World’s Top 60 Tokenization Companies 2025: Industry Intelligence Report by Spherical Insights (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

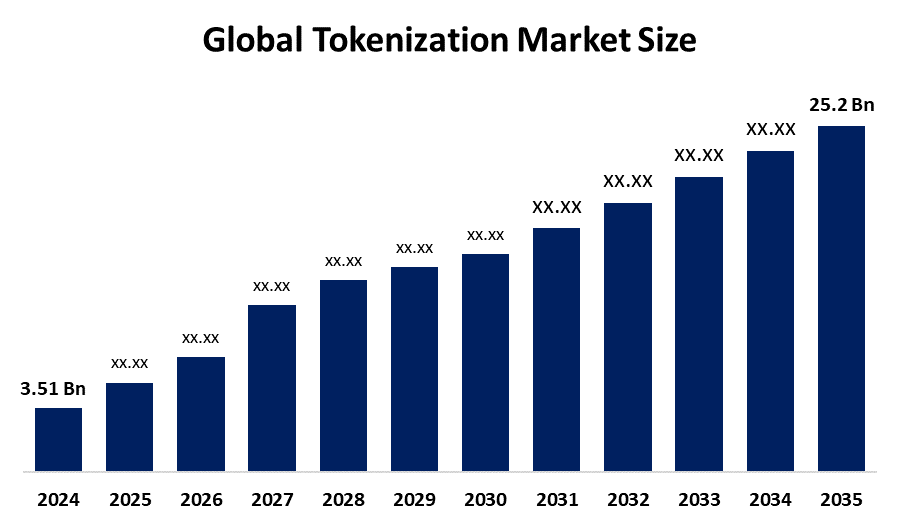

According to a research report published by Spherical Insights & Consulting, The Global Tokenization Market Size is projected to Grow from USD 3.51 Billion in 2024 to USD 25.2 Billion by 2035, at a CAGR of 19.63% during the forecast period 2025–2035. The Global Tokenization Market is growing due to rising cybersecurity concerns, increasing digital payments, stringent data protection regulations, adoption of cloud services, and demand for secure, efficient transaction processing.

Introduction

The tokenization market refers to Tokenization is the process of replacing sensitive data with unique, non-sensitive tokens to enhance security, privacy, and reduce fraud risks. The emergence of digital payments, technological developments, and rising data security demands have all contributed to the enormous growth of the global tokenisation market. Businesses handled sensitive consumer data during the COVID-19 pandemic, which drove digital transformation and brought attention to the need for secure transaction solutions. Tokenisation has emerged as a vital instrument for safeguarding confidential data, especially in the IT, banking, financial services, and insurance industries. Tokenisation has been used by businesses like PhonePe to adhere to legal requirements, increasing customer trust. The growth of cloud services improves the market by enabling the adoption of safe, cloud-based digital processes by SMEs and large organisations alike. Furthermore, by facilitating fractional investments and lowering high capital requirements, the real estate sector's transition to tokenised assets and the widespread adoption of blockchain across industries have further stimulated growth. Global market expansion is being driven by a number of factors, including the growth of digital transactions, increased worries about fraud, regulatory requirements, and standardised tokenisation technologies. These factors position tokenisation as a crucial option for safe and effective digital operations.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Tokenization Market.

Tokenization Market Size & Statistics

- The Market Size for Tokenization Was Estimated to be worth USD 3.51 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 19.63% between 2025 and 2035.

- The Global Tokenization Market Size is anticipated to reach USD 25.2 Billion by 2035.

- Europe is expected to generate the highest demand during the forecast period in the Tokenization Market

- Asia Pacific is expected to grow the fastest during the forecast period in the Tokenization Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the tokenization market. Over the course of the projected period, the Asia-Pacific market is anticipated to rise at a significant CAGR. Asia Pacific is expected to develop significantly more quickly than other regions over the projection period. The rapid adoption of state-of-the-art payment security technologies, extensive internet use, and rising smartphone penetration are driving the regional market. The proliferation of real-time payment systems, such as P2P money transfers and mobile payment platforms, is also contributing to an increase in fraud in the area.

Europe is expected to generate the highest demand during the forecast period in the tokenization market. Europe has the world's second-largest tokenisation market because of the enormous amounts of technology and data that are being digitised. Due to its central location, which facilitates global market connectivity, Europe is making significant investments in various industries, including digital services that use tokenisation to safeguard sensitive data. The European markets are ten times more reliable for tokenisation due to their high degree of innovation.

Top 10 trends in the Tokenization Market

- Rising Digital Payments

- Cloud-Based Tokenization

- Blockchain Integration

- Data Security & Privacy Regulations

- Expansion Across Industries

- API-Driven Solutions

- Contactless & Mobile Payments Growth

- Standardization of Tokenization Practices

- Fractional Asset Investment

- AI & Analytics Integration

1. Rising Digital Payments

The global shift toward online, mobile, and contactless payments has increased demand for tokenization, as it ensures secure transactions by replacing sensitive card or account information with unique tokens, reducing fraud risks and enhancing consumer trust across digital platforms.

2. Cloud-Based Tokenization

Tokenisation systems that are scalable, adaptable, and economical are made possible by cloud usage. Businesses of all sizes can benefit from the safe storage, management, and processing of tokens in cloud settings, which makes it simpler to integrate with digital platforms and lowers infrastructure costs while enhancing data security.

3. Blockchain Integration

Tokenization combined with blockchain ensures transparency, immutability, and secure asset digitization. From financial assets to real estate and supply chains, blockchain-based tokenization allows secure ownership transfer, verification, and traceability, driving adoption across industries seeking decentralized, tamper-proof transaction systems.

4. Data Security & Privacy Regulations

Strict regulations like GDPR, PCI DSS, and CCPA require businesses to protect sensitive data. Tokenization helps organizations comply by replacing confidential information with non-sensitive tokens, minimizing the risk of data breaches, fines, and reputational damage.

5. Expansion Across Industries

Tokenisation is being used not only in banking and finance but also in real estate, healthcare, retail, insurance, and logistics. Tokenization's market reach is increased as a result of industries managing sensitive data, benefiting from safe digital operations, decreased fraud, and increased consumer trust.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the tokenization market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 10 Companies Leading the Tokenization Market

- Visa

- Fiserv, Inc.

- Entrust Corporation

- American Express

- Mastercard

- Open Text Corporation

- TrustCommerce

- Thales

- TokenEx, Inc

- FIS

- Others

1. Visa

Headquarters: Foster City, California, USA

Visa Inc. is a global leader in digital payments and financial technology solutions. The company specializes in providing secure, fast, and reliable payment processing services for consumers, businesses, and financial institutions worldwide. Visa’s tokenization solutions replace sensitive payment data with unique tokens, enhancing security, reducing fraud, and enabling safer digital and contactless transactions. With a strong presence across retail, e-commerce, banking, and mobile payment platforms, Visa drives the adoption of secure digital payments globally. Through innovation, partnerships with banks, fintech companies, and merchants, and advanced fraud prevention technologies, Visa promotes financial inclusion, consumer trust, and the global transition toward a secure, cashless economy.

2. Fiserv, Inc.

Headquarters: Brookfield, Wisconsin, USA

Fiserv, Inc. is a global provider of financial services technology, specializing in payment processing, digital banking, and secure data management solutions. The company offers tokenization services that replace sensitive payment information with unique, non-sensitive tokens, enhancing security, reducing fraud, and enabling safe digital and contactless transactions. Fiserv serves banks, credit unions, retailers, and fintech companies worldwide, helping them modernize payment infrastructure and improve customer experiences. Through continuous innovation, partnerships, and advanced fraud prevention technologies, Fiserv supports secure, efficient, and reliable digital payments, driving financial inclusion and promoting the global shift toward a safer, cashless economy.

3. Entrust Corporation

Headquarters: Minneapolis, Minnesota, USA

Entrust Corporation is a global leader in digital security, identity, and payment solutions. The company specializes in tokenization, encryption, and secure transaction technologies that protect sensitive financial and personal data across digital, mobile, and contactless payment platforms. Entrust serves financial institutions, governments, enterprises, and merchants, providing solutions that reduce fraud, ensure regulatory compliance, and enhance consumer trust. By leveraging advanced cryptography, cloud integration, and identity verification technologies, Entrust enables secure digital transactions, modernizes payment infrastructures, and supports the global adoption of safe, efficient, and resilient financial ecosystems.

4. American Express

Headquarters: New York City, New York, USA

American Express (Amex) is a global financial services company specializing in payment and credit solutions for consumers, businesses, and merchants. The company leverages tokenization to replace sensitive card information with secure digital tokens, reducing fraud and enabling safe, contactless, and mobile payments. With a strong presence in credit cards, charge cards, and payment networks worldwide, Amex focuses on enhancing transaction security, customer trust, and digital payment experiences. Through innovation, partnerships, and advanced fraud prevention technologies, American Express supports the global shift toward secure, cashless, and efficient financial transactions.

5. Mastercard

Headquarters: Purchase, New York, USA

Mastercard Incorporated is a global leader in digital payments and financial technology solutions. The company specializes in secure transaction processing and tokenization, replacing sensitive payment information with unique tokens to reduce fraud and enhance data security. Mastercard serves consumers, businesses, financial institutions, and merchants worldwide, enabling seamless, contactless, and mobile payment experiences. Through innovation, partnerships, and advanced cybersecurity technologies, Mastercard promotes secure digital commerce, financial inclusion, and the global transition toward efficient, cashless, and trustworthy payment ecosystems.

Are you ready to discover more about the Tokenization market?

The report provides an in-depth analysis of the leading companies operating in the global tokenization market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes

Company Profiles

- Visa

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Fiserv, Inc.

- Entrust Corporation

- American Express

- Mastercard

- Open Text Corporation

- TrustCommerce

- Thales

- TokenEx, Inc

- FIS

- Others

Conclusion

The global tokenization Market is expanding rapidly due to the rise of digital payments, stringent data security regulations, and growing adoption across banking, fintech, healthcare, and e-commerce sectors. Technological advancements in cloud computing, blockchain, and AI-driven analytics are accelerating adoption. Increasing concerns over fraud, privacy, and regulatory compliance further drive market growth. Despite challenges such as high implementation costs, integration complexities, and evolving standards, tokenization is becoming a critical solution for securing sensitive data and enabling safe, efficient digital transactions. Overall, tokenization is poised to transform digital payment ecosystems, enhance consumer trust, and support the global transition toward secure, cashless, and technologically advanced financial operations.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?