Global Beauty & Personal Care Surfactants Market Insights Forecasts to 2035

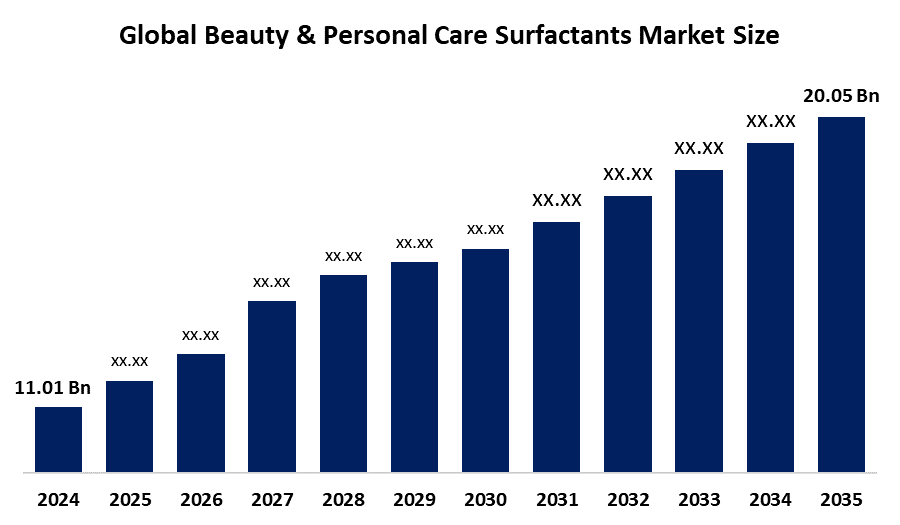

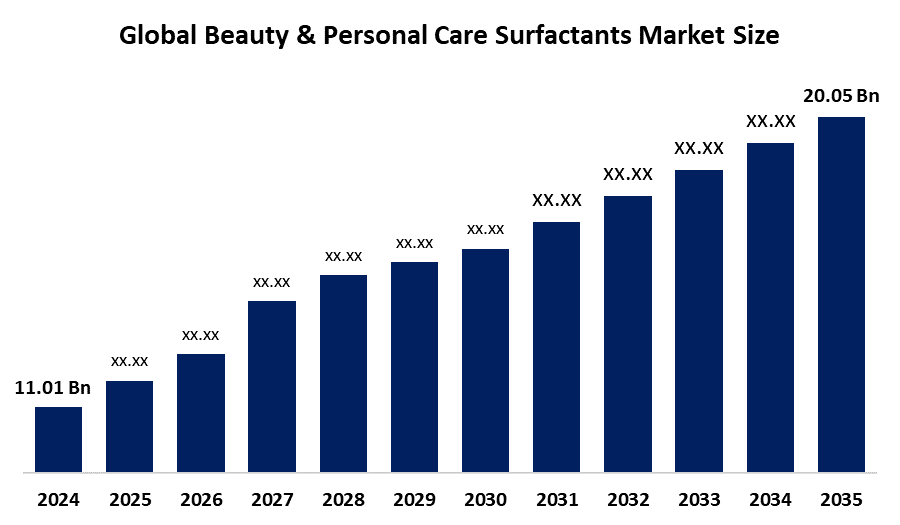

- The Global Beauty & Personal Care Surfactants Market Size Was Estimated at USD 11.01 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.6% from 2025 to 2035

- The Worldwide Beauty & Personal Care Surfactants Market Size is Expected to Reach USD 20.05 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Beauty & Personal Care Surfactants Market

The global beauty and personal care surfactants market comprises a wide range of chemical compounds used in personal care products to aid in cleansing, foaming, emulsifying, and conditioning. Surfactants are key ingredients in formulations such as shampoos, soaps, facial cleansers, body washes, creams, and lotions. These compounds work by reducing the surface tension between substances, enabling better interaction between oil, water, and dirt, which enhances product performance and user experience. The market includes both synthetic and naturally derived surfactants, with applications across skin care, hair care, oral care, and hygiene products. Surfactants are used in various formats such as anionic, cationic, nonionic, and amphoteric, each offering specific benefits depending on the product formulation. Manufacturers continuously adapt formulations to meet consumer expectations for texture, mildness, and efficacy. The market serves a diverse customer base and reflects the evolving preferences in product performance, ingredient transparency, and formulation quality across the beauty and personal care industry.

Attractive Opportunities in the Beauty & Personal Care Surfactants Market

- Technological progress in sustainable chemistry allows the creation of high-performance surfactants from renewable resources. These eco-friendly alternatives appeal to environmentally conscious consumers and regulators, providing a growth avenue through bio-based and biodegradable ingredients.

- Expanding markets such as men’s grooming, baby care, and senior skincare represent untapped potential for targeted surfactant formulations. Additionally, the rise of beauty tech and personalized skincare drives demand for adaptive surfactants tailored to individual skin types and environmental conditions.

Global Beauty & Personal Care Surfactants Market Dynamics

DRIVER: Growth of e-commerce and digital marketing is boosting product visibility and accessibility

Urbanization and rising disposable incomes, particularly in developing regions, are enabling consumers to spend more on premium and specialized beauty products. The industry is also witnessing a strong shift toward natural, mild, and eco-friendly surfactants, fueled by growing concerns over synthetic ingredients and sustainability. Innovation in product formulations, such as sulfate-free and pH-balanced solutions, is expanding market opportunities. Additionally, the growth of e-commerce and digital marketing is boosting product visibility and accessibility, further driving sales. Continuous advancements in surfactant chemistry and cosmetic science are also allowing manufacturers to develop multifunctional ingredients that enhance product performance, thus supporting long-term market expansion across all major product categories.

RESTRAINT: Increasing scrutiny over the environmental and health impacts of synthetic surfactants

One major concern is the increasing scrutiny over the environmental and health impacts of synthetic surfactants, particularly those derived from petrochemicals. Many conventional surfactants are non-biodegradable and may cause skin irritation or long-term ecological harm, prompting regulatory restrictions and consumer pushback. The shift toward natural and bio-based alternatives, while beneficial, also brings challenges such as higher production costs, limited raw material availability, and stability issues in formulations. Additionally, stringent regulations related to cosmetic ingredient safety and labeling in regions like the EU and North America can slow down product development and market entry. Fluctuating prices of raw materials, especially petroleum-based compounds, add further uncertainty to production planning and cost management. Lastly, intense market competition and the need for continuous innovation place pressure on manufacturers to balance quality, performance, and cost-effectiveness, limiting profitability in some segments.

OPPORTUNITY: Increasing popularity of multifunctional and hybrid beauty products opens doors for surfactants

The increasing popularity of multifunctional and hybrid beauty products opens doors for surfactants that offer added benefits like moisturization, anti-bacterial properties, or enhanced texture. Technological advancements in green chemistry present opportunities to create high-performance, sustainable surfactants using renewable resources, appealing to both consumers and regulators. Collaborations between cosmetic brands and biotechnology firms can accelerate innovation in biosurfactant development. Moreover, niche segments such as men’s grooming, baby care, and senior skincare are growing rapidly, offering untapped potential for targeted surfactant formulations. Lastly, the expansion of beauty tech and personalized skincare solutions may drive demand for adaptive surfactant systems that can be tailored to individual skin types or environmental conditions.

CHALLENGES: Creating natural or eco-friendly surfactants that still perform as well as synthetic ones in terms of foaming

The beauty & personal care surfactants market faces several challenges beyond regulations and environmental issues. One major challenge is creating natural or eco-friendly surfactants that still perform as well as synthetic ones in terms of foaming, cleansing, and stability. Many natural alternatives can be less effective or more expensive to produce. Changing beauty trends, like clean beauty and waterless products, also require constant innovation, which can be costly and time-consuming. Consumer misunderstandings about certain ingredients, even if they are safe, can make marketing more difficult. Another issue is the complex supply chain for specialty and natural ingredients, which can lead to delays or higher costs. The market is also highly competitive, making it harder for companies to stand out. Lastly, brands must clearly explain their product ingredients and benefits while following strict labeling rules, which can be a difficult balance to maintain.

Global Beauty & Personal Care Surfactants Market Ecosystem Analysis

The beauty & personal care surfactants market ecosystem involves raw material suppliers, surfactant manufacturers, formulators, cosmetic brands, distributors, and consumers. It starts with sourcing synthetic or natural ingredients, which are processed into various surfactants. These are then used in personal care products like shampoos and cleansers. Distributors and retailers deliver these products to consumers, while regulatory bodies ensure safety and compliance. Research institutions support innovation, and consumer preferences shape demand for sustainable, effective, and skin-friendly formulations across the beauty and personal care industry.

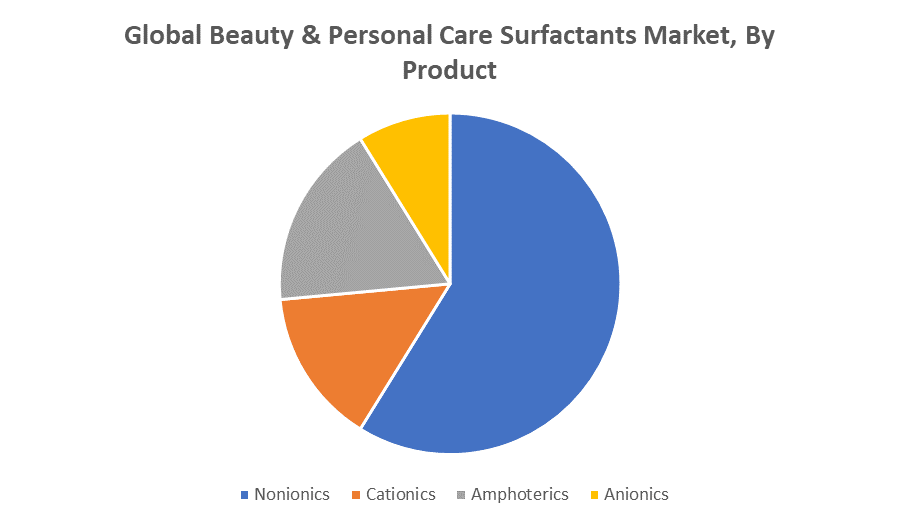

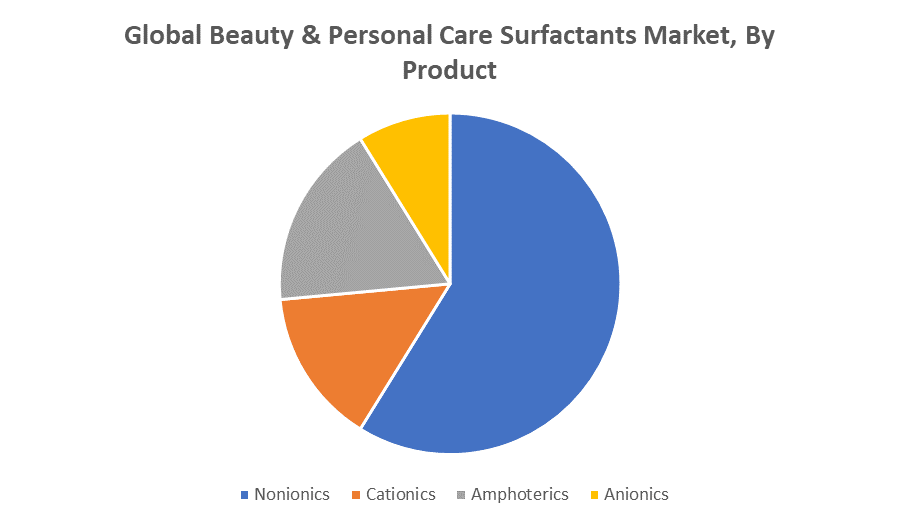

Based on the product, the nonionic segment held the largest market share over the forecast period

Nonionic surfactants are widely used in beauty and personal care products due to their mildness, low skin irritation potential, and effective cleansing and emulsifying properties. They are highly compatible with other ingredients and suitable for sensitive skin, making them ideal for applications in products like facial cleansers, shampoos, and lotions. Their versatility and stability across a wide pH range contribute to their dominant market position.

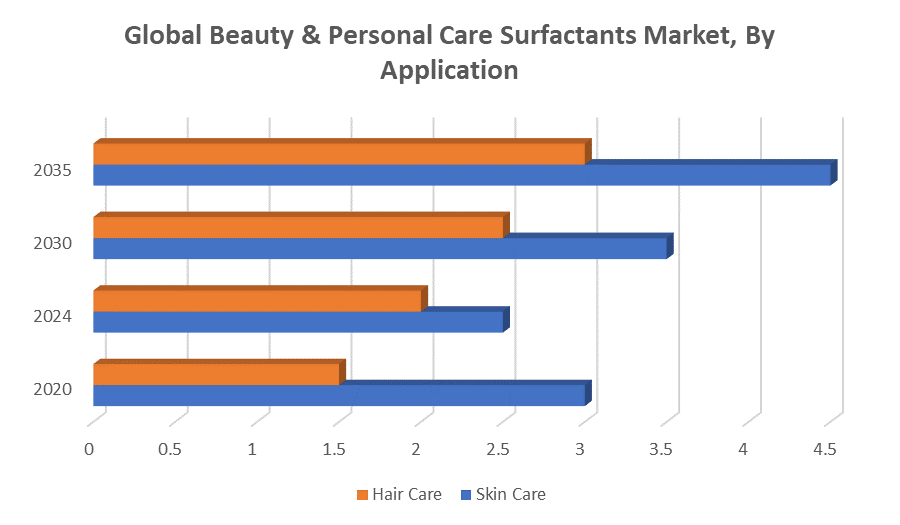

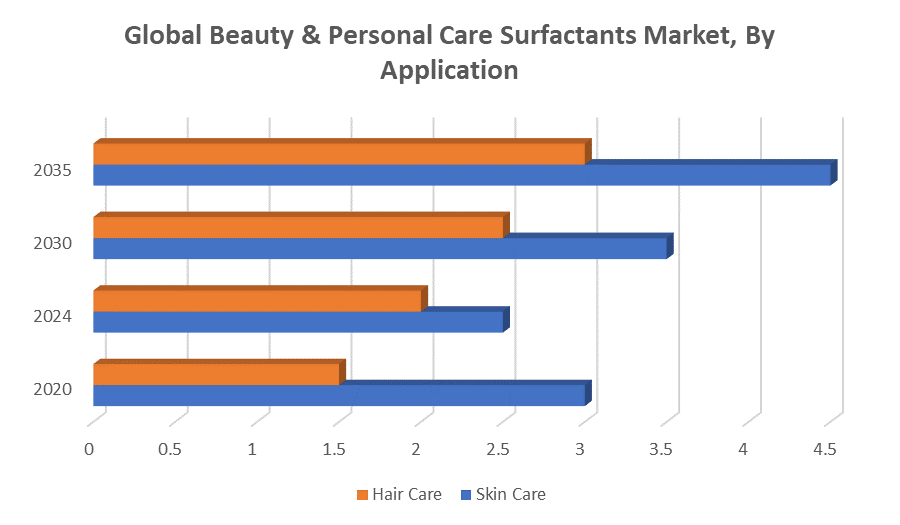

Based on the application, the skincare segment held a significant revenue share and is expected to grow at a substantial CAGR over the forecast period

Skincare segment growth is driven by increasing consumer focus on skin health, rising demand for gentle and effective cleansing products, and the popularity of multifunctional skincare formulations. Surfactants in skincare products help in cleansing, moisturizing, and improving texture, making them essential ingredients. The segment’s expansion reflects evolving beauty trends and greater awareness of personal care routines worldwide.

Asia Pacific is anticipated to hold the largest market share of the beauty & personal care surfactants market during the forecast period

Asia Pacific is anticipated to hold the largest market share of the beauty & personal care surfactants market during the forecast period. This is due to the region’s large and growing population, rising disposable incomes, and increasing urbanization. Additionally, expanding beauty and personal care industries, along with growing consumer awareness about hygiene and skincare, are fueling demand. The presence of major manufacturers and the availability of raw materials also support market growth. Overall, the Asia Pacific is expected to remain a key hub for both production and consumption in this market.

North America is expected to grow at the fastest CAGR in the beauty & personal care surfactants market during the forecast period

North America is expected to grow at the fastest CAGR in the beauty & personal care surfactants market during the forecast period. This growth is driven by increasing consumer awareness about personal hygiene and grooming, along with a rising preference for natural and sustainable products. The region hosts many leading cosmetic manufacturers focusing on innovative and specialty surfactants. Additionally, a strong retail infrastructure and high demand for premium personal care products further support market expansion. These factors position North America as a key player in the global surfactants market.

Recent Development

- In January 2022, BASF launched the Peptovitae series, a range of four patented dermocosmetic peptides developed in collaboration with Caregen. These biomimetic peptides address various skin concerns, including aging, brightness, dryness, and irritation. The series utilizes a double-layered, liposome-based encapsulation system to ensure effective delivery in cosmetic formulations.

- In February 2022, Clariant unveiled its Vita range of 100% bio-based surfactants and polyethylene glycols (PEGs). These products are derived from renewable carbon sources like sugar cane and corn, aiming to reduce CO emissions by up to 85% compared to their fossil-based counterparts.

Key Market Players

KEY PLAYERS IN THE BEAUTY & PERSONAL CARE SURFACTANTS MARKET INCLUDE

- BASF SE

- Clariant AG

- Solvay S.A.

- Croda International Plc

- Evonik Industries AG

- Stepan Company

- Ashland Global Holdings Inc.

- AkzoNobel N.V.

- Innospec Inc.

- Biopolax GmbH

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the beauty & personal care surfactants market based on the below-mentioned segments:

Global Beauty & Personal Care Surfactants Market, By Product

- Nonionic

- Cationic

- Amphoteric

- Anionics

Global Beauty & Personal Care Surfactants Market, By Application

Global Beauty & Personal Care Surfactants Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa