Global Banking System Software Market Insights Forecasts to 2035

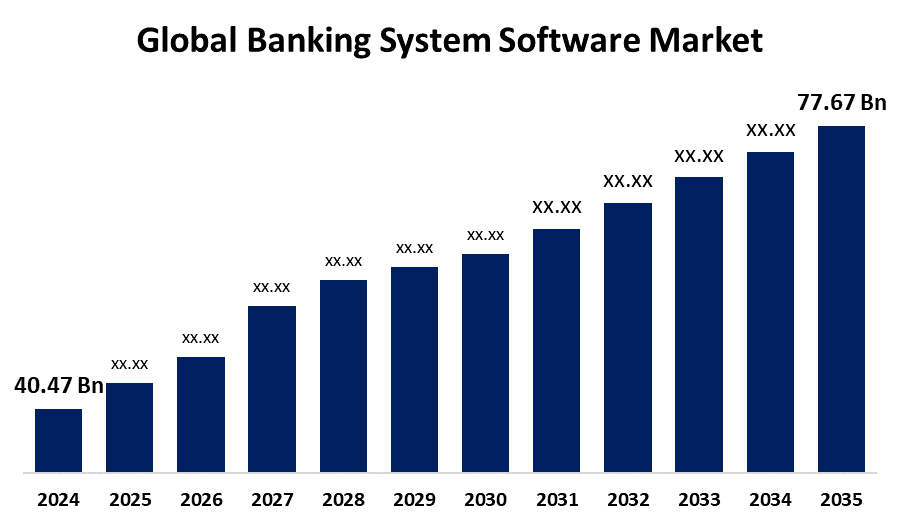

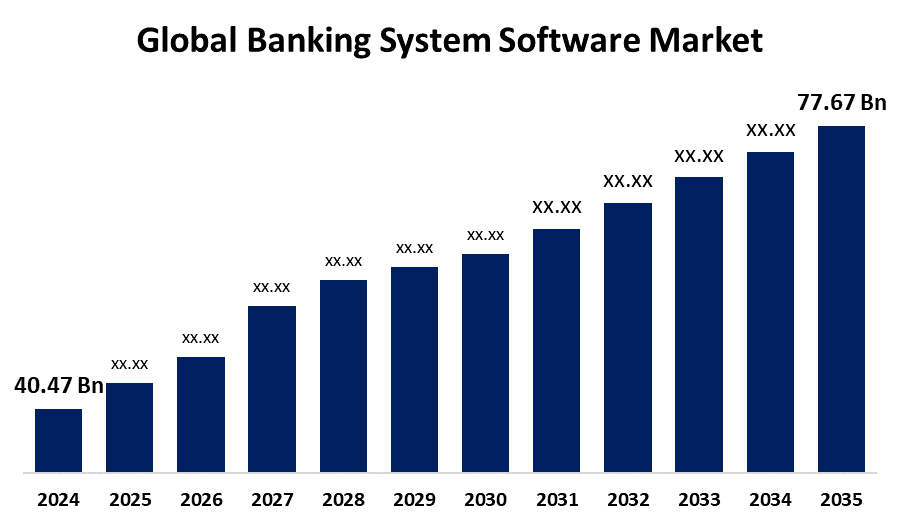

- The Global Banking System Software Market Size Was Estimated at USD 40.47 billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.11% from 2025 to 2035

- The Worldwide Banking System Software Market Size is Expected to Reach USD 77.67 billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Banking System Software Market

The global banking system software market includes a wide range of digital platforms designed to support and streamline the operations of financial institutions. These software solutions cover core banking, digital banking, loan and mortgage management, customer relationship management, and payment processing systems. By integrating these functions, banks can improve service delivery, maintain accurate records, and enhance operational efficiency. Banking system software also enables secure transactions, regulatory compliance, and seamless customer interactions across various channels. Institutions can choose between on-premise and cloud-based deployment models depending on their infrastructure and operational needs. The software is tailored for commercial banks, investment firms, credit unions, and other financial service providers, offering features that promote automation and scalability. As financial institutions continue to adapt to evolving technologies and customer expectations, banking system software plays a central role in ensuring seamless operations, data accuracy, and a consistent, reliable banking experience across digital and traditional platforms.

Attractive Opportunities in the Banking System Software Market

- Development of banking software tailored to underserved and unbanked populations, expanding access via mobile banking and microfinance solutions.

- Integrating banking services within non-financial platforms like retail and e-commerce, creating new deployment channels and innovative financial products.

- Facilitating collaboration between banks and third-party developers to enhance customer experiences and diversify product offerings.

- Developing banking software to support green financing and transparent ESG reporting, opening niche markets aligned with global sustainability goals.

Global Banking System Software Market Dynamics

DRIVER: Increasing demand for digital transformation within financial institutions

One major driver is the increasing demand for digital transformation within financial institutions, as banks strive to enhance customer experience and streamline operations. The shift toward online and mobile banking has created a need for robust, scalable software solutions that support real-time processing and omnichannel service delivery. Additionally, the rising adoption of cloud-based platforms allows for greater flexibility, reduced infrastructure costs, and easier updates. Advancements in technologies such as artificial intelligence, machine learning, and blockchain are also propelling innovation, enabling banks to offer personalized services, detect fraud, and improve decision-making. Regulatory compliance requirements are another significant driver, as institutions need software capable of managing complex and evolving regulations efficiently. Furthermore, the competitive landscape, influenced by the rise of fintech companies, is encouraging traditional banks to modernize their systems to remain relevant and meet changing customer expectations.

RESTRAINT: Upgrading legacy systems to modern platforms often requires significant investment in infrastructure

Upgrading legacy systems to modern platforms often requires significant investment in infrastructure, training, and integration. Additionally, concerns around data security and privacy remain critical, especially as cyber threats become more sophisticated and frequent. Regulatory complexity is another barrier, as banking software must continually adapt to changing compliance requirements across different regions, which can slow development and deployment. The dependence on legacy systems in many institutions also creates resistance to change due to operational risks associated with transitioning to new platforms. Furthermore, the shortage of skilled professionals to manage and develop advanced banking software solutions adds to the difficulty of implementation. These challenges collectively hinder the rapid adoption of banking system software, especially in less technologically advanced markets.

OPPORTUNITY: Collaboration between banks and third-party developers

One significant opportunity is the increasing focus on financial inclusion, which encourages the development of banking software tailored for underserved and unbanked populations through mobile banking and microfinance platforms. Additionally, the rise of embedded finance, integrating banking services within non-financial platforms like retail and e-commerce, creates new avenues for software deployment and innovation. Open banking and API-based ecosystems also present opportunities for collaboration between banks and third-party developers, fostering enhanced customer experiences and product offerings. Furthermore, there is growing demand for modular and customizable software solutions that allow financial institutions to scale and adapt without extensive system overhauls. Lastly, the push toward sustainable finance and ESG (Environmental, Social, and Governance) initiatives opens a niche market for banking software designed to support green financing and transparent reporting, highlighting new areas for innovation and growth in the sector.

CHALLENGES: Interoperability between diverse legacy systems and modern platforms remains complex

One significant challenge is the rapid pace of technological change, which requires continuous software updates and adaptability to avoid obsolescence. Banks must balance innovation with stability, ensuring new systems integrate smoothly without disrupting ongoing operations. Interoperability between diverse legacy systems and modern platforms remains complex, often requiring extensive customization and testing. Additionally, the growing volume of data generated by banking activities presents challenges in effective data management, storage, and analysis, demanding advanced analytics and big data capabilities. Another challenge is managing customer expectations for seamless, personalized experiences across multiple digital channels, which can be difficult to achieve with existing infrastructure. Furthermore, geopolitical tensions and cross-border regulatory differences complicate the deployment of standardized software solutions globally. Lastly, the shortage of cybersecurity expertise and increasing cyberattacks make protecting banking systems a persistent and evolving challenge for financial institutions worldwide.

Global Banking System Software Market Ecosystem Analysis

The global banking system software market ecosystem includes software vendors and fintech firms that develop core banking, digital, and compliance solutions. Financial institutions such as banks and credit unions are the primary users, implementing these tools to enhance operations and customer service. Supporting players include cloud providers, cybersecurity firms, and system integrators who ensure smooth deployment and protection. Regulatory bodies set compliance standards influencing software design. Customers, both individual and corporate, drive demand and feature development through their evolving needs. Together, these stakeholders create a collaborative environment that fosters innovation and efficiency in banking technology.

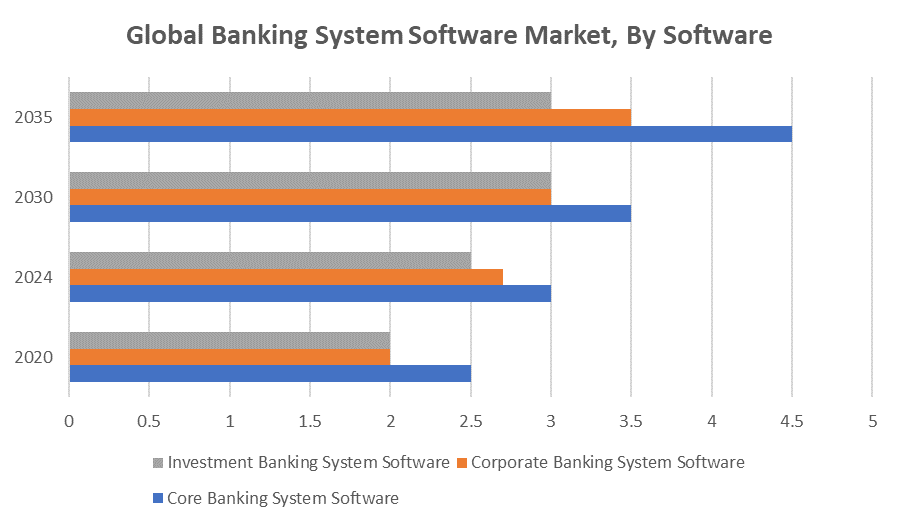

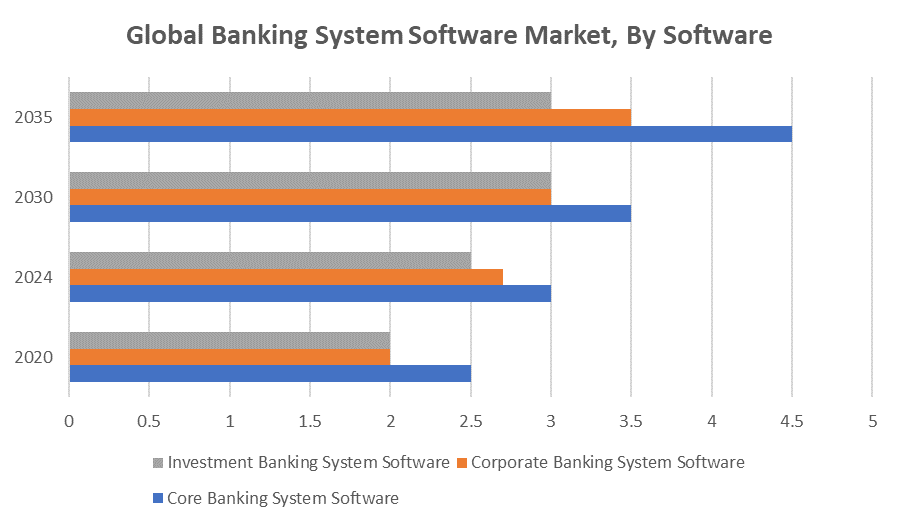

Based on the software, the core banking system software segment held the highest revenue share and is expected to grow at a remarkable CAGR over the forecast period

The core banking system software segment held the highest revenue share due to its fundamental role in managing essential banking functions such as transaction processing, account management, and loan services. As banks increasingly adopt digital transformation, there is a growing demand for real-time processing, seamless integration with mobile and online platforms, and enhanced operational efficiency. Advanced core banking systems also facilitate compliance with regulatory requirements and support emerging technologies like AI and blockchain, improving customer experience and security.

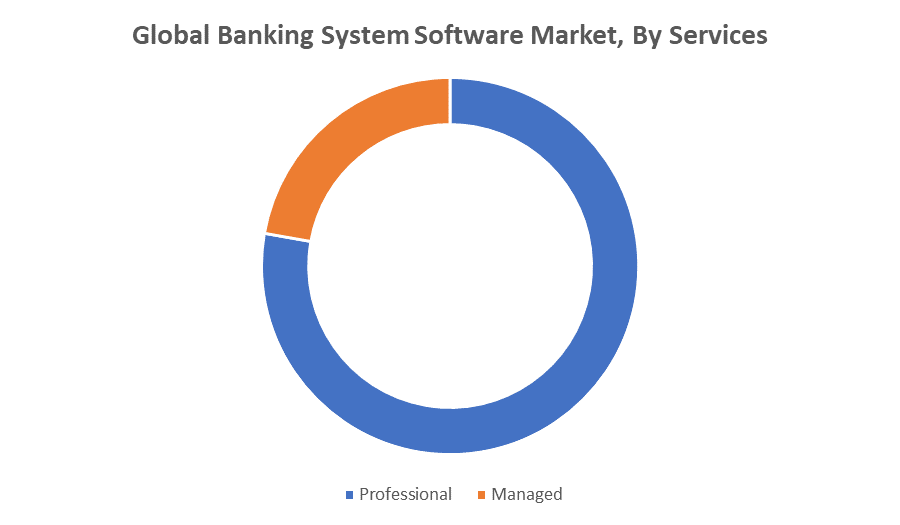

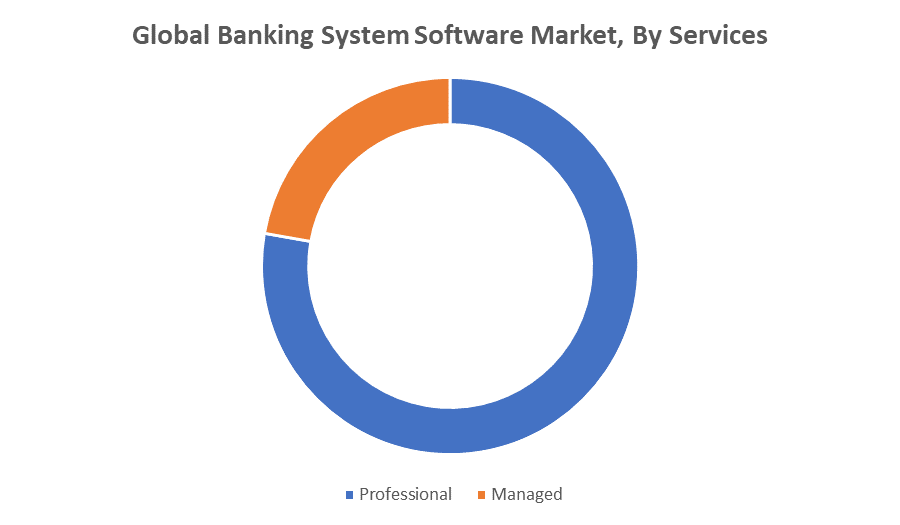

Based on the services, the professional services segment held the largest market share and is expected to grow at a significant CAGR over the forecast period

The professional services segment holds the largest share in the global banking system software market and is expected to grow steadily. These services include consulting, system integration, implementation, and training, which help banks use software smoothly and effectively. As banks adopt more advanced and customized software, they need expert support to handle technical issues and make sure everything works well with their current systems. Professional services also help banks keep their software updated and meet important regulations. Because of these ongoing needs, demand for professional services is increasing, making this segment an important part of the market’s growth.

North America is anticipated to hold the largest market share of the banking system software market during the forecast period

North America is expected to hold the largest market share in the banking system software market during the forecast period. This is due to the region’s well-established banking infrastructure, high adoption of advanced technologies, and strong focus on digital transformation. Banks in North America are investing heavily in upgrading their systems to enhance customer experience, improve security, and comply with strict regulatory requirements. Additionally, the presence of leading software vendors and fintech companies in the region supports innovation and rapid deployment of new banking solutions. These factors collectively position North America as a key driver of growth in the global banking system software market.

Asia Pacific is expected to grow at the fastest CAGR in the banking system software market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the banking system software market during the forecast period. This rapid growth is driven by the region’s expanding banking sector, increasing digitalization, and rising demand for financial services among a growing population. Many countries in Asia Pacific are investing heavily in modernizing their banking infrastructure and adopting advanced software solutions to improve customer experience and operational efficiency. Additionally, the rise of fintech startups and supportive government initiatives further accelerate the adoption of innovative banking technologies. As a result, the Asia Pacific region is poised to become a significant contributor to the global banking system software market’s growth in the coming years.

Recent Development

- In July 2022, Temenos, a cloud-based platform, strengthened its partnership with Wipro to aid banks of various sizes to hasten their digital transformation and broaden their market approach in the U.K., U.S., and Australia. The collaboration merges Wipro's technical proficiency with Temenos' comprehensive banking solutions, enabling banks to take advantage of this opportunity to undertake substantial digital changes in both the front and back end.

- In September 2022, Goldman Sachs Transaction Banking, a software platform that assists businesses in modernizing money movement, Modern Treasury, announced a collaboration to accelerate the shift to embedded payments. The partnership aimed to help joint customers integrate and scale international and domestic payments into their products to drive market growth.

Key Market Players

KEY PLAYERS IN THE BANKING SYSTEM SOFTWARE MARKET INCLUDE

- FIS (Fidelity National Information Services)

- Fiserv

- Oracle Financial Services

- Temenos

- Infosys Finacle

- Tata Consultancy Services (TCS BaNCS)

- Sopra Banking Software

- Finastra

- Mambu

- Thought Machine

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the banking system software market based on the below-mentioned segments:

Global Banking System Software Market, By Software

- Core Banking System Software

- Corporate Banking System Software

- Investment Banking System Software

Global Banking System Software Market, By Services

Global Banking System Software Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa