Top 50 Companies in Infantry Fighting Vehicle (IFV) Market: Statistics Report Till 2035

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

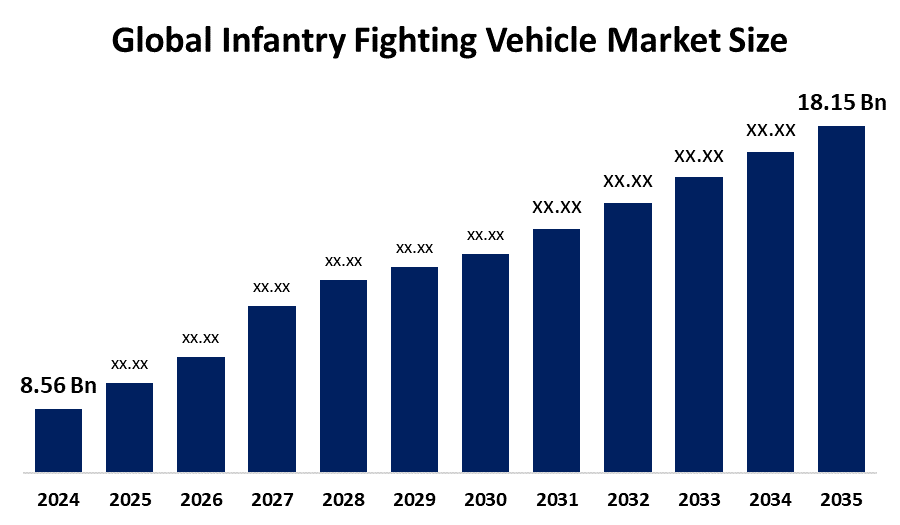

According to a research report published by Spherical Insights & Consulting, The Global Infantry Fighting Vehicle (IFV) Market Size is projected To Grow from USD 8.56 Billion in 2024 to USD 18.15 Billion by 2035, at a CAGR of 5.95% during the forecast period 2025–2035. Defense build-ups in Africa, the Middle East, and Asia Pacific are driving rising demand for infantry fighting vehicles. Manufacturers have a lot of potential in these areas since countries want to use modern weapons systems to improve security features and bolster their military.

Introduction

Powerful guns, adaptable, high-tech armor, and active protection are increasingly standard on modern combat vehicles. These developments enable IFV troops to live longer, recognize dangers more readily, and respond more skillfully, which is why they are essential to military operations that focus on victory and protection. As the defense budget increases, nations are increasing their attempts to modernize armored vehicles. Many countries are giving new armored vehicles priority due to evolving technology, which increases purchases. As new security risks arise, nations all across the world are taking these actions to strengthen their defenses and keep up with the latest technological advancements.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Infantry Fighting Vehicle (IFV) Market.

Infantry Fighting Vehicle (IFV) Market Size & Statistics

- The Market Size for Infantry fighting vehicle (IFV) Was Estimated to be worth USD 8.56 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 5.95% between 2025 and 2035.

- The Global Infantry Fighting Vehicle (IFV) Market Size is anticipated to reach USD 18.15 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Infantry Fighting Vehicle (IFV) Market

- Asia-Pacific is expected to grow the fastest during the forecast period in the Infantry Fighting Vehicle (IFV) Market.

Regional growth and demand

Asia-Pacific is expected to grow the fastest during the forecast period in the infantry fighting vehicle (IFV) market. Significant military modernization initiatives, including the purchase of cutting-edge vehicles, are being propelled by the heightened tensions among the states in the region. A lot of Asia Pacific nations are also aggressively improving their military capabilities by swapping out outdated gear for new, cutting-edge vehicles. Furthermore, it is anticipated that the market for infantry combat vehicles for internal security operations will be driven by worries about terrorism, insurgency, and border security.

North America is expected to generate the highest demand during the forecast period in the infantry fighting vehicle (IFV) market. Through procurement contracts, export promotion programs, and research and development funds, the U.S. government actively promotes its military sector, creating an environment that is conducive to the success of manufacturers. Strong export networks have been formed by the region's producers, who sell their goods to both allies and foreign governments looking to acquire cutting-edge military hardware. Additionally, the United States has a sizable and well-funded military that continuously makes investments to update its fleet of armored vehicles, opening up a sizable domestic market for producers.

Top 5 trends in the Infantry Fighting Vehicle (IFV) Market

- Integration of advanced protection systems

- Network-centric and digital battlefield capabilities

- Adoption of modular and scalable designs

- Rise of autonomous and unmanned technologies

- Use of lightweight materials for improved mobility

1. Integration of Advanced Protection Systems

Modern IFVs are increasingly equipped with active protection systems (APS), composite and reactive armor, and technology to intercept or deflect incoming threats. These advancements significantly enhance survivability against anti-armor weapons, shaping procurement priorities and vehicle design across all major militaries.

2. Network-Centric and Digital Battlefield Capabilities

IFVs now integrate sophisticated communication, battlefield management, and data-sharing tools, enabling commanders to maintain situational awareness and coordinate in real-time. This trend drives demand for digital integration, turning IFVs into networked platforms essential for modern, multi-domain operations.

3. Adoption of Modular and Scalable Designs

Modular architectures allow IFV fleets to be rapidly reconfigured for diverse missions, such as reconnaissance, urban warfare, or troop transport. Scalable designs simplify upgrades and maintenance, increasing operational flexibility and cost-effectiveness for defense forces.

4. Rise of Autonomous and Unmanned Technologies

There is growing integration of autonomous driving features, unmanned turrets, and robotic systems into IFVs. These technologies reduce risks for crew, enable unmanned operations in high-threat zones, and support manned-unmanned teaming tactics on the battlefield.

5. Use of Lightweight Materials for Improved Mobility

Developers are focusing on advanced composites and lightweight metals to create more agile and fuel-efficient IFVs. Enhanced mobility allows rapid maneuvering, better deployment over difficult terrain, and improved logistical efficiency, supporting the evolving operational doctrines of militaries worldwide.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the infantry fighting vehicle (IFV) market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the Infantry Fighting Vehicle (IFV) Market

- General Dynamics Land Systems

- BAE Systems plc

- Rheinmetall AG

- Hanwha Defense

- Oshkosh Defense

- Patria

- Krauss Maffei Wegmann (KMW)

- Nexter Systems

- ST Engineering

- Navistar Defense

- Iveco Defence Vehicles

- FNSS Defense Systems

- CMI Defence

- Denel Vehicle Systems

- Lovol Heavy Industry

- Alvis Vickers

- Singapore Technologies Kinetics

- Tata Advanced Systems Limited

- Paramount Group

- Bumar Labedy

- Otokar

- FN Herstal

- Elbit Systems

- Arma Group

- IMI Systems

1. General Dynamics Land Systems — Sterling Heights, Michigan, USA

General Dynamics is a global leader in infantry fighting vehicles, producing advanced armored combat systems including the AJAX and Griffin series. The company integrates cutting-edge firepower, protection, and mobility in its IFVs to meet modern battlefield demands. General Dynamics emphasizes digital battlefield connectivity and active protection systems, enhancing troop survivability and operational effectiveness. Its IFVs are widely used by various militaries and are known for modularity and adaptability in diverse combat scenarios. The company continuously innovates in lightweight armor and autonomous vehicle technologies, solidifying its leadership in the evolving Infantry Fighting Vehicle market.

2. BAE Systems plc — Farnborough, United Kingdom

BAE Systems is a top player in the Infantry Fighting Vehicle market, renowned for its CV90 family of IFVs. The combat-proven CV90 combines superior mobility with advanced electronic architectures supporting future upgrades. BAE focuses on survivability enhancements like active protection systems and improved firepower. The company also incorporates digital battlefield integration, enabling real-time data sharing and network-centric operations. BAE Systems’ IFVs are deployed by multiple NATO and allied forces, emphasizing flexibility and adaptability to various operational environments. It remains a technology-driven leader dedicated to evolving IFV capabilities for modern warfare.

3. Rheinmetall AG — Düsseldorf, Germany

Rheinmetall AG is a leading defense manufacturer specializing in armored vehicles and Infantry Fighting Vehicles. Its Lynx IFV platform offers modular design, advanced protection, and highly lethal firepower optimized for future combat environments. Rheinmetall prioritizes integration of active protection systems, digital command and control, and autonomous capabilities in its IFVs. The company’s product line addresses the growing market demand for scalable, networked, and agile combat vehicles. Rheinmetall’s innovative engineering and extensive international partnerships make it a key competitor in the global Infantry Fighting Vehicle market.

4. Hanwha Defense — Seoul, South Korea

Hanwha Defense is a prominent Korean defense company specializing in advancing Infantry Fighting Vehicle technologies. Its latest IFVs, such as the AS21 Redback, feature state-of-the-art weaponry, modular armor packages, and integrated battlefield management systems. Designed for high mobility and survivability, Hanwha’s IFVs support networked warfare and autonomous operation features. The company leads innovation in lightweight composite armor and hybrid propulsion systems to enhance operational range and reduce logistical footprints. Hanwha Defense’s growing presence in Asia-Pacific and export markets reflects its strategic focus in the evolving Infantry Fighting Vehicle sector.

5. Oshkosh Defense — Oshkosh, Wisconsin, USA

Oshkosh Defense specializes in tactical military vehicles, including wheeled Infantry Fighting Vehicles designed for versatility and survivability. The company integrates advanced mobility, blast protection, and digital communication systems into its IFV platforms. Oshkosh’s approach emphasizes modularity and rapid configuration changes, allowing its vehicles to address diverse mission requirements. With a focus on innovation in autonomous driving and active protection technologies, Oshkosh is expanding its footprint in armored vehicle markets. Its robust manufacturing capabilities and strategic partnerships support growing defense demands across global Infantry Fighting Vehicle segments.

Are you ready to discover more about the infantry fighting vehicle (IFV) market?

The report provides an in-depth analysis of the leading companies operating in the global infantry fighting vehicle (IFV) market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- General Dynamics Land Systems

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- BAE Systems plc

- Rheinmetall AG

- Hanwha Defense

- Oshkosh Defense

- Patria

- Krauss-Maffei Wegmann (KMW)

- Nexter Systems

- ST Engineering

- Others.

Conclusion

The Infantry Fighting Vehicle (IFV) Market Size is witnessing steady growth driven by increasing global defense modernization and geopolitical instability. Advanced technologies like active protection systems, AI, and network-centric warfare capabilities are transforming IFV design, improving survivability, firepower, and situational awareness. Regional demand is strong in North America, Europe, and Asia-Pacific, fueled by rising defense budgets and modernization programs. The market favors modular, scalable, and autonomous features in IFVs for adaptability across diverse combat scenarios.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?