Inhibitors

- Antifoulants

- Biocides

- pH Adjusters

- Coagulants and Flocculants

- Other Product

Global Desalination Chemicals Market, By Application

- Municipal Water Treatment

- Industrial Water Treatment

- Agricultural Water Treatment

Global Desalination Chemicals Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa