Global Automated Feeding Systems Market Insights Forecasts to 2035

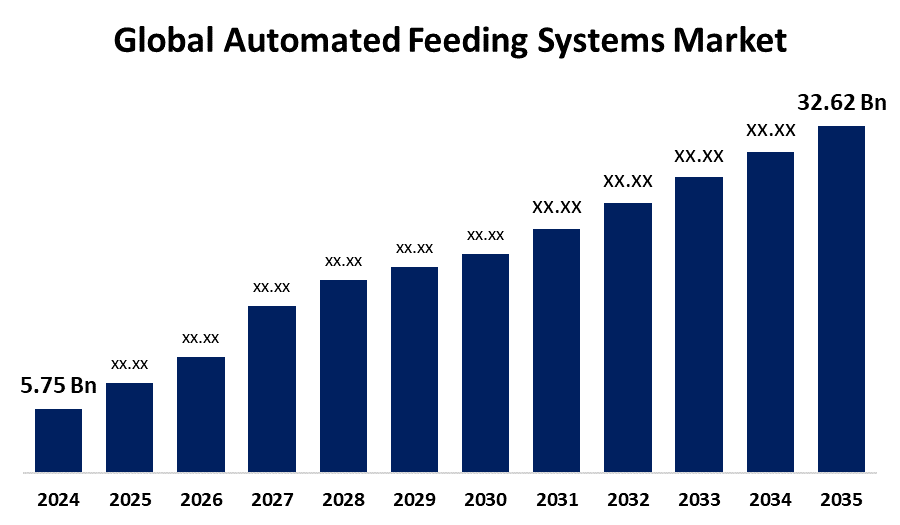

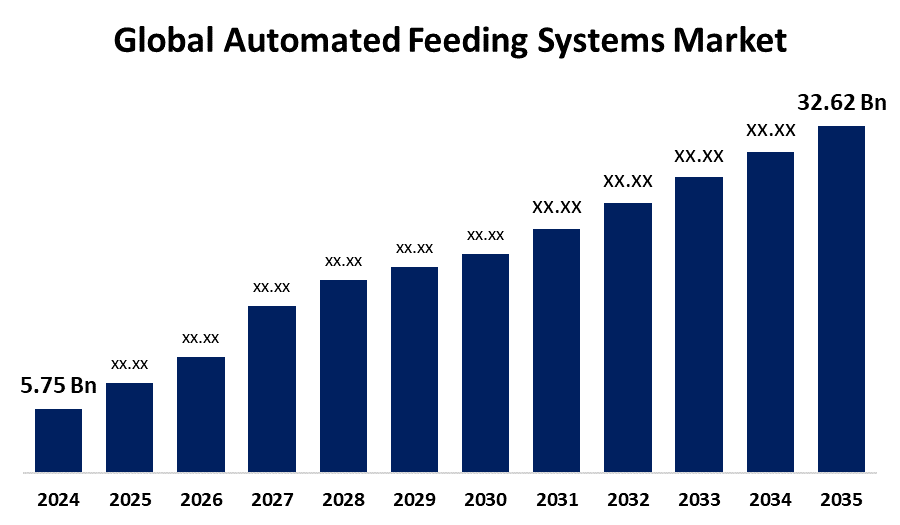

- The Global Automated Feeding Systems Market Size Was Estimated at USD 5.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 17.09% from 2025 to 2035

- The Worldwide Automated Feeding Systems Market Size is Expected to Reach USD 32.62 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Automated Feeding Systems Market

The global automated feeding systems market encompasses the development and use of technologies that automate the feeding process in livestock and aquaculture farming. These systems utilize advanced machinery, sensors, and software to deliver precise amounts of feed to animals such as poultry, cattle, swine, and fish. Automated feeding solutions include conveyor belts, robotic feeders, and automated dispensers designed to improve feeding accuracy and efficiency. By minimizing human intervention, these systems help ensure consistent nutrition, reduce feed wastage, and enhance animal growth and health. Automated feeding systems are integrated with smart technologies to monitor feed consumption and adjust feeding schedules accordingly. This automation streamlines farm operations and contributes to better resource management. As the agricultural sector evolves, automated feeding systems are becoming essential tools in modern animal husbandry, supporting increased productivity and operational efficiency. The market covers various applications across farming industries focused on improving feeding practices through technological innovation.

Attractive Opportunities in the Automated Feeding Systems Market

- The rise of precision agriculture and data analytics offers huge potential for automated feeding systems. By leveraging big data, machine learning, and IoT, feeding strategies can be tailored to individual animals’ needs, optimizing feed efficiency, improving animal health, and reducing waste. This trend opens doors for more sophisticated, smart feeding solutions that enhance productivity and sustainability on farms.

- Ongoing research and innovation are making automated feeding systems more affordable and easier to use, which helps bring automation within reach of smaller and medium-sized farms. Additionally, innovations like solar-powered or mobile feeding units enable deployment in off-grid and remote locations, expanding the market to previously underserved regions. Government initiatives supporting smart agriculture also create new growth avenues by encouraging modernization and technology adoption.

Global Automated Feeding Systems Market Dynamics

DRIVER: Advancements in farming technology and the shift towards precision agriculture

Advancements in farming technology and the shift towards precision agriculture are key drivers fueling the growth of the global automated feeding systems market. These systems help reduce labor demands by automating feed delivery, allowing farmers to save time and cut operational costs while maintaining consistent and accurate nutrition for livestock. The integration of IoT, sensors, and artificial intelligence facilitates real-time monitoring and fine-tuning of feeding schedules, which improves animal health and productivity. Increasing consumer demand for high-quality meat, dairy, and seafood products further encourages adoption of these technologies. Moreover, heightened focus on sustainable farming practices supports automated feeding systems by reducing feed wastage and environmental impact. The rise of large-scale commercial farming operations also accelerates market expansion, as automated feeders provide scalability and efficient resource management. Collectively, these factors drive the increasing acceptance and implementation of automated feeding solutions in modern agriculture.

RESTRAINT: Compatibility issues may arise when integrating new automated feeders with existing farm setups

The growth of the global automated feeding systems market is challenged by several key obstacles. One major limitation is the high upfront cost associated with purchasing and installing these advanced feeding technologies, which can deter smaller farms with tighter budgets. Additionally, the operation and maintenance of automated systems demand specialized technical skills, which are often lacking in rural farming communities. Compatibility issues may arise when integrating new automated feeders with existing farm setups, requiring costly customization. Reliability concerns also persist, as system malfunctions or power outages can interrupt feeding routines, potentially impacting animal well-being. Moreover, traditional farming practices and resistance to change slow down the adoption of automated solutions in certain regions. Finally, the dependency on stable electricity and internet infrastructure restricts the use of these systems in remote or underdeveloped areas, limiting their reach and scalability across the global farming landscape.

OPPORTUNITY: Increasing focus on precision farming and data-driven livestock management

Emerging opportunities in the global automated feeding systems market lie in the increasing focus on precision farming and data-driven livestock management. The integration of big data analytics and machine learning offers potential for more sophisticated feeding strategies tailored to individual animal needs, improving productivity and reducing waste. Expanding research and development efforts are leading to the creation of more cost-effective and user-friendly systems, making automation accessible to a broader range of farmers. Additionally, the growing trend of organic and sustainable farming presents opportunities for automated feeders designed to support eco-friendly practices. Collaboration between technology providers and agricultural stakeholders is fostering innovations such as solar-powered and mobile feeding units, which can be deployed in off-grid or remote locations. Furthermore, government initiatives promoting smart agriculture and funding for modernization projects open new avenues for market expansion. These emerging possibilities highlight the market’s potential beyond current growth drivers, positioning it for long-term evolution.

CHALLENGES: Rapid pace of technological innovation

Ensuring accurate feed formulation and delivery for mixed farming operations can be complex. Data security and privacy concerns also emerge as farms increasingly rely on connected devices and cloud-based management platforms. Moreover, the rapid pace of technological innovation poses a challenge for farmers to continuously upgrade equipment and keep up with software updates. Training farm personnel to effectively use and troubleshoot these systems remains a significant hurdle, especially in regions with limited access to technical education. Lastly, maintaining system durability and performance under harsh environmental conditions such as extreme temperatures, dust, and moisture is critical to avoid frequent breakdowns and costly repairs, adding to the operational challenges faced by users of automated feeding systems.

Global Automated Feeding Systems Market Ecosystem Analysis

The global automated feeding systems market ecosystem includes technology manufacturers who develop automated feeders, sensors, and control software, often collaborating with IoT and AI providers. Livestock and aquaculture farmers are the primary users, supported by distributors and dealers for sales and service. Research institutions drive innovation, while government bodies set regulations and offer subsidies promoting sustainable farming. Service providers ensure proper installation, maintenance, and training. Together, these players create a dynamic network that advances the development, adoption, and efficiency of automated feeding solutions globally.

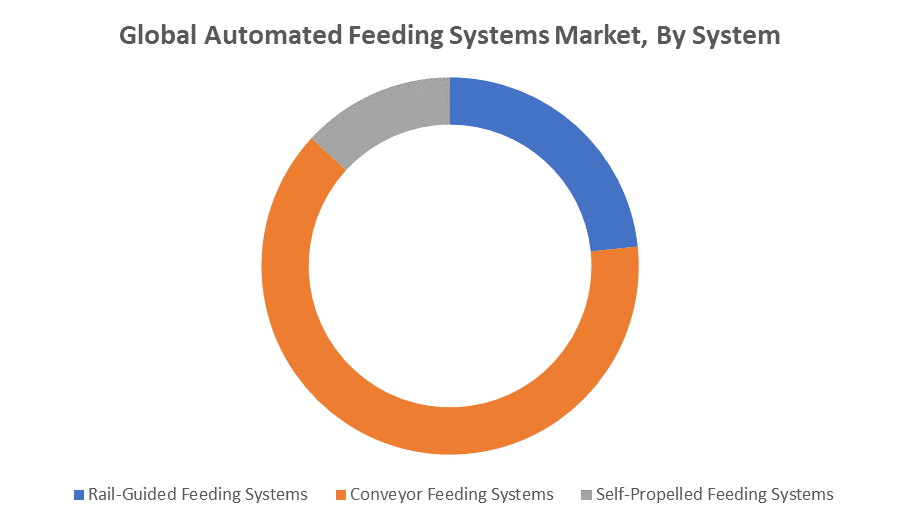

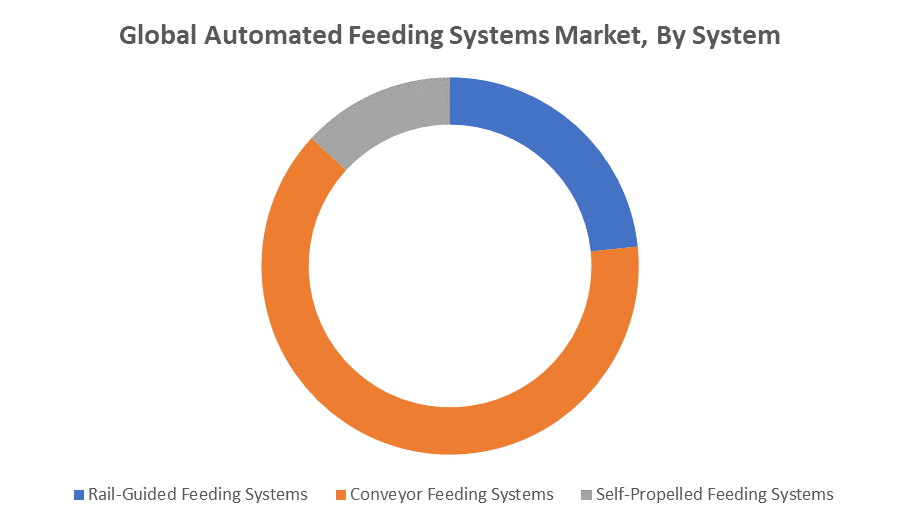

Based on the system, the conveyor feeding systems segment held the dominant market position with the largest revenue share over the forecast period

The conveyor feeding systems segment held the dominant market position, capturing the largest revenue share over the forecast period. This dominance is attributed to the system’s efficiency in delivering consistent and precise feed quantities across various livestock operations. Conveyor systems offer scalability and adaptability for different farm sizes and animal types, making them widely preferred. Their ability to automate feed distribution reduces labor costs and minimizes feed wastage, further boosting their popularity. Additionally, advancements in conveyor technology, including integration with smart sensors and automation controls, have strengthened their market leadership and driven sustained revenue growth.

Based on the livestock, the poultry segment is expected to grow at the fastest CAGR during the forecast period

The poultry segment is expected to grow at the fastest CAGR during the forecast period. This rapid growth is driven by the rising global demand for poultry products, which encourages farmers to adopt automated feeding systems to enhance efficiency and productivity. Automated feeders help optimize feed usage, improve flock health, and reduce labor costs in poultry farming. Additionally, advancements in feeding technology tailored specifically for poultry operations contribute to the segment’s accelerated expansion, making it a key focus area within the automated feeding systems market.

Europe is anticipated to hold the largest market share of the automated feeding systems market during the forecast period

Europe is anticipated to hold the largest market share in the automated feeding systems market during the forecast period. This is due to the region's advanced agricultural infrastructure, high adoption of smart farming technologies, and strong focus on sustainable livestock management. European farmers increasingly leverage automation to improve feed efficiency and reduce labor costs. Additionally, supportive government policies and investments in precision agriculture further boost the deployment of automated feeding solutions across the continent, solidifying Europe’s leading position in the market.

Asia Pacific is expected to grow at the fastest CAGR in the automated feeding systems market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the automated feeding systems market during the forecast period. Rapid modernization of agriculture, increasing livestock production, and rising demand for animal-based protein are driving this growth. Additionally, growing investments in smart farming technologies and expanding commercial farming operations across countries like China, India, and Southeast Asia are accelerating the adoption of automated feeding systems. Improvements in infrastructure and government initiatives promoting technology adoption further support the region’s swift market expansion.

Recent Development

- In March 2023, DeLaval launched the OptiWagon™, an electric autonomous feed distribution robot. This addition to the DeLaval Optimat™ system provides an efficient and flexible feeding solution, capable of supplying various animal groups with different feed mixes up to twelve times per day. The system is integrated with the DelPro farm management system, allowing for precise control and optimization.

- In September 2023, ROXELL introduced the Dos7 dispenser for sows. This automatic dispenser allows simultaneous feeding of sows, reducing waiting times and stress. It offers high-precision feeding, easy cleaning for hygiene maintenance, and the ability to handle various feed types, making it a valuable asset for modern pig farming.

Key Market Players

KEY PLAYERS IN THE AUTOMATED FEEDING SYSTEMS MARKET INCLUDE

- DeLaval

- ROXELL

- Lely

- Big Dutchman

- JBT Corporation

- SKOV Group

- Coperion K-Tron

- Impextraco NV

- Roxell NV

- Gea Group AG

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the automated feeding systems market based on the below-mentioned segments:

Global Automated Feeding Systems Market, By System

- Rail-Guided Feeding Systems

- Conveyor Feeding Systems

- Self-Propelled Feeding Systems

Global Automated Feeding Systems Market, By Livestock

Global Automated Feeding Systems Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa