Top 50 Companies in Industrial Phosphoric Acid Pa Market Worldwide 2025: Market Research Report (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

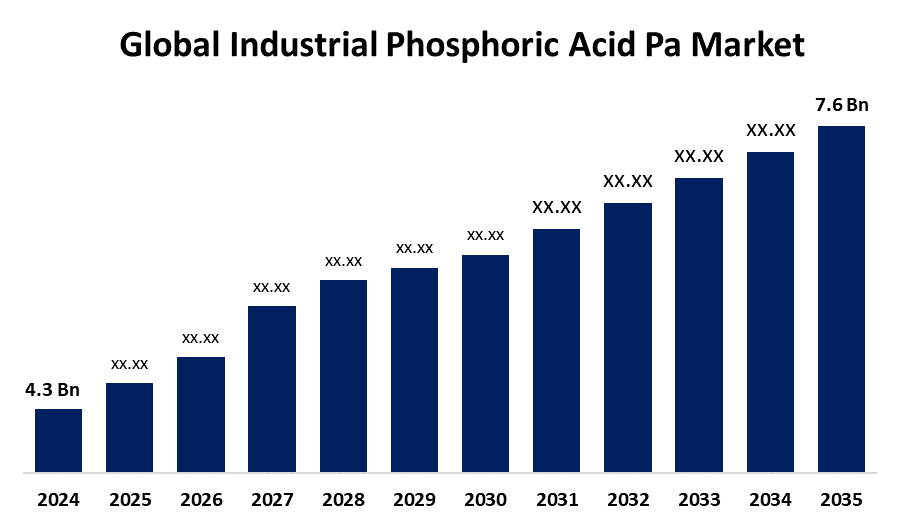

According to a research report published by Spherical Insights & Consulting, The Global Industrial Phosphoric Acid Pa Market Size is projected to Grow from USD 4.3 Billion in 2024 to USD 7.6 Billion by 2035, at a CAGR of 5.31% during the forecast period 2025–2035. The market for industrial phosphoric acid pa is in greater demand due to the growing demand for fertilisers, which make up the largest application sector and hold of the market. The growing world population and the ensuing demand for higher agricultural production are to blame for this increase.

Introduction

Industrial phosphoric acid (PA) a concentrated, colourless, and odourless liquid with the chemical formula H3PO4, is widely utilised in many industrial applications. Global population expansion and increased demand for food production are driving a significant increase in PA demand, especially in the fertiliser sector. Improved extraction and purification techniques, for example, are increasing efficiency and making higher-purity grades possible for applications in electronics, food, and industry. Pressures from the environment and regulations are forcing manufacturers to produce cleaner, adhere to food safety and water quality regulations, and implement stronger waste and emission controls. Industrial digitisation includes increasing productivity, decreasing downtime, and optimising process consistency. Examples of this include automation, smart control systems, predictive maintenance, and real-time monitoring. Growing supply chain globalisation also contributes to these businesses are sourcing raw materials and expanding PA distribution in response to trade frameworks, import/export regulations, and logistics.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Industrial Phosphoric Acid Pa Market.

Industrial Phosphoric Acid Pa Market Size & Statistics

- The Market Size for Industrial Phosphoric Acid Pa Was Estimated to be worth USD 4.3 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 5.31% between 2025 and 2035.

- The Global Industrial Phosphoric Acid Pa Market Size is anticipated to reach USD 7.6 Billion by 2035.

- Asia Pacific is expected to generate the highest demand during the forecast period in the Industrial Phosphoric Acid Pa Market

- Europe is expected to grow the fastest during the forecast period in the Industrial Phosphoric Acid Pa Market.

Regional growth and demand

Europe is expected to grow the fastest during the forecast period in the industrial phosphoric acid pa market. The market for industrial phosphoric acid pa is now growing in Europe due to strong environmental regulations, energy-efficiency requirements, and sustainable development strategies. Particularly for food, battery, and ultra-high purity applications, producers are encouraged to use approved procedures (ISO, EFSA, etc.), higher purity grades, and stricter impurity limitations. Although the need for fertiliser is stable, specialty industries are expanding more quickly. The outcome was increased investment in improved purification technology, cleaner production, and innovation driven by compliance.

Asia Pacific is expected to generate the highest demand during the forecast period in the industrial phosphoric acid pa market. The industrial phosphoric acid pa market with the quickest rate of growth throughout the study period is anticipated to be in the Asia Pacific. The market for industrial phosphoric acid is rapidly expanding in the Asia-Pacific region. The need for fertilisers, food processing, water treatment, and industrial uses is skyrocketing in China, India, and Southeast Asia due to their massive populations, growing agricultural activities, and fast industrialisation. The region's appeal is further increased by government assistance, infrastructural spending, and comparatively low production costs, such as plentiful phosphate rock and less expensive energy inputs.

Top 10 trends in the Industrial Phosphoric Acid Pa Market

- Sustainable & Circular Production

- Mergers, Acquisitions & Strategic Partnerships

- Technological Advancements in Production Processes

- Grade and Application Diversification

- Environmental Regulation & Carbon Footprint Pressure

- Flexible and modular warehouse design

- Omnichannel and micro-fulfillment integration

- Blockchain for supply chain transparency

- Immersive staff training (AR/VR)

- Advanced warehouse security and cybersecurity

1. Sustainable & Circular Production

The industrial phosphoric acid market is seeing a shift towards circular and sustainable manufacturing that emphasises resource efficiency and waste reduction. At a rate of 4–6 tonnes every tonne of PA produced, phosphogypsum is a substantial by-product of PA manufacturing. A circular economy is being promoted by the repurposing of PG, which was once dumped, in a variety of uses, such as mine repair, cement, and plaster. Furthermore, to further advance sustainability, novel techniques are being created to extract important materials from PG, including rare earth elements. In addition to lessening their influence on the environment, these programs support international sustainability objectives.

2. Mergers, Acquisitions & Strategic Partnerships

The industrial phosphoric acid industry is significantly shaped by mergers, acquisitions, and strategic alliances. In an effort to improve their operational efficiency and market visibility, businesses are merging more frequently. For example, The Mosaic Company increased its upstream supply capacity by purchasing a regional phosphate rock mining operator. Similarly, Nutrien and Yara International established a joint venture in North America to produce green phosphate using renewable energy. By securing feedstock, increasing their regional footprint, and incorporating sustainable manufacturing practices, these strategic actions help businesses maintain a competitive edge in the changing market environment.

3. Technological Advancements in Production Processes

Efficiency and purity in the manufacturing of phosphoric acid are being improved by technological developments. Improved separation and concentration stages, lower energy consumption, and less contamination hazards are all benefits of membrane filtering technologies, which are essential for applications such as semiconductors. Accurate control over production parameters is made possible by automation and real-time monitoring technologies, such as smart sensors and AI-driven analytics, which guarantee that the acid satisfies the strict purity requirements needed for semiconductor manufacture. Phosphoric acid production methods are changing as a result of these advancements, especially in sectors where high purity is crucial.

4. Grade and Application Diversification

The market for industrial phosphoric acid is diversifying significantly in terms of grade and application due to changing industrial demands and technological breakthroughs. Even while technical grade phosphoric acid is still widely used, its proportion is steadily declining as demand for higher-purity grades rises. Food-grade phosphoric acid is steadily increasing in use as a preservative and acidity regulator in processed foods and beverages. At the same time, the electronics industry is becoming a significant user, employing electronic-grade phosphoric acid in precision etching and semiconductor production. Phosphoric acid's versatility across a range of industries is demonstrated by this diversification, underscoring its crucial significance beyond conventional applications.

5. Environmental Regulation & Carbon Footprint Pressure

Pressures related to the carbon footprint and environmental requirements are having a big impact on the industrial phosphoric acid sector. PA manufacturing uses a lot of energy and produces a lot of carbon emissions, especially when done the old-fashioned wet way. For example, a standard facility that can produce one million tonnes of PA annually can emit. Stricter environmental standards are being enforced by regulatory frameworks, particularly in North America and Europe, to lessen these effects. According to Global Growth Insights, manufacturers must lower their carbon footprints and embrace cleaner technology, which will raise manufacturing costs. The industry is moving towards more innovative production methods and environmental practices as a result of these rules.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the industrial phosphoric acid pa market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the Industrial Phosphoric Acid Pa Market

- OCP Group

- The Mosaic Company

- Yara International

- Nutrien Ltd

- PhosAgro

- EuroChem

- ICL Group

- CF Industries

- Jordan Phosphate Mines

- Grupa Azoty

- Lifosa Lithuania

- Prayon SA

- Arkema

- Solvay Belgium

- Hubei Xingfa Chemicals Group

- Chengxing Group

- Yunphos

- IFFCO

- Maaden

- Wengfu Group

- Yuntianhua

- Tongling Chemical Industry Group

- Kailin Group

- Hubei Xinyangfeng Fertilizer

- Celanese

- Others

1. OCP Group

Headquarters: Casablanca, Morocco

The Moroccan state-owned company OCP Group has its main office in Casablanca. With access to more than 70% of the world's phosphate rock reserves, it is the biggest producer of phosphate and phosphate-based products. From mining and the production of phosphoric acid to the production and sale of fertiliser, the company works along the whole phosphate value chain. Over 160 clients are served by OCP Group on five continents, with a notable presence in North America, Latin America, and Africa. By implementing a green transformation strategy that includes decarbonisation and the deployment of renewable energy, the corporation has demonstrated its commitment to sustainability. OCP Group's global presence and integrated strategy bolster its standing as a phosphate industry leader.

2. The Mosaic Company

Headquarters: Tampa, Florida

The Mosaic Company is one of the leading producers of concentrated phosphate and potash, essential agricultural minerals, in the United States. The company services farmers in North America, South America, and other significant agricultural regions. Its headquarters are located in Tampa, Florida. Mosaic's product line includes well-known brands like K-Mag, Aspire, and MicroEssentials. By implementing measures to reduce its environmental impact and increase operational efficiency, the company has gained acclaim for its commitment to sustainability. Mosaic strengthens its position in the global fertiliser market by forming strategic partnerships, including the Saudi Arabian Ma'aden Wa'ad Al Shamal Phosphate Company. Mosaic's robust distribution network makes it crucial to maintain the world's food production.

3. YARA INTERNATIONAL

Headquarters: Oslo, Norway

The headquarters of the Norwegian chemical firm Yara International ASA are located in Oslo. It is one of the top producers of nitrogen-based fertilisers worldwide, as well as associated industrial goods like ammonia, nitrates, and specialty fertilisers. The business serves clients in more than 150 countries worldwide and operates in more than 60 nations. By offering sustainable agriculture solutions, Yara aims to protect the environment and responsibly feed the globe. The Norwegian government owns the majority of the corporation, which is traded on the Oslo Stock Exchange under the ticker name YAR. In order to propel the green shift in fertiliser production and other energy-intensive industries, Yara is renowned for its dedication to innovation, sustainability, and digital farming solutions.

4. Nutrien Ltd

Headquarters: Saskatchewan, Canada

Saskatchewan, Canada's Saskatoon, is the location of Nutrien Ltd.'s headquarters. It is one of the world's top producers and suppliers of the three main fertilizers nitrogen, potash, and phosphate, as well as agricultural services. Nutrien is divided into four primary business segments: Potash, Nitrogen, Phosphate, and Retail crop inputs and farm-center services. Both industrial and solid acids, feed phosphates, and other phosphorus-based products are delivered by the phosphate division. North America, South America, Australia, and portions of Asia are all part of Nutrien's global footprint, which allows for a broad distribution network. Additionally, it offers crop protection, seed solution products, agronomic assistance, and digital tools to increase agricultural output.

5. PhosAgro

Headquarters: Moscow, Russia

A vertically integrated chemical and fertiliser company, PhosAgro, is one of the top producers of high-grade phosphate rock and fertilisers based on phosphates worldwide. Phosphates, feed phosphates, industrial phosphates, complex fertilisers such as NPKs and NP kinds, and nitrogen-based substances like ammonia are all part of its extensive product line. Mostly from areas like Murmansk, Vologda, Saratov, and Leningrad, PhosAgro mines apatite-nepheline ore, which the company uses to make its own high-purity phosphate rock.

Are you ready to discover more about the industrial phosphoric acid pa market?

The report provides an in-depth analysis of the leading companies operating in the global industrial phosphoric acid pa market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- OCP Group

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- The Mosaic Company

- YARA INTERNATIONAL

- Nutrien Ltd

- PhosAgro

- JDA Software

- Epicor Software Corporation

- TECSYS

- Made4net

- Others

Conclusion

The industrial phosphoric acid pa market is accelerating due to its adoption of Industry 4.0, which makes use of cloud, IoT, and AI technologies to boost efficiency, enable smart controls, and improve digital processes. Urbanisation, industrialisation, and rising consumer incomes make emerging economies very promising. New technologies and customer segments are becoming more accessible through strategic alliances and mergers. The importance of sustainability is growing, opening up opportunities for low-carbon, circular, and eco-friendly product lines. The need for tailored, on-demand solutions is also driving portfolio diversification and grassroots innovation, particularly in precision industries like advanced manufacturing, aerospace, and defence.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?