World’s Top 50 Companies in Redistribution Layer Material 2025 Watchlist: Statistical Report (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

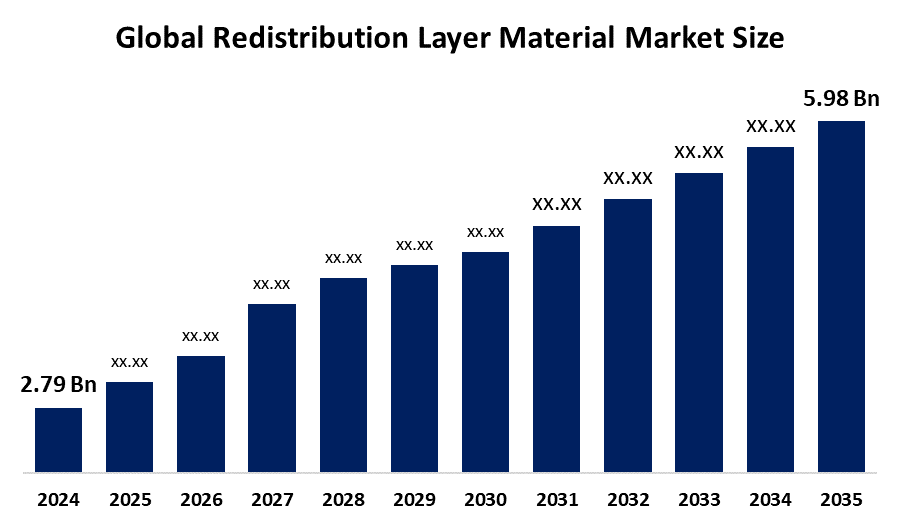

According to a research report published by Spherical Insights & Consulting, The Global Redistribution Layer Material Market Size is projected to Grow from USD 2.79 Billion in 2024 to USD 5.98 Billion by 2035, at a CAGR of 7.18% during the forecast period 2025–2035. The market for redistribution layer material is in greater demand due to the growing need for high-performance semiconductors, which are essential for cutting-edge technologies such as artificial intelligence, machine learning, and cloud computing. RDL materials enable the high-density interconnects, miniaturisation, and effective heat dissipation needed for these applications.

Introduction

The redistribution layer material is an extra metal layer that is applied to an integrated circuit to move its input/output pads. More efficient connections in advanced semiconductor packaging are made possible by this. The growing need for high-performance, small electronics is driving a rapid expansion of the RDL materials market. Because advanced packaging methods like 2.5D and 3D ICs require materials that allow high I/O density, effective thermal management, and reliability under stress, they are important drivers. Novel polymer dielectrics that sustain performance at high frequencies and in hostile environments, as well as low-dielectric-constant materials that lower parasitic capacitance and increase signal speed, are the focus of recent advancements. Sustainability is another trend. To lessen their influence on the environment and their reliance on raw materials, manufacturers are investigating lead-free, halogen-free materials and copper redistribution layers that incorporate reclaimed metals, such as recycled copper.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights-Download the Brochure now and dive deeper into the future of the Redistribution Layer Material Market.

Redistribution Layer Material Market Size & Statistics

- The Market Size for Redistribution Layer Material Was Estimated to be worth USD 2.79 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 7.18% between 2025 and 2035.

- The Global Redistribution Layer Material Market Size is anticipated to reach USD 5.98 Billion by 2035.

- Asia Pacific is expected to generate the highest demand during the forecast period in the Redistribution Layer Material Market

- Europe is expected to grow the fastest during the forecast period in the Redistribution Layer Material Market.

Regional growth and demand

Europe is expected to grow the fastest during the forecast period in the redistribution layer material market. The market for redistribution layer material is now growing in Europe due to strong government backing for sophisticated packaging technologies, cheaper labour and raw material costs, the existence of sizable semiconductor manufacturing hubs in China, Taiwan, South Korea, and Japan, as well as growing demand from the consumer electronics, automotive, and telecommunications sectors, are some of the causes.

Asia Pacific is expected to generate the highest demand during the forecast period in the redistribution layer material market. The redistribution layer material market with the quickest rate of growth throughout the study period is anticipated to be in the Asia Pacific. The region is home to important semiconductor manufacturing hubs, including China, Taiwan, South Korea, and Japan. The consumer electronics, automotive electronics, and telecom/5G sectors have a significant and growing demand, and government support and investments in cutting-edge packaging infrastructures favour high consumption of RDL materials.

Top 10 trends in the Redistribution Layer Material Market

- Advanced Packaging Demand

- Low Dielectric Constant & Thermal Expansion

- Sustainability & Environmentally Friendly Materials

- ML in Design & Process Optimization

- Ultra-Thin RDLs & Flexibility

- Automotive, IoT, 5G

- Regional Growth in Asia-Pacific

- Supply Chain Integration & Foundry

- Regulatory Pressure & Standards

- Improved Thermal & Mechanical Performance

1. Advanced Packaging Demand

The need for electrical gadgets that are faster, smaller, and use less power is driving the demand for innovative packaging. The shrinking device geometries make it difficult for conventional packaging techniques to meet the demands of heat control and high connection density. Technologies including fan-out wafer-level packaging, system-in-package, flip-chip, and 2.5D/3D IC integration are increasingly indispensable to meet performance requirements in applications such as artificial intelligence, 5G, data centres, automotive electronics, wearables, and the Internet of Things. These methods enable heterogeneous integration, which lowers latency, boosts reliability under thermal stress, and improves signal integrity by stacking or mixing many chip types in a single package. The current emphasis on multifunctionality and miniaturisation is driving package architectures towards compact form factors, embedded dies, and finer line pitches.

2. Low Dielectric Constant & Thermal Expansion

Creating dielectrics with a low dielectric constant to minimise parasitic capacitance and signal loss, and a low coefficient of thermal expansion to preserve structural integrity throughout temperature changes, is a key trend in redistribution layer materials. Because they promote superior electrical performance, polymer dielectrics with becoming more and more preferred over conventional silicon dioxide. Nevertheless, polymers frequently have lower mechanical stiffness and higher CTE. Composite materials, including polyimide matrices reinforced with diamond nanoparticles or SiC whiskers, are being investigated as a solution to this problem. These materials greatly increase thermal conductivity, reduce CTE from about 55 ppm/°C to about 16–17 ppm/°C, and enhance dependability under thermal stress.

3. Sustainability & Environmentally Friendly Materials

Stricter environmental restrictions and rising customer demand for greener devices are driving the RDL material market's adoption of eco-friendly solutions. Manufacturers are giving priority to materials free of lead and halogen in order to adhere to regulations such as RoHS and REACH. These materials improve safety and recyclability while also having less environmental impact. The industry's move towards the concepts of the circular economy is also being reflected in the growing popularity of advances in recyclable and biodegradable polymers. A larger dedication to sustainable practices is shown in this trend, which aims to reduce environmental impact while upholding high standards for electronic device performance.

4. ML in Design & Process Optimization

Redistribution layer material design and optimisation are being transformed by machine learning, which makes data-driven strategies that improve performance and dependability possible. The creation of RDL materials with customised attributes is made easier by ML algorithms, which examine enormous datasets to find intricate connections between material features, processing parameters, and performance results. For example, machine learning models can forecast how various dielectric materials would affect mechanical strength and thermal conductivity, assisting in the selection of the best materials for a certain application. Furthermore, by forecasting how RDL materials would behave in different scenarios, ML-driven simulations can speed up the design process and eliminate the need for intensive physical testing.

5. Ultra-Thin RDLs & Flexibility

Advanced packaging is changing as a result of the move towards ultra-thin redistribution layers, which make electrical devices more flexible and smaller. High-density connections and effective heat dissipation are made possible by these incredibly thin RDLs, which are frequently less than 10 micrometres thick. These features are essential for applications such as flexible sensors, wearable technology, and foldable screens. Materials with superior mechanical and thermal stability, such as polyimide and polybenzoxazole, are frequently utilized. The use of ultra-thin RDLs enables the creation of flexible electronics that preserve functionality while providing the adaptability to take on different shapes, increasing the potential uses of electronic devices across a range of industries.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the redistribution layer material market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the Redistribution Layer Material Market

- Mitsui Mining and Smelting Co., Ltd.

- Asahi Kasei Corporation

- Daikin Industries, Ltd.

- Dowa Electronics Materials Co., Ltd.

- Tanaka Holdings Co., Ltd.

- Cookson Electronics

- SEMES

- Japan Superior Co., Ltd.

- Ishihara Sangyo Kaisha, Ltd.

- Heraeus Holding GmbH

- GORE (W.L.) Associates, Inc.

- Mitsubishi Materials Corporation

- Shinko Electric Industries Co., Ltd.

- C. Starck

- Johnson Matthey Plc Source

- Others

1. Mitsui Mining and Smelting Co., Ltd.

A diverse Japanese materials company, Mitsui Mining & Smelting Co., Ltd., is involved in non-ferrous metals, mobility components, engineered materials, and related fields. Its product line includes rare metals such as tantalum and niobium oxides, copper foils, catalysts, ultra-fine metal powders, battery materials, ceramics for electronics, and automotive components. Zinc, lead, tin, and precious metals are among the nonferrous metals that are smelted and recycled in the metals section. Its activities also include resource and energy-related consultancy, environmental protection engineering, and mineral exploration.

2. Asahi Kasei Corporation

Headquarters: Tokyo, Japan

The three main business sectors of Asahi Kasei, a significant Japanese diversified materials and technology conglomerate, are materials, homes, and health care. Basic chemicals such as acrylonitrile, styrene, polyethylene, caustic soda, etc., performance polymers for electronics and automotive applications, functional additives, films and electronic materials, battery separators, and specialty solutions are all produced under its Materials business. To encourage comfortable, healthy living, the Homes segment provides houses, building supplies such as insulation and autoclaved aerated concrete, and associated services. Asahi Kasei works in the healthcare industry in the areas of biotherapeutics, medical equipment, pharmaceuticals, and diagnostics.

3. Daikin Industries, Ltd.

Headquarters: Osaka, Japan

HVAC&R heating, ventilation, air conditioning, and refrigeration systems are at the heart of the varied product line of Daikin, a significant Japanese international business. The company manufactures defence systems, electronics, oil hydraulics, fluorochemical goods such as refrigerants, resins, and elastomers, and related chemical solutions in addition to climate-control equipment. Their operations are spread across several countries, and the company is renowned for developing and selling its core technology in-house in addition to producing it.

4. Dowa Electronics Materials Co., Ltd.

Headquarters: Tokyo, Japan

Advanced fine materials, electronics materials, and semiconductors are the three main business areas of DOWA Electronics Materials, which specializes in high-value electronics materials. The semiconductor industry deals with compound semiconductor wafers, high-purity metals like gallium and indium, and LEDs, which include deep ultraviolet and infrared devices. The conductive materials produced by the electronics materials side include copper powder, silver oxide powder, and silver powder. Advanced fine materials include complex oxides, reduced iron powders, magnetic materials, ferrite powders, carrier powders, and materials that are helpful for fuel cell and recording technologies.

5. Tanaka Holdings Co., Ltd.

Headquarters: Tokyo, Japan

Tanaka Precious Metals, a corporation that specialises in precious metals and industrial precious metal products, is held by Tanaka Holdings. Manufacturing, selling, importing, exporting, refining, and recycling precious metals, including gold, silver, platinum, and others, are among its main operations. Additionally, it manufactures materials for automotive, semiconductor, and electronics applications. Its product lines include fuel cell catalysts and bonding wire. Tanaka is renowned for its worldwide activities and group firms' cooperation in creating technological solutions that use precious metals.

Are you ready to discover more about the redistribution layer material market?

The report provides an in-depth analysis of the leading companies operating in the global redistribution layer material market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Mitsui Mining and Smelting Co., Ltd.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Asahi Kasei Corporation

- DAIKIN INDUSTRIES, LTD.

- Dowa Electronics Materials Co., Ltd.

- Tanaka Holdings Co., Ltd.

- Cookson Electronics

- SEMES

- Japan Superior Co., Ltd.

- Ishihara Sangyo Kaisha, Ltd.

- Heraeus Holding GmbH

- GORE (W.L.) Associates, Inc.

- Mitsubishi Materials Corporation

- Shinko Electric Industries Co., Ltd.

- C. Starck

- Johnson Matthey Plc Source

- Others

Conclusion

The Redistribution Layer Material Market Size is accelerating due to the growing need for semiconductor miniaturisation, improved packaging, particularly 2.5D/3D IC and fan-out wafer-level packaging, and usage in the hardware industries of AI, telecom, and manufacturing. Asia-Pacific is the largest market, whereas North America and Europe are growing due to innovation and regulatory pressures.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?