Top 50 Companies in Life Insurance Software Market 2025: Strategic Overview & Future Trends (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

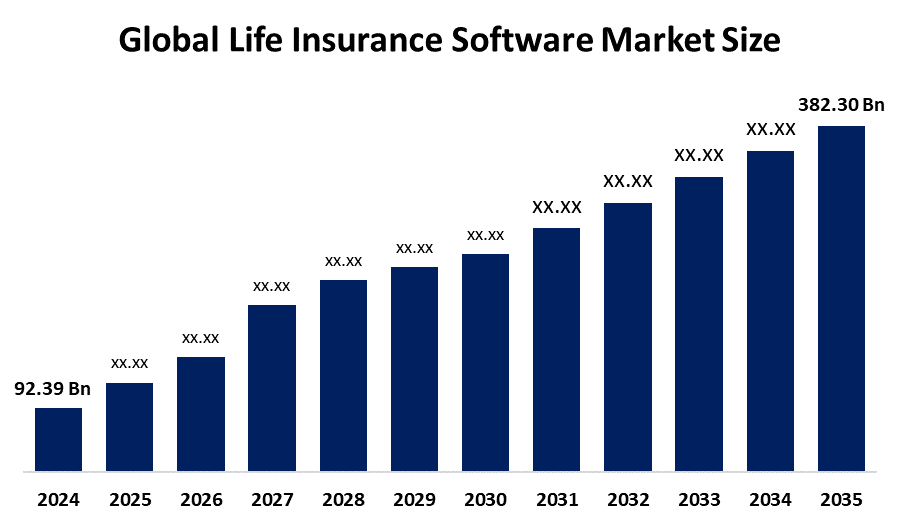

According to a research report published by Spherical Insights & Consulting, The Global Life Insurance Software Market Size is projected to Grow from USD 92.39 Billion in 2024 to USD 382.30 Billion by 2035, at a CAGR of 13.78% during the forecast period 2025–2035. The market for life insurance software is in greater demand as the growing need for digital solutions is the desire by insurers to improve client satisfaction and operational effectiveness. Insurers can automate procedures, enhance risk assessment, and provide individualized services due to developments in artificial intelligence and machine learning. Because cloud-based platforms are flexible and scalable, insurers can adjust to the shifting needs of the market.

Introduction

The life insurance software is referred to as a specialised digital solution made to automate and simplify a number of processes in the life insurance sector. Specialised digital solutions are offered by the life insurance software sector to help life insurance businesses automate and optimise their operations. These systems, which cover client relationship management, policy administration, underwriting, claims processing, and billing, help insurers increase operational effectiveness, boost customer satisfaction, and maintain regulatory compliance. Personalised offers, enhanced risk management, and better decision-making are made possible by the integration of technologies like artificial intelligence, machine learning, cloud computing, and data analytics. The importance of digital transformation in various industries is growing, and life insurance software solutions are crucial for improving customer experiences, streamlining procedures, and preserving competitiveness. Trends in demographics and lifestyle also affect the demand for insurance products, necessitating the development of software that can adapt to accommodate changing customer demands.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Life Insurance Software Market.

Life Insurance Software Market Size & Statistics

- The Market Size for Life Insurance Software Was Estimated to be worth USD 92.39 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 13.78% between 2025 and 2035.

- The Global Life Insurance Software Market Size is anticipated to reach USD 382.30 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Life Insurance Software Market

- Asia Pacific is expected to grow the fastest during the forecast period in the Life Insurance Software Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the life insurance software market. The market for life insurance softwares is now growing in Asia Pacific due to the growing need, especially among younger individuals, for reasonably priced and highly customisable life insurance solutions. AI-powered software is being used by insurers more and more to facilitate data-driven product development and dynamic pricing. The rapid rollout of contemporary life insurance platforms is a result of these AI tools' ability to streamline the large-scale design, marketing, and administration of customised offers. The insurance market is changing as a result of this technology revolution, which is making goods more affordable and in line with younger consumers' preferences.

North America is expected to generate the highest demand during the forecast period in the life Insurance Software market. The life insurance software market with the quickest rate of growth throughout the study period is anticipated to be in North America. The region's sophisticated digital infrastructure, which makes it easier for life insurance software solutions to be quickly adopted, is responsible for this supremacy. Insurers can effectively develop and scale software solutions because of robust internet access, broad cloud computing, and the extensive usage of sophisticated IT systems. These technological underpinnings encourage creativity and ongoing developments in life insurance technology across the area.

Top 10 trends in the Life Insurance Software Market

- AI and Machine Learning Integration

- Cloud-Based Solutions

- Microservices Architecture

- Blockchain for Transparency

- Mobile and Digital Platforms

- Regulatory Compliance and Data Security

- Personalized Customer Experiences

- Automation of Claims Processing

- Partnerships with InsurTech Startups

- Responsible AI Usage

1. AI and Machine Learning Integration

AI and machine learning are revolutionising life insurance software by making it possible for risk assessment, underwriting, and customised policy solutions to be completed more quickly and accurately. In addition to increasing accuracy and lowering human error, AI-driven underwriting can cut policy issuance times by as much as 50%. Automated claims processing, fraud detection, and NLP-based document analysis expedite settlements and improve customer satisfaction. AI-powered chatbots that handle queries around the clock improve customer service by freeing up agents to work on more difficult assignments. Furthermore, machine learning drives dynamic pricing and predictive analytics, enhancing risk management and facilitating customised policy suggestions.

2. Cloud-Based Solutions

Cloud-based platforms are revolutionising the life insurance software market by giving insurers more flexibility, scalability, and efficiency. Real-time policy management and smooth remote workflows are made possible by these solutions, which do away with the need for expensive on-premises equipment by providing centralised data access, automated updates, and disaster recovery. Advanced analytics and quicker service delivery are two ways that integration with AI and machine learning improves underwriting, claims processing, and customer relationship management. Furthermore, cloud solutions that include encryption, audit trails, and quick security updates strengthen data security and regulatory compliance. Increasing creativity and operational agility, cloud adoption is becoming the norm as insurers embrace digital transformation and modernise legacy systems.

3. Microservices Architecture

Microservices design is revolutionising life insurance software by breaking systems up into distinct, business-aligned services. Since insurers can expand specific activities, such as handling claims or policy management, independently to efficiently manage demand spikes, this change offers a great deal of flexibility. Through faster and safer deployment of new capabilities, teams can accelerate delivery timelines and avoid disruptions. Furthermore, by improving fault isolation, the modular structure ensures that system issues remain localised and do not compromise general availability. Importantly, this approach enables stepwise modernisation, which enables insurers to gradually abandon traditional systems and implement microservices. Because of these advantages, microservices are crucial for establishing robust, scalable, and flexible insurance systems.

4. Blockchain for Transparency

Blockchain technology is revolutionising life insurance by providing a decentralised, impenetrable ledger system that offers previously unheard-of transparency and trust. In order to minimise disputes and improve accountability, every transaction, whether it be the issue of policies, the filing of claims, or the sharing of data, is permanently documented and shared with all pertinent parties. Additionally, smart contracts automate the validation and payment of claims, reducing the possibility of fraud and human mistakes while enabling quicker, more effective servicing. Blockchain-enabled solutions can expedite claims, increase client confidence, and promote a more dependable, transparent insurance ecosystem. Examples of real-world use cases include AXA's Fizzy flight delay coverage and platforms like Etherisc and Lemonad.

5. Mobile and Digital Platforms

Life insurance is being revolutionised by the emergence of digital and mobile platforms, which offer unmatched interaction and convenience. Through user-friendly mobile apps and portals, policyholders can access, buy, and manage their policies at any time, doing away with the requirement for in-person visits and lowering customer journey friction. Additionally, these platforms provide rapid estimates, easy claim submissions, and round-the-clock policy information access, which streamlines administration and increases client satisfaction. Notably, younger generations, particularly Gen Z and Millennials, use mobile platforms extensively over 80% of them leave websites with subpar mobile experiences.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the life insurance software market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 20 Companies Leading the Life Insurance Software Market

- Accenture

- Infosys

- COGNIZANT

- Wipro

- TCS

- IBM

- Oracle

- MICROSOFT

- SAP

- Pegasystems

- FSS

- Sopra Steria

- Vertafore

- Salesforce

- Roper Technologies

- Adobe

- ServiceNow

- Sapiens International Corporation

- Majesco

- DXC Technology

- Others

1. Accenture

Headquarters: Dublin, Ireland

Accenture plc is a prominent worldwide provider of professional services with a focus on operations, strategy, technology, consulting, and digital transformation. Recognised for providing all-encompassing solutions, including AI, cloud, cybersecurity, and data analytics, Accenture works with customers in all significant sectors, including public service, communications, healthcare, and financial services.

2. Infosys

Headquarters: Karnataka, India

As a leader in next-generation digital services and consulting, Infosys Limited provides comprehensive solutions for cloud computing, data analytics, cybersecurity, microservices, blockchain, AI-powered enterprise apps, and agile digital transformation through platforms like Infosys Cobalt and EdgeVerve. Infosys helps customers in a variety of industries by accelerating innovation, streamlining business procedures, and facilitating digital transformation on a large scale from this strategic base.

3. COGNIZANT

Headquarters: New Jersey, United States

An international provider of information technology services and consultancy, Cognisant Technology Solutions Corporation is well-known for assisting multinational corporations with technology modernisation, business process reimagining, and customer experience transformation. It provides a wide range of solutions for sectors like banking, healthcare, insurance, manufacturing, and retail, including artificial intelligence, cloud services, digital engineering, corporate apps, and business process outsourcing.

4. Wipro

Headquarters: Karnataka, India

Wipro Limited is a well-known international technology corporation with a focus on business process, consulting, and IT services. With its proficiency in cognitive computing, hyper-automation, robotics, cloud, analytics, and other cutting-edge technologies, Wipro helps businesses in sectors like banking, healthcare, retail, and telecoms to innovate, drive efficiency, and navigate digital revolutions.

5. TCS

Headquarters: Maharashtra, India

Digital transformation, cloud computing, enterprise solutions, cybersecurity, and data analytics are just a few of the many services that Tata Consultancy Services, a top worldwide provider of IT services and consulting, offers. The business provides services to customers in a number of sectors, including manufacturing, banking, financial services, healthcare, and retail. TCS is renowned for its creativity and customer-focused methodology, which aid companies in overcoming difficult obstacles and achieving long-term success.

Are you ready to discover more about the life insurance software market?

The report provides an in-depth analysis of the leading companies operating in the global life insurance software market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Accenture

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Infosys

- COGNIZANT

- Wipro

- TCS

- IBM

- Oracle

- IBM

- MICROSOFT

- Others

Conclusion

The life insurance software market is accelerating by utilizing AI and data analytics, and life insurance software is increasingly allowing insurers to provide individualized coverage. By analyzing large volumes of data, these technologies enable insurers to customize policies to meet the needs of each individual, increasing consumer satisfaction. AI and automation also expedite claims processing, risk assessment, and underwriting, which results in quicker decision-making and lower operating expenses. Advanced life insurance software solutions are becoming more and more popular due to their efficiency and personalization.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?