Top 50 Companies in Electronic Warfare Systems Market: Statistics Report Till 2035

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

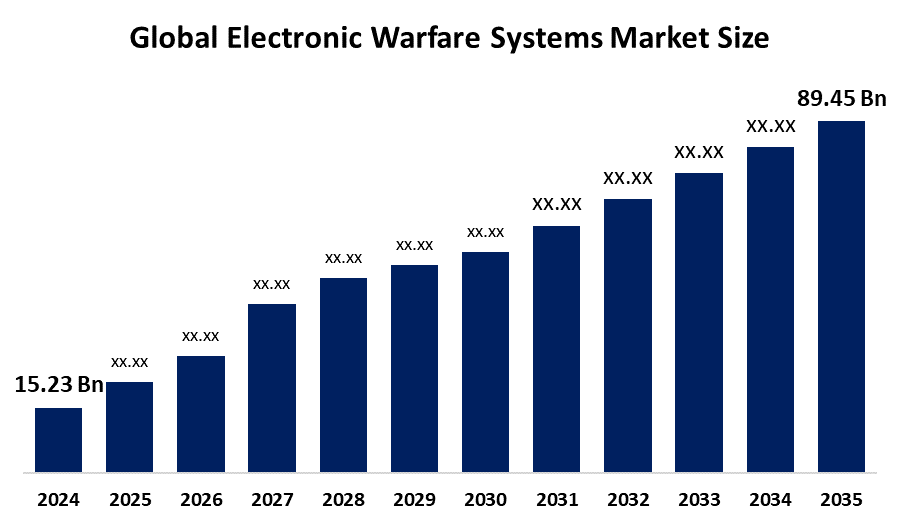

According to a research report published by Spherical Insights & Consulting, The Global Electronic Warfare Systems Market Size is projected To Grow from USD 15.23 Billion in 2024 to USD 89.45 Billion by 2035, at a CAGR of 14.59% during the forecast period 2025–2035. The market is expected to rise as a result of factors like increased military spending and modernization initiatives, as well as the quick development of network-centric and cyberwarfare.

Introduction

The Market Size for Electronic Warfare Systems is expanding primarily due to increased military budgets and modernization initiatives. Electronic warfare systems are now a fundamental part of the air force for electronic countermeasure, navies for electromagnetic protection, and armies to shield communications and intercept enemy transmissions due to the surge in military modernization programs being implemented worldwide. Furthermore, the need for electronic warfare systems to interfere with enemy drones, protect airspace, and identify low RCS targets is being fueled by the quick uptake of unmanned aerial vehicles (UAVs) in surveillance and attacks.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Electronic Warfare Systems Market.

Electronic Warfare Systems Market Size & Statistics

- The Market Size for Electronic Warfare Systems Was Estimated to be worth USD 15.23 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 14.59% between 2025 and 2035.

- The Global Electronic Warfare Systems Market Size is anticipated to reach USD 89.45 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Electronic Warfare Systems Market

- Asia-Pacific is expected to grow the fastest during the forecast period in the Electronic Warfare Systems Market.

Regional growth and demand

Asia-Pacific is expected to grow the fastest during the forecast period in the electronic warfare systems market. By 2034, the Chinese market for electronic warfare systems is expected to grow to a value of USD 6.1 billion.The People's Liberation Army (PLA) is making significant investments in cyber-electromagnetic operations, counterspace EW, and radar jamming in order to compete with Western technologies, which is a key growth driver. Additionally, aggressive military-civil fusion policies, anti-access/area denial (A2/AD) tactics, and space-based EW platforms facilitate rapid development, all of which assist regional market expansion.

North America is expected to generate the highest demand during the forecast period in the electronic warfare systems market. By placing trade restrictions on Chinese electronics and defense imports, including as semiconductor circuit boards and radio frequency modules, the Trump administration increased the cost of EW system components. The imposition of tariffs forced U.S. defense companies to look for partners or domestic suppliers in allies, which raised production costs temporarily. The U.S. EW systems market finally experienced long-term growth and self-sufficiency as a result of the domestic sourcing movement and decreased reliance on hostile countries.

Top 5 trends in the Electronic Warfare Systems Market

Artificial intelligence (AI) and cognitive EW integration

- Counter-drone and directed energy weapon development

- Expansion of cyber-electronic convergence

- Miniaturization and modular design of EW systems

- Growing demand for spectrum dominance and electromagnetic protection

1. AI and Cognitive EW Integration

AI and cognitive technologies are being embedded in EW systems, enabling adaptive and autonomous responses to complex and evolving threats. These advancements allow faster threat analysis, real-time spectrum management, and efficient electronic attack or defense measures, making EW systems more effective in dynamic combat scenarios.

2. Counter-Drone and Directed Energy Weapon Development

The rise of unmanned aerial vehicles (UAVs) has prompted heavy investment in electronic warfare countermeasures such as jamming, spoofing, and directed energy weapons. These solutions provide militaries with tools to detect, disrupt, or destroy enemy drones, strengthening airspace security and providing a technological edge in modern battlefields.

3. Expansion of Cyber-Electronic Convergence

Electronic warfare is increasingly intersecting with cyber operations, with systems now defending against both electronic and network-based attacks. This convergence enhances military capabilities to protect communications, control infrastructure, and critical systems, emphasizing the strategic importance of integrated cyber-electromagnetic operations.

4. Miniaturization and Modular Design of EW Systems

Modern EW platforms are trending toward smaller, lighter, and more modular designs, improving portability and flexibility for deployment on various military assets, including UAVs and satellites. This miniaturization allows for rapid system upgrades and cost-effective integration across different platforms, enhancing force adaptability.

5. Growing Demand for Spectrum Dominance and Electromagnetic Protection

With increasing complexity in EM threats and greater reliance on wireless communications, there is greater emphasis on spectrum management and electromagnetic protection. Advanced EW systems now offer resilient operations, frequency agility, and stealth techniques to ensure battlefield superiority and safeguard military assets from electronic attacks.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the electronic warfare systems market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the Electronic Warfare Systems Market

- Lockheed Martin

- Northrop Grumman

- Raytheon Technologies (RTX)

- L3Harris Technologies

- BAE Systems

- Israel Aerospace Industries (IAI)

- Thales Group

- Saab AB

- Leonardo S.p.A.

- Elbit Systems Ltd.

- Airbus Defence and Space

- General Dynamics

- Boeing

- Cobham (now part of Advent International)

- Rohde & Schwarz

- Mercury Systems

- Indra Sistemas

- Aselsan

- CACI International

- Harris Corporation (now part of L3Harris)

- Teledyne Technologies

- Terma A/S

- UTC Aerospace Systems (now part of Collins Aerospace)

- Bharat Electronics Limited (BEL)

- HENSOLDT.

1. Lockheed Martin Corporation — Bethesda, Maryland, USA

Lockheed Martin is a global leader in electronic warfare systems, leveraging its broad defense portfolio to integrate electronic attack, electronic support, and electronic protection capabilities across air, land, and sea domains. Its technologies ensure spectrum dominance, using open-architecture designs and advanced AI to rapidly detect, disrupt, and neutralize threats. The company’s airborne, naval, and ground electronic warfare solutions—such as the AN/ALQ family and digital receivers—equip modern combat platforms with real-time threat identification and countermeasure deployment. Lockheed Martin continually advances next-generation electronic warfare systems that support joint all-domain operations and cybersecurity, maintaining the technological edge necessary for operational superiority in contested electromagnetic environments

2. BAE Systems plc — Farnborough, United Kingdom

BAE Systems is recognized as a world leader in electronic warfare (EW), delivering end-to-end capabilities for modern defense operations across the electromagnetic spectrum. The company has produced over 12,000 tactical EW systems, protecting major platforms like the F-35 Lightning II and B-2 Spirit stealth bomber. BAE’s solutions focus on maximizing mission survivability and maintaining operational effectiveness against current and emerging threats. Its EW systems provide advanced threat detection, situational awareness, and countermeasure technologies, ensuring superior mission effectiveness. BAE Systems invests in continuous innovation, helping military forces outpace threats and maintain control over complex electromagnetic battlespaces.

3. Northrop Grumman Corporation — Falls Church, Virginia, USA

Northrop Grumman is a prominent provider of electronic warfare systems, delivering integrated solutions for air, land, sea, and space platforms. Its electronic warfare portfolio includes digital radar warning receivers, radio frequency countermeasures, and electronic support and attack suites critical to next-generation fighter jets and naval vessels. The company emphasizes cognitive EW, adaptive signal processing, and open-system architectures, allowing swift upgrades to counter evolving threats. Northrop Grumman’s EW innovations support network-centric operations and enhance the electromagnetic protection of allied forces, positioning it as a strategic partner for governments worldwide seeking resilient electronic defense capabilities.

4. RTX Corporation (Raytheon Technologies) — Arlington, Virginia, USA

RTX (formerly Raytheon Technologies) excels in electronic warfare by integrating advanced sensors, jamming systems, and radar technologies across its Collins Aerospace and Raytheon Intelligence & Space divisions. Known for its cyber-electronic warfare capabilities, RTX supplies a wide variety of customizable EW solutions, including DRFM jammers and wideband multifunction sensors. These systems provide comprehensive situational awareness, electronic attack, and protection for both defensive and offensive missions. RTX’s innovations in spectrum management and electromagnetic maneuverability make it a key supplier of mission-adaptive EW packages for military clients worldwide.

5. L3Harris Technologies, Inc. — Melbourne, Florida, USA

L3Harris Technologies is a major player in electronic warfare systems, specializing in modular, scalable, and interoperable EW solutions for military platforms worldwide. Its electronic warfare technologies feature real-time threat detection, spectrum maneuverability, and self-protection suites for aircraft, ships, and ground vehicles. L3Harris' focus on miniaturization and rapid system upgrades supports multi-domain operations and enhances operational readiness. The company’s advanced EW systems safeguard critical missions by integrating digital processing, cyber resilience, and comprehensive electromagnetic spectrum dominance, addressing contemporary threats and emerging challenges in electronic battlespace

Are you ready to discover more about the electronic warfare systems market?

The report provides an in-depth analysis of the leading companies operating in the global electronic warfare systems market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Lockheed Martin

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Northrop Grumman

- Raytheon Technologies (RTX)

- L3Harris Technologies

- BAE Systems

- Israel Aerospace Industries (IAI)

- Thales Group

- Saab AB

- Leonardo S.p.A.

- Others.

Conclusion

The Electronic Warfare Systems Market Size is experiencing robust growth, driven by the need for advanced electronic protection, attack, and support capabilities across defense operations. Rising military expenditures, increased adoption of AI and cognitive EW, and rapid integration of EW systems into air, land, and naval platforms are fueling innovation and expanding market opportunities. The sector is highly competitive, with major players like Lockheed Martin, Northrop Grumman, RTX, L3Harris, and BAE Systems leading developments in modular, adaptive, and interoperable solutions. As modern conflicts grow in complexity and sophistication, electronic warfare remains critical for operational superiority and national security in the evolving global defense landscape.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?