Aminoethylethanolamine Market Trends

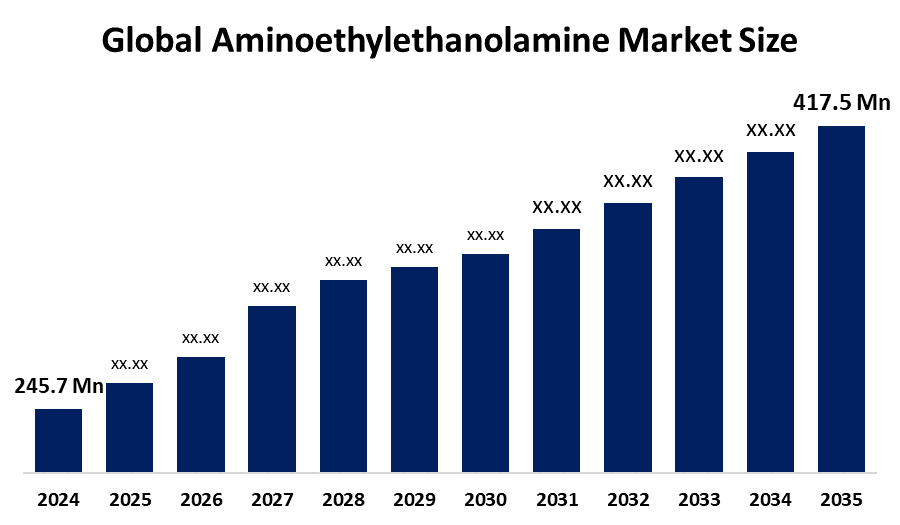

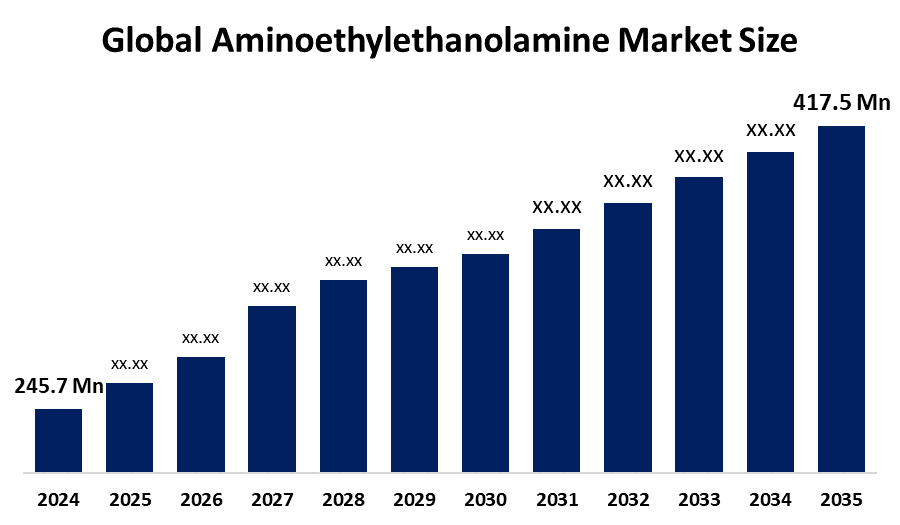

The Global Aminoethylethanolamine Market Size Was Estimated at USD 245.7 Million in 2024 and is Projected to Reach USD 417.5 Million by 2035, Growing at a CAGR of 4.95% from 2025 to 2035. The market for aminoethylethanolamine (AEEA) is expanding because of a factors, such as its adaptability to a wide range of applications, rising consumer demand for environmentally friendly goods, and growth in important end-use industries.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of over 47.6% and dominated the market globally.

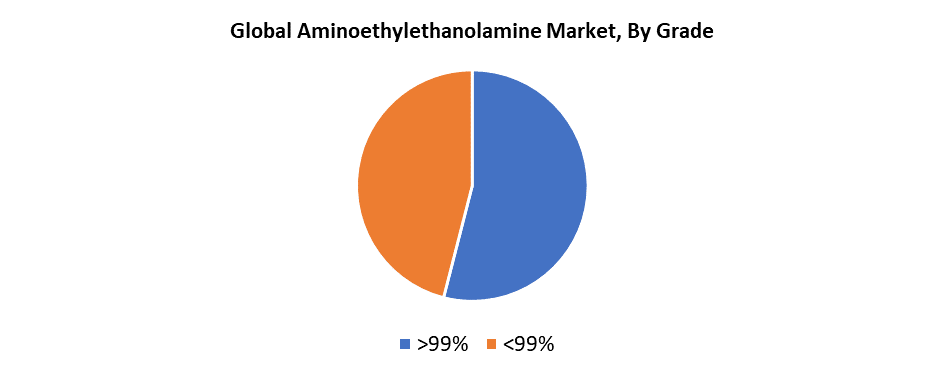

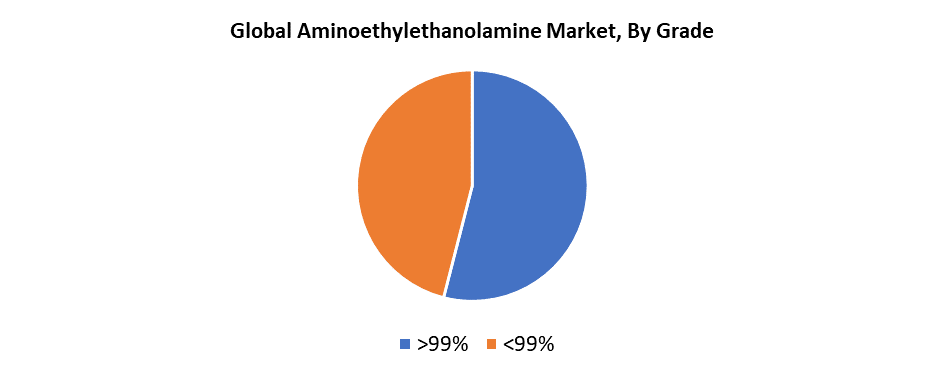

- In 2024, the >99% segment had the highest market share by grade, accounting for 54.4%.

- In 2024, the lubricants segment had the biggest market share by application, accounting for 37.5%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 245.7 Million

- 2035 Projected Market Size: USD 417.5 Million

- CAGR (2025-2035): 4.94%

- Asia Pacific: Largest market in 2024

The Aminoethylethanolamine (AEEA) Market Size represents the worldwide trading environment for AEEA chemical molecules that serve uses in surfactants, chelating agents, and corrosion inhibitors. The compound demonstrates special chemical behaviour because it contains both amine and alcohol groups, which make it suitable for different formulations. The worldwide AEEA market continues to grow because of increasing demand from the agrochemical, oil and gas sectors and water treatment sectors. Chemical additive requirements and effective corrosion management solutions have become more prominent because of expanding industrial development and urban growth, specifically in developing nations. The market for AEEA experiences growth because people want more environmentally friendly formulations and biodegradable surfactants for their cleaning and personal care products.

AEEA manufacturing technology advancements have enhanced product quality, minimized waste products, and boosted production efficiency, which results in decreased costs and expanded application potential. Industries can achieve environmental compliance and maintain competitive strength through process optimization combined with green chemistry approaches. The environmental programs that support chemical manufacturing and water treatment facilities have increased the demand for AEEA, especially across North America and Europe. The market for AEEA in environmentally friendly applications is expanding as a result of regulatory bodies like the U.S. EPA and ECHA pushing for the use of less hazardous, more sustainable chemical ingredients. The development of advanced AEEA-based products is being driven forward by both public funding and private investment in chemical research laboratories and innovation centers.

Grade Insights

The >99% segment dominated the global aminoethylethanolamine (AEEA) market in 2024 with 54.4% revenue share. A variety of industries choose this high-purity grade due to its exceptional chemical consistency, together with its low impurities and strong reactivity. The product functions excellently for specialty surfactants and water treatment chemicals, medical applications, as well as personal care products. The oil and gas industry, along with agrochemical businesses, depend on >99% pure AEEA to maintain product stability and effectiveness because of their essential quality and performance standards. The development of better purification methods, together with refining technology, has decreased the cost of creating high-purity AEEA, which supports its market supremacy. The ongoing industry focus on performance standards, together with regulatory adherence, will maintain high demand for this product.

The aminoethylethanolamine (AEEA) market's <99% purity category will grow at the fastest rate throughout the forecast period. The fast expansion of this segment occurs because industrial sectors utilize this product in applications that need lower purity standards, including lubricant manufacturing, cement additives, and certain cleaning products. Bulk manufacturing of chemicals along with major industrial operations finds <99% grade AEEA beneficial because it provides cost savings. The development of infrastructure and industrialization in emerging nations creates rising requirements for cost-effective and functional chemical intermediates. The rising adoption of this segment by water treatment and textile industries drives its rapid expansion, which establishes it as a growing sector within the AEEA market.

Application Insights

The lubricants segment dominated the aminoethylethanolamine (AEEA) market with 37.5% market share in 2024. AEEA serves as a common component in lubricant formulations because it functions as a metal deactivator while also providing corrosion inhibition and enhancing industrial and automotive lubricant performance. AEEA plays a vital role in gear oils, hydraulic fluids, and high-performance engine oils because it stabilizes metal surfaces while providing better oxidation resistance. The market expansion primarily results from industries including manufacturing, transportation, and power generation that require efficient equipment alongside durable lubrication systems. The worldwide lubricant sector recognizes AEEA as a vital component because organizations focus on reducing maintenance expenses and improving fuel efficiency.

The chelating agents segment of the aminoethylethanolamine (AEEA) market will experience the fastest growth rate throughout the projection period. The essential component of chelating compounds is AEEA, which functions to bind metal ions across multiple applications, including chemical processing, detergents, water treatment, and agriculture. The worldwide shift towards water purification, industrial wastewater management, and eco-friendly cleaning solutions creates a growing demand for efficient and biodegradable chelating agents. The market growth is supported by rising agricultural operations and the requirement for micronutrient fertilizer applications. The chelating agents market will experience enduring strong growth because of environmental chemical solution regulations and modern water treatment facility expansion for both municipal and industrial applications.

Regional Insights

The North American aminoethylethanolamine (AEEA) market receives major influence from end-use sectors such as oil and gas, water treatment, personal care, and lubricants, which form a significant part of the global industry. The United States controls the regional market due to its advanced chemical manufacturing facilities and its strict regulatory environment, and substantial demand for specialty chemicals. AEEA serves as a key component in personal care product surfactants and functions as a chelating agent in industrial water treatment applications, and protects pipelines from corrosion. The market expands because of rising investments in eco-friendly product development and sustainable chemical processing techniques. The regional market position strengthens because of major manufacturers present in the area alongside ongoing research efforts for developing specific AEEA grades with high purity levels.

Asia Pacific Aminoethylethanolamine Market Trends

The Asia Pacific region dominates the global aminoethylethanolamine (AEEA) market with 47.6% revenue share in 2024. The leadership position stems from rapid industrialization and expanding chemical production capacity, and high demand from the lubricant, agrochemical, and water treatment sectors. The combination of inexpensive manufacturing costs and business-friendly government policies, along with rising industrial and infrastructure development spending, allows China, India, Japan, and South Korea to become major AEEA consumers. The increasing urbanization, along with population growth in the region, drives high demand for cleaning agents and personal care products, which use AEEA as a vital component. The rising oil and gas sector in Asia Pacific, alongside environmental preservation initiatives, has accelerated AEEA adoption throughout various industries.

Europe Aminoethylethanolamine Market Trends

The European market for aminoethylethanolamine (AEEA) demonstrates ongoing growth because of stringent environmental regulations combined with rising demand for environmentally safe chemical compositions and technological breakthroughs. The increased usage of AEEA occurs mainly in applications including chelating agents, corrosion inhibitors, and water treatment, where environmental and biodegradable solutions hold importance. The chemical manufacturing sectors, along with REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) regulations, help Germany, France, and the UK drive market adoption. Green chemistry trends, together with rising research and development spending on amine products that deliver high performance and low toxicity, impact market development. The lubricant and construction industries drive their demand for AEEA because of their need to enhance energy efficiency and upgrade infrastructure.

Key Aminoethylethanolamine Companies:

The following are the leading companies in the aminoethylethanolamine market. These companies collectively hold the largest market share and dictate industry trends.

- Huntsman International

- AkzoNobel

- TCI Chemicals Ltd.

- Ashland

- Tosoh Corporation

- Dow Inc.

- Others

Recent Developments

- In June 2023, Dow completed a major expansion at its Asia-Pacific facility, increasing AEEA output by over 22%. The upgrade incorporated automated reactors, improving process efficiency by 18% and significantly shortening production cycles.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aminoethylethanolamine market based on the below-mentioned segments:

Global Aminoethylethanolamine Market, By Grade

Global Aminoethylethanolamine Market, By Application

- Chelating Agents

- Surfactants

- Textile Additives

- Fabric Softeners

- Lubricants

- Others

Global Aminoethylethanolamine Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa