Top 50 Companies in Radar Systems Market: Spherical Insights Analysis

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

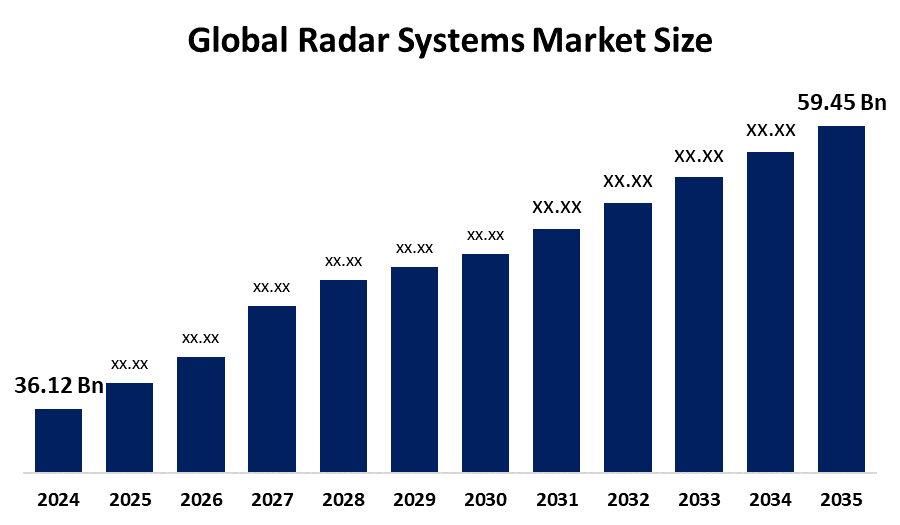

According to a research report published by Spherical Insights & Consulting, The Global Radar Systems Market Size is projected To Grow from USD 36.12 Billion in 2024 to USD 59.45 Billion by 2035, at a CAGR of 3.91% during the forecast period 2025–2035. Radar technology is driving the expanding UAV market since it can be utilized for real-time area monitoring, navigation, and collision avoidance.

Introduction

Radar Systems Market Size development, deployment, and distribution across a wide range of international sectors are all included in the radar market. These systems are crucial for military defense, air traffic control, weather forecasting, marine navigation, and vehicle safety because they use radio waves to detect, monitor, and track items, including cars, aircraft, ships, and weather occurrences. The need for sophisticated radars to combat contemporary threats like drones and missiles is driven by growing worldwide defense spending. Investment in dependable, networked systems for real-time monitoring is pushed by a greater emphasis on homeland security. New revenue streams are made possible by civilian uses, including automobile radars for self-driving cars. Global modernization initiatives place a higher priority on smaller, more intelligent radars for a variety of roles. Robust research and development in AI and solid-state technology improve performance and lower maintenance expenses.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Radar Systems Market.

Radar Systems Market Size & Statistics

- The Market Size for Radar Systems Was Estimated to be worth USD 36.12 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 3.91% between 2025 and 2035.

- The Global Radar Systems Market Size is anticipated to reach USD 59.45 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Radar Systems Market

- Asia-Pacific is expected to grow the fastest during the forecast period in the Radar Systems Market.

Regional growth and demand

Asia-Pacific is expected to grow the fastest during the forecast period in the radar systems market. Rising defense budgets in China, India, and Japan fuel demand for advanced radar systems to counter regional tensions like South China Sea disputes. Military modernization pushes adoption of AI-driven and 5G-enabled radars for faster threat detection. Growing commercial aviation and smart city projects boost civilian radar use for traffic and security. Strong R&D in South Korea and Australia drives innovation in compact, high-range sensors.

North America is expected to generate the highest demand during the forecast period in the radar systems market. Investment in advanced radars for air surveillance and missile defense is fueled by the United States' enormous defense budget, which exceeds $800 billion annually. Secure, networked technologies are necessary for homeland security to track threats in real time. Solid-state and multi-mission technologies are introduced via modernization efforts such as the U.S. Air Force's Next Gen Radar initiative. Interoperable radars are required for cooperative operations as part of Canada's NATO-aligned upgrading.

Top 5 trends in the Radar systems Market

AI Integration in Radar Processing

- Growth in Automotive Radar Applications

- Adoption of Solid-State and Phased Array Radars

- Miniaturization for Compact Systems

- Expansion into Multi-Mission and Airborne Platforms

1. AI Integration in Radar Processing

AI is being added to radar systems to improve how they spot and track targets, making decisions quicker in busy environments. This helps cut down on false alerts and boosts overall accuracy, which is key for defense and aviation sectors. Companies are rolling out these upgrades to meet demands for smarter surveillance, driving steady market gains.

2. Growth in Automotive Radar Applications

Radar tech is seeing bigger use in cars for collision avoidance and self-driving features, as more vehicles hit the roads needing safety boosts. This shift opens up new sales channels beyond military, pulling in automakers and suppliers to invest in short-range systems. It's fueling faster growth in the civilian side of the market through 2030.

3. Adoption of Solid-State and Phased Array Radars

Solid-state radars and phased arrays are replacing older models with better reliability and electronic steering for wider coverage without moving parts. They lower maintenance costs and handle multiple tasks at once, appealing to navies and air forces modernizing their setups. This trend is speeding up equipment upgrades across industries.

4. Miniaturization for Compact Systems

Smaller radar designs are making it easier to fit systems into drones, vehicles, and wearables for on-the-go monitoring. This opens doors for urban security and unmanned ops where size matters, cutting weight and power needs. Manufacturers are focusing here to tap into rising demand from smart cities and IoT projects.

5. Expansion into Multi-Mission and Airborne Platforms

Multi-mission radars that work for surveillance, weather tracking, and defense are growing fast, especially in aircraft for versatile use. Airborne setups lead in growth rates, supporting everything from commercial flights to military patrols. This broadens market reach, as operators seek flexible tools to cover more ground with less gear.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the radar systems market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the Radar systems Market

- RTX Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Thales Group

- BAE Systems plc

- Leonardo S.p.A.

- L3Harris Technologies, Inc.

- General Dynamics Corporation

- Saab AB

- Hensoldt AG

- Elbit Systems Ltd.

- Israel Aerospace Industries

- Airbus SE

- Honeywell International Inc.

- Raytheon Technologies

- Boeing Company

- FLIR Systems, Inc.

- Aselsan A.S.

- Cobham plc

- Hanwha Systems

- Mitsubishi Electric

- NXP Semiconductors N.V.

- Continental AG

- Robert Bosch GmbH

- Denso Corporation

1. RTX Corporation, headquartered in Arlington, Virginia

RTX Corporation plays a major role in the radar systems market through its Raytheon segment, focusing on advanced air and missile defense solutions like the AN/TPY-2 and SPY-6 radars that deliver precise tracking over long ranges. The company brings in about 68 billion in annual revenue, with a big chunk from U.S. defense contracts that support everything from shipboard surveillance to ground-based threat detection. It's pushing digital beamforming tech to handle more threats at once, helping navies and air forces stay ahead in crowded skies, while keeping costs down through reliable upgrades rather than full replacements. This approach has boosted RTX's share in global radar deals, especially with allies facing rising tensions. Overall, their radar work ties directly into broader defense needs, making them a steady pick for governments looking for proven gear.

2. Lockheed Martin Corporation, headquartered in Bethesda, Maryland

Lockheed Martin Corporation leads in radar systems with multi-mission setups like the SPY-1 in Aegis systems and ground radars for air surveillance that spot targets early and guide responses. Pulling in 67 billion yearly, mostly from DoD projects, the firm integrates radars into aircraft and ships for seamless data sharing across forces. They're advancing gallium nitride tech for better range and power efficiency, which cuts maintenance and fits into modern unmanned ops. This keeps Lockheed at the front for programs like F-35 radar upgrades, drawing contracts from over 45 nations. Their focus on adaptable sensors meets the push for flexible defense tools, solidifying market position amid budget squeezes.

3. Northrop Grumman Corporation, headquartered in Falls Church, Virginia

Northrop Grumman Corporation stands out in radar systems by building high-end sensors for aircraft and ground use, including the AN/APG-81 for F-35 fighters that provide all-weather targeting. The company reports around 40 billion in revenue, with defense as the core driver through contracts for missile defense and surveillance radars. They're investing in active electronically scanned arrays for quicker scans and less downtime, appealing to users in tough environments like maritime patrols. This has helped secure big deals for integrated radar networks, especially in the U.S. and Asia-Pacific. Northrop's radar efforts support broader mission systems, keeping them key for operators needing durable, high-performance tech without constant overhauls.

4. Thales Group, headquartered in Paris, France

Thales Group contributes strongly to the radar systems market with versatile ground and naval radars like the Ground Master series for air defense that detect low-flying threats over wide areas. Generating 18.4 billion in revenue last year, over half from military sales, Thales supplies encrypted sensors for NATO forces and export markets. The firm is rolling out software-upgradable radars to add AI for faster threat sorting, reducing operator workload in joint ops. This ties into their push for interoperable systems, landing contracts in Europe and beyond for border security. Thales' radar lineup fits the trend toward networked warfare, helping clients modernize without breaking budgets.

5. BAE Systems plc, headquartered in London, United Kingdom

BAE Systems plc excels in radar systems through electronic warfare and surveillance tech, such as the Blue Vixen-derived radars for fighters that offer reliable detection in jammed conditions. The company clocks about 25 billion in annual revenue, ranking high among European defense suppliers with deep U.S. ties. They're focusing on solid-state upgrades for longer life and multi-role use, from ship radars to ground stations, which lowers long-term costs for fleets. This has won them spots in Typhoon and F-35 programs, expanding reach to allies in the Middle East and Australia. BAE's radar innovations align with demands for resilient comms in contested zones, strengthening their hold on international upgrades.

Are you ready to discover more about the radar systems market?

The report provides an in-depth analysis of the leading companies operating in the global radar systems market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- RTX Corporation

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Thales Group

- BAE Systems plc

- Leonardo S.p.A.

- L3Harris Technologies, Inc.

- General Dynamics Corporation

- Saab AB

- Others.

Conclusion

The Market Size for Radar Systems is expected to increase steadily due to rising defense budgets worldwide and rising need for sophisticated monitoring in both the military and the civilian sector. Solid-state radars and AI integration are two examples of innovations that are improving performance and increasing the dependability and adaptability of systems in complex situations. The market is growing beyond conventional defense applications due to the increase in automotive radar for self-driving cars. Due to significant investments in modernization and the necessity for regional security, North America and Asia-Pacific are in the lead.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?