Craft Spirit Market Summary, Size & Emerging Trends

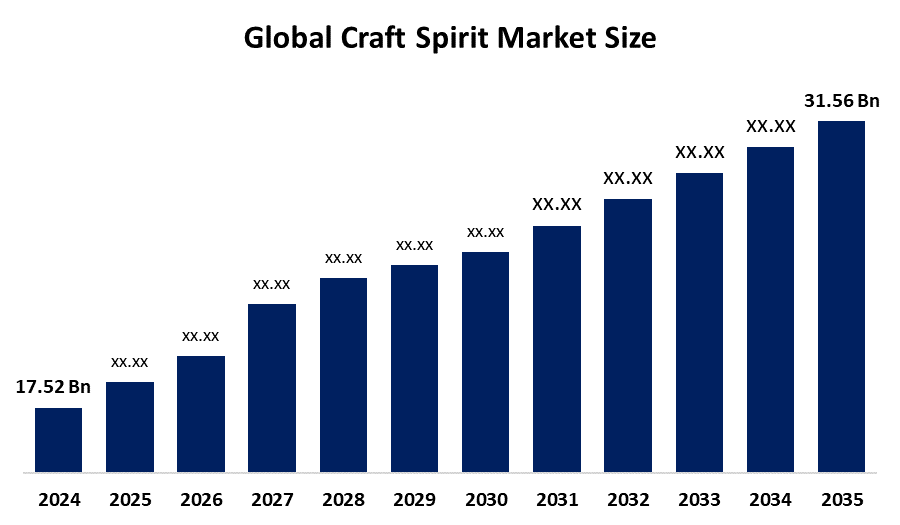

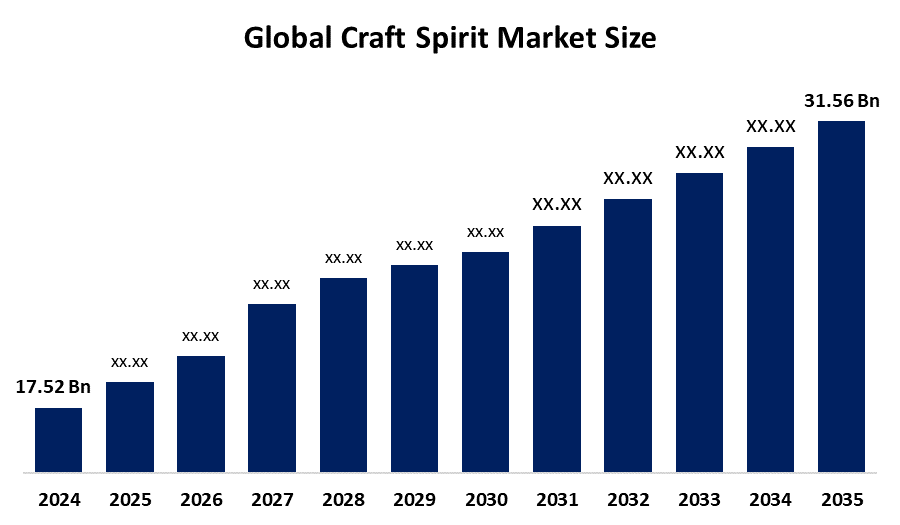

According to Spherical Insights, The Global Craft Spirit Market Size is expected to Grow from USD 17.52 Billion in 2024 to USD 31.56 Billion by 2035, at a CAGR of 5.5% during the forecast period 2025-2035. Increasing consumer preference for premium and artisanal alcoholic beverages, along with the rising cocktail culture in bars and restaurants, is a key driving factor for the craft spirit market.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the craft spirit market during the forecast period.

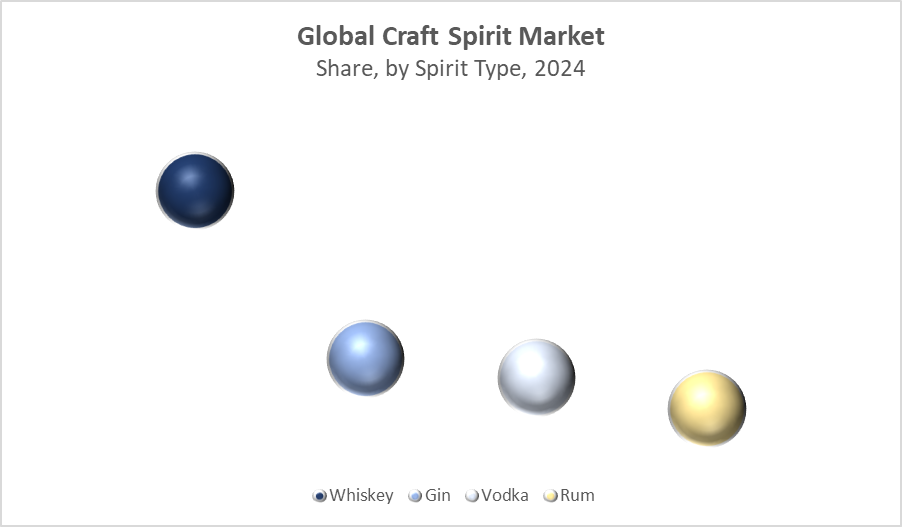

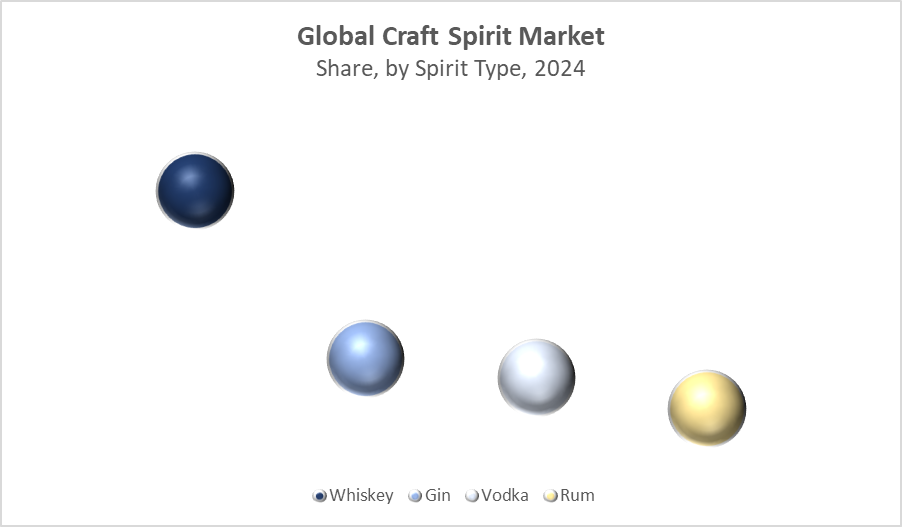

- In terms of spirit type, the whiskey segment dominated in terms of revenue during the forecast period.

- In terms of distribution channel, the retail segment accounted for the largest revenue share in the global craft spirit market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 17.52 Billion

- 2035 Projected Market Size: USD 31.56 Billion

- CAGR (2025-2035): 5.5%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Craft Spirit Market

The craft spirit market focuses on artisanal alcoholic beverages made with high-quality ingredients and traditional distillation methods. Key types include whiskey, gin, vodka, and rum, which are popular in bars, restaurants, and for at-home consumption. Growth is driven by increasing consumer preference for premium, unique flavors and the rising cocktail and mixology culture. Government support for tourism, hospitality, and local distilleries also boosts market expansion. Craft spirits appeal to consumers seeking authenticity, innovation, and sophistication in beverages, differentiating them from mass-produced alcohol. With trends like limited editions, flavored variants, and online sales, the market continues to attract both enthusiasts and casual drinkers. Overall, craft spirits are becoming central to modern drinking culture, combining tradition, creativity, and premium experiences for a growing global audience.

Craft Spirit Market Trends

- Growing consumer preference for premium and locally produced spirits is driving market expansion.

- Innovative flavors and limited-edition releases are gaining traction in bars and retail outlets.

- Online platforms and direct-to-consumer sales channels are increasingly popular, boosting accessibility and sales.

Craft Spirit Market Dynamics

Driving Factors: Rising demand for premium beverages and cocktail culture

The craft spirit market is fueled by a growing consumer preference for artisanal, high-quality alcoholic beverages. Whiskey, gin, vodka, and rum crafted with unique ingredients and traditional methods appeal to consumers seeking premium experiences. Increasing disposable income, particularly among millennials and urban populations, enables more spending on luxury and niche products. The rise of mixology culture in bars, restaurants, and at-home settings has also boosted demand for craft spirits. Consumers increasingly explore creative cocktails, signature drinks, and limited-edition releases, driving sales. Expansion of retail outlets and online platforms ensures greater accessibility, connecting craft spirit brands to a broader, global audience.

Restrain Factors: Competition from mainstream spirits and regulatory restrictions

Despite growing interest, craft spirits face strong competition from established mainstream alcoholic beverages with large marketing budgets and brand recognition. Regulatory frameworks, including licensing, labelling, and taxation, can be stringent and vary across regions, limiting entry and scaling for smaller producers. High production costs and fluctuations in raw materials, such as grains, botanicals, and barrels, can further impact profitability. These factors create barriers for emerging craft spirit brands seeking to gain market share.

Opportunity: Expansion of online sales and emerging markets

The craft spirit market holds significant opportunities in online retail and subscription-based services, allowing brands to reach consumers directly. Emerging markets with rising disposable incomes offer potential for growth, as consumers increasingly seek premium and exotic beverages. Collaborations with bars, restaurants, festivals, and event promotions can enhance brand visibility and encourage trial consumption. Limited editions, flavour innovations, and experiential marketing also provide avenues for differentiation and deeper consumer engagement.

Challenges: Supply chain disruptions and stringent licensing regulations

Market growth is sometimes hindered by supply chain disruptions, including delays in sourcing quality ingredients, packaging materials, and distillation equipment. Seasonal availability of botanicals or grain price volatility can affect production planning. Additionally, navigating complex licensing regulations across countries, including permits for production, distribution, and import/export, poses challenges for craft spirit producers. These constraints can slow expansion, particularly for small- and medium-sized distilleries trying to scale operations internationally.

Global Craft Spirit Market Ecosystem Analysis

The global craft spirit market ecosystem includes key players like raw material suppliers (grains, botanicals, and sugarcane), distillers, distributors, and end-users in bars, restaurants, and retail channels. Suppliers, particularly in Asia and Europe, influence raw material availability and costs. Distillers focus on innovation, quality, and brand differentiation. Regulatory bodies enforce licensing and quality standards. Market growth depends on balancing supply, innovation, and compliance with regulations.

Global Craft Spirit Market, By Spirit Type

Whiskey remains the leading segment in the craft spirits market, accounting for approximately 45% of the market share in 2023. This dominance is attributed to strong consumer demand for premium, aged, and single-malt products, particularly in North America and Europe. Craft whiskey's appeal lies in its rich flavor profiles, traditional production methods, and the growing trend of consumers seeking authenticity and uniqueness in their alcoholic beverages. Innovations in barrel-aging techniques and the introduction of small-batch labels have further enhanced whiskey's position in the market.

Gin is experiencing significant growth in the craft spirits market, with an estimated 24% market share in 2023. This surge is driven by the rising popularity of mixology and the increasing consumer interest in innovative and botanically infused flavors. Gin's versatility in cocktails and its appeal to urban markets, especially in Europe, have contributed to its rapid expansion. Craft distillers are capitalizing on this trend by experimenting with local botanicals and creating distinctive products that cater to the evolving tastes of consumers.

Global Craft Spirit Market, By Distribution Channel

The retail channel, encompassing supermarket chains, liquor stores, and speciality shops, holds the largest revenue share in the craft spirit market. In 2023, it represented approximately 56.9% of the premium spirits market share. This segment's growth is driven by the increasing consumer preference for convenience and the ability to purchase premium spirits at competitive prices. Retail outlets offer a wide selection of craft spirits, allowing consumers to explore various brands and styles. Additionally, the rise of e-commerce platforms has further bolstered retail sales, providing consumers with easy access to a broader range of products.

The on-trade channel, encompassing bars, restaurants, hotels, and cafés (HORECA), plays a pivotal role in the craft spirit market. In 2024, it accounted for approximately 58.34% of the market share, highlighting its dominance in revenue generation. This segment's prominence is attributed to the rise of mixology culture and the increasing popularity of craft cocktail bars. Consumers are drawn to these establishments for unique drinking experiences, personalised service, and the opportunity to explore a diverse range of artisanal spirits. Bartenders often serve as brand ambassadors, introducing patrons to new craft spirit offerings and enhancing brand visibility.

Asia Pacific holds the largest share of the craft spirit market, driven by factors such as increasing disposable income, rapid urbanization, and the expansion of the middle-class population. The region’s growing hospitality and tourism sectors, including bars, restaurants, and hotels, have accelerated demand for premium and artisanal spirits. Countries like China, Japan, and South Korea are witnessing a surge in cocktail culture and premium alcohol consumption. Additionally, rising awareness of global drinking trends and the proliferation of retail and e-commerce channels have made craft spirits more accessible, further boosting market growth across the region.

North America, particularly the United States, is experiencing rapid growth in the craft spirit segment. The boom is largely attributed to the rising popularity of craft cocktail culture, an expanding bar and restaurant scene, and high consumer spending on premium beverages. Consumers increasingly seek unique, small-batch, and artisanal products, driving demand for whiskey, gin, rum, and other craft spirits. Innovative marketing strategies, collaborations with mixologists, and an emphasis on sustainability and local production further strengthen North America’s position as a key growth market.

WORLDWIDE TOP KEY PLAYERS IN THE CRAFT SPIRIT MARKET INCLUDE

- Diageo plc

- Pernod Ricard

- Bacardi Limited

- Brown-Forman Corporation

- William Grant & Sons Ltd.

- Campari Group

- Rémy Cointreau

- Sazerac Company

- Other

Product Launches in Craft Spirit Market

- In March 2024, Bacardi Limited introduced a limited-edition botanical gin series aimed at premium cocktail bars across Europe and North America. This launch reflects Bacardi’s strategy to capitalize on the growing demand for unique, artisanal spirits and the rising popularity of mixology culture. By targeting upscale bars, the company aims to reach consumers who value high-quality ingredients, innovative flavors, and exclusive drinking experiences. Limited-edition releases help create a sense of scarcity and desirability, encouraging trial and repeat purchases.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the craft spirit market based on the below-mentioned segments:

Global Craft Spirit Market, By Spirit Type

Global Craft Spirit Market, By Distribution Channel

- Bars/HORECA

- Retail

- Online

Global Craft Spirit Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa