5G Testing Equipment Market Size & Trends

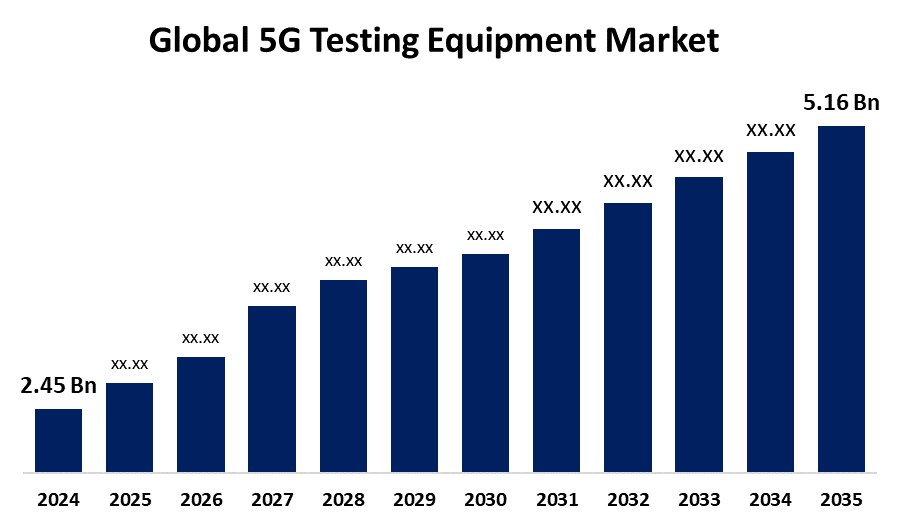

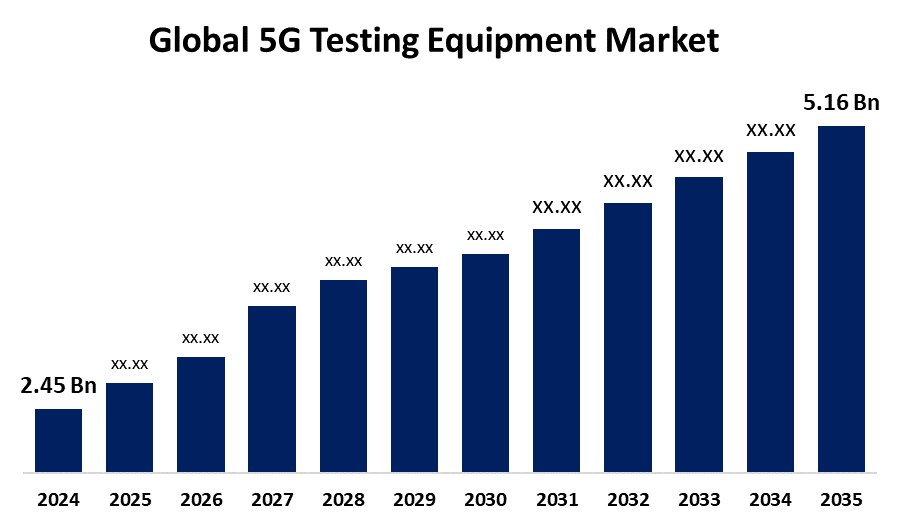

The Global 5G Testing Equipment Market Size Was Estimated at USD 2.45 Billion in 2024 and is Projected to Reach USD 5.16 Billion by 2035, Growing at a CAGR of 7.01% from 2025 to 2035. The worldwide deployment of 5G networks and the growing complexity of 5G technologies are driving the demand for 5G testing equipment. The increasing demand for fast internet, the spread of 5G-capable devices, and the application and industry expansion of 5G are the main drivers of this rise.

Key Regional and Segment-Wise Insights

- In 2024, the North American 5 G testing equipment market accounted for 44.5% of the market's revenue.

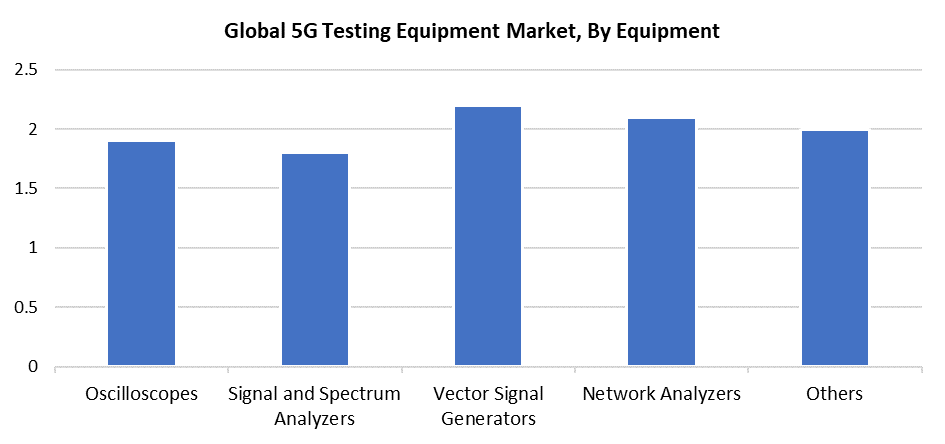

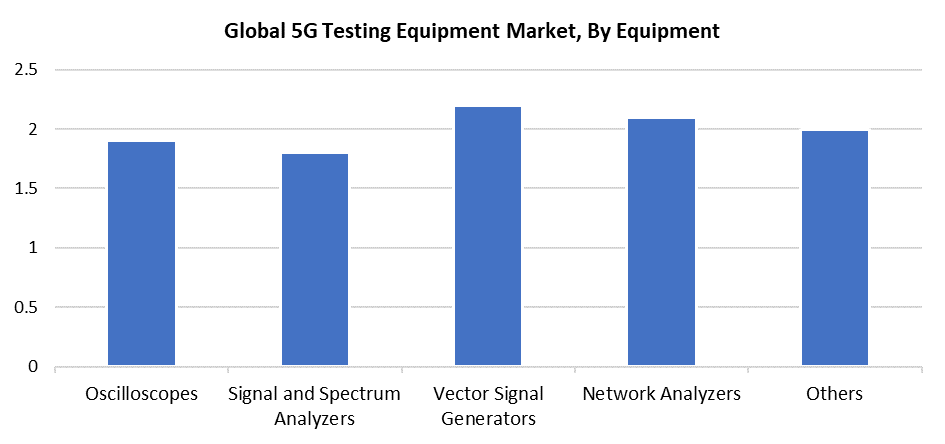

- In 2024, the vector signal generators segment held the largest revenue share by equipment, accounting for 22.7%.

- In 2024, the new category accounted for the greatest market share by revenue source.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.45 Billion

- 2035 Projected Market Size: USD 5.16 Billion

- CAGR (2025-2035): 7.01%

- North America: Largest market in 2024

5G testing equipment sector focuses on specialised tools which verify and ensure the operational excellence of 5G networks and devices. The rising demand for fast mobile networks, together with smart gadgets and Internet of Things applications, is driving substantial growth in the 5G testing equipment market. The implementation of 5G networks requires advanced testing solutions because they support massive device connections and more data traffic, along with strict Quality of Service (QoS) requirements. The rising need for precise and affordable testing instruments stems from businesses adopting 5G to support high-performance applications, which include industrial automation and driverless cars, and smart cities. Telecom companies must invest in advanced technology to guarantee network performance and speed, and security, because users demand enhanced multimedia experiences through augmented reality (AR) and real-time video streaming, which require more bandwidth and dependable networks.

The market for 5G testing equipment continues to grow because telecom infrastructure gets updated while testing solutions incorporate software-defined approaches and artificial intelligence (AI). These technologies deliver improved test precision and automation, which enables both real-time system monitoring and predictive analysis, and faster 5G deployment. Testing systems must remain flexible and scalable because modern network environments grow more complex through edge computing integration with cloud technology and connected devices. Network integrity and regulatory compliance require thorough testing because of sophisticated cyber threats, so security has become a primary concern. To ensure quality and safety alongside network optimisation during telecom operators' 5G infrastructure growth, they should acquire next-generation testing equipment.

The vector signal generators sector led the 5G testing equipment market in 2024 with a 22.7% market share because it provides essential performance evaluation for 5G networks. The generators function as essential tools which develop complex signal modulations together with sophisticated waveforms that simulate authentic signal environments. The advanced complexity of 5G signals, including Massive MIMO and beamforming and millimetre-wave frequencies, has driven up the need for exact testing instruments such as vector signal generators. Network providers, together with device manufacturers, use these tools to evaluate signal fidelity while checking functionality and global standard compliance. Network performance optimisation and dependable 5G service delivery require precise network condition modelling, which leads to increased demand for high-speed, low-latency communication solutions.

Network analyzers segment is expected to experience the fastest growth during the forecast period because 5G networks are evolving into more complex and dense systems. The instruments function to measure signal quality and detect interference while maintaining maximum network performance. Network analyzers deliver essential diagnostics capabilities which telecom operators need to resolve issues ahead of time and decrease deployment time as they build their 5G infrastructure. Network Service Providers rely on advanced analytical tools to monitor network performance as traffic increases and to deliver services with low latency and high reliability. Network analyzers provide system-wide insights which support decision-making throughout the design and deployment stages and during maintenance operations. The rapid changes in 5G networks make these instruments vital because they ensure both service continuity and efficient infrastructure operation.

Revenue Source Insights

The new segment held the greatest revenue share and led the 5G testing equipment market in 2024 because of fast technological advancement and expanding 5G adoption across various business sectors. 5G-enabled devices continue their growing adoption across manufacturing, healthcare and smart city sectors, and the automotive industry to enhance connection capabilities and automate processes and deliver real-time data sharing. The transformation requires advanced testing equipment to confirm performance standards and reliability while matching evolving standards. Businesses need customised testing solutions to validate complex device networks and application relationships during their digital transformation initiatives. The new market dominates because of increasing Industry 4.0 implementation and connected infrastructure, which drives the need for high-precision testing equipment.

The rental segment will register a strong CAGR during the forecast period because businesses need affordable 5G testing equipment without capital expenditure. Equipment rental provides a flexible and cost-effective alternative which serves businesses that run short-term projects or pilot tests or operate in environments with fast-changing technologies. Startups, along with small businesses and budget-conscious operators, choose this approach because it lets them access modern testing technology without needing to cover ownership expenses. Leasing solutions enable businesses to maintain up-to-date technology without significant risk because 5G standards and technologies evolve. Consumers' growing preference for flexible, cost-effective options drives the rental market to grow at an accelerated pace.

Regional Insights

North America led the worldwide market for 5G testing equipment in 2024 through a 44.5% revenue share due to its strategic investments in telecommunications infrastructure and rapid 5G technology implementation. The United States hosts major telecom providers and equipment manufacturers that enable rapid deployment and continuous testing of innovative 5G networks. Businesses have implemented 5G testing solutions to ensure optimal performance alongside security and scalability requirements. The market growth receives a boost from government-led initiatives, which promote broadband accessibility expansion and next-generation wireless technology support. The continued research and development activities across various sectors, including automotive, healthcare and smart cities, drive the need for advanced testing solutions, which establishes North America as the leading region for 5G testing equipment.

Europe 5G Testing Equipment Market Trends

The European market for 5G testing equipment will experience substantial growth throughout the forecasted period because of fast digitalisation and high-speed connectivity adoption in the region. The European Union supports broad 5G deployment across member states through its strategic investments in next-generation telecom infrastructure, which includes the 5G Action Plan. Advanced testing equipment serves as an essential requirement for applications that need dependable high-performance networks, such as smart cities and connected cars and industrial automation, and healthcare systems. Telecom operators prioritise 5G testing because data usage continues to rise within residential and commercial networks, so they can maintain consistent network performance while meeting regulations. The growing dependence on modern connectivity solutions in Europe leads to increased requirements for advanced testing services and equipment.

Asia Pacific 5G Testing Equipment Market Trends

The Asia Pacific region will witness substantial growth in the 5G testing equipment market from 2025 until 2035 because of important telecom infrastructure investments and digital transformation, and rapid urbanisation. The trend advances because China and India, together with Japan and South Korea, extend their 5G networks and create additional 5G-compatible products. Advanced testing solutions become essential to deliver high-speed connectivity and network dependability through the spread of Internet of Things (IoT) applications and smart cities, and connected businesses. The market develops rapidly because companies perform more research and development, and governments back it up, and people want better communication solutions. As Asia Pacific solidifies its technology leadership position, the demand for scalable, efficient and affordable 5G testing equipment continues to grow.

Key 5G Testing Equipment Companies:

The following are the leading companies in the 5G testing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Anritsu

- Rohde & Schwarz

- Keysight Technologies

- Intertek Group Plc

- EXFO Inc.

- Ceragon

- Teradyne Inc.

- MACOM

- Artiza Networks Inc.

- VIAVI Solutions Inc.

- Others

Recent Development

- In September 2024, In Bengaluru, Tata Elxsi unveiled the "xG-Force" lab, a cutting-edge facility designed to spur 5G innovation. This lab supports a range of applications in the media, transportation, healthcare, and Industry 4.0 sectors by offering cutting-edge tools, ready-to-use infrastructure, and an integrated partner ecosystem. The facility facilitates the development of 5G solutions while allowing businesses to investigate and evaluate innovative technologies.

- In July 2024, Accenture successfully acquired Fibermind, an Italian network services provider with expertise in fiber and mobile 5G network deployment. In addition to giving clients access to a wealth of industry expertise and technology resources driven by automation, robots, data, and artificial intelligence, this purchase strengthens Accenture's telecommunications network engineering capabilities.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the 5 G testing equipment market based on the below-mentioned segments:

Global 5G Testing Equipment Market, By Equipment

- Oscilloscopes

- Signal and Spectrum Analyzers

- Vector Signal Generators

- Network Analyzers

- Others

Global 5G Testing Equipment Market, By Revenue Source

Global 5G Testing Equipment Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa