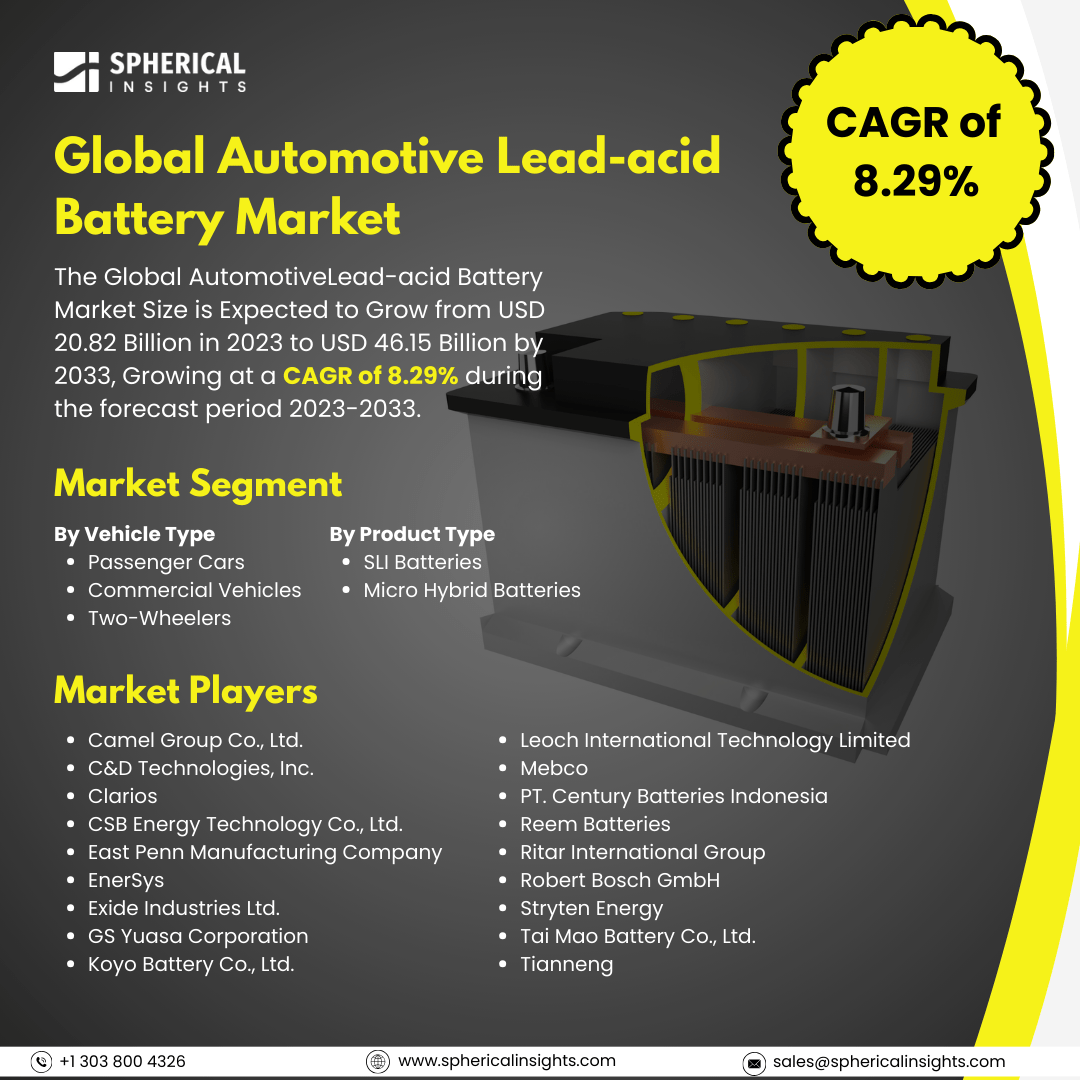

Global Automotive Lead-acid Battery Market Size to Exceed USD 46.15 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Automotive Lead-acid Battery Market Size is Expected to Grow from USD 20.82 Billion in 2023 to USD 46.15 Billion by 2033, Growing at a CAGR of 8.29% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Automotive Lead-acid Battery Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers), By Product Type (SLI Batteries, Micro Hybrid Batteries), By Battery Type (Flooded Batteries, Enhanced Flooded Batteries, VRLA Batteries), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

The worldwide automotive lead-acid battery market refers to the business that develops and distributes a lead storage battery, that runs on sulfuric acid and lead. Lead acid batteries have a limited lifespan despite their outstanding reliability. The market for automotive lead acid battery is expanding due to the constant need for dependable and cost-effective storage of energy solutions for traditional automobiles, especially in the passenger car and commercial vehicle categories. Further, industry shifts to electric cars (EVs), lead-acid batteries, which are commonly utilized for starting, lighting, and ignition (SLI) functions, remain essential in vehicles with internal combustion engines (ICEs). However, market expansion is restricted due to the limited life span.

The commercial vehicles segment accounted for the largest share of the global automotive lead-acid battery market in 2023 and is predicted to grow at a substantial CAGR over the forecast period.

On the basis of vehicle type, the global automotive lead-acid battery market is divided into passenger cars, commercial vehicles, and two-wheelers. Among these, the commercial vehicles segment accounted for the largest share of the global automotive lead-acid battery market in 2023 and is predicted to grow at a substantial CAGR over the forecast period. This segment revenue share contributed to the market expansion because lead-acid batteries are in great need of repair and replacement due to the extensive aftermarket. Moreover, its dependability and longevity make it perfect for the demanding operating conditions of commercial vehicles, ensuring consistent performance even in challenging circumstances boost the segment growth.

The SLI segment held the largest share of the global automotive lead-acid battery market in 2023 and is anticipated to grow at a substantial CAGR over the forecast period.

On the basis of the product type, the global automotive lead-acid battery market is classified into sli batteries, micro hybrid batteries. Among these, the SLI segment held the largest share of the global automotive lead-acid Battery market in 2023 and is anticipated to grow at a substantial CAGR over the forecast period. This segment growing revenue share contributed to the market expansion due to SLI (starting, lighting, and ignition) batteries being the market and engine consistently, and are less expensive than their alternatives, they are the preferred choice in the market. Further, Despite the growing popularity of electric and hybrid vehicles, the majority of cars on the road still run on internal combustion engines, which sustains the demand for SLI batteries.

The flooded batteries segment accounted for the largest share of the global automotive lead-acid battery market in 2023 and is anticipated to grow at a significant CAGR over the forecast period.

On the basis of the battery type, the global automotive lead-acid battery market is segmented into flooded batteries, enhanced flooded batteries, VRLA batteries. Among these, the flooded batteries segment accounted for the largest share of the global automotive lead-acid battery market in 2023 and is anticipated to grow at a significant CAGR over the forecast period. This segment growth contributed to the market expansion due to their longstanding position in the automotive industry and high density of power storage, dependability, and performance, cost-effective option. Further, flooded batteries can deliver powerful current bursts that ensure reliable engine starting, even during extreme weather, which boosts the segment growth.

Asia Pacific is anticipated to hold the largest share of the global automotive lead-acid battery market over the forecast period.

Asia Pacific is projected to hold the greatest revenue share of the global automotive lead-acid battery market over the forecast period. The primary factors for this dominance encompass the region's large automobile industry, strong vehicle production, and quickly growing car fleets, especially in nations like China, India, and Japan. Additionally, the presence of key battery manufacturers, increasing urbanization, and increasing disposable incomes are all contributing factors to an upsurge in automobile ownership, which will guarantee Asia Pacific's market leadership during the projection period.

North America is expected to grow at the fastest CAGR growth of the global automotive lead-acid battery market over the forecast period. The regional market expansion is driven by the region's powerful automotive industry, high rate of vehicle ownership, and high need for replacement batteries. Although EVs are growing more prevalent, traditional vehicles' reliance on lead-acid batteries ensures continued use.

Company Profiling

Major vendors in the global automotive lead-acid battery market are Camel Group Co., Ltd., C&D Technologies, Inc., Clarios, CSB Energy Technology Co., Ltd., East Penn Manufacturing Company, EnerSys, Exide Industries Ltd., GS Yuasa Corporation, Koyo Battery Co., Ltd., Leoch International Technology Limited, Mebco, PT. Century Batteries Indonesia, Reem Batteries, Ritar International Group, Robert Bosch GmbH, Stryten Energy, Tai Mao Battery Co., Ltd., and Tianneng, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, Exide Industries Ltd introduced a new advanced Absorbent Glass Mat (AGM) battery for starting, light, and ignition (SLI) applications in the automotive market. This AGM battery was designed to provide reliable starting power, improved durability, and potentially longer life compared to standard lead-acid batteries. The new SLI-AGM batteries were developed in collaboration with East Penn Manufacturing, USA, and catered to the both domestic and international market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global automotive lead-acid battery market based on the below-mentioned segments:

Global Automotive Lead-acid Battery Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

Global Automotive Lead-acid Battery Market, By Product Type

- SLI Batteries

- Micro Hybrid Batteries

Global Automotive Lead-acid Battery Market, By Battery Type

- Flooded Batteries

- Enhanced Flooded Batteries

- VRLA Batteries

Global Automotive Lead-acid Battery Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa