Cordless Power Tools Market Summary

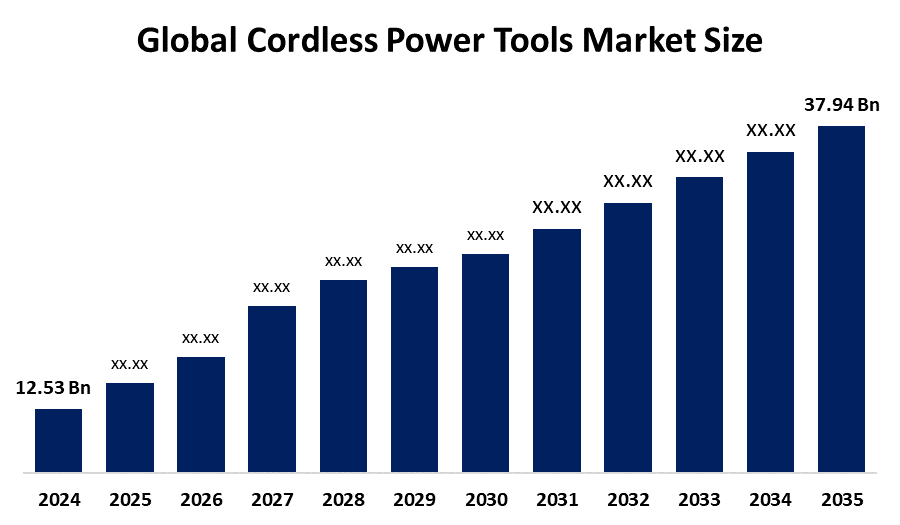

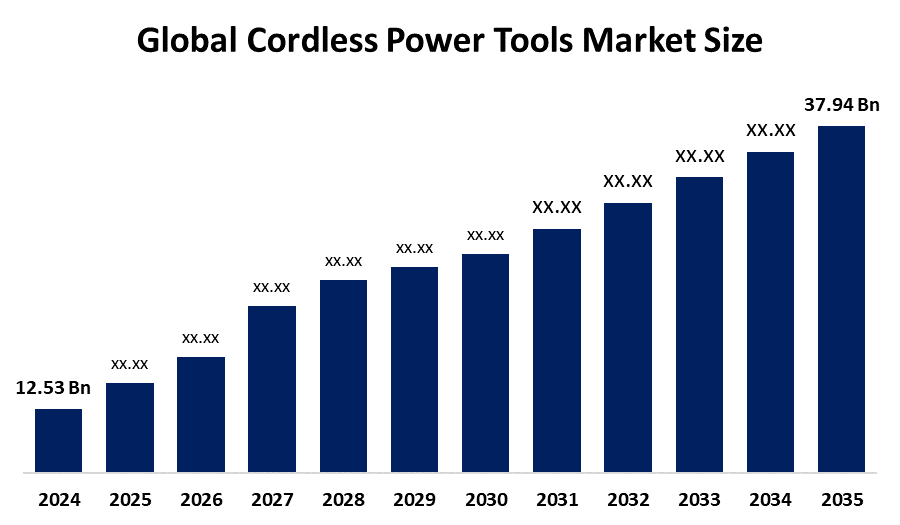

The Global Cordless Power Tools Market Size Was Estimated at USD 12.53 Billion in 2024 and is Projected to Reach USD 37.94 Billion by 2035, Growing at a CAGR of 10.6% from 2025 to 2035. The market for cordless power tools is growing due to a number of factors, including improvements in battery technology, a growing need for portable and effective tools, an increase in do-it-yourself and construction projects, a rise in industrial automation, and a move toward environmentally friendly, low-maintenance, and time-saving equipment.

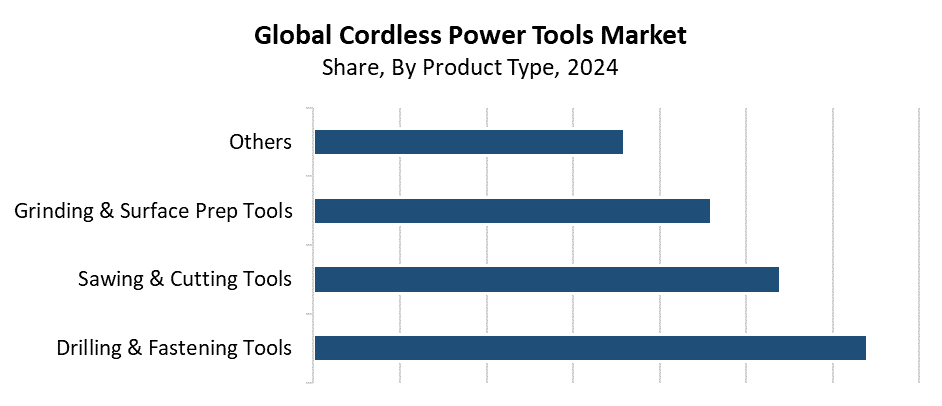

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific cordless power tools market held the largest revenue share of 32.6% and dominated the global market.

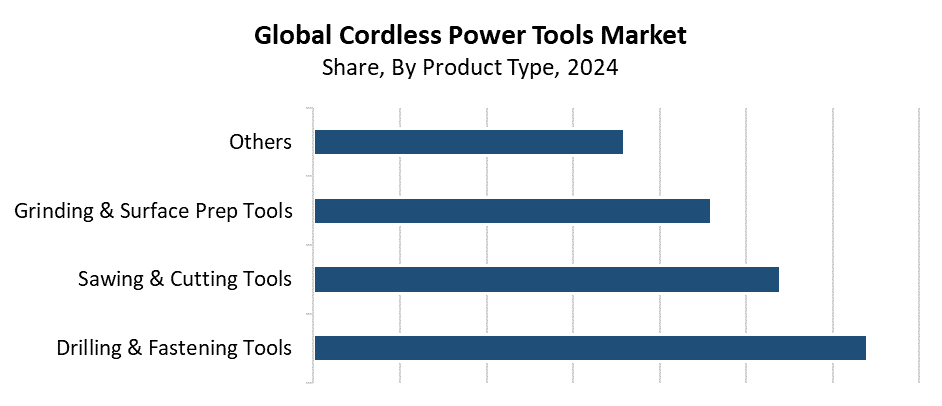

- In 2024, the drilling and fastening tools segment held the highest revenue share of 32.5% and dominated the global market by product type.

- With the biggest revenue share of 66.4% in 2024, the industrial segment led the worldwide cordless power tools market by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 12.53 Billion

- 2035 Projected Market Size: USD 37.94 Billion

- CAGR (2025-2035): 10.6%

- Asia Pacific: Largest market in 2024

The cordless power tools market exists to produce and sell battery-operated tools, including drills, saws, grinders, wrenches, and screwdrivers, that operate without requiring direct electrical connections. The tools exist to boost mobility, safety, and operational efficiency for manufacturing, home renovation, automotive, and construction industries. The market expansion depends on four main drivers, which include fast urban growth, expanding infrastructure projects, rising interest in DIY home improvement, and increasing demand for portable and effective equipment. The market experiences worldwide growth because professional settings demand better operational results. Users want equipment that enhances both comfort and efficiency.

The market for cordless power tools operates under the major impact of technological advancements that have transformed the industry. The combination of brushless motors with lithium-ion technology has resulted in tools that last longer while delivering superior performance and better energy efficiency. The integration of IoT with digital connectivity and smart sensors enables real-time monitoring and enhanced safety systems. The government supports cordless power tools through programs that promote workplace safety standards, environmentally friendly manufacturing, and energy-saving products. The current market growth, along with continuous research funding and sustainable design development, enables widespread implementation across commercial spaces, residential areas, and industrial facilities.

Product Type Insights

The drilling and fastening tools segment led the cordless power tools market in 2024 with the largest revenue share of 32.5%. The manufacturing sector, along with woodworking, automotive, and construction industries, heavily depends on impact wrenches, screwdrivers and cordless drills, which lead to this dominance. These tools serve as vital equipment for professional users and DIY enthusiasts because they deliver high performance and versatile operation, exact results in drilling and fastening tasks. The segment experiences growth because of technological improvements, which include brushless motors and enhanced torque control systems and durable lithium-ion battery power sources. The demand for small, ergonomic, lightweight tools has led to a global rise in cordless drilling and fastening solutions.

The sawing and cutting tools segment is expected to grow at a significant CAGR because construction operations, together with woodworking, metalworking, and remodelling operations, need these tools at increasing rates. The portability, accuracy, and convenience of use of cordless saws and cutting tools such as jigsaws, reciprocating saws, and circular saws make them more and more popular in a variety of professional settings. The battery technology advancements lead to market expansion because they deliver better power performance, longer operational time, and higher efficiency. This enables these tools to perform at the same level as their corded counterparts. The worldwide expansion of cordless sawing and cutting tools stems from safer ergonomic models and the growing number of consumers who choose to do their own home renovations.

End Use Insights

The industrial segment led the cordless power tools market in 2024 by holding the largest revenue share of 66.4%. The leadership position comes from the extensive use of cordless tools in manufacturing, automotive, aerospace, energy, and construction sectors, which need precise operations with high-performance, durable, and effective instruments. The need for industrial environments to have flexible operations and secure conditions at all times has created a high demand for cordless solutions that eliminate cable restrictions and reduce operational disruptions. The industrial applications of these tools have gained strength through better tool performance and durability. This resulted from battery technology advancements and smart feature integration. The segment will continue to lead the market because of ongoing infrastructure development and industrial automation growth.

The residential segment is expected to grow at a significant rate throughout the forecast period because consumers now prefer to handle their own home improvement projects and maintenance tasks. The widespread adoption of cordless power tools for domestic use stems from three main factors, which include better living standards, expanding urban areas, and increased knowledge about tool accessibility and operation. These instruments function as ideal tools for home users who want to boost their efficiency and convenience because they come in a compact size, are lightweight, and user-friendly. The development of battery technology, together with lithium-ion technology price reductions, has made tools more affordable and accessible to users. The worldwide market expansion continues to grow strongly because of the emergence of e-commerce platforms. The promotional activities are conducted by leading manufacturers.

Regional Insights

The Asia Pacific region led the global cordless power tool market with the largest revenue share of 32.6% in 2024. The leading economies of China, Japan, South Korea, and India have achieved this control through their fast industrial growth and expanding construction and manufacturing sectors. The market has seen rapid growth because the area needs more infrastructure development and strong portable equipment solutions. The market for cordless tools continues to grow because of the rising DIY culture and home renovation activities. These mostly take place in cities. The Asia Pacific region maintains its market leadership in cordless power tools because of its numerous domestic and foreign manufacturers, its advanced technology, and its government-backed programs that support industrial development and environmentally friendly operations.

North America Cordless Power Tools Market Trends

The North American cordless power tools market held a significant revenue share in 2024 because the industrial, automotive, and construction sectors showed strong demand for these products. The market growth stems from the region's strong infrastructure network, its high acceptance of advanced technology, and its established manufacturing base, which includes Milwaukee Tool, DeWalt and Stanley Black & Decker. The market continues to grow because more consumers choose to do their own home renovations while they seek out basic tools that function simply and perform well. The performance and durability of tools have improved because of battery technology progress. This includes brushless motor systems and lithium-ion batteries that last longer. Government programs which promote workplace safety and energy-efficient equipment serve as key drivers for the North American cordless power tool market growth.

Europe Cordless Power Tools Market Trends

The European cordless power tools market experiences significant growth because industrial automation expands, consumers choose more DIY projects, and construction and renovation projects increase. Germany, the United Kingdom, and France lead the contributions through their strong manufacturing base and technological progress. The market continues to grow because of strict safety and environmental regulations and the shift toward sustainable energy-efficient tools. The reliability and performance of cordless tools have improved because of battery technology advancements, which include quick charging systems. Enhanced lithium-ion battery capabilities. The European cordless power tools market will continue its strong growth because smart connected tools become more common and infrastructure development receives increased funding.

Key Cordless Power Tools Companies:

The following are the leading companies in the cordless power tools market. These companies collectively hold the largest market share and dictate industry trends.

- Ideal Power Tools

- Milwaukee

- Festool

- Ryobi

- Makita

- Stanley Black & Decker

- Bosch

- Hilti

- DeWalt

- Craftsman

- Others

Recent Developments

- In August 2025, Festool introduced the HLC 82 to the market. With its 82mm width and spiral blade cutter, this tool creates pulling cuts for a quieter, cleaner finish.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisors has segmented the cordless power tools market based on the below-mentioned segments:

Global Cordless Power Tools Market, By Product Type

- Drilling & Fastening Tools

- Sawing & Cutting Tools

- Grinding & Surface Prep Tools

- Others

Global Cordless Power Tools Market, By End Use

Global Cordless Power Tools Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa