Global Accounts Receivable Automation Market Insights Forecasts to 2035

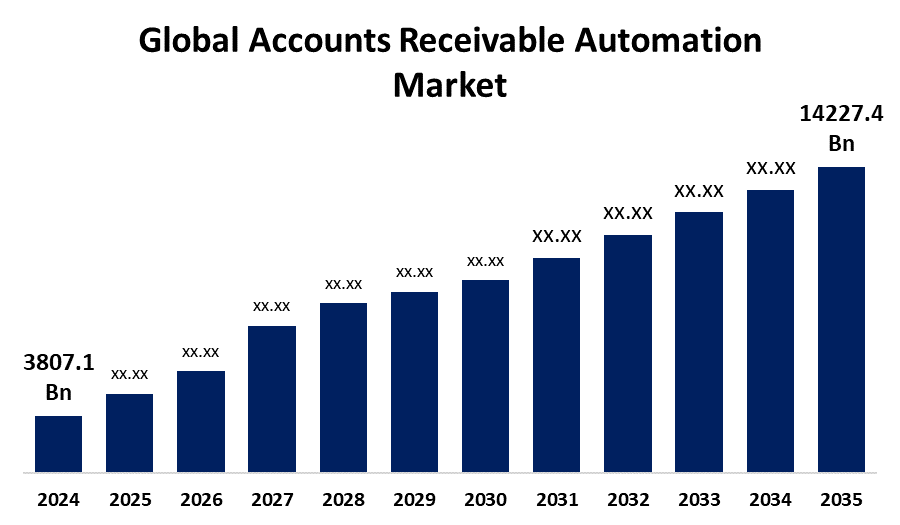

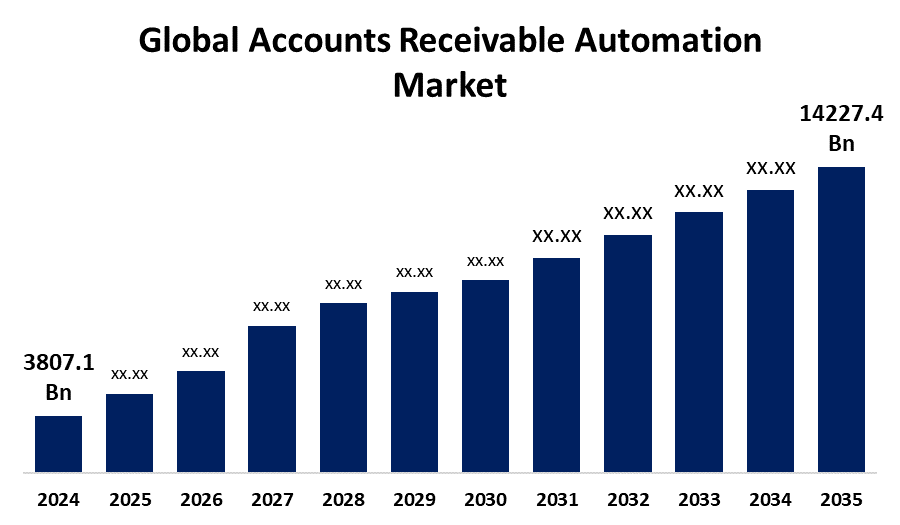

- The Global Accounts Receivable Automation Market Size Was Estimated at USD 3807.1 million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.73% from 2025 to 2035

- The Worldwide Accounts Receivable Automation Market Size is Expected to Reach USD 14227.4 million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Accounts Receivable Automation Market

The accounts receivable automation market involves the use of advanced software and tools to streamline and optimize the management of outstanding customer invoices and payments. By automating routine processes like invoicing, payment reminders, and collections, businesses can enhance their cash flow, reduce manual errors, and speed up the payment cycle. Key features of AR automation solutions include automated invoice generation, real-time tracking, credit management, and dispute resolution, all of which improve operational efficiency and financial accuracy. This technology is widely adopted across industries such as retail, manufacturing, healthcare, and services, aiming to boost financial management practices and improve overall organizational productivity. The market is continuously evolving, with innovations such as artificial intelligence and machine learning further enhancing capabilities by providing advanced predictive analytics and smarter decision-making tools. As businesses seek better control over their receivables and quicker access to funds, the AR automation market is experiencing steady growth globally.

Attractive Opportunities in the Accounts Receivable Automation Market

- Integrating AR automation with other financial technologies like Treasury Management Systems (TMS) and Enterprise Resource Planning (ERP) can offer businesses a more holistic financial solution. This opens up the opportunity to provide end-to-end automation solutions that manage all aspects of a company’s financial operations.

- The integration of artificial intelligence (AI) into AR automation solutions can improve fraud detection and offer more accurate predictive cash flow forecasting. As businesses seek smarter decision-making tools, AI-driven AR solutions present a major opportunity for growth.

Global Accounts Receivable Automation Market Dynamics

DRIVER: Businesses are increasingly seeking to enhance operational efficiency

Businesses are increasingly seeking to enhance operational efficiency and reduce manual errors associated with traditional invoicing and payment processes. Automation speeds up the entire receivables cycle, improving cash flow and reducing the risk of late payments. Second, the growing demand for real-time data and insights is pushing companies to adopt AR automation solutions, as these tools provide real-time tracking and analytics to optimize cash management. Third, the rise of cloud-based solutions offers cost-effective and scalable options for businesses of all sizes, enabling easier integration with existing systems. Additionally, advancements in technologies like artificial intelligence (AI) and machine learning (ML) are enhancing predictive analytics and decision-making, further driving adoption. Lastly, increasing regulatory compliance requirements and the need for greater transparency in financial reporting are prompting businesses to invest in automated solutions for improved accuracy and reporting capabilities.

RESTRAINT: Upfront cost associated with implementing AR automation solutions

One primary restraint is the significant upfront cost associated with implementing AR automation solutions, particularly for smaller businesses with limited financial resources. The expenses related to software, training, and system integration can be prohibitive. Moreover, the complexity of integrating these solutions with existing financial systems and infrastructure often requires specialized knowledge and could lead to operational disruptions during the transition period. Many companies also face internal resistance, as employees accustomed to traditional methods may be hesitant to embrace fully automated processes, necessitating a shift in corporate culture and additional training. Data privacy concerns, especially in cloud-based platforms, can deter adoption, as businesses worry about the security of sensitive financial information. Additionally, the lack of universal standards across AR automation tools can result in compatibility issues, making it harder for companies to scale and adapt these solutions as their needs evolve.

OPPORTUNITY: Growing potential in emerging markets

One such opportunity is the growing potential in emerging markets, where businesses are still in the early stages of digital transformation. These regions present a large base of potential customers looking to modernize their financial operations. Additionally, there is an opportunity for AR automation vendors to collaborate with financial institutions, offering integrated solutions that enhance payment processing and liquidity management for both businesses and banks. Another significant opportunity lies in the customization of AR solutions for niche industries like healthcare, construction, or professional services, where unique billing and payment processes create demand for tailored automation. Moreover, the integration of AR automation with other financial technologies, such as Treasury Management Systems (TMS) or Enterprise Resource Planning (ERP), opens doors for more holistic financial solutions. The increased adoption of artificial intelligence (AI) also presents opportunities for continuous improvement in fraud detection and predictive cash flow forecasting.

CHALLENGES: Ongoing need for skilled personnel to manage and optimize AR automation systems

Beyond the typical restraining factors, the accounts receivable automation market faces additional challenges that impact its adoption and growth. One key challenge is the variability in the quality of automation solutions available, as not all platforms offer the same level of sophistication, customization, or scalability. This inconsistency can make it difficult for businesses to select the right solution for their needs, leading to dissatisfaction or suboptimal results. Additionally, the ongoing need for skilled personnel to manage and optimize AR automation systems is a challenge. While automation reduces manual tasks, it doesn’t eliminate the requirement for knowledgeable professionals who can oversee the technology’s performance and troubleshoot issues. The lack of standardization in terms of payment methods and financial regulations across different regions also complicates the global implementation of AR automation solutions. Finally, despite automation, there remains a dependency on customer behavior, such as payment delays, which can undermine the effectiveness of automated processes.

Global Accounts Receivable Automation Market Ecosystem Analysis

The global accounts receivable automation market ecosystem involves a network of technology providers, end users, payment solutions, and third-party vendors. Key players include software vendors offering cloud-based AR platforms, financial institutions facilitating payment processing, and consulting firms that assist with integration. The ecosystem also includes payment gateways, credit agencies, and regulatory bodies ensuring compliance. Advancements in AI and machine learning enhance predictive analytics and fraud detection, while automation streamlines processes like invoicing, collections, and cash application. This interconnected landscape drives efficiency and improves cash flow management for businesses globally.

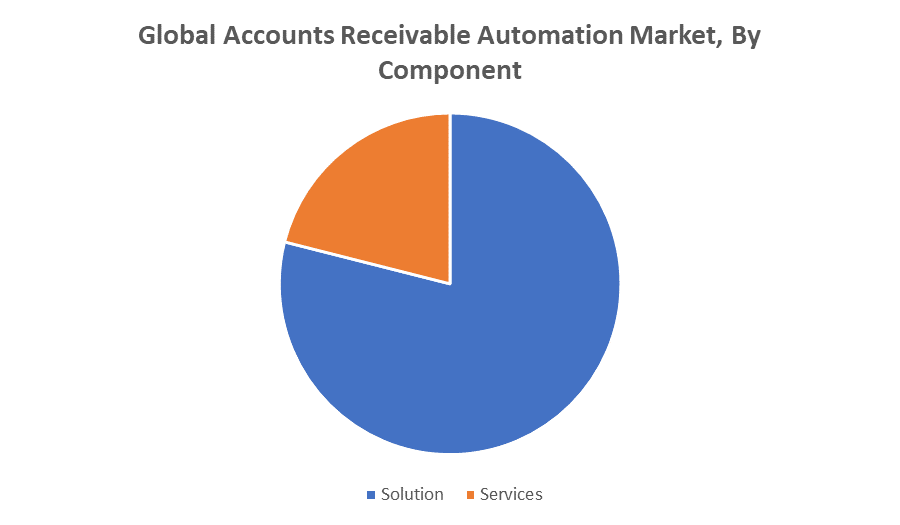

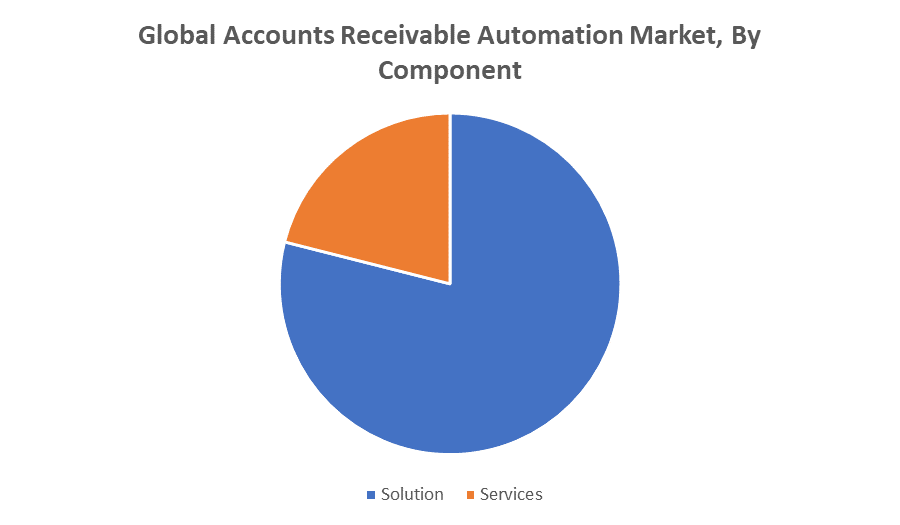

Based on the component, the solution segment dominated the accounts receivable automation market over the forecast period

The solution segment is expected to dominate the accounts receivable automation market over the forecast period, driven by the increasing demand for comprehensive, integrated software platforms. These solutions encompass a wide range of functionalities, including invoicing, payment processing, cash application, credit management, and dispute resolution. The growing need for businesses to automate routine tasks, enhance cash flow, and reduce manual errors is pushing the adoption of these end-to-end solutions. Additionally, cloud-based AR solutions offer scalability, cost-effectiveness, and easier integration with existing enterprise systems, further boosting their market share. The continuous advancements in AI, machine learning, and predictive analytics within these solutions also make them increasingly attractive for businesses seeking smarter, data-driven decision-making capabilities. As businesses strive to optimize their financial operations, the comprehensive nature of these solutions is expected to drive sustained growth in the market.

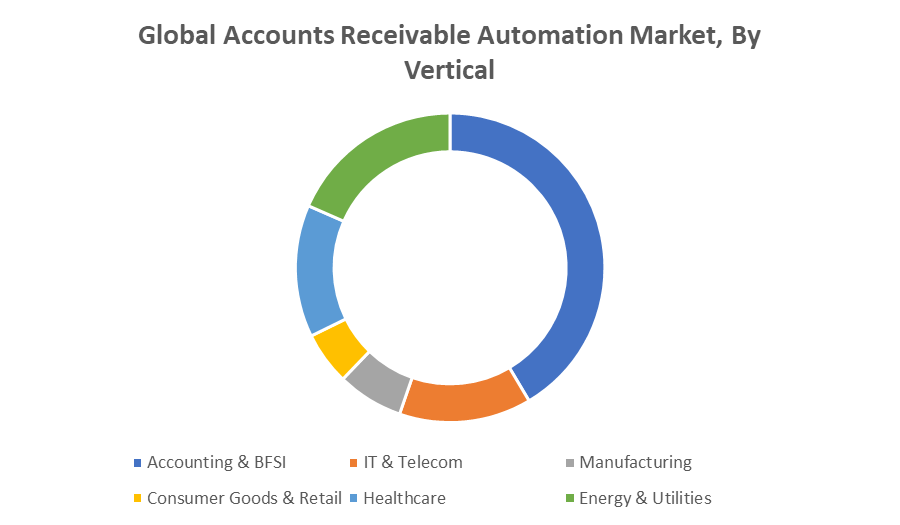

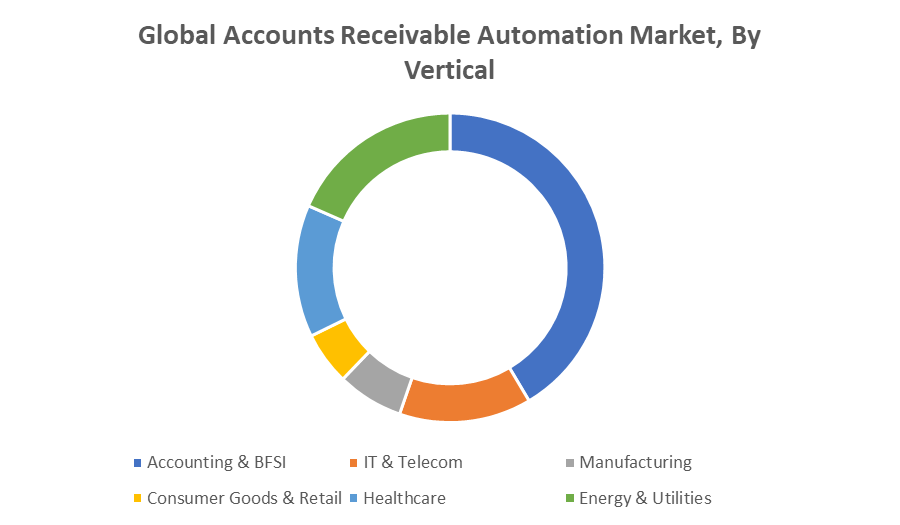

Based on the vertical, the accounting & BFSI segment held a significant market revenue share and is expected to grow at a remarkable CAGR over the forecast period

The growth is primarily driven by the increasing complexity of financial operations within these industries and the need for greater efficiency in managing receivables. In the BFSI sector, automation streamlines critical processes such as invoicing, payment processing, and collections, helping institutions reduce operational costs, minimize errors, and enhance cash flow management. Additionally, the growing focus on regulatory compliance, fraud prevention, and real-time financial reporting within the accounting and BFSI sectors has further accelerated the adoption of AR automation solutions. As these industries continue to embrace digital transformation and seek faster, more accurate financial management, the AR automation solutions tailored to their needs will see sustained demand and significant growth.

North America is anticipated to hold the largest market share of the accounts receivable automation market during the forecast period

North America is anticipated to hold the largest market share of the Accounts Receivable (AR) Automation market during the forecast period. This dominance is driven by the high adoption of advanced technologies, such as cloud computing, artificial intelligence, and machine learning, in the region. Businesses in North America, particularly in industries like banking, finance, and healthcare, are increasingly implementing AR automation to streamline operations, reduce costs, and enhance cash flow management. The presence of major AR automation vendors, such as HighRadius and Billtrust, also supports market growth in the region. Additionally, the region’s mature infrastructure, high levels of digitization, and increasing demand for compliance with regulatory standards further fuel the adoption of AR automation solutions. As North American businesses continue to prioritize efficiency and operational agility, the market for AR automation is expected to grow significantly, solidifying its position as a key region in the global market.

Asia Pacific is expected to grow at the fastest CAGR in the accounts receivable automation market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the accounts receivable (AR) automation market during the forecast period. This growth is fueled by the region's rapid digital transformation, increased adoption of cloud technologies, and rising demand for automation across various industries. Key markets like China, India, and Southeast Asia are witnessing a surge in small and medium-sized enterprises (SMEs) adopting AR automation solutions to streamline financial processes and improve cash flow management. Additionally, the growing need for operational efficiency, reduced manual errors, and better customer experience in industries such as manufacturing, retail, and finance is driving the shift toward AR automation. As businesses in the Asia Pacific region increasingly prioritize digitalization, the market for AR automation is expected to expand rapidly. Furthermore, favorable government initiatives to support technological advancements and the presence of global AR solution providers in the region will further accelerate market growth.

Recent Development

- In October 2023, HighRadius, a leader in AI-powered AR automation, acquired Comarch, a company specializing in receivables management. This acquisition expands HighRadius’s capabilities, allowing it to enhance their offering with more advanced AI-driven solutions for cash management and accounts receivable automation.

- In July 2023, Billtrust, a major player in AR automation, entered into partnerships with Visa and MasterCard to integrate their automated invoicing and payments solutions. This collaboration aims to streamline the payment process for Billtrust's global client base, offering enhanced flexibility and faster payment processing.

Key Market Players

KEY PLAYERS IN THE ACCOUNTS RECEIVABLE AUTOMATION MARKET INCLUDE

- HighRadius

- Billtrust

- SAP

- Oracle

- Quadient (YayPay)

- Infor

- Aderant

- Esker

- Tradeshift

- Serrala

Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the accounts receivable automation market based on the below-mentioned segments:

Global Accounts Receivable Automation Market, By Component

Global Accounts Receivable Automation Market, By Vertical

- Accounting & BFSI

- IT & Telecom

- Manufacturing

- Consumer Goods & Retail

- Healthcare

- Energy & Utilities

Global Accounts Receivable Automation Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa