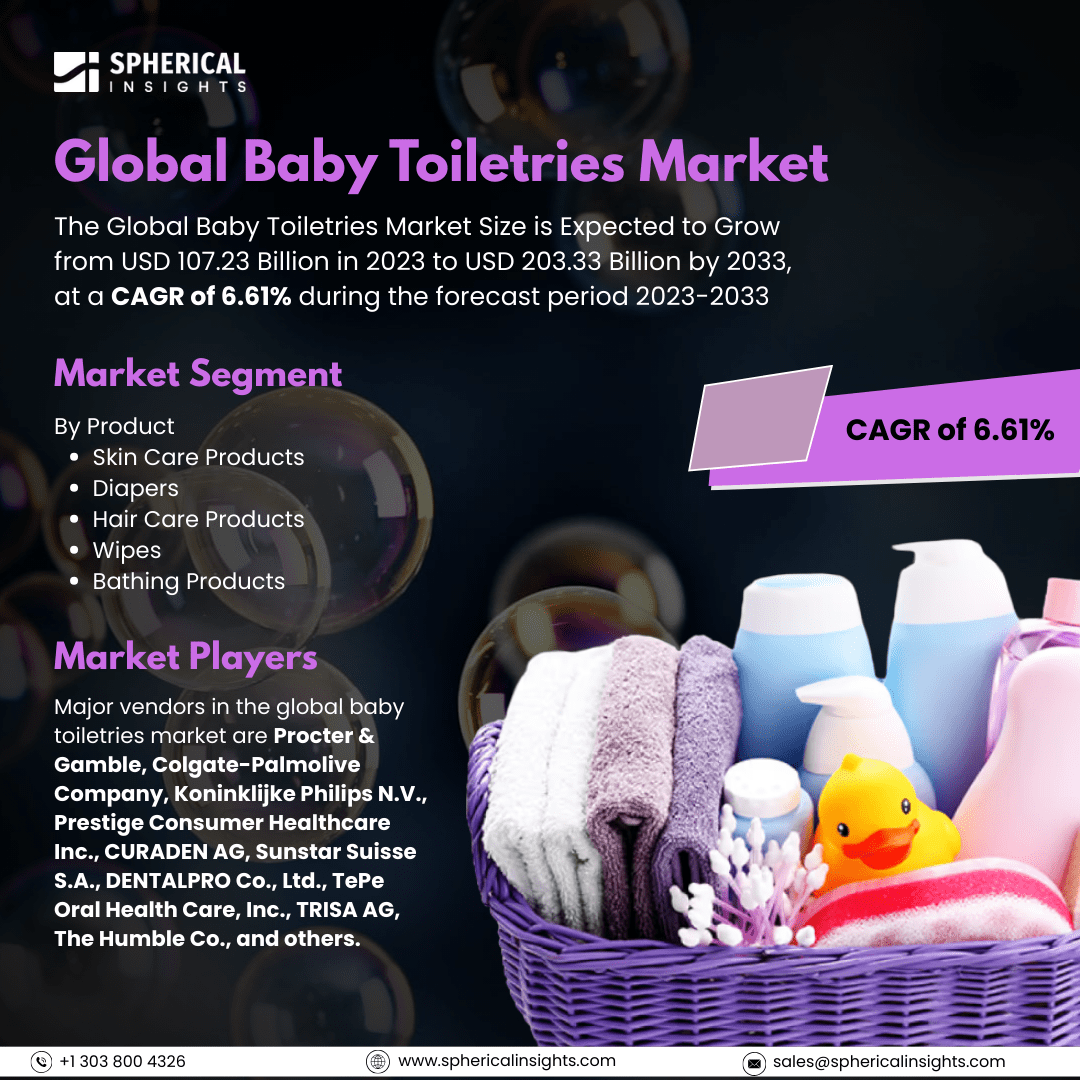

Global Baby Toiletries Market Size To Exceed USD 203.33 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Baby Toiletries Market Size is Expected to Grow from USD 107.23 Billion in 2023 to USD 203.33 Billion by 2033, at a CAGR of 6.61% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Baby Toiletries Market Size, Share, and COVID-19 Impact Analysis, By Product (Skin Care Products, Diapers, Hair Care Products, Wipes, and Bathing Products), By Distribution Channel (Hypermarkets, Chemist and Pharmacy Stores, and E-commerce), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

The baby toiletries market is a worldwide industry engaged in the manufacturing, distribution, and sale of baby hygiene and personal care products. These include baby shampoos, soaps, wipes, diapers, lotions, powders, and oils, made with gentle, hypoallergenic, and safe ingredients. Moreover, the market for baby toiletries is fueled by growing parental awareness of baby hygiene, growing birth rates in emerging markets, greater demand for organic and hypoallergenic items, increased disposable incomes, innovations in products, effective branding by major players, increasing e-commerce, and governmental regulations encouraging safe, chemical-free baby care items. However, high costs of premium quality organic products, regulatory compliance hurdles, increasing customer worries about adverse chemicals, domestic alternatives, instability in raw materials prices, and low levels of awareness among rural consumers constitute market restraints.

The diapers segment accounted for the largest share of the global baby toiletries market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on product, the global baby toiletries market is divided into skin care products, diapers, hair care products, wipes, and bathing products. Among these, the diapers segment accounted for the largest share of the global baby toiletries market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is owing to their fundamental contribution towards baby cleanliness, greater usage rate, and perpetual demand. Conditions such as growing birth rates, enhanced disposable incomes, innovation within the product line (biodegradable and super-absorbent nappies), and wider use of the internet-based sale promote this segment's global domination.

The hypermarkets segment accounted for a substantial share of the global baby toiletries market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the distribution channel, the global baby toiletries market is divided into hypermarkets, chemist and pharmacy stores, and e-commerce. Among these, the hypermarkets segment accounted for a substantial share of the global Baby Toiletries market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is because of its extensive product offerings, competitive pricing, bulk purchases, and consumer confidence. Consumers prefer hypermarkets for convenience, immediate availability of products, and regular discounts, thus making them the leading channel of distribution, particularly in urban and developed areas.

Asia Pacific is projected to hold the largest share of the global baby toiletries market over the projected period.

Asia Pacific is projected to hold the largest share of the global baby toiletries market over the projected period. This is attributable to high birth rates, increasing disposable incomes, improving infant hygiene awareness, and rapidly growing demand for high-end baby care products. China, India, and Japan are key drivers in the market with increasing retail networks and high consumer affinity for branded goods.

North America is expected to grow at the fastest CAGR of the global baby toiletries market during the projected period. The growth is driven by strong consumer expenditure on high-end baby care products, rising demand for organic and hypoallergenic toiletries, high e-commerce penetration, and ongoing product innovations by leading market players in the United States and Canada.

Company Profiling

Major vendors in the global baby toiletries market are Procter & Gamble, Colgate-Palmolive Company, Koninklijke Philips N.V., Prestige Consumer Healthcare Inc., CURADEN AG, Sunstar Suisse S.A., DENTALPRO Co., Ltd., TePe Oral Health Care, Inc., TRISA AG, The Humble Co., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, TRISA announced the introduction of interdental brushes made of paper, with the handle and pouch of the product being made of FSC-certified paper. The bristles of these brushes have also been produced using renewable raw materials and are said to provide effective cleaning of interdental areas. This product release is part of the company's pursuit towards sustainability, as TRISA had launched eco-friendly dental care products made from such materials as bio-based plastics, wood, and recycled PET bottles before.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global baby toiletries market based on the below-mentioned segments:

Global Baby Toiletries Market, By Product

- Skin Care Products

- Diapers

- Hair Care Products

- Wipes

- Bathing Products

Global Baby Toiletries Market, By Distribution Channel

- Hypermarkets

- Chemist and Pharmacy Stores

- E-commerce

Global Baby Toiletries Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa