Top 50 Companies in High Nickel Ternary Precursor Market Worldwide 2025: Market Research Report (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

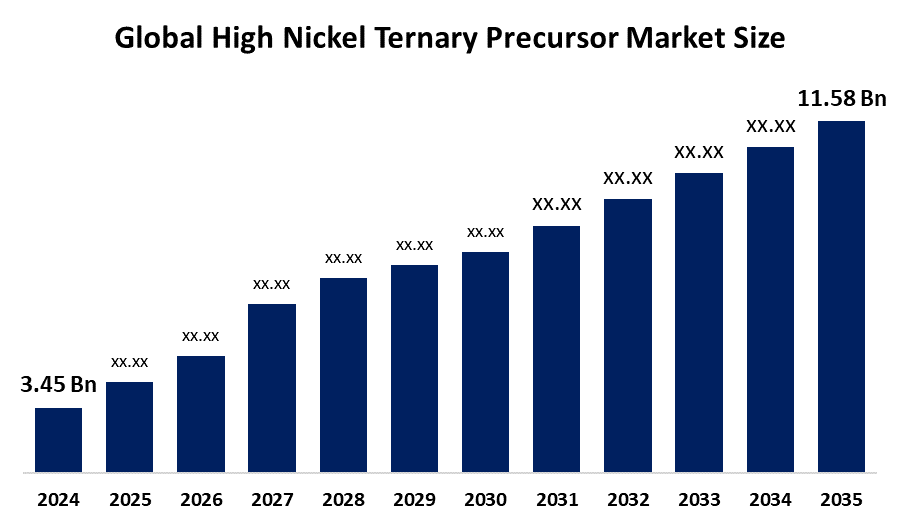

According to a research report published by Spherical Insights & Consulting, The Global High Nickel Ternary Precursor Market Size is projected to Grow from USD 3.45 Billion in 2024 to USD 11.58 Billion by 2035, at a CAGR of 11.64% during the forecast period 2025–2035. The market for high nickel ternary precursors is in greater demand due to the growing demand for energy storage devices and electric cars, which call for batteries with a higher energy density. Longer driving ranges and enhanced performance are made possible by high-nickel precursors like NCM811 and NCA, which are becoming more and more popular in portable devices and automobiles.

Introduction

High-nickel ternary precursors are partially processed materials used to make nickel-rich ternary cathode compounds, such as NiCoMn or NiCoAl, for lithium-ion batteries. The market for high-nickel ternary precursors is growing quickly due to the increased need for cutting-edge lithium-ion battery technologies, particularly in grid energy storage and electric vehicles. EVs can drive farther between charges due to precursors with a better energy density and longer battery lifecycle, such as NCM811 and NCA. One of the main themes is that sustainability businesses are focusing on better recycling of wasted batteries to recover important metals and on procuring nickel, cobalt, and manganese responsibly. Brand reputation and supplier selection are being impacted by Environmental, Social, and Governance factors. The volatility of raw material prices (nickel, cobalt), maintaining thermal stability in high-nickel cathode formulations, and enhancing safety are still obstacles, nevertheless. Notwithstanding these limitations, the worldwide movement towards carbon reduction, regulatory support, and the drive for improved performance all provide strong foundations for future market expansion.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights-Download the Brochure now and dive deeper into the future of the High Nickel Ternary Precursor Market.

High Nickel Ternary Precursor Market Size & Statistics

- The Market Size for High Nickel Ternary Precursor Was Estimated to be worth USD 3.45 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 11.64% between 2025 and 2035.

- The Global High Nickel Ternary Precursor Market Size is anticipated to reach USD 11.58 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the High Nickel Ternary Precursor Market

- Asia Pacific is expected to grow the fastest during the forecast period in the High Nickel Ternary Precursor Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the high nickel ternary precursor market. The market for high nickel ternary precursors is now growing in the Asia Pacific due to its massive EV adoption, robust government support, and established, vertically integrated supply chains. Asia Pacific is predicted to develop at the fastest rate in the high-nickel ternary precursor market. Nations with easy access to nickel raw resources, such as China, Japan, and South Korea, make significant investments in battery research and development and produce substantial quantities of high-nickel cathodes. In the meantime, the region has both capacity and demand pull due to favourable policies and the quick growth of battery gigafactories.

North America is expected to generate the highest demand during the forecast period in the high nickel ternary precursor market. The high nickel ternary precursor market with the quickest rate of growth throughout the study period is anticipated to be in North America. The U.S. and Canada are increasing grid-scale energy storage, building out battery gigafactories, and speeding the adoption of electric vehicles, which is likely to create a significant demand for high-nickel ternary precursors in North America. Demand is also supported by government incentives, more domestic production of raw materials (nickel, cobalt), and stricter emissions and renewable energy standards. Innovation in high-nickel chemistries is also being pushed by partnerships between North American battery material companies and automakers.

Top 10 trends in the High Nickel Ternary Precursor Market

- Shift toward higher nickel content cathodes

- Cobalt reduction & ethical sourcing

- Rise of recycling and closed-loop supply chains

- Government incentives, regulations, and policy support

- Energy storage demand as a driver

- Technological innovations to improve stability and performance

- Scale and capacity expansion

- Supply chain diversification & resilience

- Cost optimization pressures

- Environmental & sustainability constraints

1. Shift toward higher nickel content cathodes

The requirement for batteries with higher energy density, longer driving range, and lower weight, particularly for EVs and grid-storage systems, is driving the trend towards cathodes with a higher nickel content. By increasing the amount of nickel compared to cobalt and manganese, cathodes such as NCM-811 or NCA enhance capacity per unit mass. However, there are drawbacks to a larger nickel concentration, including decreased thermal stability, a higher chance of unfavourable side reactions, mixing of Li and Ni cations, and structural damage such as microcracks during cycling. The viability of high-nickel cathodes depends on improving cycle life, safety, and stability through enhanced material design, coatings, crystal structure management, and electrolyte optimisation.

2. Cobalt reduction & ethical sourcing

The need for reduced-cobalt cathode chemistries has been fuelled by growing awareness of the threats to human rights, the environment, and the supply chain associated with cobalt extraction, particularly in the Democratic Republic of the Congo, where many artisanal mines use child labour and frequently lack safety regulations. At the same time, manufacturers and regulators are being prompted to demand improved traceability and certification of mined commodities due to environmental concerns about habitat destruction, water pollution, and deforestation caused by cobalt mining. Research indicates that, when balanced with increased nickel and structural adjustments, a large decrease in cobalt concentration frequently has only a minor effect on battery capacity or operating voltage.

3. Rise of Recycling and closed-loop supply chains

Recycling lithium-ion batteries has grown in importance as a supply of nickel, cobalt, and lithium feedstock as battery adoption soars, lowering dependency on virgin mining. Critical metals, such as nickel and cobalt, are being recovered from black mass that is created by shredding used batteries using hydrometallurgical and mechanical processes. Manufacturing scrap is gradually being replaced by end-of-life batteries as the primary source of recycling feedstock. Closed-loop approaches, in which extracted metals are recycled back into the production of precursors and cathodes, provide better traceability, purer resources, and less environmental impact per unit.

4. Government incentives, regulations, and policy support

Government policies, rules, and incentives play a major role in determining the high-nickel ternary precursor market. Investment in battery materials is encouraged by policies that support electric mobility and renewable energy, which favour the use of high-nickel precursors. The Inflation Reduction Act in North America influences precursor trade flows and procurement tactics by linking EV tax credits to strict mineral sourcing and processing criteria.

5. Energy storage demand as a driver

The market for high-nickel ternary precursors is being greatly impacted by the rising demand for energy storage systems. The demand for effective energy storage systems has increased as countries switch to renewable energy sources like wind and solar. High-nickel cathode materials, such as NCM811, are preferred for ESS because of their longer cycle life and higher energy density, both of which are critical for effectively storing significant amounts of energy. The importance of high-performance batteries in maintaining grid stability and incorporating renewable energy sources is highlighted by this expansion.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the high nickel ternary precursor market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the High Nickel Ternary Precursor Market

- GEM Co.

- Umicore

- CNGR Corporation

- Brunp Recycling

- Tanaka Chemical Corporation

- Kelong New Energy

- Zhejiang Huayou Cobalt

- Fangyuan

- Greatpower Technology

- Ronbay Technology

- Hunan Changyuan Lico

- Ganfeng Lithium

- Jiana Energy

- Jinchuan Group

- JDA Software

- Others

1. GEM Co.

Headquarters: Shenzhen

Cobalt, nickel, lithium, and rare earth elements are among the vital resources that GEM Co., Ltd., a prominent Chinese corporation, specialises in urban mining and recycling. With recycling industrial parks in places like South Korea, Indonesia, and South Africa, GEM is a global company with its headquarters located in Shenzhen, Guangdong Province. Ternary precursors, cathode materials, cobalt and nickel products, and other tungsten materials are among the company's wide variety of offerings. The Chinese government has designated GEM as a national green factory and a national urban mining demonstration base. GEM, which places a high priority on sustainability, is essential to the circular economy since it offers solutions for recycling batteries, technological trash, and scrap automobiles.

2. Umicore

Headquarters: Brussels, Belgium

The global materials technology and recycling business Umicore is based in Brussels, Belgium. The company specialises in recycling precious and specialty metals as well as developing and producing innovative materials. Recycling, Specialty Materials, Energy & Surface Technologies, and Catalysis are the four business groups that comprise Umicore's operations. The business, which focuses on clean technology and the circular economy, is renowned for its dedication to sustainability and innovation. The automotive, electronics, and energy sectors are just a few of the industries in which Umicore has experience and offers solutions that promote resource efficiency and greener mobility. Umicore has operations at many industrial facilities and research facilities across the world.

3. CNGR Corporation

Headquarters: Guizhou Province, China

One well-known Chinese business that focuses on the study, creation, and manufacturing of innovative battery materials is CNGR Innovative Material Co., Ltd. With a global network of industrial bases, including sites in Ningxiang, Qinzhou, Kaiyang, and Morowali, Indonesia, CNGR is headquartered in Tongren, Guizhou Province, China. The company sells a wide variety of goods, including iron phosphate, cobalt tetroxide, ternary precursors, sodium-ion battery precursors, and other novel energy metal items. CNGR is renowned for its dedication to sustainability and technological innovation, to become a major worldwide supplier of battery solutions and materials.

4. Brunp Recycling

Headquarters: Guangdong Province, China

A well-known Chinese business that specialises in battery recycling and cathode material manufacture is Brunp Recycling, formally known as Guangdong Brunp Recycling Technology Co., Ltd. The corporation, which has its headquarters in Foshan, Guangdong Province, China, runs an extensive recycling system that extracts valuable metals from old batteries, including nickel, cobalt, lithium, and manganese. By turning used batteries into recyclable materials, Brunp Recycling, a division of Contemporary Amperex Technology Co., Ltd., contributes significantly to the circular economy and helps the electric vehicle sector grow sustainably. To improve its recycling skills and satisfy the rising demand for battery materials, the company has set up several production bases in China and abroad, including sites in Hunan, Hubei, and Indonesia.

5. Tanaka Chemical Corporation

Headquarters: Fukui City, Japan

The headquarters of the Japanese business Tanaka Chemical Corporation are located in Fukui City. Positive electrode materials for rechargeable batteries, such as lithium-ion and nickel-metal hydride batteries, are the company's specialty. Their product line includes cobalt-coated nickel hydroxide, nickel hydroxide, and ternary cathode materials. The production of high-performance battery materials depends on Tanaka Chemical Corporation's cutting-edge technology in particle sphering, multi-element co-precipitation, and crystal structure control. Tanaka Chemical Corporation is dedicated to sustainability and concentrates on developing cutting-edge products that support energy and environmental solutions.

Are you ready to discover more about the high nickel ternary precursor market?

The report provides an in-depth analysis of the leading companies operating in the global high nickel ternary precursor market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- GEM Co.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Umicore

- CNGR CORPORATION

- Brunp Recycling

- Tanaka Chemical Corporation

- Kelong New Energy

- Zhejiang Huayou Cobalt

- Fangyuan

- Greatpower Technology

- Ronbay Technology

- Hunan Changyuan Lico

- Ganfeng Lithium

- Jiana Energy

- Jinchuan Group

- JDA Software

- Others

Conclusion

The High Nickel Ternary Precursor Market Size is accelerating, due to its advanced battery technologies are in high demand due to the growing use of renewable energy sources, especially wind power. Technological developments in battery recycling are improving the industry's sustainability. Recycling process innovations are enhancing the recovery of important materials like cobalt and nickel, decreasing reliance on extracted resources, and facilitating the shift to a circular economy. For those involved in the market for high-nickel ternary precursors, these advancements provide substantial prospects.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?