Global Dental Gypsum Market Size to Exceed USD 207.9 Million by 2033

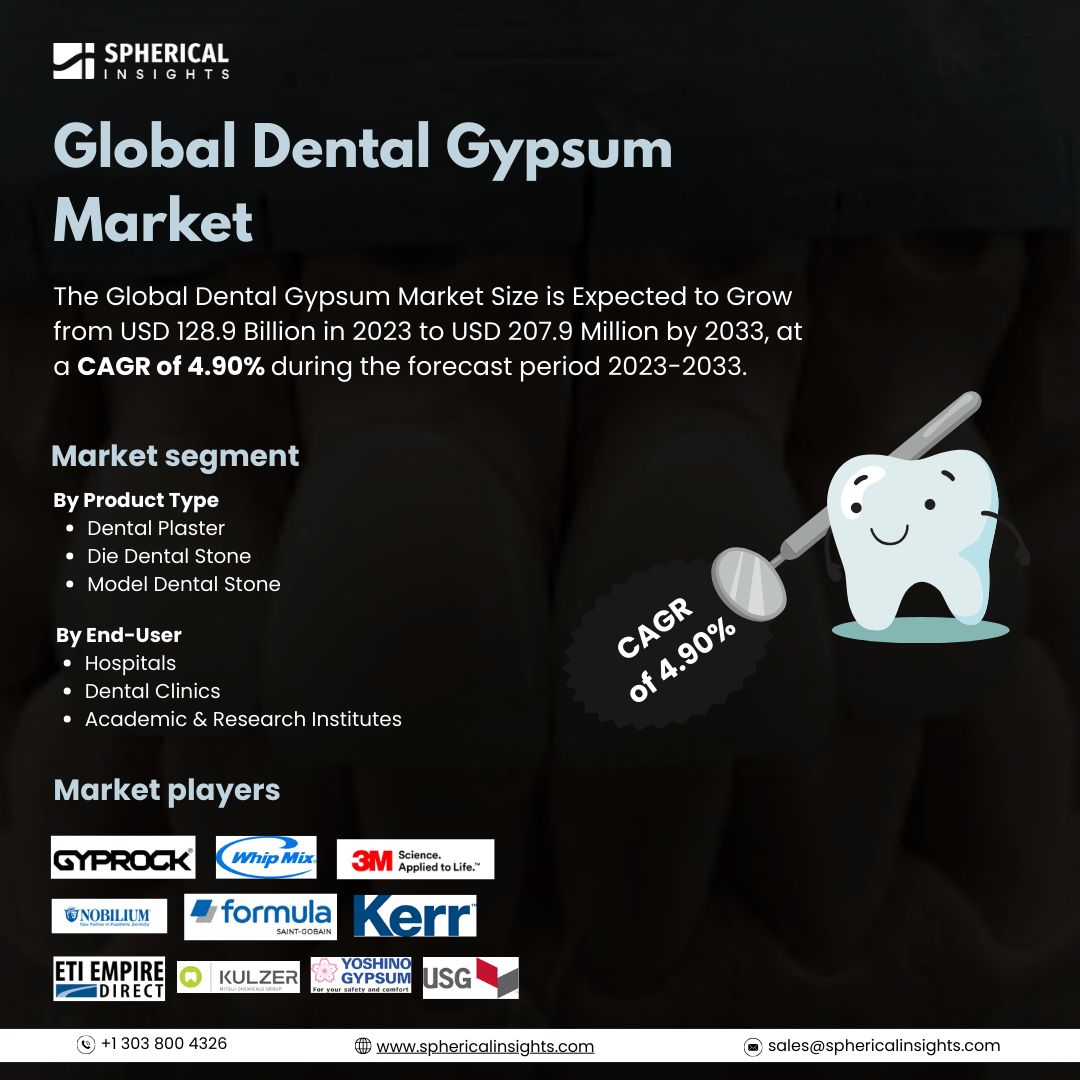

According to a research report published by Spherical Insights & Consulting, the Global Dental Gypsum Market Size is Expected to Grow from USD 128.9 Billion in 2023 to USD 207.9 Million by 2033, at a CAGR of 4.90% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Dental Gypsum Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Dental Plaster, Die Dental Stone, and Model Dental Stone), By End-User (Hospitals, Dental Clinics, and Academic & Research Institutes), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The dental gypsum market refers to the global industry involved in the production, distribution, and sale of gypsum-based materials used in dentistry. Dental gypsum is a calcium sulfate-based material widely utilized for making dental molds, casts, dies, and impressions in prosthodontics, orthodontics, and restorative dentistry. The market includes various types of dental gypsum, such as model plaster, dental stone, and high-strength die stone, catering to dental clinics, laboratories, and academic institutions. Market growth is driven by increasing dental procedures, technological advancements, and rising awareness about oral health. Furthermore, the global dental gypsum market is driven by the increasing prevalence of dental disorders, rising demand for prosthetics and restorations, and advancements in dental materials. Growth in dental tourism, expanding dental laboratories, and technological innovations in gypsum formulations further boost market expansion. Additionally, increasing awareness of oral health and rising disposable incomes contribute to market growth during the forecast period. However, the high material costs, environmental concerns over gypsum disposal, availability of alternative materials, stringent regulations, and limited adoption in developing regions, hindering market growth are key restraining factors for the growth of the market.

The die dental stone segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the product type, the global dental gypsum market is divided into dental plaster, die dental stone, and model dental stone. Among these, the die dental stone segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its superior strength, accuracy, and durability in creating precise dental models and restorations. Increasing demand for high-quality prosthetics, advancements in dental materials, and the growing number of dental procedures are expected to drive significant CAGR growth during the forecast period.

The hospitals segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the end user, the global dental gypsum market is divided into hospitals, dental clinics, and academic & research institutes. Among these, the hospitals segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is attributed to the increasing number of dental procedures, advanced infrastructure, and availability of specialized dental care. Rising patient inflow, improved healthcare investments, and growing adoption of high-quality dental materials are expected to drive a remarkable CAGR during the forecast period.

North America is projected to hold the largest share of the global dental gypsum market over the forecast period.

North America is projected to hold the largest share of the global dental gypsum market over the forecast period. North America is expected to dominate the global dental gypsum market due to its well-established dental care infrastructure, high prevalence of dental disorders, and increasing demand for advanced restorative procedures. Rising healthcare expenditures, the strong presence of key market players, and growing awareness about oral health further drive market growth, ensuring the region maintains its leading position during the forecast period.

Asia Pacific is expected to grow at the fastest CAGR growth of the global dental gypsum market during the forecast period. Asia Pacific is projected to grow at the fastest CAGR in the global dental gypsum market due to increasing dental disorders, rising awareness of oral health, and expanding healthcare infrastructure. Growing investments in dental care, a rising number of dental clinics, and advancements in restorative dentistry further drive market growth, making the region a key contributor during the forecast period.

Company profiling

Major vendors in the global dental gypsum market are Heraeus Kulzer, 3M Science, USG, Kerr Dental, Yoshino Gypsum, Whip-Mix, Saint-Gobain Formula, Nobilium, ETI Empire Direct, Gyprock, Georgia-Pacific Gypsum, Coltene, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2024, 3M Science introduced the 3M Verify App. This was designed to tackle counterfeit PPE.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global dental gypsum market based on the below-mentioned segments:

Global Dental Gypsum Market, By Product Type

- Dental Plaster

- Die Dental Stone

- Model Dental Stone

Global Dental Gypsum Market, By End-User

- Hospitals

- Dental Clinics

- Academic & Research Institutes

Global Dental Gypsum Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa