Top 70 Companies in Oil And Gas Exploration And Production Market Worldwide in 2025: Market Research Report (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

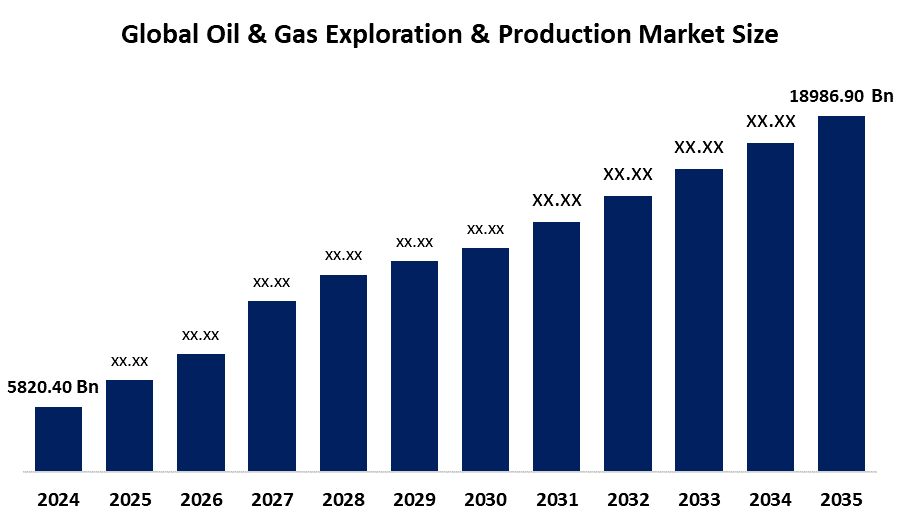

According to a research report published by Spherical Insights & Consulting, The Global Oil & Gas Exploration & Production Market Size is projected to Grow from USD 5820.40 Billion in 2024 to USD 18986.90 Billion by 2035, at a CAGR of 11.35% during the forecast period 2025–2035. Offshore development, unconventional resource extraction, digitisation, energy security enhancement, new drilling technology, and strategic investments in unexplored and developing areas are all potential prospects in the oil and gas exploration and production sector.

Introduction

The oil & gas exploration & production (E&P) market refers to the sector of the energy industry focused on discovering, extracting, and initially processing crude oil and natural gas. It includes seismic surveys, drilling exploration and production wells, and developing oil and gas fields. The market for oil and gas exploration and production (E&P) is expanding significantly as a result of the pressing need to meet the world's growing energy demands while moving towards greener alternatives. A key component is liquefied natural gas (LNG), which lowers greenhouse gas emissions by replacing traditional fossil fuels with less carbon-intensive fuels. Investments are being driven by the expansion of LNG infrastructure, which includes terminals, storage facilities, and transportation networks. While major producers like the United States, Qatar, and Australia are increasing capacity, Asia and Europe are making significant investments in import facilities to improve energy security. This expansion lessens dependency on coal and oil while promoting international trade, economic opportunities, and a more dependable energy source. Crude oil continues to be essential, being converted into fuels and lubricants, while natural gas, mostly methane, is being utilised more and more as CNG or LNG for a variety of purposes. Together, oil and gas continue to be vital to businesses and world economies, even as emission tracking and sustainability programs help to influence this strategically important industry's future.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Oil & Gas Exploration & Production Market.

Oil & Gas Exploration & Production Market Size & Statistics

- The Market Size for Oil & Gas Exploration & Production Was Estimated to be worth USD 5820.40 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 11.35% between 2025 and 2035.

- The Global Oil & Gas Exploration & Production Market Size is anticipated to reach USD 18986.90 Billion by 2035.

- Asia Pacific is expected to generate the highest demand during the forecast period in the Oil & Gas Exploration & Production Market

- North America is expected to grow the fastest during the forecast period in the Oil & Gas Exploration & Production Market.

Regional growth and demand

North America is expected to grow the fastest during the forecast period in the oil & gas exploration & production market. North America's expansion is mostly driven by technological advancements in shale oil and gas production, increased exploration of unconventional resources, and ongoing infrastructure improvements. The United States and Canada, in particular, contribute significantly because of their enormous shale resources and supportive regulatory environments that encourage production expansion. The oil and gas industry in the Middle East is being driven by the United States' geopolitical importance and favourable geographic location.

Asia Pacific is expected to generate the highest demand during the forecast period in the oil & gas exploration & production market. The Asia Pacific area is primarily driven by rising energy demand, ongoing exploration costs, and significant reserves in countries like China, India, Indonesia, and Australia. The region's focus on expanding offshore and unconventional oil and gas activities has further contributed to its dominant market position. China's significance in the oil and gas production sector is greatly influenced by its vast population and expanding economy, which creates an unceasing demand for energy resources.

Top 10 trends in the Oil & Gas Exploration & Production Market

- Expansion of Liquefied Natural Gas (LNG) infrastructure

- Digitalization and adoption of advanced technologies (AI, IoT, big data)

- Focus on carbon capture, utilization, and storage (CCUS)

- Shift toward cleaner fuels and energy transition strategies

- Increased deepwater and ultra-deepwater exploration projects

- Growing investment in shale oil and gas production

- Enhanced oil recovery (EOR) techniques development

- Expansion of global energy trade and cross-border pipelines

- Integration of renewable energy in oil & gas operations

- Rising emphasis on ESG (Environmental, Social, and Governance) compliance

1. Expansion of Liquefied Natural Gas (LNG) infrastructure

Global LNG demand is growing as nations seek cleaner energy. Investments in terminals, pipelines, and storage expand trade routes, strengthen energy security, and reduce reliance on coal and oil, positioning LNG as a vital transitional fuel in the global energy mix.

2. Digitalization and adoption of advanced technologies (AI, IoT, big data)

For real-time monitoring, reservoir mapping, and predictive maintenance, the sector makes use of AI, IoT, and data analytics. By lowering expenses, increasing productivity, and enhancing safety, these technologies help oil and gas firms maximise output and exploration while lowering risks and downtime.

3. Focus on carbon capture, utilization, and storage (CCUS)

CCUS technologies are gaining traction to mitigate emissions from hydrocarbon extraction. By capturing and reusing or storing CO2, companies align with climate goals, enhance sustainability, and maintain oil and gas’s role in a decarbonizing global energy landscape.

4. Shift toward cleaner fuels and energy transition strategies

Natural gas, biofuels, and hydrogen are being used by energy corporations to diversify their portfolios. In order to achieve global decarbonisation goals, meet growing energy demand, and satisfy investor pressure for environmentally conscious corporate practices, this transition strikes a balance between traditional fossil fuel reliance and renewable integration.

5. Increased deepwater and ultra-deepwater exploration projects

Investments offshore, especially in deepwater and ultra-deepwater projects, are driven by depleting onshore reserves. Despite increased operational risks and capital requirements, advances in subsea engineering and drilling technology make it possible to tap complex reservoirs, increasing the potential for global production and drawing long-term investment.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the oil & gas exploration & production market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 10 Companies Leading the Oil & Gas Exploration & Production Market

- Shell Plc

- TotalEnergies

- Vedanta Limited

- Oilex Group Lp

- Saudi Arabian Oil Co

- Reliance Industries Limited

- Exxon Mobil Corporation

- Indian Oil Corporation Limited

- Equinor

- Eni

- Others

1. Shell Plc

Headquarters: London, England, UK

Shell plc, originally established in 1907 through the merger of Royal Dutch Petroleum and the "Shell" Transport and Trading Company, is one of the world’s largest energy companies. Headquartered in London, it operates across more than 70 countries, focusing on oil, natural gas, petrochemicals, and renewable energy. Shell plays a central role in the global energy supply chain, with operations spanning exploration, production, refining, and marketing. Listed on the London Stock Exchange and a constituent of the FTSE 100 Index.

2. TotalEnergies

Headquarters: Paris, France

A prominent worldwide integrated energy corporation, TotalEnergies SE, was established in 1924 as Compagnie Française des Pétroles. Its operations span over 130 countries and include oil, natural gas, power, and renewable energy. Its headquarters are located in Paris. With significant investments in solar, wind, hydrogen, and biofuels in addition to its conventional oil and gas activities, the firm is dedicated to making the shift to sustainable energy. Over 100,000 people are employed globally by TotalEnergies, which is listed on Euronext Paris and a part of the CAC 40 Index. Because of its strategy focus on cleaner, more economical, and reliable energy solutions.

3. Vedanta Limited

Headquarters: Mumbai, India

Vedanta Limited, founded in 1965, is a leading diversified natural resources company engaged in oil and gas, zinc, lead, silver, copper, iron ore, steel, aluminium, and power. Headquartered in Mumbai, it operates extensively across India and globally, with significant assets in Africa. A subsidiary of Vedanta Resources Limited, the company is listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). With over 65,000 employees and contractors, Vedanta emphasizes sustainability, innovation, and community development.

4. Oilex Group Lp

Headquarters: Perth, Australia

The independent oil and gas exploration and production firm Oilex Group LP was founded in 2003 to develop hydrocarbon assets in Australia and India. With its main office in Perth, the firm mainly works in India's Cambay Basin and has important exploration licenses in Western Australia. By using sustainable methods, cost-effective operations, and cutting-edge drilling technologies, Oilex seeks to optimise resource recovery. With a focus on innovation and environmental responsibility, the company, which is listed on the Australian Securities Exchange (ASX) and the London Stock Exchange's AIM market, is essential to regional energy security.

5. Saudi Arabian Oil Co

Headquarters: Dhahran, Saudi Arabia

Saudi Arabian Oil Co. (Saudi Aramco), founded in 1933, is the world’s largest integrated oil and gas company, specializing in exploration, production, refining, and distribution. Headquartered in Dhahran, Aramco manages vast crude oil and natural gas reserves, making it a global energy leader. The company operates one of the world’s most extensive refining and petrochemical networks, supplying energy to over 80 countries. Listed on the Saudi Stock Exchange (Tadawul), Aramco emphasizes technological innovation, energy efficiency, and sustainability. With over 70,000 employees, it continues to drive Saudi Arabia’s economic diversification while maintaining a leading role in global energy markets.

Are you ready to discover more about the Oil & Gas Exploration & Production market?

The report provides an in-depth analysis of the leading companies operating in the global oil & gas exploration & production market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes

Company Profiles

- Shell Plc

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- TotalEnergies

- Vedanta Limited

- Oilex Group Lp

- Saudi Arabian Oil Co

- Reliance Industries Limited

- Exxon Mobil Corporation

- Indian Oil Corporation Limited

- Equinor

- Eni

- Others

Conclusion

Technology developments, energy transition programs, and growing global energy consumption are expected to propel the oil and gas exploration and production (E&P) market's steady expansion. Deepwater exploration, improved recovery methods, and expanded LNG infrastructure all increase production efficiency and resource use. Safety, predictive maintenance, and operational monitoring are all improved by the combination of digital technologies, AI, and IoT. Sustainability goals are supported concurrently by investments in greener fuels, carbon management, and ESG compliance. Despite obstacles including high capital costs and market volatility, the E&P sector is guaranteed to remain a vital part of the energy supply chain thanks to rising global energy consumption, significant investments in infrastructure, and international trade.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?