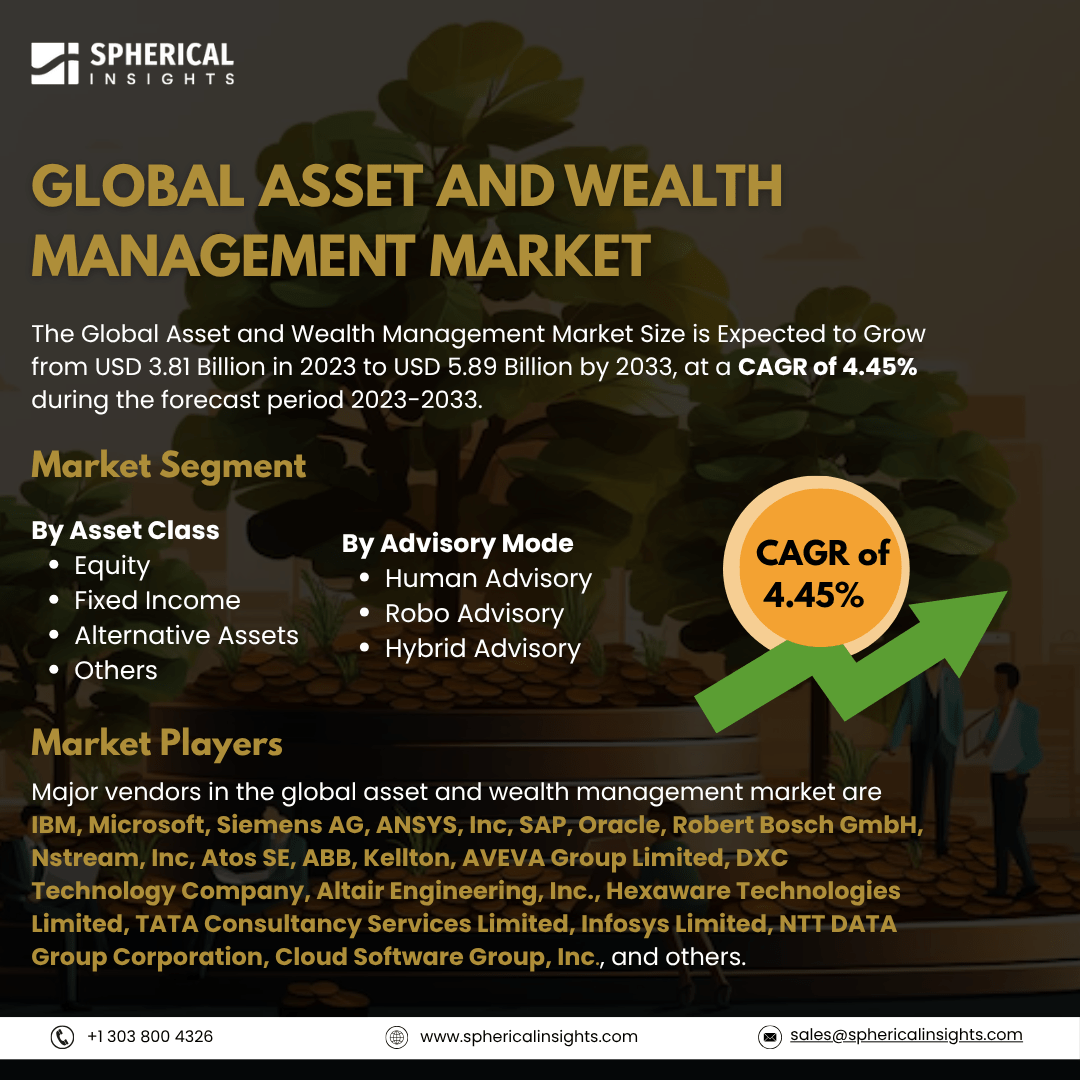

Global Asset and Wealth Management Market Size To Exceed USD 5.89 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Asset and Wealth Management Market Size is Expected to Grow from USD 3.81 Billion in 2023 to USD 5.89 Billion by 2033, at a CAGR of 4.45% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Asset and Wealth Management Market Size, Share, and COVID-19 Impact Analysis, By Asset Class (Equity, Fixed Income, Alternative Assets, and Others), By Advisory Mode (Human Advisory, Robo Advisory, and Hybrid Advisory), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The global asset and wealth management market refers to the worldwide industry that provides investment management, financial planning, and advisory services to individuals, institutions, and high-net-worth clients. It encompasses the management of a broad range of financial assets including equities, bonds, real estate, and alternative investments, to grow and preserve wealth over time. Furthermore, the global asset and wealth management market is driven by rising high-net-worth individuals, growing demand for personalized financial services, technological advancements like AI and robo-advisors, regulatory shifts, and increasing awareness of retirement planning. Additionally, emerging markets and generational wealth transfers are expanding the client base, while ESG investing trends are reshaping investment strategies and attracting sustainability-focused investors. However, restraining factors include regulatory complexities, high compliance costs, market volatility, cybersecurity threats, rising competition from fintechs, and limited digital adoption among traditional firms, slowing growth and operational efficiency in the sector.

The equity segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the asset class, the global asset and wealth management market is divided into equity, fixed income, alternative assets, and others. Among these, the equity segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to strong investor preference for higher returns amid economic recovery and market optimism. Increased retail participation, technological advancements in trading platforms, and growing demand for equity-based investment products are expected to drive its continued growth at a significant CAGR during the forecast period.

The human advisory segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the advisory mode, the global asset and wealth management market is divided into human advisory, robo advisory, and hybrid advisory. Among these, the human advisory segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is attributed to clients’ trust in personalized financial guidance, especially amid market uncertainties. High-net-worth individuals and complex portfolios continue to prefer expert advisors, driving demand. Ongoing wealth creation and relationship-based services are expected to support its strong growth at a remarkable CAGR ahead.

North America is projected to hold the largest share of the global asset and wealth management market over the forecast period.

North America is projected to hold the largest share of the global asset and wealth management market over the forecast period. The regional growth is attributed to its mature financial infrastructure, high concentration of wealth, and presence of leading asset management firms. Strong regulatory frameworks, widespread adoption of advanced technologies, and a large base of institutional and high-net-worth investors further support sustained market dominance in the region.

Asia Pacific is expected to grow at the fastest CAGR in the global asset and wealth management market during the forecast period. The regional growth is attributed to rapid economic expansion, rising middle-class wealth, and increasing demand for investment solutions. Government initiatives supporting financial inclusion, digital adoption, and expanding capital markets also drive growth. Additionally, growing awareness of wealth management among emerging affluent populations fuels strong regional demand for professional asset and wealth management services.

Company Profiling

Major vendors in the global asset and wealth management market are IBM, Microsoft, Siemens AG, ANSYS, Inc, SAP, Oracle, Robert Bosch GmbH, Nstream, Inc, Atos SE, ABB, Kellton, AVEVA Group Limited, DXC Technology Company, Altair Engineering, Inc., Hexaware Technologies Limited, TATA Consultancy Services Limited, Infosys Limited, NTT DATA Group Corporation, Cloud Software Group, Inc., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global asset and wealth management market based on the below-mentioned segments:

Global Asset and Wealth Management Market, By Asset Class

- Equity

- Fixed Income

- Alternative Assets

- Others

Global Asset and Wealth Management Market, By Advisory Mode

- Human Advisory

- Robo Advisory

- Hybrid Advisory

Global Asset and Wealth Management Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa