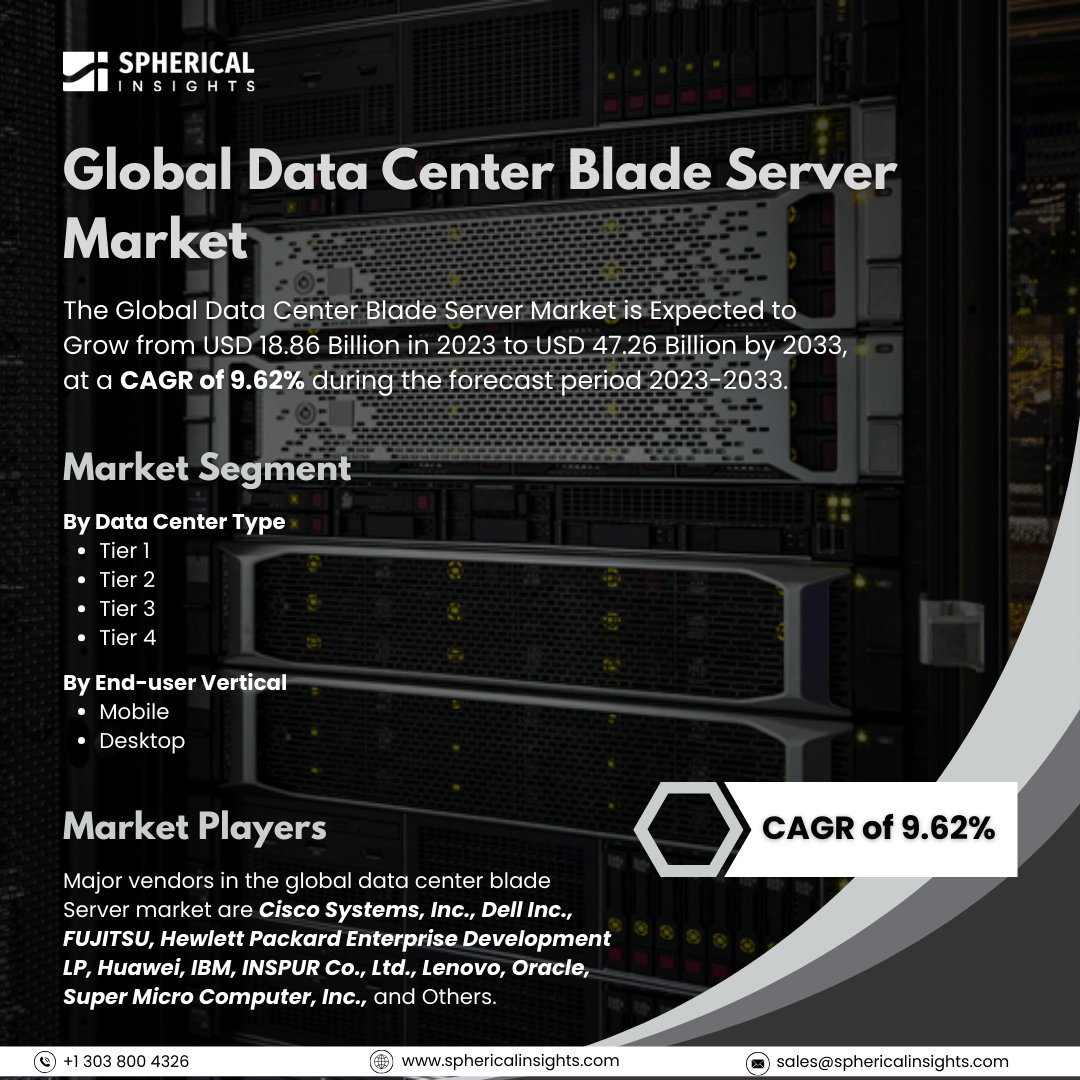

Global Data Center Blade Server Market Size to Exceed USD 47.26 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Data Center Blade Server Market is Expected to Grow from USD 18.86 Billion in 2023 to USD 47.26 Billion by 2033, at a CAGR of 9.62% during the forecast period 2023-2033.

Browse 210 Market Data Tables and 45 Figures Spread Through 190 Pages and In-Depth TOC On the Global Data Center Blade Server Market Size, Share, and COVID-19 Impact Analysis, By Data Center Type (Tier 1, Tier 2, Tier 3, and Tier 4), By End-user Vertical (BFSI, Manufacturing, Energy & Utility, and Healthcare), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The data center blade server market is an industry that focuses on the manufacturing, distribution, and deployment of blade servers, and compact, high-performance computing systems developed for data centers. The housing of servers within blade enclosures allows for the achievement of a high-density form of computing while reducing power consumption and enhancing scalability. Moreover, The rising adoption of cloud computing, virtualization, and AI-driven workloads, which require high-performance computing solutions, drives the Data Center Blade Server Market. Energy efficiency, space-saving, and scalability in server infrastructure are further growth drivers. The expansion of hyperscale data centers, increasing edge computing deployments, and growing needs for high-density storage and processing further accelerate market expansion. Advancements in server automation and management software also contribute to growth. However, the data center blade server market faces challenges from high initial investment costs, compatibility issues with legacy systems, increased heat generation, complex maintenance requirements, and cybersecurity risks associated with centralized, high-density computing environments.

The linear video ads segment held the highest share in 2023 and is estimated to grow at a CAGR during the forecast period.

Based on the data center type, the global data center blade server market is categorized into tier 1, tier 2, tier 3, and tier 4. Among these, the liner video ads segment held the highest share in 2023 and is estimated to grow at a CAGR during the forecast period. This is due to their balance of cost-efficiency, reliability, and redundancy. They offer 99.982% uptime, multiple power and cooling paths, and scalability, making them the preferred choice for enterprises, cloud providers, and colocation facilities seeking high-performance infrastructure.

The mobile segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-user vertical, the global data center blade server market is categorized into BFSI, manufacturing, energy & utility, and healthcare. Among these, accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of its strong demand for secure, high-speed data processing, storage, and real-time transaction capabilities, financial institutions require scalable, energy-efficient servers to support digital banking, fintech innovations, regulatory compliance, and advanced analytics, thereby gaining market dominance.

North America is anticipated to hold the largest share of the global data center blade server market over the forecast period.

North America is anticipated to hold the largest share of the global data center blade server market over the forecast period. This is due to the high concentration of hyperscale data centers, strong cloud adoption, and advanced IT infrastructure. The presence of major tech companies, increasing AI and IoT deployments and growing investments in data center expansion further drive market growth in the region.

Asia Pacific is estimated to grow at the fastest CAGR growth of the global data center blade server market during the forecast period. This is driven by rapid digital transformation, increased cloud adoption, and expansion of hyperscale data centers. Rising investments in 5G, AI, and IoT, coupled with growing demand from BFSI, manufacturing, and IT sectors, are accelerating the growth of the market, particularly in China, India, and Southeast Asia.

Company Profiling

Major vendors in the global data center blade Server market are Cisco Systems, Inc., Dell Inc., FUJITSU, Hewlett Packard Enterprise Development LP, Huawei, IBM, INSPUR Co., Ltd., Lenovo, Oracle, Super Micro Computer, Inc., and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Development

- In January 2023, Supermicro announced the launch of its new server and storage portfolio with more than 15 families of performance-optimized systems focusing on cloud computing, AI, and HPC, as well as enterprise, media, and 5G/telco/edge workloads. SuperBlade would deliver the computational performance of a whole server rack in a considerably smaller physical footprint by using shared, redundant components, including cooling, networking, power, and chassis management. These blade server systems are geared for AI, Data Analytics, HPC, Cloud, and Enterprise applications and feature GPU-enabled blades.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global data center blade server market based on the below-mentioned segments:

Global Data Center Blade Server, By Data Center Type

- Tier 1

- Tier 2

- Tier 3

- Tier 4

Global Data Center Blade Server Market, By End-user Vertical

Global Data Center Blade Server, By End Users

- Retail

- E-Commerce

- IT & Telecom

- Media and Entertainment

- Automotive

- Financial Services

- Consumer Goods & Electronics

- Others

Global Data Center Blade Server Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa