Global Accounting Software Market Insights Forecasts to 2035

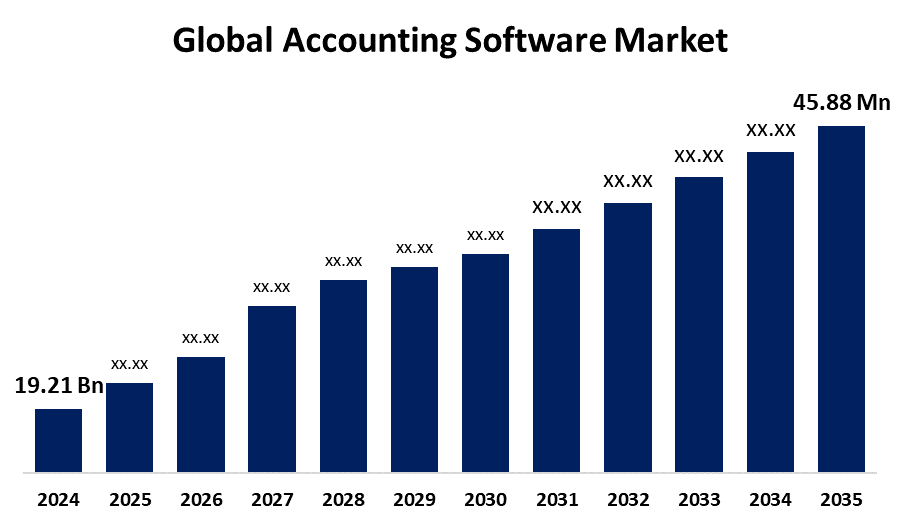

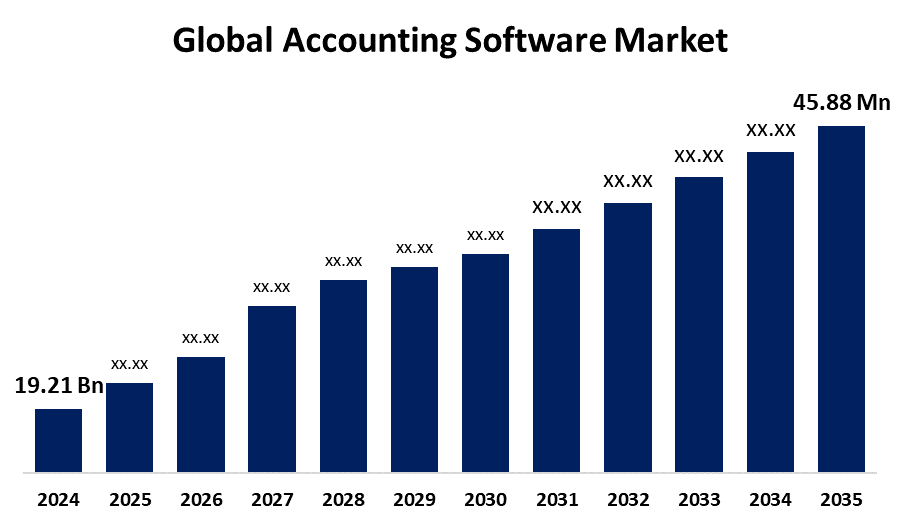

- The Global Accounting Software Market Size Was Estimated at USD 19.21 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.24% from 2025 to 2035

- The Worldwide Accounting Software Market Size is Expected to Reach USD 45.88 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Accounting Software Market

The global accounting software market encompasses the development and distribution of software solutions designed to automate financial tasks such as bookkeeping, invoicing, payroll, tax management, and financial reporting for businesses and individuals. These software solutions help organizations manage their accounting processes efficiently by reducing manual errors and improving accuracy. The market includes a wide range of products, from simple accounting tools tailored for small businesses to comprehensive enterprise-level systems that integrate multiple financial functions. Cloud-based accounting software has become increasingly popular, providing users with real-time access, scalability, and ease of use. The market is characterized by numerous providers offering diverse features to meet the specific needs of different industries and business sizes. With the growing importance of digital financial management, accounting software is now an essential component for businesses globally, facilitating improved financial visibility and compliance with regulatory requirements. The industry continues to evolve, driven by innovations aimed at enhancing usability and integration capabilities.

Attractive Opportunities in the Accounting Software Market

- Accounting software that integrates seamlessly with other business systems such as Customer Relationship Management (CRM), Supply Chain Management (SCM), and Enterprise Resource Planning (ERP) is in high demand. Offering integrated solutions can provide users with a holistic, efficient approach to managing their business functions.

- As businesses increasingly expand globally, there is a growing demand for accounting software that supports multi currency and multi language capabilities. These features are essential for companies dealing with international transactions, taxation, and compliance across different regions.

- The rise of remote work and decentralized business operations has led to an increased need for cloud-based and mobile accounting solutions that allow businesses to access financial data anytime and anywhere. The ability to manage accounting processes on the go, from various devices, is becoming a critical requirement for businesses.

Global Accounting Software Market Dynamics

DRIVER: Increasing adoption of cloud-based solutions is a major catalyst

The increasing adoption of cloud based solutions is a major catalyst, as these platforms offer scalability, real time access, and cost efficiency, making them attractive to businesses of all sizes. The rising number of small and medium sized enterprises (SMEs) worldwide is also boosting demand, as these businesses seek affordable and easy to use accounting tools to manage their finances effectively. Additionally, growing regulatory complexities and compliance requirements are prompting organizations to adopt automated software to ensure accuracy and timely reporting. The integration of advanced technologies like artificial intelligence, machine learning, and automation further enhances the functionality of accounting software, enabling predictive analytics and reducing manual workloads. Digital transformation initiatives across industries encourage companies to shift from traditional manual accounting methods to automated solutions, improving operational efficiency. Together, these factors contribute to the expanding adoption and continuous innovation within the global accounting software market.

RESTRAINT: High initial cost of implementing advanced accounting software can be a barrier

One significant challenge is data security and privacy concerns, as financial information is highly sensitive, and any breach can lead to severe consequences for businesses. Many organizations remain cautious about adopting cloud-based solutions due to fears of cyberattacks and data leaks. Additionally, the high initial cost of implementing advanced accounting software can be a barrier for small businesses and startups with limited budgets. Integration issues with existing legacy systems and other business software also pose challenges, often requiring additional time and resources to ensure smooth operation. Furthermore, a lack of technical expertise among users can hinder the effective adoption and utilization of these software solutions. Lastly, frequent updates and the complexity of some advanced features may overwhelm smaller organizations, slowing down their transition to automated accounting systems. These factors collectively restrain the market’s growth potential.

OPPORTUNITY: Growing trend of integration with other business software

One key opportunity lies in the increasing demand for specialized industry specific solutions, such as accounting software tailored for healthcare, real estate, or retail sectors. Customization of accounting tools to meet niche needs can create a significant market for developers. Another opportunity is the growing trend of integration with other business software, such as customer relationship management (CRM) and supply chain management systems, providing users with a comprehensive, seamless experience. Furthermore, as the global economy becomes more interconnected, internationalization features such as multi-currency and multi-language support are in high demand, offering new avenues for expansion. The shift towards remote work and decentralized business operations is also creating opportunities for mobile and cloud-based solutions, as businesses increasingly seek flexibility. Additionally, offering services such as real-time analytics, financial forecasting, and automation can attract businesses looking for more advanced capabilities within their accounting systems.

CHALLENGES: Rapid pace of technological change

One challenge is the rapid pace of technological change, which can result in software becoming obsolete or requiring frequent updates. This can create a constant pressure on companies to stay ahead of technological trends and invest in regular upgrades. Additionally, the wide range of accounting software products available can lead to market fragmentation, making it difficult for businesses to select the right solution. For vendors, this can result in intense competition and lower profit margins, especially with the proliferation of affordable solutions. Another challenge is the varying regulatory standards across different regions, which can complicate software development and require constant updates to remain compliant with local laws. Additionally, the diversity of user needs and skill levels can make it difficult to create universally user-friendly software, leading to potential usability issues. Finally, customer loyalty can be a challenge, as businesses often switch between providers due to evolving needs or pricing structures.

Global Accounting Software Market Ecosystem Analysis

The global accounting software market ecosystem consists of software vendors (e.g., QuickBooks, Sage), end users (SMEs, enterprises, freelancers), channel partners (resellers, system integrators), cloud service providers (AWS, Azure), consultants, and regulatory bodies. Vendors develop solutions tailored to user needs, while cloud providers ensure scalability and security. Consultants and accountants assist with implementation, and regulatory bodies enforce compliance. The ecosystem thrives through collaboration, with technology providers enhancing software through AI and analytics, ensuring solutions remain efficient, secure, and adaptable to evolving market demands.

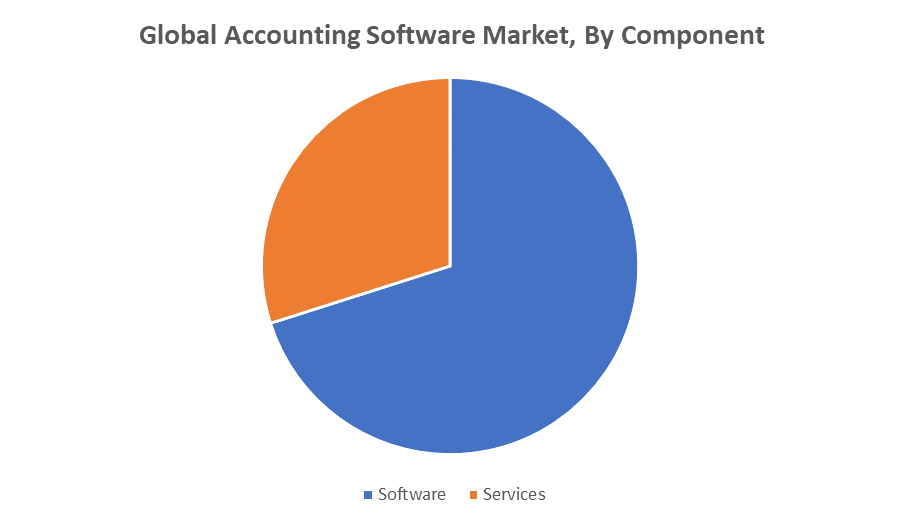

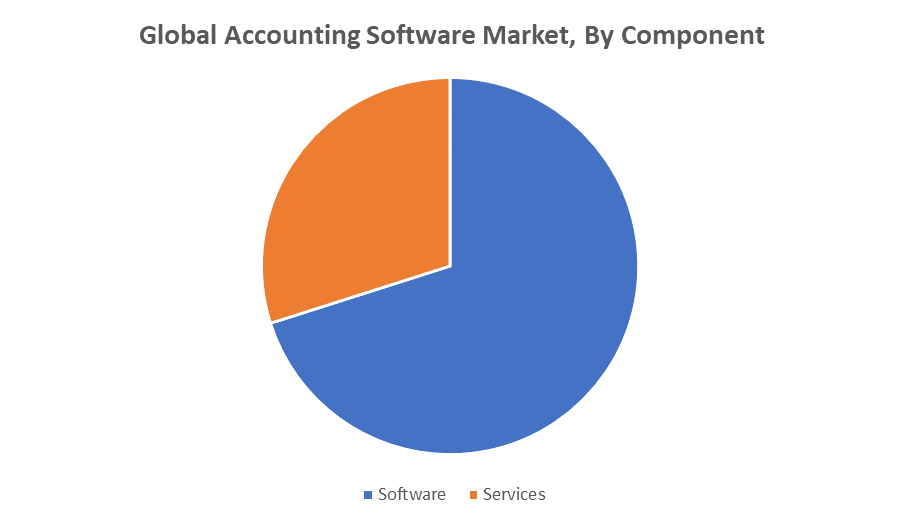

Based on the component, the software segment accounted for the largest share over the forecast period

The segment includes both cloud-based and on-premise accounting solutions, offering a wide range of features such as bookkeeping, invoicing, payroll management, financial reporting, and tax compliance. As businesses increasingly shift towards digital solutions, the demand for efficient, user-friendly, and secure software is growing, particularly among small and medium-sized enterprises (SMEs) seeking cost-effective solutions. Moreover, advancements in AI, machine learning, and automation are enhancing the capabilities of accounting software, driving its adoption across industries. With continuous innovations and integration features, the software segment is poised to dominate, addressing businesses' needs for greater operational efficiency, real-time data access, and regulatory compliance.

Based on the deployment, the cloud-based segment held the largest market share and is expected to grow at a substantial CAGR over the forecast period

The cloud based segment growth is driven by the increasing demand for scalable, flexible, and cost efficient solutions that allow businesses to access their financial data in real time from anywhere. Cloud based accounting software eliminates the need for extensive IT infrastructure and reduces upfront costs, making it particularly attractive to small and medium-sized enterprises (SMEs). Additionally, cloud solutions offer automatic updates, enhanced data security, and seamless integration with other business applications, further encouraging adoption. As businesses increasingly embrace digital transformation, the cloud based segment is projected to continue its strong growth, driven by ongoing advancements in cloud technology and the rising need for remote access to financial information and analytics.

North America is anticipated to hold the largest market share of the accounting software market during the forecast period

North America is anticipated to hold the largest market share of the global accounting software market during the forecast period. The region's dominance can be attributed to the presence of major software vendors like Intuit (QuickBooks), Sage, and Microsoft, as well as the high adoption rate of advanced financial technologies by businesses across various sectors. The growing demand for cloud based accounting solutions, coupled with the increasing number of small and medium sized enterprises (SME) seeking efficient financial management tools, further contributes to this growth. Additionally, North America benefits from a favorable regulatory environment, technological infrastructure, and a strong focus on automation, data security, and real-time financial reporting, making it a key region for the accounting software market. The presence of a well established IT ecosystem and ongoing innovation in accounting solutions are expected to maintain North America's leading position in the market.

Asia Pacific is expected to grow at the fastest CAGR in the accounting software market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the accounting software market during the forecast period. This growth is driven by the region's rapidly expanding small and medium-sized enterprises (SME), increasing digitalization, and rising adoption of cloud based solutions. As businesses in countries like China, India, and Southeast Asia digitize their financial processes, the demand for affordable, scalable, and user-friendly accounting software is soaring. Additionally, the region’s improving IT infrastructure, government initiatives supporting digital transformation, and the growing need for automation and real time financial insights are accelerating adoption. The increasing focus on regulatory compliance, financial transparency, and cost management further boosts the market. With a young, tech savvy workforce and a strong push towards modernization, Asia Pacific is poised to become a major growth driver for the global accounting software market over the forecast period.

Recent development

In July 2025, Intuit launched proactive AI agets in QuickBooks to automate workflows across invoicing, lead tracking, payments, reconciliation, and financial analysis, claiming to save SMBS uo to 12 hours per month

- In June 2025, Xero struck a deal to acquir U.S. based payments platform melio with price tags of US 2 billion (Reuters) to 4 billion (The Australian). This adds AP/AR capabilities into Xers core accounting suits.

Key Market Players

KEY PLAYERS IN THE ACCOUNTING SOFTWARE MARKET INCLUDE

- Intuit Inc.

- Xero Ltd.

- Sage Group plc

- Oracle Corporation

- SAP SE

- Microsoft Corporation

- FreshBooks

- Wave Financial

- Zoho Corporation

- Workday, Inc.

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the accounting software market based on the below-mentioned segments:

Global Accounting Software Market, By Component

Global Accounting Software Market, By Deployment

Global Accounting Software Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa