Aviation Headsets Market Summary, Size & Emerging Trends

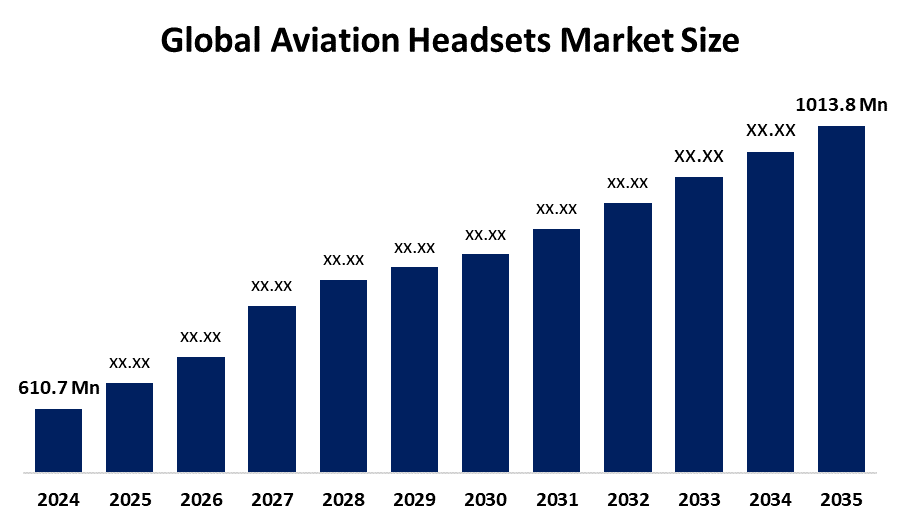

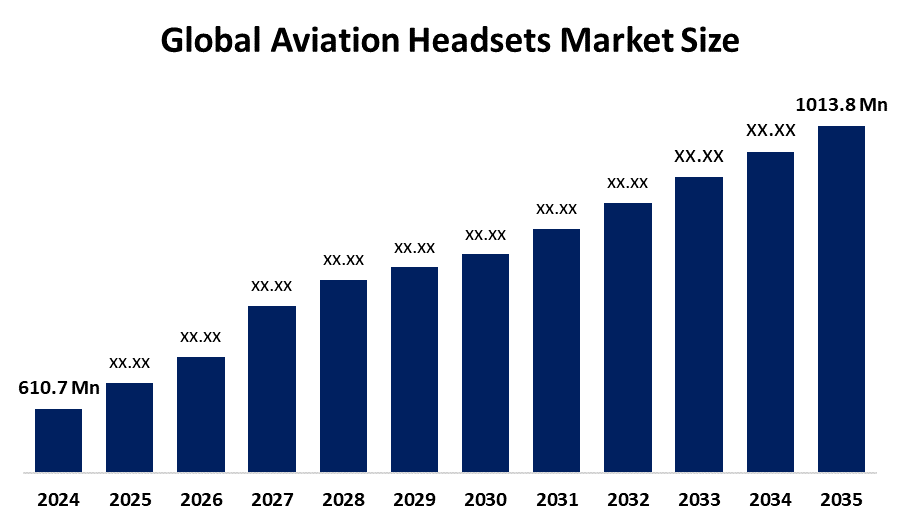

According to Decision Advisor, The Global Aviation Headsets Market Size is Expected to Grow from USD 610.7 Million in 2024 to USD 1013.8 Million by 2035, at a CAGR of 4.72% during the forecast period 2025-2035. Growing demand for advanced noise-cancellation technology and the expansion of general aviation are key driving factors for the aviation headsets market.

Key Market Insights

- North America is expected to account for the largest share in the aviation headsets market during the forecast period.

- In terms of type, the over-ear aviation headsets segment dominated in terms of revenue during the forecast period.

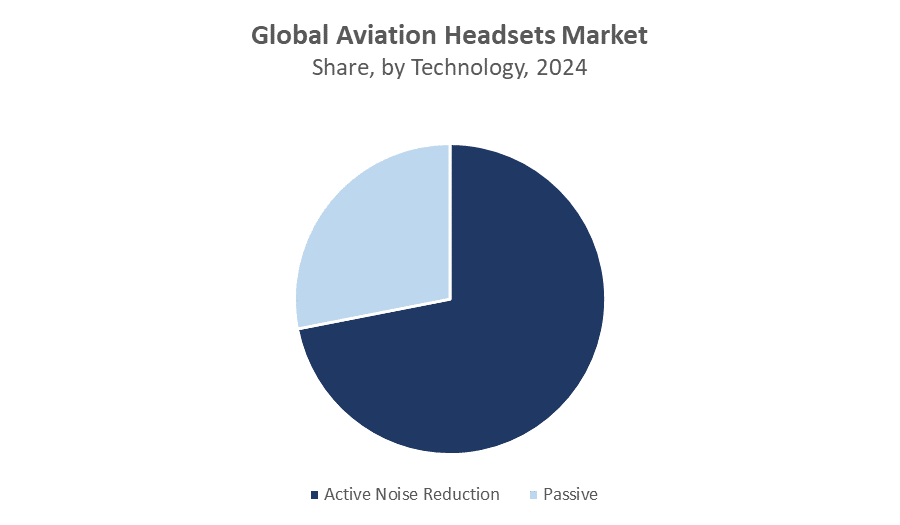

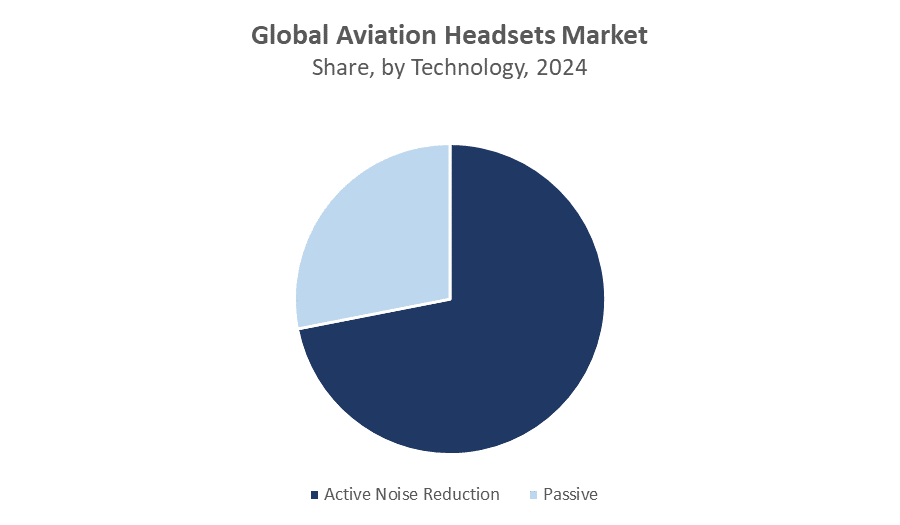

- In terms of technology, the active noise reduction segment accounted for the largest revenue share in the global aviation headsets market during the forecast period.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 610.7 Million

- 2035 Projected Market Size: USD 1013.8 Million

- CAGR (2025-2035): 4.72%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Aviation Headsets Market

The Aviation Headsets Market Size centers on the production of high-performance headsets essential for pilot communication and hearing protection. These headsets, offering passive and active noise reduction, enhance pilot safety, comfort, and operational efficiency. They are widely used in commercial, general, and military aviation due to their ability to reduce noise fatigue and improve communication clarity. Governments globally support pilot safety regulations, encouraging adoption of advanced headsets. The demand is fueled by increasing pilot training programs, growth in general aviation, and modernization of aircraft fleets. With rising emphasis on safety and comfort, the market is positioned for steady growth, reinforcing its role in modern aviation operations.

Aviation Headsets Market Trends

- Growing adoption of active noise reduction (ANR) technology to improve communication clarity.

- Development of lightweight and ergonomic designs for pilot comfort during long flights.

- Increasing integration of wireless connectivity and smart communication systems in aviation headsets.

Aviation Headsets Market Dynamics

Driving Factors: Rising demand from commercial and general aviation

The aviation headsets market is growing due to higher demand from both commercial and general aviation sectors. Increasing pilot training programs and expansion of general aviation fleets drive the need for high-quality headsets. Additionally, stringent regulations mandating hearing protection for pilots promote widespread adoption. Technological improvements, particularly in active noise reduction (ANR) and ergonomic headset designs, enhance comfort, safety, and communication clarity. Together, these factors create a favorable environment for market growth, as airlines and training institutions invest in advanced headsets to meet operational and regulatory requirements.

Restrain Factors: High cost of premium headsets

The high price of advanced aviation headsets is a major market constraint. Premium models with active noise reduction, ergonomic design, and integrated communication systems are often cost-prohibitive for budget-conscious operators. Older aircraft may face compatibility issues with modern headsets, limiting adoption. Smaller general aviation operators may delay upgrades due to financial constraints. These factors collectively slow market expansion, as affordability and system integration challenges restrict widespread use, particularly in regions with less-developed aviation infrastructure or smaller fleets, preventing uniform adoption of high-end headset technology.

Opportunity: Technological innovation

Technological advancements create substantial opportunities in the aviation headsets market. Innovations like lightweight materials reduce pilot fatigue, while integrated wireless systems improve communication efficiency. AI-enhanced noise reduction provides superior clarity in high-noise environments. Emerging aviation markets with growing infrastructure and pilot training programs present new avenues for headset adoption. Additionally, evolving aircraft technology and demand for smarter cockpit solutions encourage investment in advanced headsets. Companies can capitalize on these trends to differentiate products, expand market presence, and target new customer segments, driving overall growth in both developed and emerging regions.

Challenges: Supply chain and integration issues

The aviation headsets market faces challenges from supply chain and integration issues. Disruptions in sourcing electronic components, microphones, or noise-canceling modules can delay production. Ensuring new headset models integrate seamlessly with existing aircraft communication systems is also critical. Compatibility issues, particularly in older fleets, can limit adoption despite technological improvements. Additionally, geopolitical tensions or logistical problems may impact the timely delivery of parts. These challenges require manufacturers to optimize supply chains, maintain quality control, and offer adaptable solutions to ensure consistent production and market expansion.

Global Aviation Headsets Market Ecosystem Analysis

The global aviation headsets market ecosystem includes key players like headset manufacturers, avionics providers, pilot training institutions, and regulatory authorities. Manufacturers focus on ergonomic designs, noise reduction technology, and integration with communication systems. Regulatory bodies enforce standards for hearing protection and safety. This ecosystem’s growth depends on technological innovation, regulatory compliance, and increasing aviation activity worldwide.

Global Aviation Headsets Market, By Type

The over-ear aviation headset segment dominated the global market in terms of revenue during the forecast period. Its market share is approximately 60%, driven by superior comfort, effective passive and active noise reduction (ANR), and long-duration wearability for pilots. These headsets are widely preferred in commercial aviation and pilot training schools, where extended flight hours require ergonomic designs to reduce fatigue. Their high-performance microphones and clear audio quality make them ideal for communication in noisy cockpit environments, reinforcing their leading position in the aviation headset market.

The in-ear or headphone segment is gaining significant traction, holding an estimated 25% of the global aviation headset market. These headsets are particularly popular in military aviation and general aviation due to their compact size, lightweight design, and compatibility with helmets. In-ear headsets are easier to store, integrate seamlessly with protective headgear, and allow pilots greater mobility. Rising adoption in specialized aviation sectors, along with improvements in in-ear ANR technology, is fueling steady growth, positioning this segment as a fast-growing alternative to traditional over-ear headsets.

Global Aviation Headsets Market, By Technology

The active noise reduction (ANR) segment leads the global aviation headsets market, accounting for approximately 65% of revenue. ANR headsets use advanced electronics to cancel ambient cockpit noise, providing pilots with clearer communication and reducing fatigue during long flights. This technology is widely adopted in commercial airlines, military aviation, and flight training programs where high performance and safety are critical. The superior noise-canceling capabilities, combined with ergonomic designs, make ANR headsets the preferred choice for professional pilots and high-end aviation operators globally.

The passive noise reduction (PNR) segment holds an estimated 30% of the global aviation headset market. PNR headsets rely on physical ear padding and design to block ambient noise rather than electronic cancellation. Their cost-effectiveness, reliability, and minimal maintenance requirements make them popular in general aviation, flight schools, and budget-conscious operators. While PNR headsets may not provide the same level of noise reduction as ANR models, they remain a practical choice for short-duration flights, basic training, or smaller aircraft where advanced electronics may not be necessary.

North America is the largest market for aviation headsets, accounting for approximately 45% of global revenue. The region’s dominance is driven by extensive commercial aviation operations, a strong general aviation sector, and a large number of pilot training programs. Widespread adoption of advanced ANR and over-ear headsets supports market growth. Regulatory requirements for pilot hearing protection further boost headset usage. The presence of major headset manufacturers and advanced aviation infrastructure ensures easy availability of high-end products, making North America the leading region in terms of both revenue and technology adoption.

Europe holds around 30% of the global aviation headset market. Growth is fueled by strict aviation safety and noise exposure regulations, encouraging widespread adoption of ANR and high-performance over-ear headsets. Commercial airlines, flight schools, and military aviation programs are the primary consumers. Technological awareness and preference for ergonomic designs further support demand. While the market is mature compared to Asia-Pacific, continuous upgrades in headset technology and compliance with stringent European Union aviation standards maintain a steady growth trajectory across the region.

Asia-Pacific is the fastest-growing market, with an estimated 20% share. Rapid expansion of aviation infrastructure, increasing number of pilot training schools, and growth of general and commercial aviation contribute to market growth. Rising disposable income and increasing fleet sizes in countries like China, India, and Japan fuel demand for advanced ANR and ergonomic headsets. Investment in aviation safety and technological adoption, combined with emerging airlines and training centers, positions the region as a high-potential market for headset manufacturers, driving significant future growth opportunities.

WORLDWIDE TOP KEY PLAYERS IN THE AVIATION HEADSETS MARKET INCLUDE

- Bose Corporation

- David Clark Company

- Honeywell International Inc.

- Sennheiser Communications

- Lightspeed Aviation

- Garmin Ltd.

- Telex Communications

- Plantronics Inc.

- Gentex Corporation

- Uclear

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the aviation headsets market based on the below-mentioned segments:

Global Aviation Headsets Market, By Type

- Over-ear Aviation Headsets

- In-ear/Headphones

- Military/Others

Global Aviation Headsets Market, By Technology

- Active Noise Reduction

- Passive

Global Aviation Headsets Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

FAQs

Q: What technological opportunities exist in the aviation headsets market?

A: Innovations include lightweight materials, integrated wireless systems, AI-enhanced noise reduction, and smarter cockpit solutions, creating growth potential in both developed and emerging regions.

Q: What challenges are affecting the aviation headsets market?

A: Challenges include supply chain disruptions, integration with existing aircraft systems, component sourcing issues, and geopolitical or logistical problems affecting timely delivery.

Q: Which application segment of aviation headsets is expected to grow the fastest?

A: The over-ear ANR headsets segment in commercial and general aviation is expected to grow rapidly due to increasing pilot training programs and fleet modernization.

Q: How do North America and Asia-Pacific compare in terms of market growth?

A: North America currently holds the largest market share (~45%) due to established aviation infrastructure, while Asia-Pacific, with a 20% share, is the fastest-growing region driven by fleet expansion and rising aviation activity.

Q: What are the latest trends in the aviation headsets market?

A: Key trends include adoption of active noise reduction technology, ergonomic and lightweight headset designs, and integration of wireless and smart communication systems.

Q: What is the long-term outlook (2025–2035) for the Global Aviation Headsets Market?

A: The market is expected to grow steadily, supported by technological advancements, expansion of general and commercial aviation, rising pilot safety awareness, and modernization of aircraft fleets globally.