Global Dental Acrylic Materials Market Insights Forecasts to 2035

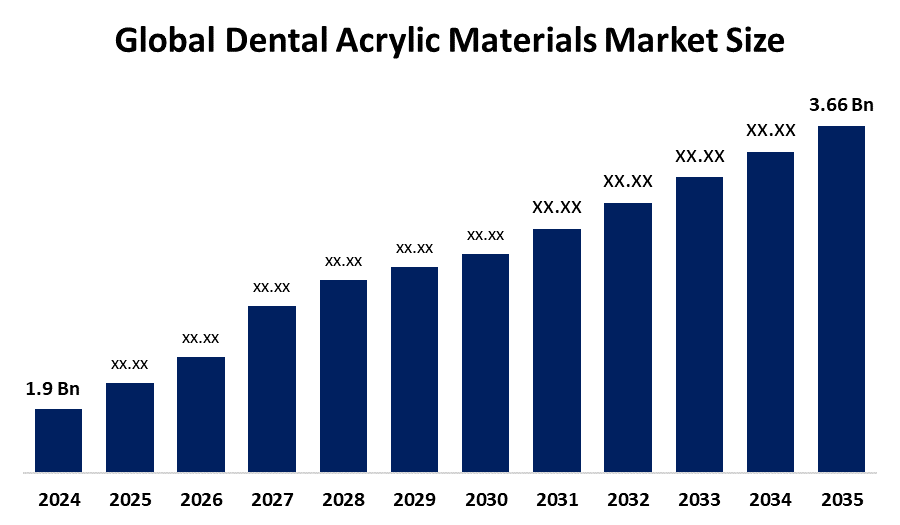

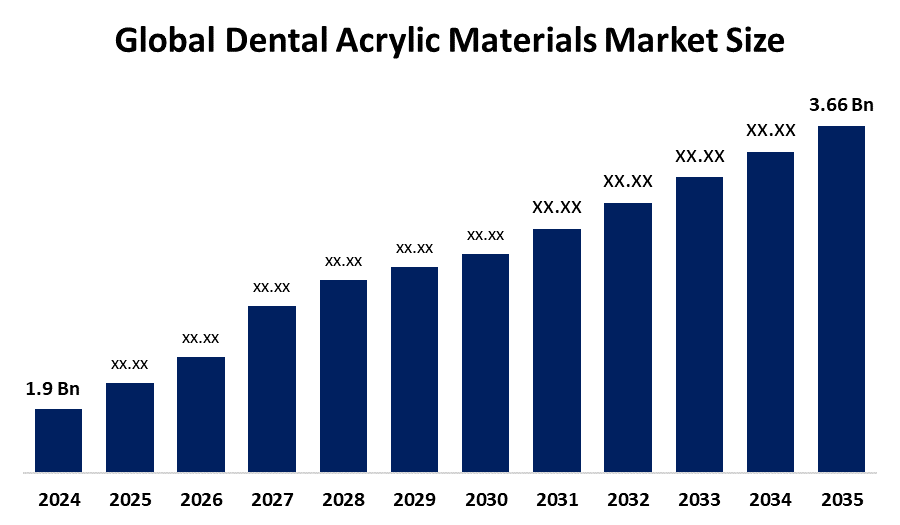

- The Global Dental Acrylic Materials Market Size Was Estimated at USD 1.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.14% from 2025 to 2035

- The Worldwide Dental Acrylic Materials Market Size is Expected to Reach USD 3.66 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Dental Acrylic Materials Market

Synthetic resins known as dental acrylic materials are frequently used in dentistry for orthodontic devices, temporary crowns, dentures, and other artificial devices. Because of their bio-revision, durability, simplicity of manipulation, and cosmetic qualities that resemble genuine teeth, these materials, primarily polymethyl methacrylate (PMMA), are useful. There are several types of dental acrylic, including heat-grind, cold-cream, and light-cut varieties, and each offers unique processing advantages. The global market is being driven by advancements in acrylic formulation, restorative and cosmetic dentistry, and an ageing population.

Attractive Opportunities in the Dental Acrylic Materials Market

- Premium acrylic resins that provide durability and natural looks are becoming more and more popular due to the increasing demand for cosmetic and restorative dentistry, especially in countries where presence is an important factor.

- Strong, more colorful, and wear-resistant acrylic, as well as antimicrobial strands that increase patient safety and product lifespan, have been made possible by the development of polymer chemistry.

- With the help of increasing disposable income, easy access to dental care, and extended dental insurance coverage, the possibilities of an adequate increase in emerging markets in Asia-Pacific and Latin America are opening up and lowering the cost of high-quality artificial solutions for a wide range of people.

Global Dental Acrylic Materials Market Dynamics

DRIVER: Rising Geriatric Population and Tooth Loss Prevalence

Global growth in the aging population is one of the strongest drivers for the dental acrylic materials market, as elderly individuals have a greater prevalence of dentures and require dentures or partial prosthetics. According to the World Health Organization, about 30% of people aged 65–74 experience the complete loss of teeth, causing a continuous demand for denture base resins. This trend is carried forward by increasing awareness about oral health, beauty restoration preferences, and the availability of advanced dental remedies that improve function and appearance. A combination of demographic changes and increasing demand for inexpensive, durable prosthetics continues, and markets continue to grow.

RESTRAINT: Competition from Alternative Dental Materials

The presence of alternative materials such as flexible nylon-based resins, high-performance, and advanced ceramics creates a restraint for the development of dental acrylic. These materials often offer increased comfort, better aesthetics, or high durability, inspiring some dental professionals and patients to choose traditional acrylic options. This trend is particularly clear in areas with high income, where patients are ready to pay more for premium content. While acrylic cost cost-effective and versatile, its market share in some sections can be challenged without ongoing innovation to match the performance of competitive products.

OPPORTUNITY: Innovations in Acrylic Formulations and Processing

Progress in acrylic resolutions is creating important opportunities for market expansion. New growth includes better fracture resistance, high effects of acrylic with colour-stained formula that maintain aesthetic quality over time, and antimicrobial resins that help reduce the growth of bacteria on decorative surfaces. Additionally, modern CAD/CAM-Sant streamlines acrylic production processes and improves the fit of prosthetics, appealing to dental laboratories and clinics that are targeted for precision and efficiency. These innovations are expanding the scope of dental acrylic applications and strengthening their competitive status in the market.

CHALLENGES: Allergic Reactions and Biocompatibility Concerns

The risk of allergic reactions due to residual monomers in acrylic formulation may cause mucosal irritation and discomfort in the patient. Although these reactions are relatively rare, they can affect the patient's confidence and cause dentists to opt for alternative materials in sensitive cases. To address this issue, manufacturers need to refine polymerization procedures, improve resin purity, and develop hypoallergenic acrylic variants. Regulatory bodies and dental associations are also encouraged to ensure the safety of the patient and adopt safe processing techniques to maintain the reputation of acrylic-based prosthetic solutions.

Global Dental Acrylic Materials Market Ecosystem Analysis

The ecosystem includes raw material suppliers, resin makers, dental laboratories, distributors, and end users such as dental clinics, hospitals, and dental schools. Leading companies like Dentsply Sirona, Ivoclar Vivadent, GC Corporation, Kulzer GMBH, and Lang Dental play a central role in driving innovation and establishing quality standards. Regulatory compliance is maintained through certificates like ISO 20795 through approval from denture base polymers and bodies like the FDA and CE. Distribution channels include both dental laboratories and direct supply for sale through authorized distributors serving dental clinics worldwide.

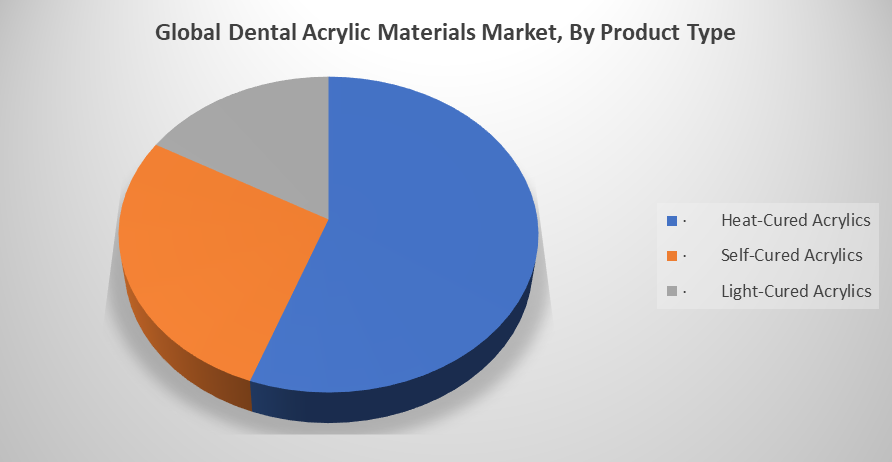

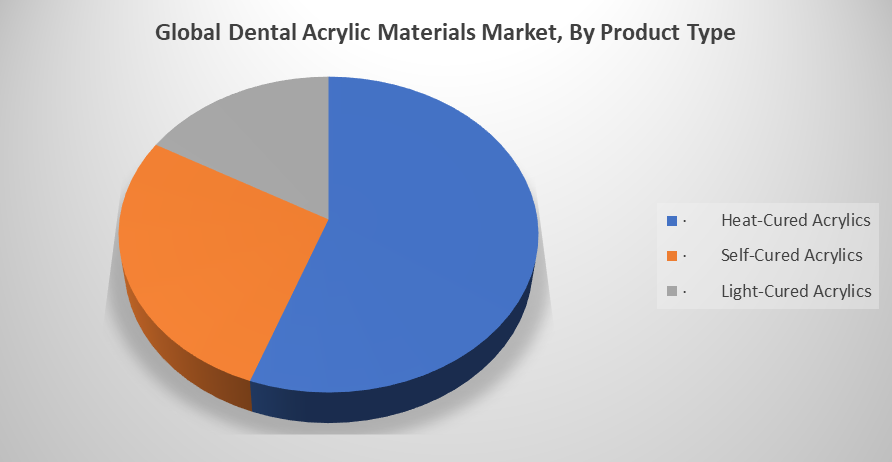

Based on the product type, the heat-cured acrylics segment led the market with the leading revenue share over the forecast period.

The segment dominance is driven by these materials are the recommended option for permanent denture bases because of their exceptional strength, dimensional stability, and long-term durability. Their extensive use in dental labs and clinics around the world is guaranteed by their superior wear resistance and ability to provide a precise fit when compared to cold-cured acrylics.

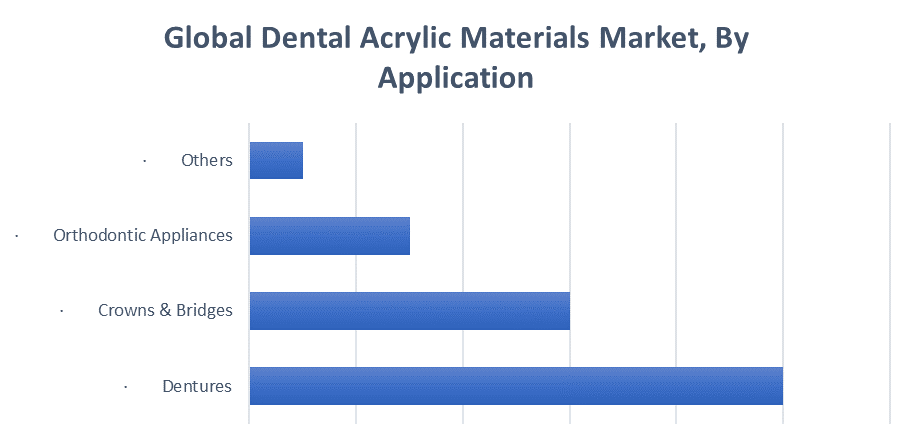

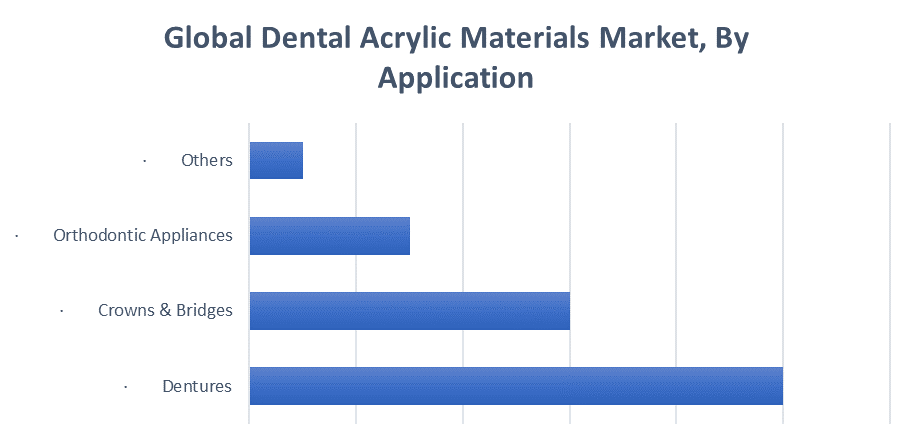

Based on the application, the denture segment led the market with the major revenue share during the forecast period

The denture segment led the market, holding the largest revenue share during the forecast period. The high rate of tooth loss worldwide, especially among elderly persons. Acrylic denture bases are prized for their affordability as compared to other materials, ease of moulding, and gum colour matching capabilities. As edentulism rates rise and dental treatment becomes more accessible in emerging economies, this market continues to expand.

North America is anticipated to hold the largest market share of the dental acrylic materials market during the forecast period.

North America is anticipated to hold the largest market share in the dental acrylic materials market during the forecast period. The modern dental care infrastructure, a well-established network of dental laboratories and a high frequency of restorative and cosmetic dentistry procedures. Strong purchasing power, favourable dental insurance coverage, and the presence of top manufacturers like Dentsply Sirona and Kulzer GmbH are all advantages for the area. The public's strong awareness of oral health and appearance also contributes to the market for high-end acrylic dental products.

Asia Pacific is expected to grow at the fastest CAGR in the dental acrylic materials market during the forecast period.

Asia Pacific is expected to grow at the fastest CAGR in the dental acrylic materials market during the forecast period. In nations like China, India, and Japan, there is a growing emphasis on oral health, expanded access to dental treatment, and rising disposable incomes. Both urban and rural communities now have better access to dental care thanks to government-led dental health initiatives and rising investments in state-of-the-art dental facilities. Dentures and other acrylic-based dental restorations are in high demand due to the region's sizable and ageing population as well as growing awareness of cosmetic dentistry operations.

Recent Development

- In October 2024, Dentsply Sirona collaborated with the McGuire Institute (iMc) and introduced the PrimeTaper EV Implant Registry to assess its performance in various real-world clinical environments.

- In June 2025, Dentsply Sirona announced the launch of its new CEREC Cercon 4D™ multi-dimensional zirconia abutment blocks, described as the first zirconia intermediate blocks designed to combine high strength and aesthetics for hybrid abutments and screw-retained crowns.

Key Market Players

KEY PLAYERS IN THE DENTAL ACRYLIC MATERIALS MARKET INCLUDE

- Dentsply Sirona

- Ivoclar Vivadent AG

- Kulzer GmbH

- GC Corporation

- Mitsui Chemicals, Inc.

- 3M ESPE

- DenMat Holdings, LLC

- Lang Dental Manufacturing Co., Inc.

- Esschem Europe Ltd.

- Keystone Industries

- Zhermack SpA

- Kerr Corporation

- Yates Motloid

- Dental Technologies, Inc.

- Wells Dental Inc.

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dental acrylic materials market based on the below-mentioned segments:

Global Dental Acrylic Materials Market, By Product Type

- Heat-Cured Acrylics

- Self-Cured Acrylics

- Light-Cured Acrylics

Global Dental Acrylic Materials Market, By Application

- Dentures

- Crowns & Bridges

- Orthodontic Appliances

- Others

Global Dental Acrylic Materials Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa