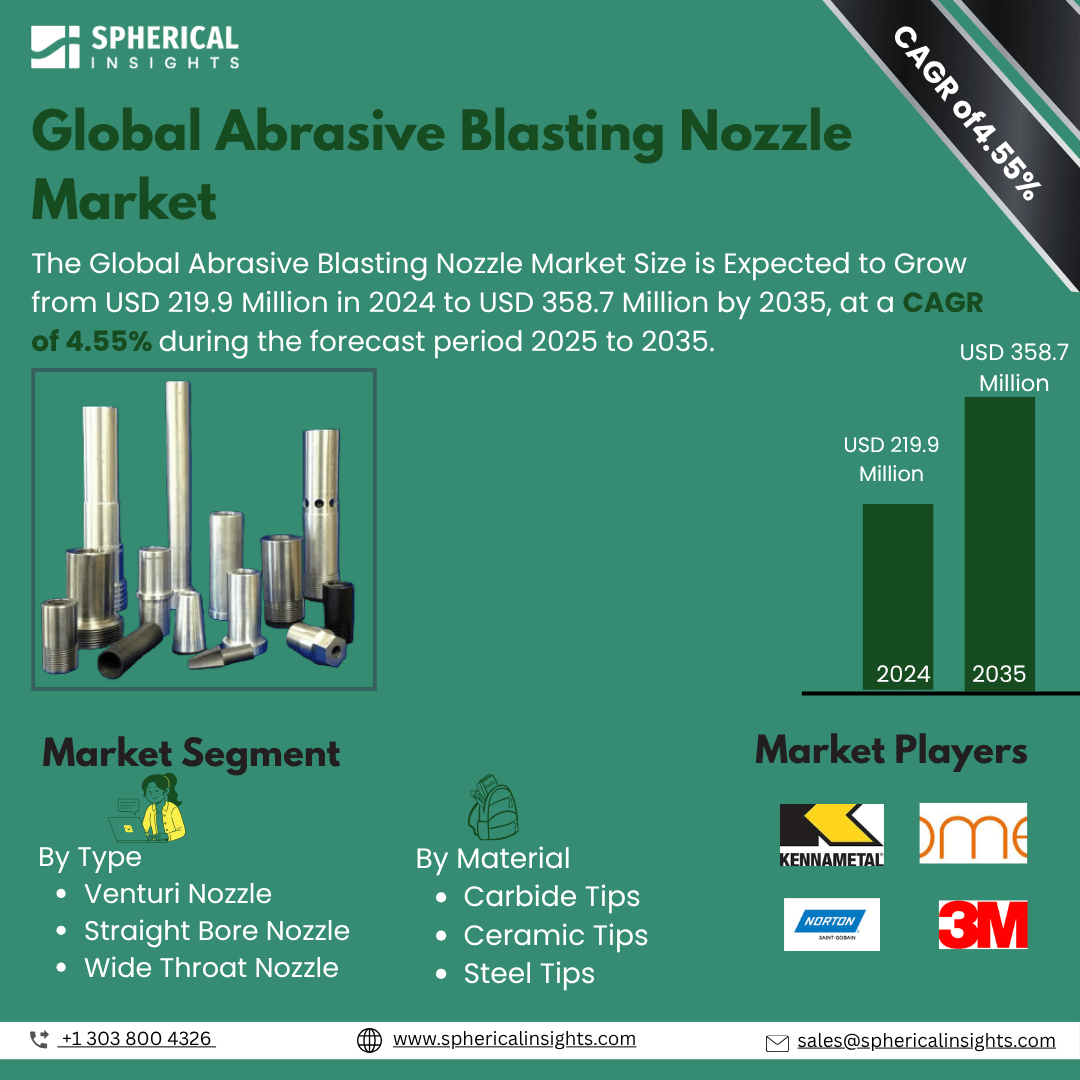

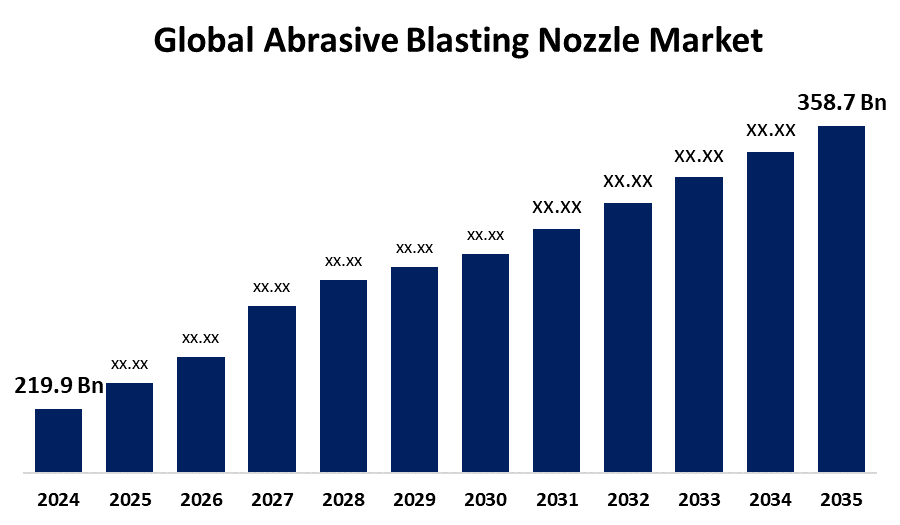

Global Abrasive Blasting Nozzle Market Insights Forecasts to 2035

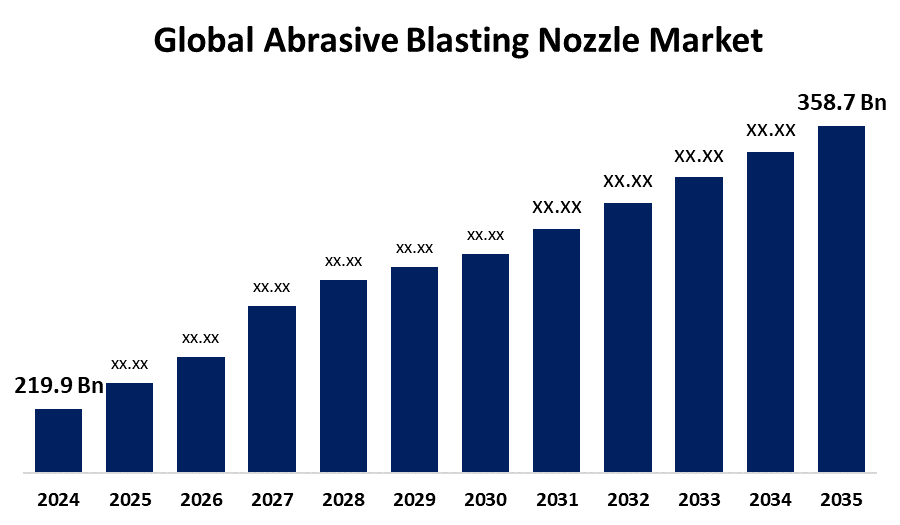

- The Global Abrasive Blasting Nozzle Market Size Was Estimated at USD 219.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.55% from 2025 to 2035

- The Worldwide Abrasive Blasting Nozzle Market Size is Expected to Reach USD 358.7 Million by 2035

- Middle East & Africa is expected to grow the fastest during the forecast period.

Abrasive Blasting Nozzle Market

The global abrasive blasting nozzle market encompasses the manufacturing and distribution of nozzles used in abrasive blasting processes. These nozzles are designed to control and direct the flow of abrasive materials such as sand, grit, or steel shot, which are propelled at high speeds to clean, smooth, or shape surfaces. Constructed from durable materials like tungsten carbide, boron carbide, and ceramic, abrasive blasting nozzles are critical in industries such as automotive, construction, aerospace, and marine for surface preparation and finishing. The market is characterized by various nozzle types, including venturi and wide-throat nozzles, each offering specific advantages in terms of abrasive velocity and productivity. The demand for these nozzles is driven by the need for efficient and precise surface treatment techniques. Innovations in nozzle design and materials continue to enhance performance and lifespan, contributing to steady growth in the market. Overall, abrasive blasting nozzles remain vital tools for industrial cleaning and surface preparation.

Attractive Opportunities in the Abrasive Blasting Nozzle Market

- Development of nozzles with enhanced wear resistance and improved designs that increase efficiency and reduce abrasive consumption. These innovations lead to cost savings and longer service life, attracting more users and expanding market adoption.

- Increasing use of automated and robotic abrasive blasting requires specialized nozzles designed for precision, repeatability, and integration with advanced machinery. This opens new avenues for manufacturers to develop tailored products for automated surface preparation.

- Rapid industrialization and infrastructure projects in developing countries present untapped potential. Increased manufacturing activities and modernization efforts in regions like Asia Pacific and Middle East & Africa drive demand for effective surface treatment technologies, creating growth opportunities for nozzle manufacturers.

Global Abrasive Blasting Nozzle Market Dynamics

DRIVER: Demand for effective surface preparation and cleaning methods rises

The growth of the global abrasive blasting nozzle market is mainly driven by increasing industrialization and the expanding manufacturing sector worldwide. As industries such as automotive, aerospace, construction, and shipbuilding continue to develop, the demand for effective surface preparation and cleaning methods rises. Abrasive blasting nozzles play a vital role in these processes by enabling efficient removal of rust, paint, and contaminants, ensuring better adhesion for coatings and improving product quality. Additionally, advancements in nozzle materials and design, such as the use of tungsten carbide and boron carbide, have improved durability and performance, making the nozzles more cost-effective and attractive to end users. The growing focus on maintenance and refurbishment of aging infrastructure also boosts market demand. Furthermore, increasing environmental regulations encourage the use of abrasive blasting as a cleaner alternative to chemical methods, further promoting adoption. Together, these factors contribute to steady market growth and innovation in abrasive blasting nozzle technologies.

RESTRAINT: Environmental concerns related to dust generation and the disposal of used abrasive materials

The global abrasive blasting nozzle market faces several restraining factors that could limit its growth. One major challenge is the high cost of advanced nozzles made from materials like tungsten carbide and boron carbide, which can be expensive to manufacture and replace. This cost may discourage small and medium-sized enterprises from adopting these high-performance nozzles. Additionally, abrasive blasting requires skilled operators and proper safety measures due to the health risks associated with dust and abrasive particles, which can increase operational costs and limit widespread use. Environmental concerns related to dust generation and the disposal of used abrasive materials also pose challenges, leading to stricter regulations and higher compliance costs. Moreover, the availability of alternative surface preparation techniques such as laser cleaning and chemical treatments may reduce the demand for traditional abrasive blasting nozzles. These factors combined create barriers that could slow the overall market expansion despite rising industrial demand.

OPPORTUNITY: Emerging markets in developing countries present untapped potential due to increasing industrial activities and infrastructure projects

One significant opportunity lies in technological innovation, such as the development of nozzles with enhanced wear resistance and improved designs that increase efficiency and reduce abrasive consumption. This can lead to cost savings and longer service life, attracting new users. Another opportunity is the growing adoption of automation and robotic blasting systems, which require specialized nozzles tailored for precision and repeatability, opening new avenues for manufacturers. Additionally, emerging markets in developing countries present untapped potential due to increasing industrial activities and infrastructure projects. Environmental sustainability is also creating opportunities for eco-friendly blasting solutions, such as using recyclable abrasives and nozzles that minimize dust generation. Furthermore, expanding applications beyond traditional industries into areas like electronics, medical device manufacturing, and renewable energy sectors offers new market segments. These opportunities enable companies to diversify and innovate beyond existing demand drivers.

CHALLENGES: Maintaining consistent nozzle performance under harsh operating conditions

The abrasive blasting nozzle market faces several challenges that are distinct from the usual restraining factors. One major challenge is maintaining consistent nozzle performance under harsh operating conditions, as abrasive materials cause rapid wear and tear, requiring frequent replacements and downtime. Ensuring product quality while reducing maintenance costs is difficult for manufacturers. Another challenge is the need for skilled labor to operate blasting equipment safely and efficiently, which can be scarce in some regions, limiting market expansion. Additionally, the industry must keep up with evolving regulations related to worker safety and environmental protection, which often require costly upgrades to equipment and processes. Competition from alternative surface treatment technologies, such as laser or water jet cleaning, also challenges market players to continuously innovate. Lastly, supply chain disruptions affecting raw materials for nozzle production can impact availability and pricing, creating uncertainty in the market. Overcoming these challenges is essential for sustainable growth in the abrasive blasting nozzle industry.

Global Abrasive Blasting Nozzle Market Ecosystem Analysis

The global abrasive blasting nozzle market ecosystem includes manufacturers producing durable nozzles using materials like tungsten carbide and ceramics. Raw material suppliers provide essential inputs, while distributors deliver products to industries such as automotive, aerospace, and construction. Equipment manufacturers integrate nozzles into blasting systems, often offering custom solutions. Research and development drive innovation in design and performance. Regulatory bodies set safety and environmental standards, and service providers support maintenance and training. Together, these players create a comprehensive ecosystem supporting the abrasive blasting nozzle market.

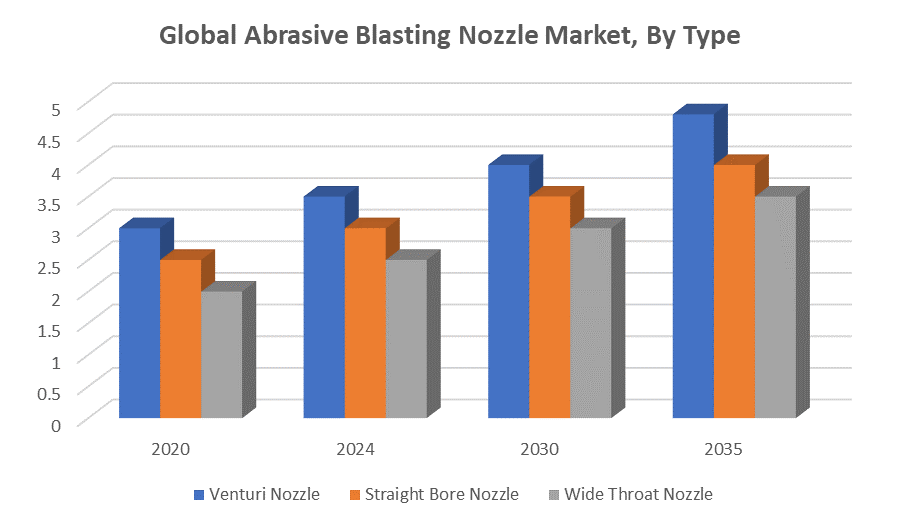

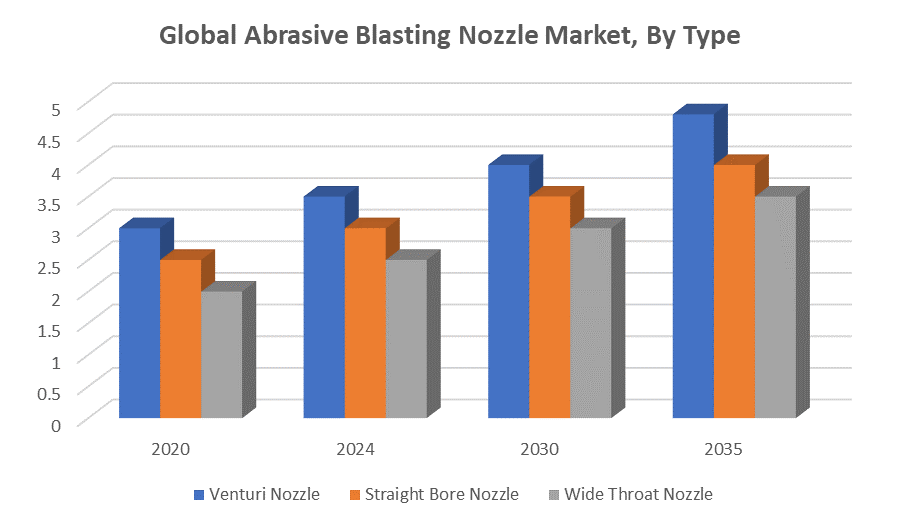

Based on the type, the venturi nozzle segment held the highest market share over the forecast period

The venturi nozzle segment held the highest market share in the global abrasive blasting nozzle market over the forecast period. This is due to its ability to generate high abrasive velocity, resulting in efficient surface cleaning and preparation. Venturi nozzles are preferred for their superior performance, durability, and effectiveness across various industries such as automotive, aerospace, and construction. Their design allows for optimized abrasive flow, making them a popular choice for achieving precise and consistent blasting results.

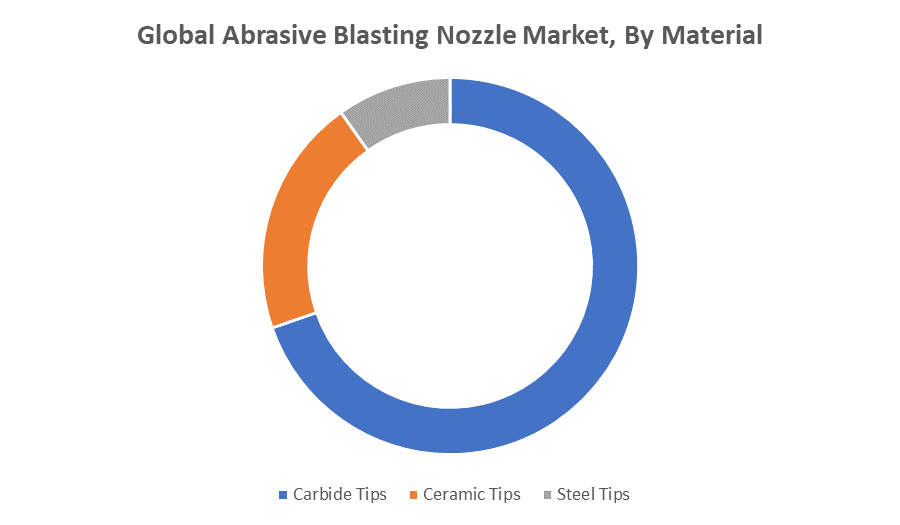

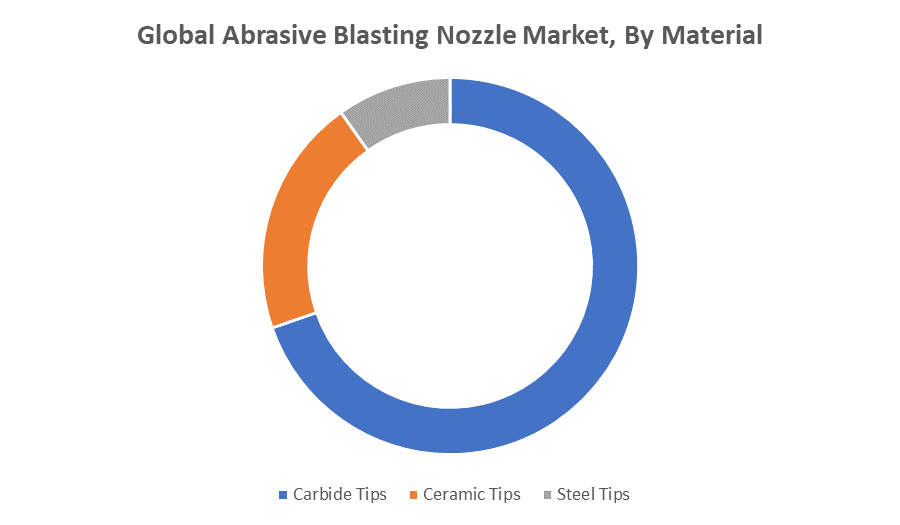

Based on the material, the carbide tips segment dominated the market with the highest revenue share during the forecast period

Carbide tips, typically made from tungsten carbide, offer exceptional hardness and wear resistance, making them highly durable in abrasive blasting applications. Their long lifespan and ability to withstand high-pressure abrasive flow contribute to better performance and lower maintenance costs. As a result, carbide-tipped nozzles are widely preferred across industries such as automotive, aerospace, and construction, driving their dominance in the market.

Asia Pacific is anticipated to hold the largest market share of the abrasive blasting nozzle market during the forecast period

Asia Pacific is anticipated to hold the largest market share of the abrasive blasting nozzle market during the forecast period. This is attributed to rapid industrialization, expanding manufacturing activities, and growing infrastructure development in countries like China, India, and Southeast Asian nations. The region’s increasing demand for surface preparation and cleaning solutions across automotive, construction, shipbuilding, and aerospace sectors further fuels market growth. Additionally, the presence of a large base of small and medium-sized enterprises adopting advanced blasting technologies supports Asia Pacific’s leading position in the market.

Middle East & Africa is expected to grow at the fastest CAGR in the abrasive blasting nozzle market during the forecast period

The Middle East & Africa region is expected to grow at the fastest CAGR in the abrasive blasting nozzle market during the forecast period. This rapid growth is driven by increasing investments in infrastructure development, oil and gas industries, and construction projects. The rising demand for surface preparation and maintenance in these sectors is boosting the adoption of abrasive blasting technologies. Additionally, ongoing industrialization and modernization efforts in countries within this region contribute to expanding market opportunities, making Middle East & Africa a high-growth area for abrasive blasting nozzles.

Recent Development

- In March 2023, Kennametal Inc. introduced the Blast Ninja nozzle. Engineered by Oceanit, this nozzle offers exceptional quality, heightened productivity, and superior hearing protection, aligning with OSHA regulations for safety.

Key Market Players

KEY PLAYERS IN THE ABRASIVE BLASTING NOZZLE MARKET INCLUDE

- Kennametal Inc.

- Elcometer Limited

- Norton Abrasives

- 3M Company

- BlastOne International

- Abrasive Engineering Inc.

- SGS Industrial Supplies

- Blast Equipment Limited (BEL)

- Fluorocarbon Corporation

- The National Blower Company

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the abrasive blasting nozzle market based on the below-mentioned segments:

Global Abrasive Blasting Nozzle Market, By Type

- Venturi Nozzle

- Straight Bore Nozzle

- Wide Throat Nozzle

Global Abrasive Blasting Nozzle Market, By Material

- Carbide Tips

- Ceramic Tips

- Steel Tips

Global Abrasive Blasting Nozzle Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa