Top 50 Companies in Packaging Wax Market: Market Research Report (2024–2035)

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

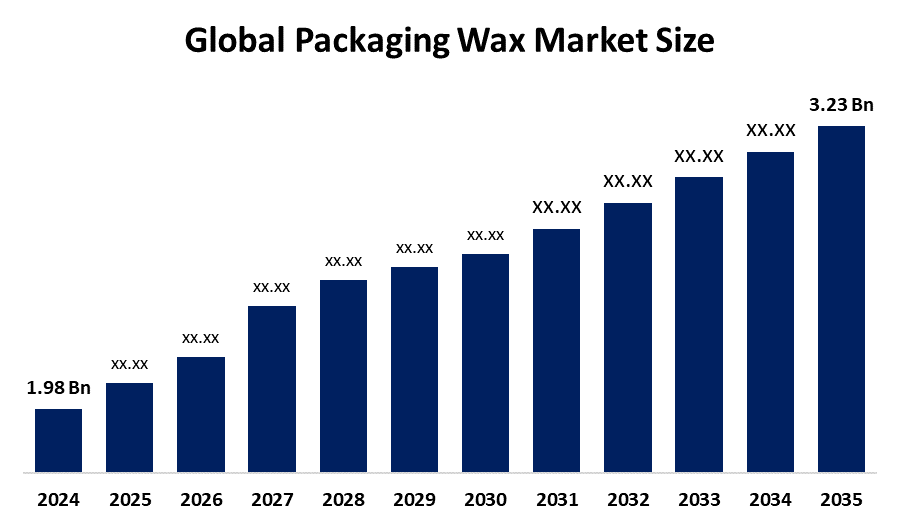

According to a research report published by Spherical Insights & Consulting, The Global Packaging Wax Market Size is projected To Grow from USD 1.98 Billion in 2024 to USD 3.23 Billion by 2035, at a CAGR of 4.55% during the forecast period 2025–2035. One of the main factors propelling the packaging wax market's expansion is the growing emphasis on sustainability on a global scale. The need for sustainable packaging solutions is growing as businesses and consumers adopt more environmentally friendly habits, and natural waxes are playing a significant role in this trend.

Introduction

In the packaging industry, waxes such as paraffin, microcrystalline, and synthetic waxes are used. This is known as the packaging wax market. In order to enhance qualities like water resistance, gloss, and barrier performance—all of which are essential for maintaining the integrity of goods during storage and transportation—these waxes are added to packaging materials. Commonly used for food packaging, cosmetics, medicines, and other consumer goods, packaging wax gives the packaging strength, style, and functionality. These waxes help to enhance the performance of materials like paper, cardboard, and film, offering added protection to the products inside. Packaging wax's versatility and the growing need for better packaging solutions have led to an increase in demand. Furthermore, the move to more environmentally friendly and sustainable packaging options is spurring market innovation and uptake. A crucial component of the packaging business, packaging wax provides an effective way to improve product appearance while upholding sustainability goals.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Packaging Wax Market.

Packaging Wax Market Size & Statistics

- The Market for Packaging Wax was Estimated to be worth USD 1.98 Billion in 2024.

- The Market is Going to Expand at a CAGR of 4.55% between 2025 and 2035.

- The Global Packaging Wax Market Size is anticipated to reach USD 3.23 Billion by 2035.

- North America is Expected to Generate the highest demand during the forecast period in the Packaging wax market

- Asia Pacific is Expected to grow the fastest during the forecast period in the Packaging wax Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the Packaging wax market. Rapid urbanization, industrialization, and the expansion of the middle class, particularly in nations like China, India, and Japan, are to blame for this domination. The food packaging, cosmetics, and pharmaceutical industries have a particularly high demand for packaging wax. Additionally, the use of natural waxes like beeswax and carnauba, which are biodegradable and satisfy consumers' growing desire for green products, has increased due to the trend toward sustainable and eco-friendly packaging solutions.

North America is expected to generate the highest demand during the forecast period in the Packaging wax market. The demand for packing wax is highest in the United States, mostly in the candle and packaging industries. Paraffin wax is still the most widely used option because of its affordability and many useful qualities. Stricter laws and growing consumer awareness of sustainability are also causing a slow transition to natural and synthetic wax substitutes.

Top 10 trends in the Packaging Wax Market

- AI-driven demand for biodegradable waxes

- Growth of smart packaging technologies

- Increased adoption of natural and plant-based waxes

- Expansion in e-commerce and protective packaging

- Rising sustainability and eco-friendly initiatives

- Innovation in moisture- and grease-resistance performance

- Customized packaging solutions for premium segments

- Regulatory pressure for renewable and recyclable materials

- Shift toward vegan and cruelty-free wax alternatives

- Integration of intelligent, trackable, and anti-counterfeit features

1. AI-driven demand for biodegradable waxes

Both businesses and consumers are increasingly seeking biodegradable waxes to reduce environmental impact. This demand, often identified and accelerated by AI-driven supply chain and consumer insights tools, encourages manufacturers to develop plant-based and compostable wax solutions, especially to replace petroleum-based coatings in food, pharma, and cosmetics packaging.

2. Growth of smart packaging technologies

Smart packaging innovations such as the integration of RFID tags, IoT sensors, and QR codes—are transforming how packaging waxes are applied and used. Wax-coated packaging is being paired with these digital tools to ensure real-time monitoring (e.g., freshness, tampering, or authenticity), meeting the needs of sectors like pharmaceuticals and food where traceability and safety are crucial.

3. Increased adoption of natural and plant-based waxes

Consumer preference for sustainability is driving greater use of waxes from renewable sources like soy, candelilla, and carnauba. These materials are prized for being non-toxic, compostable, and cruelty-free, reflecting a shift away from animal-derived or petroleum-based wax in new product launches and existing product reformulations.

4. Expansion in e-commerce and protective packaging

The rise of e-commerce is boosting the demand for durable, protective wax-coated packaging. Brands seek flexible and rigid wax-coated solutions to ensure that goods remain safe and undamaged during increasingly complex shipping and logistics chains, especially for food and pharmaceuticals.

5. Rising sustainability and eco-friendly initiatives

More stringent regulations and consumer scrutiny are pushing packaging companies and their suppliers to innovate with recyclable and renewable wax options. Investment in green packaging initiatives—including recyclable coatings, compostable waxes, and processes with lower carbon footprints—is expanding across all major regions and industry verticals

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the packaging wax market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the Packaging Wax Market

- Exxon Mobil Corporation

- Honeywell International Inc.

- Dow Inc.

- Sasol Limited

- China Petrochemical Corporation (Sinopec)

- Royal Dutch Shell plc

- BP p.l.c.

- HF Sinclair Corporation

- CNPC (China National Petroleum Corporation)

- NIPPON SEIRO CO., LTD

- The International Group, Inc.

- Evonik Industries AG

- BASF SE

- Mitsui Chemicals, Inc.

- Baker Hughes Company

- Calumet, Inc.

- Shell plc

- Clariant

- Paramelt

- BYK-CHEMIE GmbH

- Braskem

- Arkema

- Calwax

- Ilumina Wax d.o.o.

- Strahl & Pitsch LLC

1. Exxon Mobil Corporation

Headquarters: Irving, Texas, USA

Exxon Mobil is a global giant in packaging wax, offering high-performance paraffin and microcrystalline waxes for a wide array of packaging applications. Leveraging its deep expertise in petrochemical manufacturing, Exxon Mobil’s packaging wax solutions, now unified under its Prowaxx brand, provide outstanding moisture resistance and barrier properties, critical for food, pharmaceutical, and industrial sectors. The company continually innovates to meet demand for both performance and sustainability, introducing eco-friendlier waxes and driving advancements in packaging durability and recyclability. Exxon Mobil’s packaging wax leadership is backed by robust supply chains and a strong global production footprint, making it a trusted provider for high-volume commercial packaging needs.

2. Honeywell International Inc.

Headquarters: Charlotte, North Carolina, USA

Honeywell is a top innovator in the packaging wax sector, supplying advanced materials that raise the bar in sustainability and end-use performance. Honeywell packaging waxes are engineered to optimize shelf life, enhance printability, and provide secure, tamper-evident coatings in premium food and pharmaceutical packages. The company’s ongoing R&D investments target new, environmentally-friendly wax blends that reduce carbon footprint while maintaining high barrier properties. With an emphasis on green chemistry and compliance, Honeywell is responding to regulatory trends and shifting market expectations for sustainable packaging wax solutions.

3. Dow Inc.

Headquarters: Midland, Michigan, USA

Dow Inc. is renowned for delivering innovative, high-quality packaging waxes tailored to diverse industries. Their wax product line enhances packaging flexibility, durability, and sustainability, particularly for food and beverage, personal care, and specialty applications. Dow leverages its strong background in materials science to continually expand its wax portfolio, developing new solutions that satisfy performance standards while addressing global trends like recyclability and reduced plastic use. Its commitment to responsible sourcing and the development of sustainable wax technologies positions Dow as a forward-thinking leader in the packaging wax market.

4. Sasol Limited

Headquarters: Sandton, Johannesburg, South Africa

Sasol is a key player in the global packaging wax market, specializing in Fischer-Tropsch and paraffin waxes for rigid, semi-rigid, and flexible packaging. The company’s SASOLWAX line, including the new LC100 with a 35% lower carbon footprint, is designed to support high-performance packaging adhesives and coatings while helping customers achieve sustainability goals. Sasol’s strong focus on low-emission manufacturing and circular economy solutions places it at the forefront of green innovation in the packaging wax sector, serving customers engaged in food packaging, pharmaceuticals, and cosmetics.

5. China Petrochemical Corporation (Sinopec)

Headquarters: Beijing, China

Sinopec dominates the packaging wax market in Asia and globally, leveraging large-scale refining and chemical capabilities to supply premium paraffin and specialty waxes. The company’s packaging wax products meet stringent quality standards for food safety, pharmaceutical integrity, and personal care protection—key for modern, high-performance packaging. Sinopec invests continuously in advanced petrochemical refining and sustainable production practices, aligning its product development with market shifts toward biodegradable and plant-based wax alternatives. Its strong regional presence ensures fast, reliable supply for major packaging producers worldwide.

Are you ready to discover more about the packaging wax market?

The report provides an in-depth analysis of the leading companies operating in the global packaging wax market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Exxon Mobil Corporation

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Honeywell International Inc.

- Dow Inc.

- Sasol Limited

- China Petrochemical Corporation (Sinopec)

- Royal Dutch Shell plc

- BP p.l.c.

- HF Sinclair Corporation

- CNPC (China National Petroleum Corporation)

- Others.

Conclusion

The global packaging wax market is on a robust growth trajectory, driven by rising demand for sustainable and innovative packaging solutions. With the market expected to more than double by 2035, key trends such as the adoption of biodegradable and plant-based waxes, smart packaging technologies, and a strong emphasis on eco-friendly practices are reshaping industry standards. North America remains the largest market, while Asia Pacific stands out as the fastest-growing region, fueled by rapid urbanization and shifting consumer preferences. Leading companies are responding with advanced, high-performance wax products that meet evolving regulatory and environmental expectations.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?