Global Small Satellite Market Size, Share, and COVID-19 Impact Analysis, By Type (Nano, Micro, Mini), By Mass (Small Satellite and CubeSat), By Application (Navigation, Communication, & Scientific Research, Earth Observation, & Others), By Component (Satellite Bus, Payload, Solar Panel, Satellite Antenna), By End-user (Commercial, Civil, Military, & Government), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Aerospace & DefenseGlobal Small Satellite Market Insights Forecasts to 2032

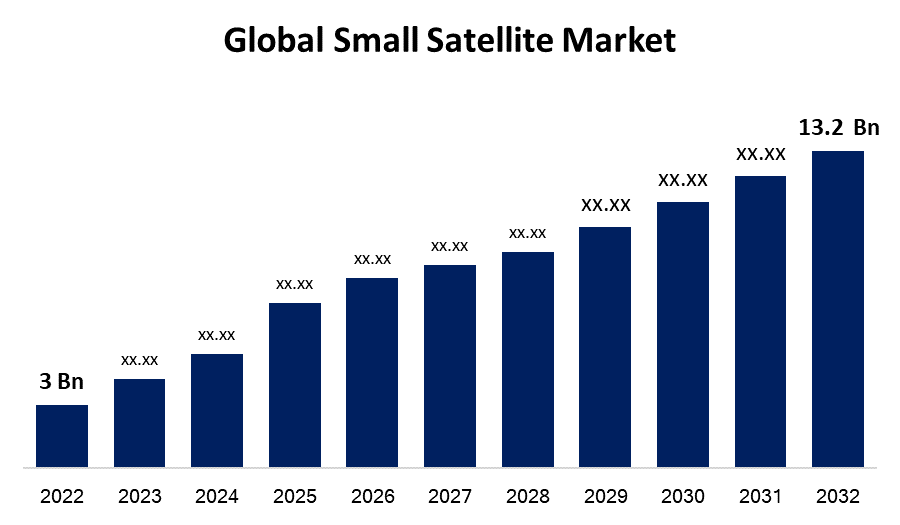

- The Global Small Satellite Market Size was valued at USD 3 Billion in 2022.

- The Market Size Is Growing at a CAGR of 15.9% from 2022 to 2032.

- The worldwide Small Satellite Market size is expected to reach USD 13.2 Billion by 2032.

- Asia Pacific Is Expected To Grow the fastest during the forecast period.

Get more details on this report -

The Global Small Satellite Market Size is expected to reach USD 13.2 Billion by 2032, at a CAGR of 15.9% during the forecast period 2022 to 2032.

Market Overview

Small satellites are low-cost alternatives that have allowed commercial firms, non-profit organizations, and educational institutions to perform low-Earth orbit missions. These small satellites make it possible to conduct a wide range of scientific experiments and technology demonstrations in orbit at a low cost, on time, and with relative ease. Smaller and lighter satellites necessitate smaller and cheaper launch vehicles, therefore numerous satellite launches are frequently conceivable. They can also be used to 'piggyback' on bigger launch vehicles, gaining access to extra launch vehicle capability. Small satellites offer lower-cost design and mass production. Technological advances in the small satellite industry have made designing, manufacturing, and operating small spacecraft easier and less expensive. Miniaturization advances, for example, have allowed for greater capability to be packed into smaller and lighter satellites. Furthermore, there is an increasing need for earth observation data and pictures for applications such as weather forecasting, agricultural monitoring, and environmental monitoring. Small satellites are ideal for these missions because they can provide frequent and comprehensive photos at a low cost. Small satellites are also used for communications services, such as providing internet access to remote locations throughout the world.

Report Coverage

This research report categorizes the global small satellite market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global small satellite market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global small satellite market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Small Satellite Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 15.9% |

| 2032 Value Projection: | USD 13.2 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application, By Component, By End-user, By End-user. |

| Companies covered:: | Airbus S.A.S, Boeing Company, Lockheed Martin Corporation, Northrop Grumman Corporation, Sierra Nevada Corporation, ST Engineering, Thales Group, SPACEX, L3Harris Technologies, Inc. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The small satellite industry is likely to expand significantly. Several reasons are driving this expansion, including increased demand for tiny satellites in low-Earth orbit (LEO) and increased demand for satellite-based communication services. Both of these things contribute to its expansion. Small satellite manufacture and launch have gotten more efficient in recent years as technology has advanced. As a result, putting tiny satellites into orbit is now considerably easier and less expensive. Furthermore, there has been a growth in the need for data related to earth observation and remote sensing, which has resulted in an increasing demand for tiny satellites in a range of businesses. Also, Low-cost small satellites with enhanced capacity are in high demand for corporate data (retail, banking), the energy industry (oil, gas, mining), and governments in developed nations. The Internet of Things (IoT) requires the connection of gadgets to the Internet. Many IoT applications may be supported via Wi-Fi, Bluetooth, and terrestrial GSM networks. They cannot, however, provide the same amount of coverage as satellites. In addition, emerging technologies such as artificial intelligence and machine learning may potentially have a substantial influence on the small satellite business. These technologies have the potential to be used to improve the performance and efficiency of tiny satellites, thereby increasing demand for certain specific types of spacecraft in the future.

Restraining Factors

The initial cost of producing military laser systems is costly due to the demand for the appropriate time for research and development, infrastructure for building laser systems from scratch, field testing, demonstration, and installation. Furthermore, military laser system design and manufacturing are complex and require a high level of technical skill, resulting in significant production costs. Because of the high level of complexity and precision required, these systems must also be maintained and upgraded regularly, raising the overall cost. Also, the lower life period of smaller satellites can restrict the growth of the worldwide small satellite market. The small satellite usually has a lifetime of 12 to 15 years. When the fuel is depleted, the satellite must be discarded in a space 'graveyard' orbital position. The expense of moving the satellite to the cemetery and subsequently replacing the satellite is a significant capital commitment. As a result, this cost issue may limit the expansion of the worldwide satellite market.

Market Segmentation

- In 2022, the mini segment is dominating the largest market share over the forecast period.

Based on the type, the global small satellite market is divided into nano, micro, & mini. Among these segments, the mini segment is dominating the market with the largest revenue share during the forecast period. Minisatellites are tiny spacecraft that provide greater access to space and scientific study. They are also known as mini spacecraft weighing 100 to 500 kg. They offer several benefits over other small and big satellites, such as lower costs for future space missions for scientific and human exploration. Minisatellites are mostly employed for earth observation since they have high-resolution cameras and sensors that give vital data for natural resource management, agriculture, and urban planning. They're also utilized to learn about the Earth's atmosphere, temperature, and oceans. They can bring broadband internet and communication services to underserved and distant places. Minisatellite’s widespread use and improved operating efficiency are likely to drive market growth.

- In 2022, the CubeSat segment is influencing the largest market growth over the forecast period.

Based on the mass, the global small satellite market is segmented into different segments such as small satellites and CubeSat. Among these segments, in 2022, the CubeSat section of the small satellite industry was estimated to be worth more than USD 1.5 billion. It has shown rapid development in recent years and is expected to continue. A CubeSat is a tiny spacecraft with a defined form factor of 10x10x10 cm and a mass of up to 1.33 kg. This makes it easier to construct and deploy than regular satellites. The CubeSat market is expanding as governments and commercial firms become more interested in deploying tiny satellites for space missions and scientific research, such as investigating space weather, planetary exploration, and Earth's atmosphere.

- In 2022, the earth observation segment is leading the market with the largest market growth during the forecast period.

Based on the application, the global military laser systems market is bifurcated into navigation, communication, & scientific research, Earth Observation, & Others. Among these segments, the earth observation segment is dominating the market with the largest share during the forecast period due to the growing popularity of earth observation satellites in a wide range of economic sectors, as well as the incorporation of digital data analysis and geospatial data fusion, have all contributed to market value growth. Also, Small satellites provide a wide range of uses in earth observation, including agriculture, natural resource management, disaster management, climate monitoring, and urban planning.

- In 2022, the commercial segment is leading the largest market share over the forecast period.

Based on the end users, the global small satellite market is divided into commercial, civil, military, & government. Among these segments, the commercial segment is dominating the market with the largest market share during the forecast period, due to the growing number of internet services and mobile users in 2022, the commercial sector will have the biggest market share. The increasing use of tiny satellites for adversary monitoring is moving the industry forward. Commercial applications for small satellites include navigation, communications, weather forecasting, and others.

Regional Segment Analysis of the global small satellite market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominates the market with the largest market share of 35% share during the forecast period.

Get more details on this report -

North America dominates the market with the largest market share during the forecast period, due to the enormous expansion in the communication and telecom sectors. In remote areas, satellite communication technology provides data, phone, and video services. It aids in the tracking and monitoring of vehicles and boats to provide effective logistics assistance. As a result, the need for tiny satellites in the North American communication and telecom industry is propelling the small satellite market forward.

Asia Pacific is predicted to be the second fastest-growing region for the small satellite market during the forecast period. Countries such as India, China, Japan, Australia, and others are spending heavily on small satellite projects due to the numerous uses offered by small satellites such as military surveillance, asset tracking, weather predictions, natural catastrophe monitoring, and others.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global small satellite market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Airbus S.A.S

- Boeing Company

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Sierra Nevada Corporation

- ST Engineering

- Thales Group

- SPACEX

- L3Harris Technologies, Inc.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, the Italian space agency awarded a contract to the joint venture between Leonardo and Thales Alenia Space for the development of the Space Factory 4.0 program. Thales Alenia Space is also heading a partnership that includes Argotec, Sitael, and CIRA in the development of an interconnected system with numerous facilities situated across Italy that are planned to begin operations in 2026.

- In August 2022, blue Canyon Technologies established a modest satellite manufacturing site in Colorado. The new facility raised the company's production capacity to 85 space vehicles per year, solidifying the company's position as a market leader.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Small Satellite Market based on the below-mentioned segments:

Global Small Satellite Market, By Type

- Nano

- Micro

- Mini

Global Small Satellite Market, By Mass

- Small Satellite

- CubeSat

Global Small Satellite Market, By Application

- Navigation

- Communication

- Scientific Research

- Earth Observation

- Others

Global Small Satellite Market, By Component

- Satellite Bus

- Payload

- Solar Panel

- Satellite Antenna

Global Small Satellite Market, By End User

- Commercial

- Civil

- Military

- Government

Small Satellite Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?