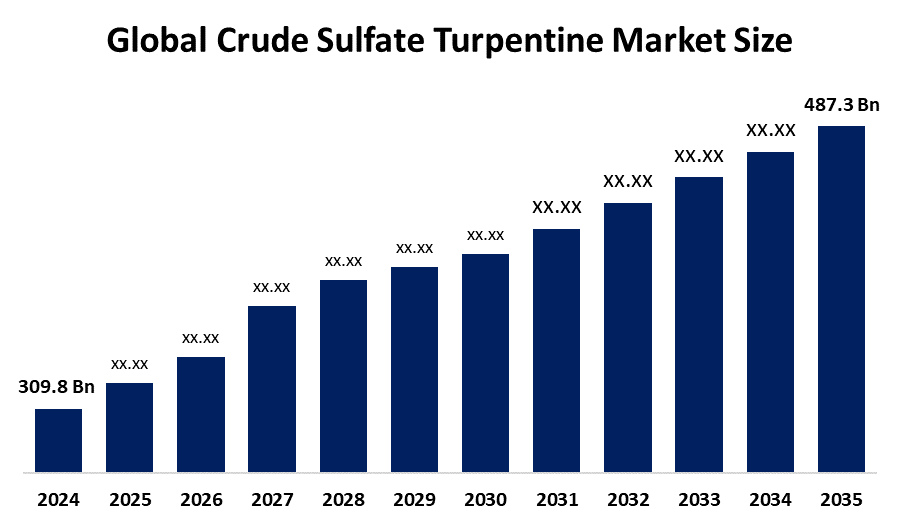

Global Crude Sulfate Turpentine Market Insights Forecasts to 2035

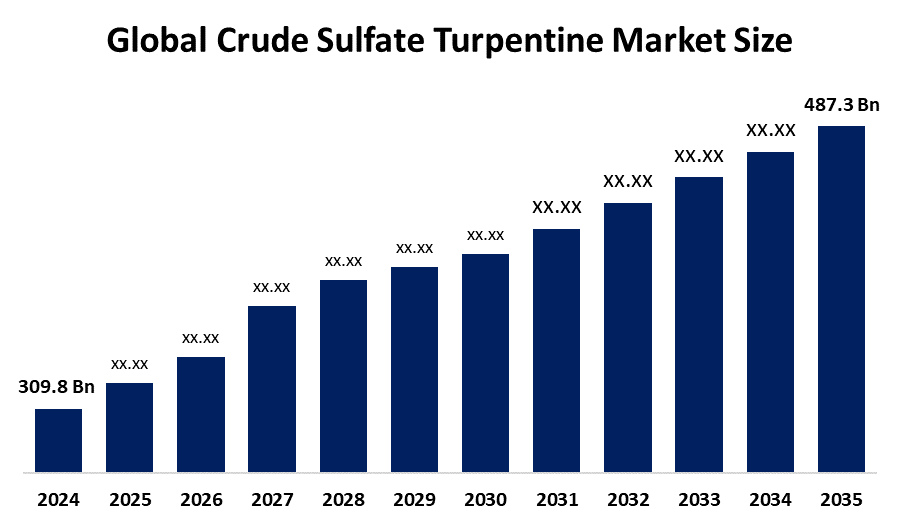

- The Global Crude Sulfate Turpentine Market Size Was Estimated at USD 309.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.2% from 2025 to 2035

- The Worldwide Crude Sulfate Turpentine Market Size is Expected to Reach USD 487.3 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Crude Sulfate Turpentine Market

Crude sulfate turpentine is a natural, terpene-rich byproduct obtained during the Kraft pulping process in paper manufacturing. It primarily contains compounds such as alpha-pinene and beta-pinene and is widely used as a renewable and eco-friendly alternative to synthetic chemicals. CST serves as a key raw material in various industries, including chemicals, personal care, cosmetics, paints, coatings, and cleaning agents. In the chemical industry, it is utilized for producing solvents, resins, and adhesives, while in personal care and cosmetics, it contributes to fragrances and flavoring agents. Its natural origin and versatility make CST an important component in formulations requiring sustainable ingredients. The global crude sulfate turpentine market has been growing steadily, reflecting increasing industrial applications and consumer demand for natural products. With its broad utility and environmentally friendly profile, CST continues to hold significant relevance across multiple sectors worldwide.

Attractive Opportunities in the Crude Sulfate Turpentine Market

- Advances in extraction and purification technologies can significantly enhance the purity and yield of crude sulfate turpentine. This can open the door to high-value specialty products derived from CST, such as higher-purity terpenes and bio-based chemicals.

- With the growing industrialization in emerging economies, particularly in regions such as Asia-Pacific and Latin America, there’s a substantial opportunity to expand CST’s reach into these markets. These regions have increasing industrial sectors, which are becoming more attuned to the demand for sustainable, bio-based raw materials.

- The global push toward circular economy practices present a unique opportunity for CST, as it’s a by-product of paper production. By leveraging this "waste" material, CST can be positioned as a key sustainable resource that transforms byproducts into valuable raw materials.

Global Crude Sulfate Turpentine Market Dynamics

DRIVER: Manufacturers are shifting towards natural alternatives like CST

The growth of the crude sulfate turpentine market is primarily driven by the increasing demand for sustainable and eco-friendly raw materials across various industries. As environmental concerns rise globally, manufacturers are shifting towards natural alternatives like CST, which is derived from renewable sources and offers biodegradability. The chemical industry extensively uses CST for producing solvents, adhesives, and resins, fueling market demand. Additionally, the personal care and cosmetics sectors increasingly favor CST due to its natural terpene content, which is valued in fragrances and flavoring agents. The expanding paint and coatings industry also contribute to CST growth, leveraging its solvent properties. Furthermore, the rise in paper production, which generates CST as a by-product, ensures a steady raw material supply. Advances in extraction and purification technologies have improved CST quality and application versatility, further boosting its market potential. Overall, growing consumer preference for green products and industrial demand for sustainable chemicals are key factors propelling CST market expansion.

RESTRAINT: Extraction and purification processes for CST can be complex and costly

One major challenge is the volatility in raw material supply, as CST is a by-product of the Kraft pulping process, making its availability closely tied to fluctuations in the paper industry. Any downturn or shift in paper production can directly affect CST production volumes. Additionally, the extraction and purification processes for CST can be complex and costly, limiting its adoption, especially among smaller manufacturers. The presence of synthetic alternatives, which often offer consistent quality and lower prices, also poses significant competition. Moreover, regulatory restrictions related to environmental and safety concerns can hinder the use of CST in certain regions or applications. Variations in the chemical composition of CST may lead to inconsistency in end products, which can deter industries requiring uniform raw materials. These factors collectively constrain the widespread adoption and growth potential of the CST market.

OPPORTUNITY: Innovations in extraction and refining technologies

Innovations in extraction and refining technologies can enhance CST purity and yield, opening doors for high-value specialty products. Additionally, expanding into untapped regional markets with growing industrial sectors presents substantial growth potential. Collaborations between pulp producers and chemical manufacturers can create integrated supply chains, improving efficiency and cost-effectiveness. The rising trend of circular economy practices encourages the utilization of byproducts like CST, turning waste into valuable raw materials. Furthermore, increasing investments in research to derive novel derivatives from CST could lead to advanced materials with enhanced functionalities, further broadening its application scope. These opportunities position CST as a versatile resource for future sustainable industrial solutions.

CHALLENGES: Competition from more established, synthetic alternatives that offer stability

One significant challenge is the variability in the quality and composition of CST, which can fluctuate based on the wood source and pulping conditions. This inconsistency can affect its performance in certain applications, especially in industries that require precise specifications, like pharmaceuticals or high-end cosmetics. Another challenge is the competition from more established, synthetic alternatives that offer stability, lower cost, and readily available supply. Despite CST's eco-friendly appeal, some industries are slow to transition from synthetic materials due to concerns about performance reliability. The environmental impact of paper mills, despite their role in CST production, also poses a reputational risk to CST as a green solution, as paper manufacturing itself is energy-intensive and generates significant emissions. Lastly, limited awareness about CST’s benefits and applications can hinder its adoption, particularly in new sectors looking for sustainable raw materials.

Global Crude Sulfate Turpentine Market Ecosystem Analysis

The global crude sulfate turpentine market ecosystem includes raw material suppliers (paper mills), manufacturers refining CST into valuable compounds like alpha-pinene, and end-users in industries such as chemicals, cosmetics, and paints. Key players drive demand through innovations in extraction and product development. Regulatory bodies influence the market with sustainability standards, encouraging eco-friendly solutions. Investors and market analysts play a crucial role in funding R&D and tracking trends. Together, these components foster CST’s growth in the sustainable materials sector.

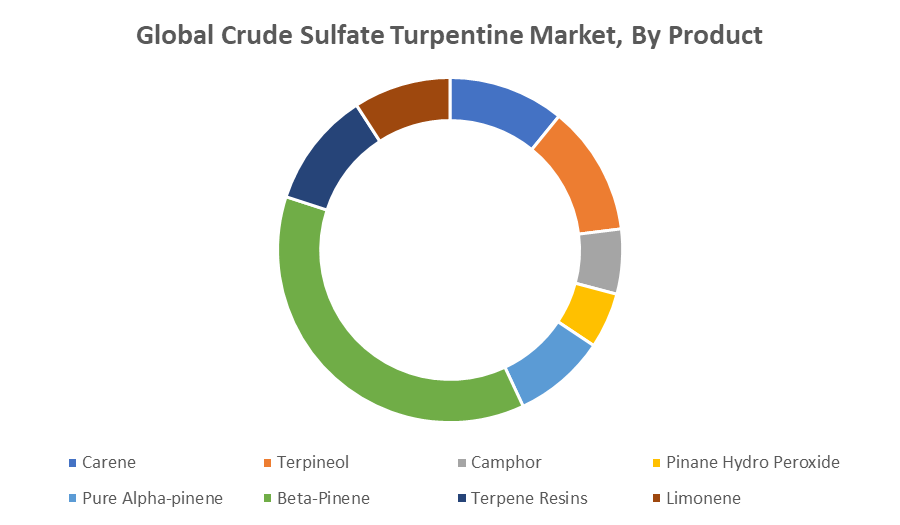

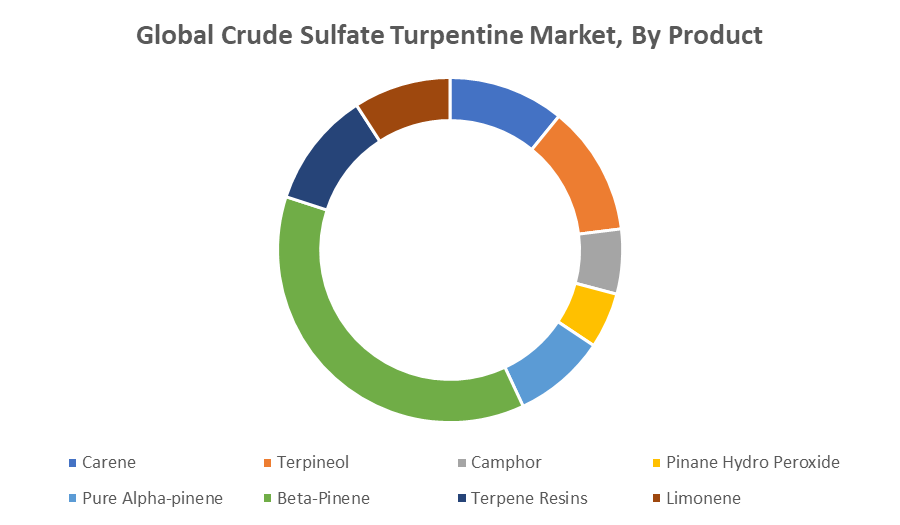

Based on the product, the beta-pinene segment dominated the crude sulfate turpentine market over the forecast period

Beta-pinene, a major component of CST, is widely used in the production of fragrances, solvents, resins, and adhesives. Its demand in the chemicals and personal care sectors, particularly in natural fragrances and flavoring agents, continues to rise as consumers prefer eco-friendly and sustainable products. Additionally, the growing need for green solvents in industrial applications further supports the market for beta-pinene, positioning it as a key driver in the overall growth of the CST market. With increasing awareness of environmental sustainability, beta-pinene’s natural origin and biodegradable properties make it a preferred choice, ensuring its dominance in the market throughout the forecast period.

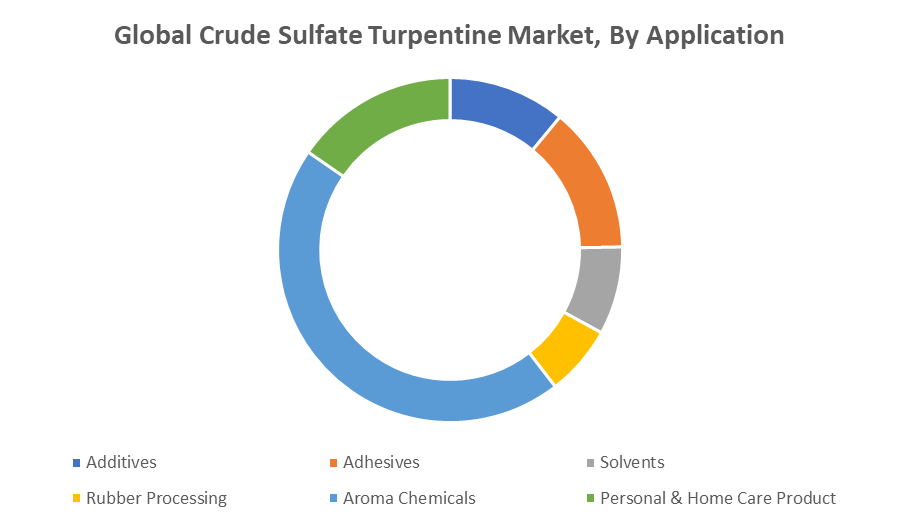

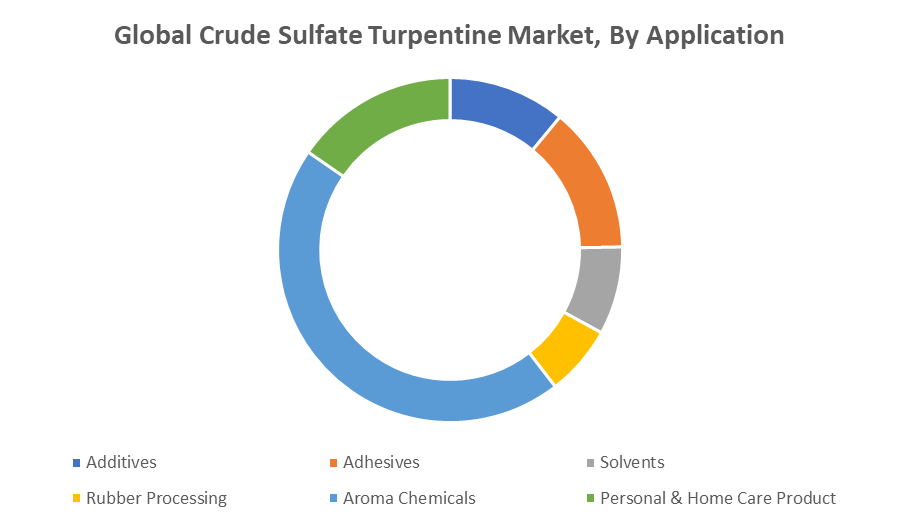

Based on the application, the aroma chemicals segment dominated the crude sulfate turpentine market during the forecast period

CST, rich in terpene compounds like alpha-pinene and beta-pinene, is a key source of aroma chemicals, which are widely used in perfumes, cosmetics, and personal care products. With increasing consumer preference for natural and eco-friendly products, manufacturers are turning to CST-derived aroma chemicals for their renewable and biodegradable properties. This trend is further supported by the expanding global fragrance market, where sustainability is becoming a critical factor. The aroma chemicals segment is thus poised for continued growth, contributing significantly to the overall expansion of the CST market as consumers and industries seek greener, more natural alternatives.

Asia Pacific is anticipated to hold the largest market share of the crude sulfate turpentine market during the forecast period

Asia Pacific is anticipated to hold the largest market share of the crude sulfate turpentine market during the forecast period, driven by rapid industrial growth and increasing demand for sustainable raw materials. The region's expanding pulp and paper industry plays a crucial role in CST production, as it is a key by-product of the Kraft pulping process. Additionally, the rising demand for eco-friendly products in industries such as chemicals, cosmetics, and personal care further fuels the market. Asia Pacific’s growing focus on sustainable solutions and bio-based chemicals, coupled with increasing consumer awareness, positions it as a leading market for CST. The region's robust manufacturing capabilities, coupled with a large population and growing middle class, also contribute to the strong demand for green solvents, aroma chemicals, and bio-based materials, supporting CST’s widespread use.

North America is expected to grow at the fastest CAGR in the crude sulfate turpentine market during the forecast period

North America is expected to grow at the fastest CAGR in the crude sulfate turpentine market during the forecast period, driven by increasing demand for sustainable raw materials and eco-friendly alternatives. The region’s strong focus on environmental sustainability and green chemistry is propelling the adoption of CST in industries such as chemicals, personal care, and paints. Additionally, the growing trend of using natural ingredients in consumer products, such as fragrances and flavoring agents, is boosting demand for CST-derived aroma chemicals. North America’s advanced industrial infrastructure and investments in R&D for improved CST extraction and refinement technologies also support its rapid market growth. As businesses and consumers prioritize sustainability, the demand for bio-based solvents and renewable resources in North America is expected to continue to rise, making it a key driver of growth in the global CST market.

Key Market Players

KEY PLAYERS IN THE CRUDE SULFATE TURPENTINE MARKET INCLUDE

- International Flavors & Fragrances Inc.

- Kraton Polymers

- Pinova Holdings, Inc.

- Eastman Chemical Company

- Dérivés Résiniques et Terpéniques (DRT)

- Forest Products Laboratories (FPL)

- Terpene Technologies

- Yunnan Tin Company Limited

- Georgia-Pacific LLC

- Sinopec Limited

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the crude sulfate turpentine market based on the below-mentioned segments:

Global Crude Sulfate Turpentine Market, By Product

- Carene

- Terpineol

- Camphor

- Pinane Hydro Peroxide

- Pure alpha-pinene

- Beta-Pinene

- Terpene Resins

- Limonene

Global Crude Sulfate Turpentine Market, By Application

- Additives

- Adhesives

- Solvents

- Rubber Processing

- Aroma Chemicals

- Personal & Home Care Product

Global Crude Sulfate Turpentine Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa