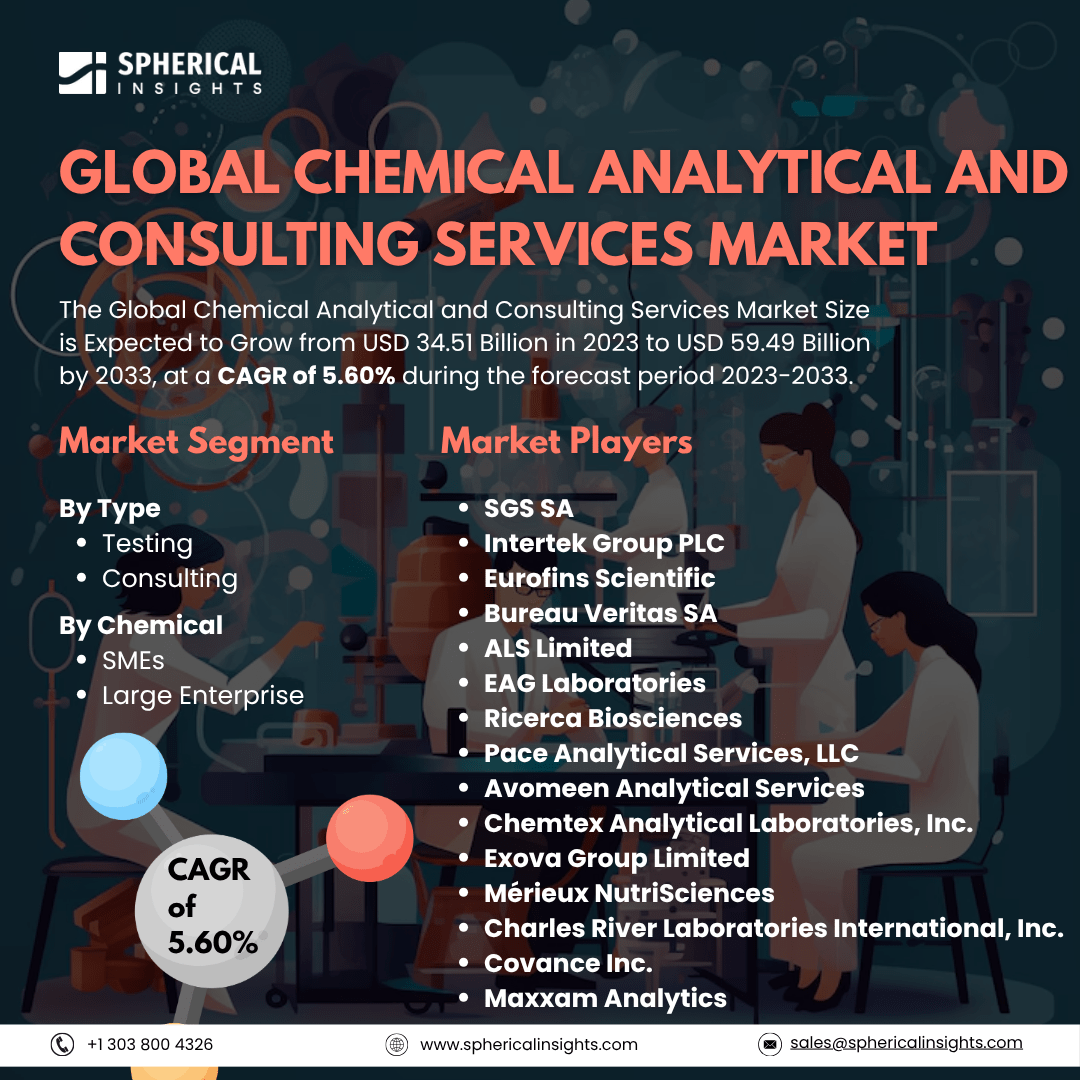

Global Chemical Analytical and Consulting Services Market Size To Exceed USD 59.49 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Chemical Analytical and Consulting Services Market Size is Expected to Grow from USD 34.51 Billion in 2023 to USD 59.49 Billion by 2033, at a CAGR of 5.60% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Chemical Analytical and Consulting Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Testing and Consulting), By Application (SMEs and Large Enterprise), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The chemical analytical and consulting services market encompasses a range of services aimed at analyzing chemical compositions, properties, and behaviors of various substances, as well as providing expert advice to industries reliant on chemical processes. These services are crucial for ensuring product quality, safety, and compliance with regulatory standards across sectors such as pharmaceuticals, chemicals, food and beverage, and energy. Furthermore, the Global Chemical Analytical and Consulting Services Market is driven by rising regulatory compliance needs, increased demand for product quality and safety, technological advancements in analytical techniques, and growing R&D activities across pharmaceuticals, food, and environmental sectors. Additionally, the globalization of trade and heightened awareness of environmental impact further fuel the need for specialized chemical analysis and expert consulting services. However, restraining factors include high service costs, limited skilled professionals, stringent regulatory compliance, data security concerns, and slow adoption in developing regions, hindering market growth and service accessibility across industries.

The consulting segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the type, the global chemical analytical and consulting services market is divided into testing and consulting. Among these, the consulting segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the increasing demand for expert guidance in regulatory compliance, quality assurance, and process optimization across industries. Companies are leveraging specialized consulting services to navigate complex chemical regulations and enhance operational efficiency, driving this segment's expansion.

The large enterprise segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the application, the global chemical analytical and consulting services market is divided into SMEs and large enterprise. Among these, the large enterprise segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is attributed to their substantial resources and complex operational needs. They require comprehensive services for regulatory compliance, quality assurance, and process optimization. This demand is expected to drive significant growth in this segment.

North America is projected to hold the largest share of the global chemical analytical and consulting services market over the forecast period.

North America is projected to hold the largest share of the global chemical analytical and consulting services market over the forecast period. The regional growth is attributed to the presence of well-established chemical industries, stringent regulatory frameworks, and advanced technological infrastructure. The region’s strong emphasis on research and development, coupled with high demand for quality assurance and environmental safety, drives consistent investment in analytical and consulting services.

Asia Pacific is expected to grow at the fastest CAGR growth of the global chemical analytical and consulting services market during the forecast period. This growth is driven by rapid industrialization, particularly in countries like China and India, leading to increased demand for chemical analysis to ensure product quality and regulatory compliance. Additionally, government initiatives promoting industrial development and foreign investments have bolstered the chemical sector, further fueling the need for analytical and consulting services. The region's competitive production costs and evolving trade dynamics also contribute to this accelerated expansion.

Company Profiling

Major vendors in the global chemical analytical and consulting services market are SGS SA, Intertek Group PLC, Eurofins Scientific, Bureau Veritas SA, ALS Limited, EAG Laboratories, Ricerca Biosciences, Pace Analytical Services, LLC, Avomeen Analytical Services, Chemtex Analytical Laboratories, Inc., Exova Group Limited, Mérieux NutriSciences, Charles River Laboratories International, Inc., Covance Inc., Maxxam Analytics and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global chemical analytical and consulting services market based on the below-mentioned segments:

Global Chemical Analytical and Consulting Services Market, By Type

Global Chemical Analytical and Consulting Services Market, By Chemical

Global Chemical Analytical and Consulting Services Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa