World’s Top 10 Companies in Aviation Asset Management Market 2025 Watchlist: Statistical Report (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

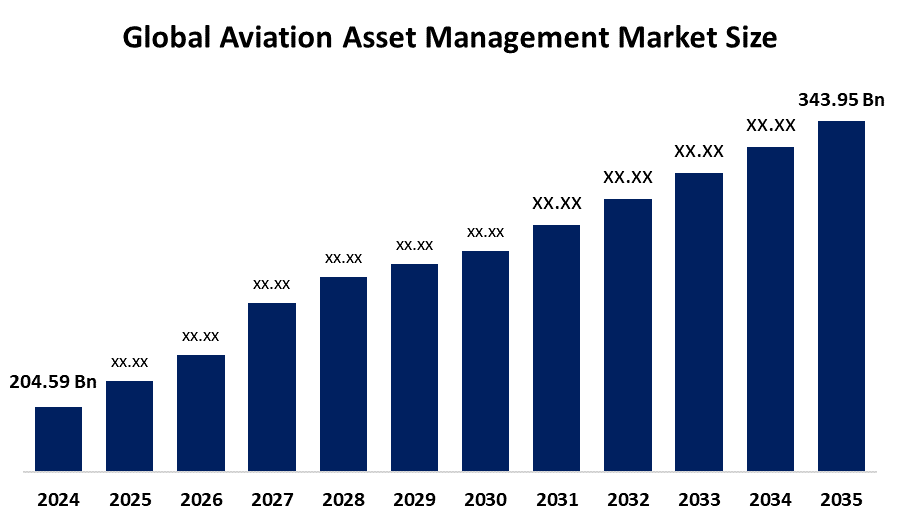

According to a research report published by Spherical Insights & Consulting, The Global Aviation Asset Management Market Size is projected to Grow from USD 204.59 Billion in 2024 to USD 343.95 Billion by 2035, at a CAGR of 4.84% during the forecast period 2025–2035. The advancement of technology and the need for efficient asset management solutions will propel market expansion while opening exciting opportunities for companies in this sector. The demand for air travel is on the rise due to the growing middle class, economic expansion, and the growing global population. The management of aviation assets has been transformed by the incorporation of cutting-edge technology such as artificial intelligence (AI), big data analytics, and the Internet of Things (IoT). These technologies facilitate data-driven decision-making, predictive maintenance, and real-time aircraft performance monitoring.

Introduction

A quickly expanding industry, the global aviation asset management market is centered on maximizing the value, upkeep, and use of aviation assets. It includes a broad range of services and solutions, such as fleet management, remarketing, leasing of aircraft, and technical advice services. Aviation asset management ensures optimal fleet utilization, lowers operating costs, and boosts overall efficiency, all of which assist airlines and aircraft lessors in optimizing their returns on investment. Making well-informed judgments on fleet composition, maintenance plans, and fleet expansion or contraction requires technical know-how, data analytics, and strategic planning. There is fierce competition in the sector, with many businesses providing a variety of services to airlines, aircraft lessors, and other aviation enthusiasts. There are also a lot of prospects for expansion in the developing aviation sector. The need for effective asset management solutions is growing in these regions as a result of airport growth, the emergence of low-cost carriers, and the relaxation of air transport regulations.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Aviation Asset Management Market.

Aviation Asset Management Market Size & Statistics

- The Market Size for Aviation Asset Management Was Estimated to be worth USD 204.59 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 4.84% between 2025 and 2035.

- The Global Aviation Asset Management Market Size is anticipated to reach USD 343.95 Billion by 2035.

- Asia Pacific is expected to generate the highest demand during the forecast period in the aviation asset management market.

- North America is expected to grow the fastest during the forecast period in the aviation asset management market.

Regional growth and demand

North America is anticipated to grow at the fastest CAGR during the forecast period in the global aviation asset management market.

The area hosts prominent aircraft leasing companies, major lessors, and MRO service providers. Established aviation centers, like those in the United States and Canada, aid in the market's expansion. North America boasts numerous airlines and a robust aviation sector, fueling the need for asset management services. The area's strong regulatory environment, technological progress, and availability of funding position it as an important market for managing aviation assets.

Asia Pacific is expected to grow at the highest share over the forecast period in the global aviation asset management market.

The growing middle class in the region, coupled with economic development and heightened air travel demand, is fueling the necessity for effective asset management solutions, China, India, and Southeast Asian nations are experiencing substantial expansion in their aviation industries, resulting in heightened demand for leasing services, MRO operations, and asset management knowledge, The emergence of budget airlines and the growth of airports play a role in the markets expansion in this area.

Top 10 trends in the Aviation Asset Management Market

- Transformation and Predictive Analytics

- Prevalence of Aircraft Leasing

- Sustainability and ESG Guidelines

- Incorporation of Technology within the Supply Chain

- Heightened Emphasis on Component and Engine Oversight

- Regulatory Complications and Adherence

- Market Integration and Strategic Alliances

- Expansion of Cargo and Regional Markets

- Administration of Non-Traditional Assets

- Economic Instability and Risk Mitigation

1. Transformation and Predictive Analytics

Transitioning from reactive to proactive maintenance through the use of data, AI, and digital twins for predicting failures and enhancing scheduling.

2. Prevalence of Aircraft Leasing

The increasing preference for operating leases and sale-leaseback deals, shifting the market towards lessors and away from direct ownership by airlines.

3. Sustainability and ESG Guidelines

The development of sustainable end-of-life solutions, the use of green financing, and the purchase of new fuel-efficient aircraft.

4. Regulatory Complications and Adherence

Automated and streamlined adherence to airworthiness regulations and other legal obligations through the use of digital instruments

5. Expansion of Cargo and Regional Markets

A movement for cross-industry collaborations, mergers, and acquisitions to provide more extensive services

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Aviation Asset Management market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 10 Companies Leading the Aviation Asset Management Market

- GA Telesis, LLC

- BBAM Aircraft Leasing & Management

- Aviation Asset Management Inc

- Airbus Group

- Charles Taylor Aviation (Asset Management) Ltd.

- Skyworks Capital, LLC.

- AerCap Holdings N.V

- AerData

- Acumen

- GE Capital Aviation Services

- Others

1. GA Telesis, LLC

Headquarters: Fort Lauderdale, Florida, USA

GATX Corporation, a well-known lessor of transportation assets, is present in the aviation asset management market, which is very targeted and specialized. They specialize in the extremely lucrative and vital market of leasing aircraft spare engines rather than leasing entire aircraft. A significant strategic change led to GATX's current aviation asset management approach. In the past, GATX managed a portfolio of more than 200 aircraft as a full-service aircraft lessor. The company decided to strategically leave the broad aircraft leasing business in the middle of the 2000s, claiming that it lacked the scale and cost of capital necessary to effectively compete with industry leaders such as International Lease Finance Corporation (ILFC) and GE Capital Aviation Services (GECAS).

2. Charles Taylor Aviation (Asset Management) Ltd.

Headquarters: London, United Kingdom

Charles Taylor Aviation (Asset Management) Ltd is a major player in the aviation asset management market and plays a different role than an airline or an aircraft lessor. Their aviation asset management services are based on technical know-how, risk management, and claims processing, and they are a part of the broader Charles Taylor group, a global provider of professional services and technological solutions to the insurance market. For asset management, they offer a variety of specialized services to airlines, lessors, financiers, and aircraft owners. They are crucial in making sure that aviation assets are effectively managed, stay in compliance with regulations, and are safeguarded from a technical and financial standpoint for the duration of their operational life.

3. Skyworks Capital, LLC.

Headquarters: Greenwich Avenue, United States

Leading asset management and aviation advice company SkyWorks Capital, LLC, offers a wide range of services to lessors, financial investors, and commercial airlines. The core of SkyWorks' business strategy is offering clients professional guidance and a comprehensive platform to assist them in managing their aviation assets and transactions, in contrast to a traditional lessor that deals mainly in aircraft ownership and leasing. SkyWorks' 360° perspective as an asset management and advising organization is the foundation of its unique market position. They can offer impartial counsel and serve as a middleman for a variety of clients because they are not a capital-intensive aircraft lessor. Their staff has experience with every stage of the aviation lifecycle, from ordering new aircraft to providing solutions.

4. Acumen

Headquarters: Dublin, Ireland

Acumen is an international asset management firm for the aviation industry. Instead of being an aircraft owner or lessor, it is a consultant and service provider. Acumen provides banks, airlines, lessors, and investors with a full range of in-house services to manage aviation assets across their whole lifecycle. Acumen offers a wide range of technical services to safeguard an aircraft's worth. Pre-purchase inspections, mid-lease audits, aircraft seizure and redelivery, and records management are all included in this. Their specialty is making sure that lease changes go smoothly. SPARTA: AI and machine learning powered cloud-based, comprehensive asset management software. It is employed for inspections, asset tracking, and giving customers real-time fleet visibility. With important offices in China, India, and the United States, Acumen has a global presence.

5. AerCap Holdings N.V

Headquarters: AerCap House, Dublin, Ireland

AerCap Holdings N.V. is the biggest aviation asset manager globally. They have a huge fleet of commercial aircraft, engines, and helicopters that they own and lease to airlines and other operators around the world. They manage their assets to make money through asset sales and trading, as well as long-term leasing arrangements. With an emphasis on fuel-efficient, cutting-edge aircraft like the A320neo and Boeing 737 MAX, they purchase aircraft that are currently in production. In order to obtain savings, they frequently make bulk purchases.

Are you ready to discover more about the aviation asset management market?

The report provides an in-depth analysis of the leading companies operating in the global aviation asset management market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- GA Telesis, LLC

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- BBAM Aircraft Leasing & Management

- Aviation Asset Management Inc

- Airbus Group

- Charles Taylor Aviation (Asset Management) Ltd.

- Skyworks Capital, LLC.

- AerCap Holdings N.V

- AerData

- Acumen

- GE Capital Aviation Services

- Others

Conclusion

By 2035, the worldwide aviation asset management market is expected to have grown from approximately USD 204.59 to USD 208 billion in 2024 to approximately USD 336 to USD 352 billion. This corresponds to a compound annual growth rate (CAGR) of roughly 4.8% to 5.4% throughout the predicted period of 2025-2035. Key factors driving the market include the growing middle class and economic growth, which are driving up demand for air travel technology advancements like artificial intelligence (AI), big data analytics, and the Internet of Things (IoT) for asset optimization and predictive maintenance, and an increase in aircraft leasing and sale-leaseback transactions. With its rapidly expanding fleet, the Asia Pacific region is clearly the largest demand generator, but North America's well-established aviation sector and regulatory framework are predicted to drive the quickest regional market development.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?