Global Aviation Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Type (Direct Purchase, Operating Lease, Finance Lease, Sale Lease Back), By Service Type (Leasing Services, Technical Services, Regulatory Certifications), By End Use (Commercial Platforms, MRO Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Aerospace & DefenseGlobal Aviation Asset Management Market Insights Forecasts to 2032

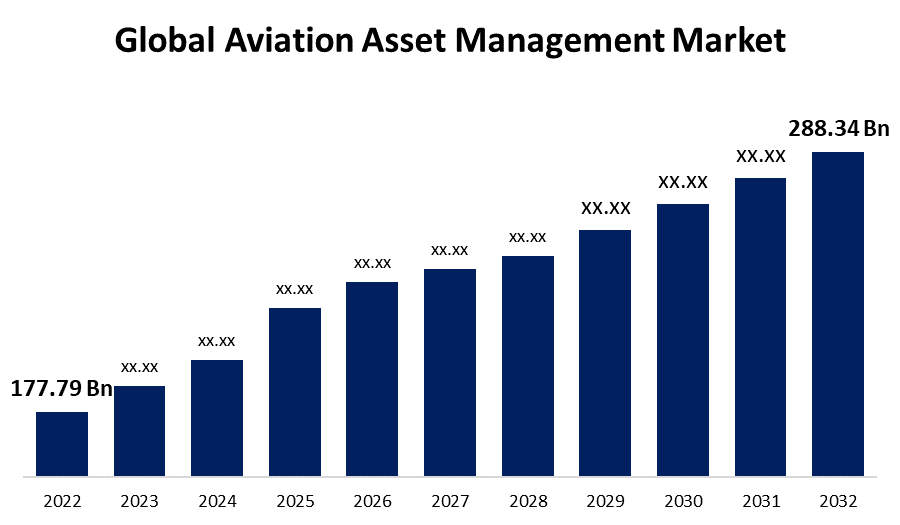

- The Global Aviation Asset Management Market Size was valued at USD 177.79 Billion in 2022.

- The Market Size is Growing at a CAGR of 4.9% from 2022 to 2032

- The Worldwide Aviation Asset Management Market Size is expected to reach USD 288.34 Billion by 2032

- North America is expected To Growth the fastest during the forecast period

Get more details on this report -

The Global Aviation Asset Management Market Size is anticipated to exceed USD 288.34 Billion by 2032, Growing at a CAGR of 4.9% from 2022 to 2032. The Global Aviation Asset Management Market is expected to experience significant growth in the coming years as the aviation industry continues to evolve and expand. The demand for efficient asset management solutions, coupled with technological advancements, will drive market growth and open up new opportunities for companies operating in this space.

Market Overview

The Global Aviation Asset Management Market is a rapidly growing sector that focuses on optimizing the utilization, maintenance, and value of aviation assets. It encompasses a wide range of services and solutions, including aircraft leasing, fleet management, remarketing, and technical advisory services. One of the primary drivers of the market is the increasing demand for air travel, driven by factors such as economic growth, rising middle-class population, and increasing tourism. This has led to a surge in the number of aircraft being operated by airlines, creating a need for efficient asset management solutions. Aviation asset management helps airlines and aircraft lessors maximize their returns on investment by ensuring optimal utilization of their fleets, reducing operational costs, and improving overall efficiency. It involves strategic planning, data analytics, and technical expertise to make informed decisions regarding fleet composition, maintenance schedules, and fleet expansion or contraction. The market is highly competitive, with numerous companies offering a range of services to airlines, aircraft lessors, and other aviation stakeholders. Key players in the industry include aircraft leasing companies, aviation consultants, and specialized asset management firms. Additionally, the market is global, with significant growth opportunities in emerging economies, where the aviation industry is expanding rapidly.

Report Coverage

This research report categorizes the market for the global aviation asset management market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the aviation asset management market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the aviation asset management market.

Global Aviation Asset Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022 : | USD 177.79 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.9% |

| 2032 Value Projection: | USD 288.34 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Service Type, By End Use, By Region. |

| Companies covered:: | GA Telesis, LLC, BBAM Aircraft Leasing & Management, Aviation Asset Management Inc, Airbus Group, Charles Taylor Aviation (Asset Management) Ltd., Skyworks Capital, LLC., AerCap Holdings N.V, AerData, Acumen, GE Capital Aviation Services, Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising global population, economic growth, and expanding middle-class population have led to a surge in air travel demand. This has resulted in airlines expanding their fleets to cater to the growing passenger numbers. As a result, there is a greater need for efficient asset management solutions to optimize the utilization, maintenance, and value of these aircraft. The integration of advanced technologies like the Internet of Things (IoT), artificial intelligence (AI), and big data analytics has revolutionized aviation asset management. These technologies enable real-time monitoring of aircraft performance, predictive maintenance, and data-driven decision-making. By harnessing the power of these innovations, aviation stakeholders can optimize their asset utilization, reduce downtime, and improve operational efficiency. The growth of the aviation industry in emerging economies presents significant opportunities for aviation asset management. As these markets continue to develop, there is a growing demand for aircraft leasing, fleet management, and technical advisory services. The expansion of airports, the rise of low-cost carriers, and the liberalization of air transport policies in these regions contribute to the increasing need for efficient asset management solutions.

Restraining Factors

Implementing effective aviation asset management solutions requires substantial upfront investments. The cost of acquiring and implementing advanced technologies, such as IoT sensors, data analytics systems, and AI platforms, can be significant. For smaller airlines or lessors with limited financial resources, this initial investment may act as a barrier to entry or hinder their ability to adopt comprehensive asset management practices. The aviation industry is subject to stringent regulations and compliance requirements. Adhering to these regulations and staying up to date with evolving safety and maintenance standards can be challenging. Asset managers need to ensure that their processes and procedures align with regulatory frameworks, which may vary across different jurisdictions. Navigating this complex regulatory landscape can be time-consuming and resource-intensive.

Market Segmentation

The Global Aviation Asset Management Market share is classified into type, service type, and end use.

- The operating lease segment is expected to grow at the fastest CAGR in the global aviation asset management market during the forecast period.

The global aviation asset management market is categorized by type into direct purchase, operating lease, finance lease, and sale lease back. Among these, the operating lease segment is expected to grow at the fastest CAGR in the global aviation asset management market during the forecast period. The growth can be attributed due the operating leases offer flexibility, cost-efficiency, and risk mitigation for airlines and lessors, making them a popular choice in the aviation industry. The operating lease segment involves the short- to medium-term lease of aircraft from lessors. Airlines can lease aircraft for a specific period, typically ranging from a few months to several years, without assuming ownership.

- The leasing services segment is expected to hold the largest share of the global aviation asset management market during the forecast period.

Based on the service type, the global aviation asset management market is divided into leasing services, technical services, and regulatory certifications. Among these, the leasing services segment is expected to hold the largest share of the global aviation asset management market during the forecast period. This segment's dominance is driven by the advantages it offers in terms of cost efficiency, fleet flexibility, and risk mitigation. Aircraft leasing companies offer a range of leasing options, such as operating leases and finance leases, allowing airlines and other operators to acquire aircraft without the upfront cost of purchasing. Leasing services provide flexibility in fleet management, enabling airlines to adjust fleet size and composition based on market demand.

- The MRO services segment is expected to hold the largest share of the global aviation asset management market during the forecast period.

Based on the end use, the global aviation asset management market is divided into commercial platforms and MRO services. Among these, the MRO (Maintenance, Repair, and Overhaul) services segment is expected to hold the largest share of the global aviation asset management market during the forecast period. The reason behind the growth is, maintenance is an essential aspect of aviation asset management, and the maintenance needs of a vast fleet of aircraft worldwide drive the demand for MRO services. MRO providers offer a wide range of services to maintain and repair aircraft, engines, components, and systems. These services include scheduled maintenance, unscheduled repairs, modifications, inspections, and component overhauls. MRO services ensure the airworthiness, safety, and operational reliability of aviation assets.

Regional Segment Analysis of the Global Aviation Asset Management Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the global aviation asset management market over the predicted timeframe.

Get more details on this report -

Asia Pacific is expected to hold the largest share of the global aviation asset management market during the forecast period. The region's expanding middle-class population, economic growth, and increasing air travel demand are driving the need for efficient asset management solutions. China, India, and Southeast Asian countries are witnessing significant growth in their aviation sectors, leading to increased demand for leasing services, MRO activities, and asset management expertise. The presence of emerging low-cost carriers and the expansion of airports contribute to the market's growth in this region.

North America is projected to grow at the fastest pace in the global aviation asset management market over the predicted years. The region is home to major aircraft lessors, leasing companies, and MRO service providers. The presence of established aviation hubs, such as the United States and Canada, contributes to the growth of the market. North America has a significant number of airlines and a well-developed aviation industry, driving the demand for asset management services. The region's robust regulatory framework, technological advancements, and access to capital make it a key market for aviation asset management.

The Middle East and Africa region have emerged as important players in the aviation industry, with prominent airlines and leasing companies based in the region. The Middle East, in particular, is known for its major airlines and aircraft lessors. The region's strategic location as a hub for global air traffic, along with its substantial investments in aviation infrastructure, drive the demand for asset management services. Africa is also witnessing growth in its aviation sector, presenting opportunities for asset management providers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global aviation asset management along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GA Telesis, LLC

- BBAM Aircraft Leasing & Management

- Aviation Asset Management Inc

- Airbus Group

- Charles Taylor Aviation (Asset Management) Ltd.

- Skyworks Capital, LLC.

- AerCap Holdings N.V

- AerData

- Acumen

- GE Capital Aviation Services

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2022, AirAsia signed a partnership agreement with Avolon, an aircraft leasing company based in Ireland, to lease a minimum of 100 VX4 eVTOL aircraft. This agreement is expected to assist the former in revolutionising air travel by providing passengers with advanced air mobility, allowing the airline to stay ahead of the competition.

- In February 2022, flydocs, a UK-based provider of asset management solutions, collaborated with SGI Aviation Services, a Netherlands-based provider of aviation asset management services, to develop a financial asset management software solution to serve a variety of aviation asset owners through flydocs' digitised asset management tools, maximising the value of assets through the use of technology and support.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Aviation Asset Management Market based on the below-mentioned segments:

Global Aviation Asset Management Market, By Type

- Direct Purchase

- Operating Lease

- Finance Lease

- Sale Lease Back

Global Aviation Asset Management Market, By Service Type

- Leasing Services

- Technical Services

- Regulatory Certifications

Global Aviation Asset Management Market, By End Use

- Commercial Platforms

- MRO Services

Global Aviation Asset Management Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?