Aquafeed Additives Market Summary

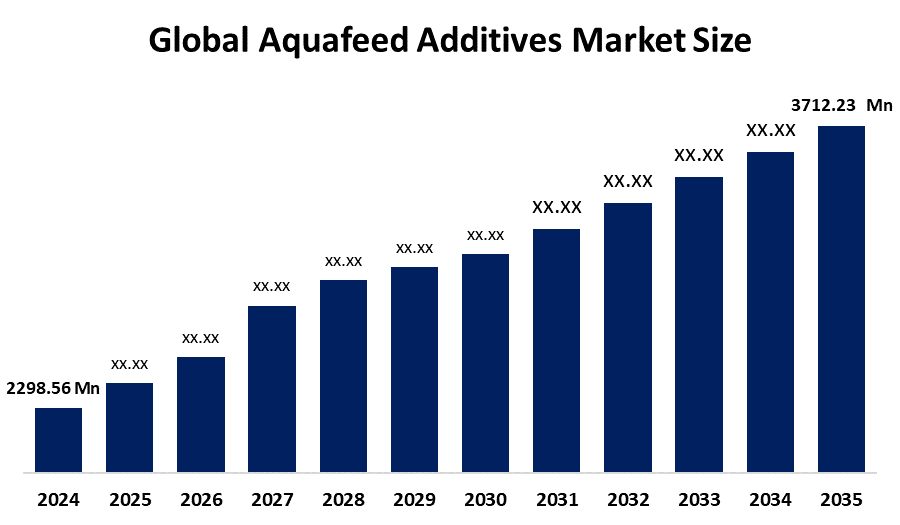

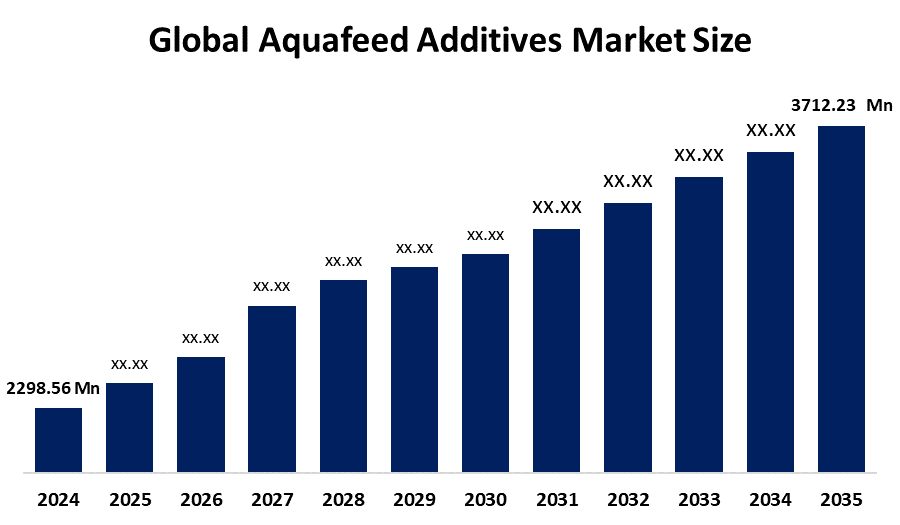

The Global Aquafeed Additives Market Size Was Estimated at USD 2298.56 Million in 2024 and is Projected to Reach USD 3712.23 Million by 2035, Growing at a CAGR of 4.45% from 2025 to 2035. The market for aquafeed additives is expanding due mainly to the growing demand for seafood worldwide, which is being driven by dietary changes and population increase.

Key Regional and Segment-Wise Insights

- In 2024, Latin America held the greatest revenue share of 36.48% in the worldwide aquafeed additives market.

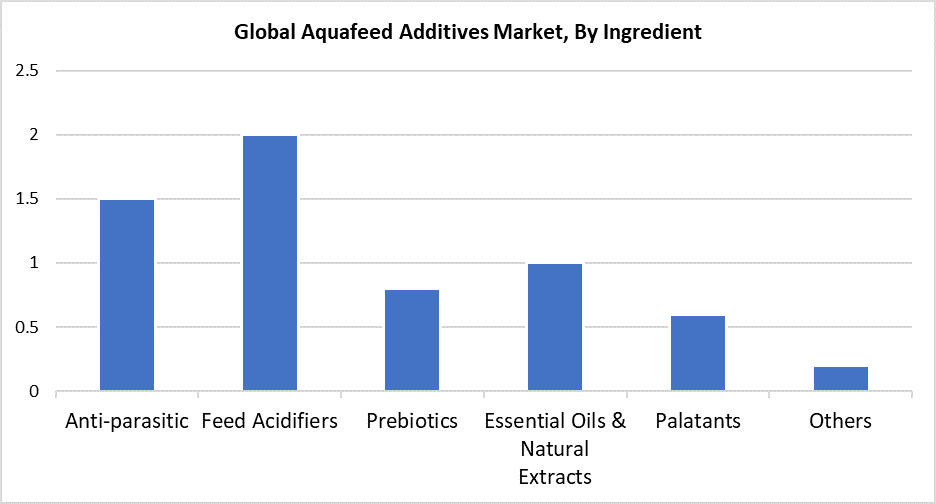

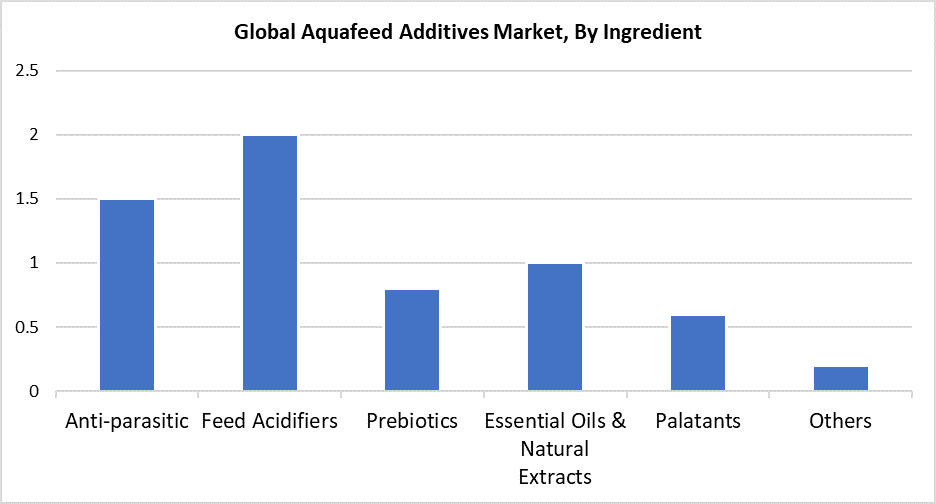

- The feed acidifiers section had an impressive revenue share in 2024 based on the ingredient segment.

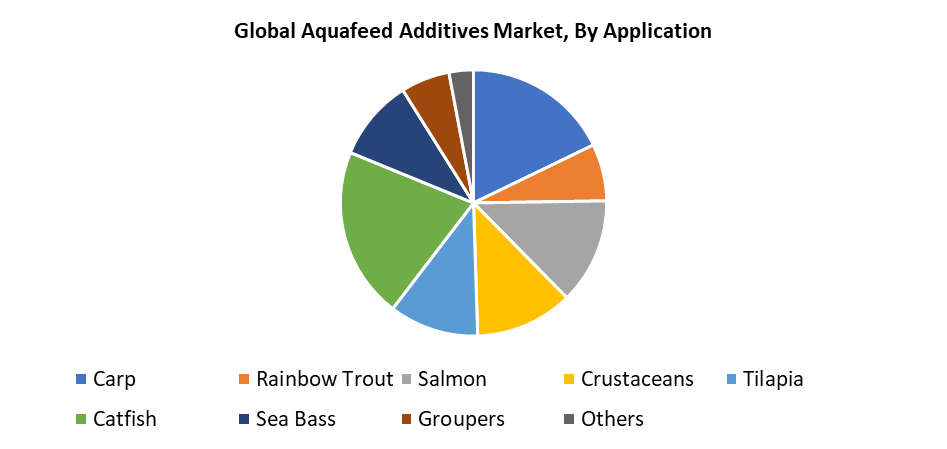

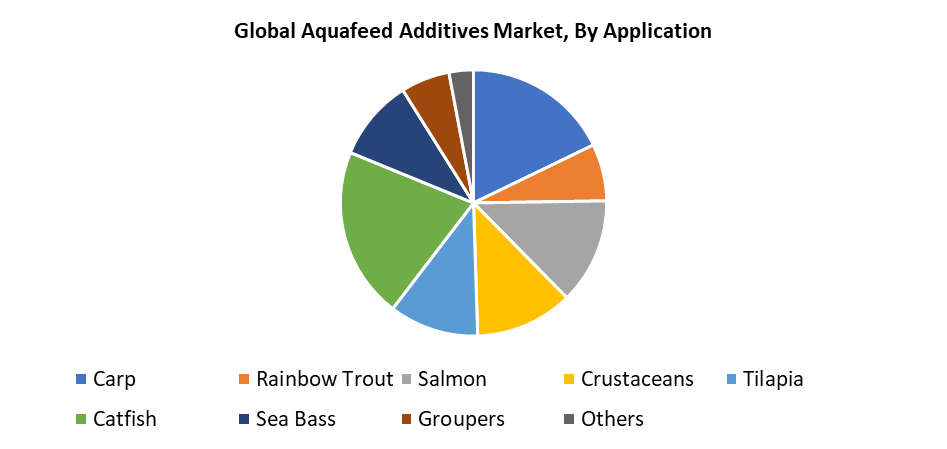

- In 2024, the catfish application category held the largest revenue share of 21.75%, dominating the market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2298.56 Million

- 2035 Projected Market Size: USD 3712.23 Million

- CAGR (2025-2035): 4.45%

- Latin America: The Largest market in 2024

The worldwide market that provides chemical additives to enhance fish and aquatic animal feed for their nutritional value, growth, and health benefits is referred to as the Aquafeed Additives Market. The increasing worldwide seafood demand, together with rising knowledge about fish health benefits, has triggered a significant expansion of the aquafeed additives market. The essential nutrients found in fish, such as Omega-3 fatty acids, play a key role in controlling weight and supporting heart health while enhancing cognitive development. The aquaculture industry is expanding its operations to fulfill the rising demand for better protein options. The use of high-quality aquafeed additives is essential to produce healthy, disease-resistant aquatic livestock. The growing adoption of sustainable aquaculture practices drives market growth through the implementation of fish health-improving additives, which boost feed performance while reducing environmental impact.

The production of customized aquafeed formulations represents a key growth factor because technological developments in this area enable manufacturers to meet the specific nutritional requirements of species. The addition of probiotics together with enzymes, vitamins, and immune-boosting additives constitutes essential components for improving survival rates and accelerating growth, which results in enhanced sustainability and cost-effectiveness of aquaculture. The growth of fish farming operations across North America and the Asia-Pacific region has driven extensive chemical usage for maintaining optimal health conditions in densely populated aquaculture environments. Aquaculture operations are experiencing rising demand because of the post-pandemic recovery and the renewed interest in aquaculture production. Market growth remains steady because companies require dependable, high-quality feed additives as operations resume their expansion.

Ingredient Insights

The feed acidifiers industry shows strong growth potential with significant revenue in 2024. The rising demand for animal protein across the world, together with enhanced aquaculture technologies, drives this increase. The reduction of feed pH levels through feed acidifiers enables decreased pathogenic infections alongside better nutritional absorption and enhanced gut health for fish. Intensive aquaculture systems need feed acidifiers to achieve production goals because they generate faster fish development and superior feed usage. The rising consumer preference for natural and organic products makes producers include organic acids such as citric and lactic acid in their products. The category experiences market growth because producers face increased pressure to use safer, low-pH additives in response to mounting health issues and sustainable aquaculture initiatives.

The antiparasitic segment will experience significant growth during the forecast period because it maintains the health of aquatic animals. The components fight and control parasite infections that would create substantial losses in aquaculture operations. The use of antiparasitics enables more sustainable and secure fish farming by decreasing antibiotic usage, which supports environmental and regulatory trends. The increased demand for natural and organic aquafeed solutions has driven the growth of plant-based antiparasitic chemicals and bio-derived antiparasitic substances. The pharmacological benefits of these compounds allow them to expand their market presence and generate new business opportunities in aquatic veterinary medicine. The segment's growth in aquaculture worldwide remains driven by disease management alongside environmental safety functions.

Application Insights

The aquafeed additives market is dominated by the catfish segment, with 21.75% revenue share in 2024 because of its rising popularity as an affordable, nutritious protein source. Catfish appeals to health-aware consumers worldwide because it contains substantial omega-6 fatty acids and vitamin D. Large-scale aquaculture operations find catfish to be an optimal choice. After all, this species thrives in different types of freshwater and saltwater farming environments. Since catfish consume both plant and animal matter, they need a well-balanced diet, which drives the demand for high-quality additives such as probiotics, together with vitamins, minerals, amino acids, and antiparasitics. The segment's development accelerates as aquaculture worldwide advances because its components stimulate healthy growth along with illness resistance and feed efficiency.

The carp segment within the aquafeed additives market will experience substantial growth because of its established importance in aquaculture and strong worldwide market demand. The farming of carp is widespread because these fish can adapt to different environmental settings while maintaining durability, and they can thrive in both high-density and medium-density farming operations. Their specific dietary needs require feed additives, including vitamins, amino acids, and immune boosters, to achieve optimal growth and health. The increasing utilization of carp by food producers, together with pharmaceutical companies and cosmetic manufacturers, drives additional market demand. The future segment growth will be driven by rising farmer adoption of carp cultivation because they require customized aquafeed additives while being more cost-effective than other species.

Regional Insights

The North American aquafeed additives market will experience a 2.7% CAGR throughout the forecasted period because of the region's well-established aquaculture industry and the United States market dominance. Knowledge about the beneficial health effects of aquafeed additives, including improved fish development and immune system strength, along with enhanced disease protection, is driving market demand. Strict regulatory frameworks push for sustainable, high-quality feed additives because they protect feed safety and minimize environmental effects. The sector receives growing government support through programs and financial initiatives that boost confidence in aquaculture development. Health-conscious consumers drive the rising demand for seafood products. The North American aquafeed additives market will experience substantial growth during the forecast period because of these multiple factors.

Latin America Aquafeed Additives Market Trends

Latin America led the worldwide aquafeed additives market with 36.48% revenue share in 2024 because of its expanding aquaculture sector. The aquaculture industry in Brazil, Chile, and Ecuador produces large amounts of fish and shrimp, thus creating high demand for advanced aquafeed additives. The rising population, together with urban development and increasing wealth levels, has made seafood consumption necessary for people to obtain their protein needs. The region's natural resources, together with its pleasant environment, enable extensive aquaculture operations to thrive. The market growth in this region stems from the rising demand for aquatic species health and growth and disease resistance feed additives, which stems from sustainability initiatives and export-based production activities.

Europe Aquafeed Additives Market Trends

The European aquafeed additives market remains smaller than Asia Pacific and North America, but it will grow at a consistent pace because of environmental and regulatory as well as consumer-related factors. The European Union's restrictive synthetic additive policies have driven feed solution providers to develop innovative, environmentally friendly products through natural and organic alternatives. Aquaculture operations in the United Kingdom, together with France, Italy, and Spain, experience consistent growth because of improved environmental practices combined with enhanced feed conversion and nutrient absorption capabilities. The increasing demand for salmon and other high-value species has driven up the use of specialized sedation and anesthesia additives for secure transportation purposes. The market growth will remain modest but steady because of both consumer demands for sustainability and regulatory requirements.

Key Aquafeed Additives Companies:

The following are the leading companies in the aquafeed additives market. These companies collectively hold the largest market share and dictate industry trends.

- Aker Biomarine

- DuPont de Nemours Inc

- Olmix Group

- Kemin Industries

- Calanus AS

- Biorigin

- Alltech

- Nouryon

- Norel SA

- Lallemand Inc.

- Nutriad Inc.

- Phileo by Lesaffre

- Others

Recent Developments

- In July 2025, AquaScienceTM from Kemin Industries will keep improving aquafeed safety and efficiency. With improved feed conversion and fish health, their cutting-edge products, which include lysophospholipids, enzymes, organic acids, and antioxidants, improve nutrient absorption, reduce microbial spoilage, and prolong feed shelf life, thereby promoting sustainable aquaculture.

- In July 2024, Aker Capital and American Industrial Partners purchased Aker BioMarine's Feed Ingredients division. The action enables Aker BioMarine to focus more strategically while emphasizing the unit's worth and expansion prospects. Numerous partners were participating in the deal, which shows that the industry is very interested in and confident in the company's future.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aquafeed additives market based on the below-mentioned segments:

Global Aquafeed Additives Market, By Ingredient

- Anti-parasitic

- Feed Acidifiers

- Prebiotics

- Essential Oils & Natural Extracts

- Palatants

- Others

Global Aquafeed Additives Market, By Application

- Carp

- Rainbow Trout

- Salmon

- Crustaceans

- Tilapia

- Catfish

- Sea Bass

- Groupers

- Others

Global Aquafeed Additives Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa