Top 50 Small Satellite Companies in Global 2025: Statistics View by Spherical Insights & Consulting.

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

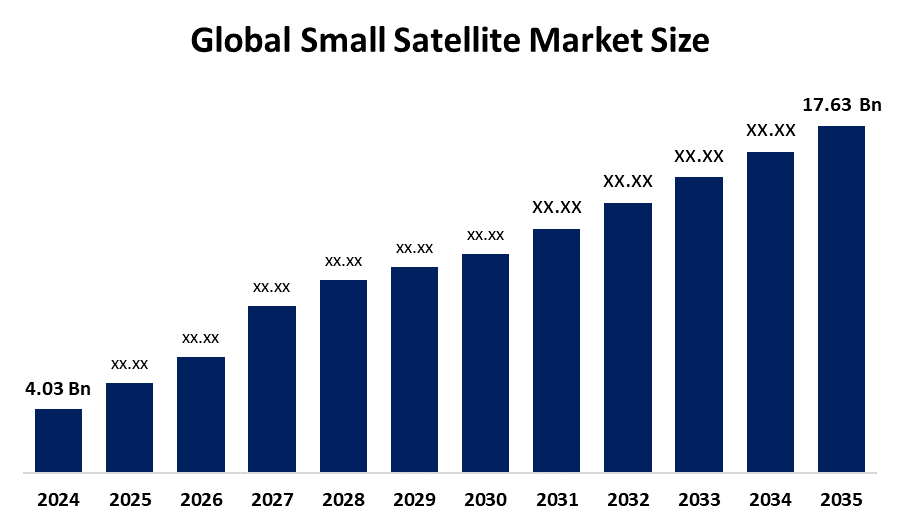

According to a research report published by Spherical Insights & Consulting, The Global Small Satellite Market Size is projected to Grow from USD 4.03 Billion in 2024 to USD 17.63 Billion by 2035, at a CAGR of 15.9 % during the forecast period 2025–2035. The small satellite market offers future opportunities in earth observation, global broadband connectivity, space research, defense surveillance, and IoT integration, driven by cost-effective launches, miniaturized technology, and increasing commercial space missions.

Introduction

The small satellite market refers to the industry segment focused on the development, production, and deployment of miniaturized satellites typically weighing less than 500 kilograms, including microsatellites, nanosatellites, and CubeSats. These satellites are used for applications such as Earth observation, communication, scientific research, and defense. Key driving factors include reduced launch costs, advancements in satellite miniaturization, increasing demand for real-time data, the growth of private space enterprises, and the rise in low Earth orbit (LEO) satellite constellations for broadband and IoT services. Additionally, supportive government policies and funding for space research further accelerate market expansion.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights-Download the Brochure now and dive deeper into the future of the small satellite market.

Small Satellite Market Size & Statistics

The market Size for small satellite was estimated to be worth USD 4.03 Billion in 2024.

The market Size is going to expand at a CAGR of 15.9 % between 2025 and 2035.

The Global Small Satellite Market Size is anticipated to reach USD 17.63 Billion by 2035.

North America is expected to generate the highest demand during the forecast period in the small satellite Market.

Asia Pacific is expected to grow the fastest during the forecast period in the small satellite Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the small satellite market. The small satellite market is expected to see Asia Pacific as the second fastest-growing region during the forecast period. Nations like India, China, Japan, Australia, and others are investing significantly in small satellite initiatives because of the various applications provided by small satellites, including military reconnaissance, asset tracking, weather forecasting, disaster observation, and more.

North America is expected to generate the highest demand during the forecast period in the small satellite market. North America leads the market with the biggest market share throughout the forecast period, thanks to significant growth in the communication and telecom industries. In distant regions, satellite communication technology offers data, voice, and video services. It helps in tracking and overseeing vehicles and boats to deliver efficient logistics support. Consequently, the demand for small satellites in the North American communication and telecom sector is driving the small satellite market ahead.

Top Key Drivers & Small Satellite Trends

- Growing Demand for Earth Observation and Remote Sensing

One of the major drivers of the small satellite market is the increasing demand for real-time Earth observation and remote sensing services across various industries. Sectors such as agriculture, disaster management, climate monitoring, defense, and urban planning rely heavily on satellite imagery and data. Small satellites offer cost-effective, high-resolution monitoring capabilities with frequent revisit times, making them ideal for tracking environmental changes, natural disasters, and crop patterns. The continuous need for accurate and timely data, especially in developing regions, is encouraging the deployment of large constellations of small satellites for enhanced global coverage and faster data delivery.

- Technological Advancements and Cost Reduction in Satellite Launch and Design

Rapid technological innovation is significantly boosting the small satellite market. Miniaturization of components, improved propulsion systems, and increased payload capacities are making small satellites more powerful and multifunctional. Simultaneously, the rise of reusable launch vehicles and rideshare launch programs has reduced launch costs, enabling more frequent and affordable satellite deployments. Startups and academic institutions are also entering the space sector due to lower financial and technical barriers. These advancements are accelerating the shift from traditional large satellites to agile small satellite networks, enhancing flexibility, operational efficiency, and access to new commercial and scientific applications.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the small satellite market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 5 Emerging Small Satellite Startups

1. EnduroSat – CubeSats

The size and expense of artificial satellites are influenced by the intricacy and type of their payloads. The progress in miniaturizing payloads, along with lower assembly and launch costs, fosters the expansion of small satellites. Referred to as smallsats, these satellites possess a low mass, typically below 500 kilograms. CubeSats, a category of nanosatellite, are among the most widely used smallsat varieties today, thanks to their cost-effectiveness, modular design, and straightforward development process. Bulgarian company EnduroSat offers CubeSat construction modules and systems, emphasizing swarm satellite technology and inter-satellite communication. The startup provides CubeSat structures, communication systems, solar arrays, onboard processing antennas, and tailored power modules. This approach allows businesses across different sectors that use satellites to create improved options for current space technologies.

2. Kepler Communications – Satellite Constellation

Historically, geostationary communication satellites are substantial, frequently exceeding a weight of 1,000 kilograms. Smallsat constellations provide extensive spatial and temporal coverage of the planet. Fast product development periods and minimal expenses additionally entice startups to focus on groundbreaking communications technology. Kepler Communications, a Canadian startup, provides telecom services via its constellation of nanosatellites in low-earth orbit (LEO). The startup employs a tailor-made software-defined radio (SDR) to constantly improve satellite capabilities via software upgrades. This solution adjusts bandwidths, data rates, and center frequencies dynamically based on the network requirements. The startup is also creating everywhereIOT to offer worldwide connectivity for internet of things (IoT) applications using nanosatellite constellations.

3. Analytical Space – Satellite Relay Network

Groups of remote sensing satellites produce a large volume of data daily. At present, satellites compress and handle the data before sending it back to Earth, due to restrictions on data throughput. Startups create satellite relay network systems to remove limitations on data throughput and other data-related obstacles in space. The startup Analytical Space, based in the US, is creating FastPixel, a satellite relay network that utilizes nanosatellites. The startup employs CubeSat hybrid RF-laser data relays to enhance data transmission rates for satellites. FastPixel maintains backward compatibility and can also gather data from various radio frequencies, allowing clients to enhance their downlink capabilities. These relay networks are utilized in weather prediction, hyperspectral imaging, and asset monitoring.

4. Orbex – Micro-Launch Vehicle

Smallsats are deployed into orbit either as components of a payload in heavy-lift rockets or in dedicated small launch vehicles. Compared to heavy-lift launches, micro-launches offer increased flexibility regarding launch timings and frequencies. The rising demand for smallsats is driving startups to create sustainable small launch vehicles and affordable launch services. British company Orbex is creating a micro-launch vehicle that is recoverable and reusable, featuring exclusive zero-shock stage separation technology for affordable orbital launches. The small satellite launch vehicle features a 3D printed engine, a coaxial fuel tank, and primary structures made of carbon fiber or graphene composites, utilizing low-carbon bio-propane as its fuel source.

5. Aurora Propulsion Technologies – In-Space Propulsion System

In-space propulsion systems are utilized for minor orbital adjustments, controlling orbital maneuvers to extend satellite lifespan, ensuring precise pointing, and avoiding collisions. Smallsats need accurate propulsion systems for space that are lightweight and efficient in energy use. New space technology firms are addressing the in-space issues that hinder the industry's expansion. Finnish company Aurora Propulsion Technologies provides the Orbital Thruster, a resistojet propulsion module utilizing water for small satellites. The multi-thruster setup offers three-axis attitude management, adjustable tank dimensions, in addition to varying thruster power needs and magnetorquers. The water-based propellant enhances the safety of both the satellite launch and the journey to the launch location. The startup provides modules for deorbiting CubeSats utilizing their Plasma Brake, which employs the Coulomb force to create drag.

Top 9 Companies Leading the Small Satellite Market

- Airbus S.A.S

- Boeing Company

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Sierra Nevada Corporation

- ST Engineering

- Thales Group

- SPACEX

- L3Harris Technologies, Inc.

1. Airbus S.A.S

Headquarters: Leiden, Netherlands (operational HQ in Toulouse, France)

Airbus S.A.S is a global aerospace leader specializing in the design, manufacture, and delivery of commercial aircraft, helicopters, defense systems, and space solutions. Its space division, Airbus Defence and Space, is a major player in satellite development, particularly in Earth observation, telecommunications, and navigation. Airbus is actively involved in small satellite technology through programs like OneWeb and Eurostar Neo. The company leverages its extensive aerospace expertise and global infrastructure to innovate modular, high-performance satellite platforms. Focused on digitalization, sustainability, and space connectivity, Airbus plays a critical role in advancing small satellite capabilities for both commercial and government sectors.

2. Boeing Company

Headquarters: Arlington, Virginia, USA

Boeing is one of the world’s largest aerospace and defense companies, known for its commercial jetliners, military aircraft, and space systems. Through Boeing Defense, Space & Security, the company develops advanced satellite systems, including small satellites for communications, Earth observation, and scientific missions. Boeing is at the forefront of modular satellite design, investing in lightweight platforms and autonomous capabilities to meet evolving global needs. Its partnerships with NASA and government agencies support innovation in low-Earth orbit technologies. With a focus on scalability, digital engineering, and sustainability, Boeing continues to push boundaries in next-generation small satellite development and deployment.

3. Lockheed Martin Corporation

Headquarters: Bethesda, Maryland, USA

Lockheed Martin is a global defense, aerospace, and security company with a significant footprint in space exploration and satellite systems. Its Space Systems division specializes in the development of small satellites for military, civil, and commercial applications. Lockheed Martin’s LM 50 and LM 400 series represent its commitment to flexible, scalable small satellite platforms. These spacecraft support missions in Earth observation, weather monitoring, and global communications. Leveraging advanced manufacturing techniques and AI-driven technologies, the company is accelerating rapid deployment and customization of space assets. Lockheed Martin continues to lead the way in innovation for space resilience, autonomy, and national security applications.

4. Northrop Grumman Corporation

Headquarters: Falls Church, Virginia, USA

Northrop Grumman is a premier global aerospace and defense company that provides a wide array of space systems, including small satellite solutions. The company plays a critical role in the U.S. national space infrastructure, offering spacecraft for defense, commercial, and civil missions. Its small satellite platforms are used in communications, remote sensing, and scientific research, including NASA CubeSat missions. Through its Space Systems sector, Northrop Grumman integrates cutting-edge propulsion, AI, and payload adaptability to deliver fast, affordable, and high-performance small satellite systems. The company’s experience in scalable space solutions makes it a leader in low-Earth orbit and beyond.

5. Sierra Nevada Corporation (SNC)

Headquarters: Sparks, Nevada, USA

Sierra Nevada Corporation is a privately held aerospace and defense contractor known for its innovative spacecraft, aviation systems, and space technologies. SNC’s Space Systems Group is a leader in small satellite development, offering turnkey solutions for defense, commercial, and civil applications. It designs and delivers modular satellite buses like the SN-100 and supports satellite missions in communications, ISR (intelligence, surveillance, and reconnaissance), and deep space exploration. The company is also the developer of the Dream Chaser spaceplane. With a strong focus on rapid prototyping, affordability, and mission flexibility, SNC is helping reshape the small satellite landscape through agile engineering and advanced R&D.

Are you ready to discover more about the small satellite market?

The report provides an in-depth analysis of the leading companies operating in the global small satellite market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Airbus S.A.S.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Boeing Company

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Sierra Nevada Corporation

- ST Engineering

- Thales Group

- SPACEX

- L3Harris Technologies, Inc.

Conclusion

The small satellite market is poised to revolutionize global space operations through its versatility, affordability, and technological advancements. With growing adoption across industries such as defense, agriculture, telecommunications, and environmental monitoring, small satellites are redefining how data is gathered, processed, and utilized. The emergence of agile startups and expanding government-private partnerships continues to fuel innovation and accessibility. From CubeSats to sophisticated micro-launch systems, the industry is embracing a future shaped by miniaturization and sustainability. As demand surges for real-time connectivity and Earth observation, small satellites will remain a cornerstone in driving digital transformation and strategic growth in the space sector.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?