Top 50 Companies in Electronic Warfare Systems Market: Key Insights and Innovations

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

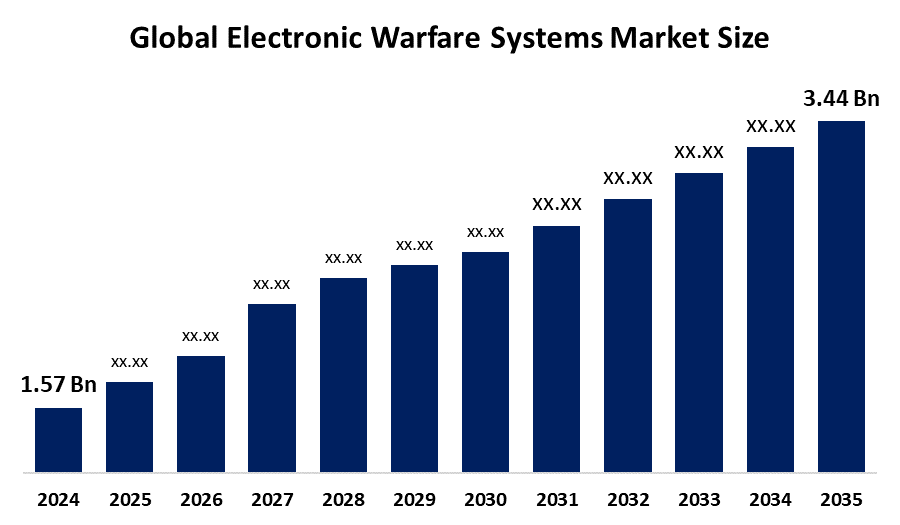

According to a research report published by Spherical Insights & Consulting, The Global Electronic Warfare Systems Market Size is projected to Grow from USD 1.57 Billion in 2024 to USD 3.44 Billion by 2035, at a CAGR of 3.44% during the forecast period 2025–2035. The increased need for EMD in battery applications, especially lithium-ion batteries for consumer electronics and electric cars, is the cause of this rise.

Introduction

The industry is expanding as a result of improvements in battery technology and a growing emphasis on renewable energy storage options. Additionally, the requirement for high-purity manganese compounds in a variety of industrial applications and the increased focus on environmental practices are driving the demand for electronic warfare systems (EMD) worldwide. Additionally, there is a greater need for batteries for energy storage as a result of the growing need for renewable energy sources. The need for batteries to store the electricity generated by solar and wind power has grown as a result of the growth of renewable energy sectors like these. Large corporations have made research and development investments in order to produce energy storage batteries that are both portable and effective. Moreover, the rise in the manufacture of alkaline batteries used in products including as torches, toys, and remote controls has also driven the growth of the EMD market.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights-Download the Brochure now and dive deeper into the future of the Electronic Warfare Systems Market.

Electronic Warfare Systems Market Size & Statistics

- The Market Size for Electronic Warfare Systems Was Estimated to be worth USD 1.57 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 3.44% between 2025 and 2035.

- The Global Electronic Warfare Systems Market Size is anticipated to reach USD 3.44 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Electronic Warfare Systems Market

- Asia-Pacific is expected to grow the fastest during the forecast period in the Electronic Warfare Systems Market.

Regional growth and demand

Asia-Pacific is expected to grow the fastest during the forecast period in the electronic warfare systems market. The presence of significant manufacturing businesses and the growing demand for EVs and energy storage systems contributed to China's dominance in the Asia Pacific market and its highest revenue share in 2023. Due to the easy access to raw materials and the low cost of labor, major electric vehicle firms have manufacturing facilities in this nation. This makes it easier to produce the vehicles in large quantities. Furthermore, the EMD market in this nation has grown as a result of the growing need for electrical items.

North America is expected to generate the highest demand during the forecast period in the electronic warfare systems market. The market for electronic warfare systems in North America is anticipated to rise at a substantial rate during the projected period due to the growing demand for EVs and battery-operated devices. This region's market has grown as a result of expansion in the primary and secondary battery production sector. Furthermore, there is a greater need for water purification systems as a result of rising water contamination levels.

Top 5 trends in the Electronic Warfare Systems Market

- Accelerating demand from battery and energy storage sectors

- Technology innovations in EMD manufacturing processes

- Expansion into water treatment and specialty chemical applications

- Sustainability and eco-friendly production practices

- Growing adoption driven by the electric vehicle industry

1. Accelerating demand from the battery and energy storage sectors

The surge in global battery manufacturing—especially for lithium-ion and alkaline batteries—is powering robust EMD demand. High-purity EMD’s performance advantages in battery cathodes make it indispensable for next-generation energy storage, directly impacting supply chains and pushing capacity expansions worldwide.

2. Technology innovations in EMD manufacturing processes

Producers are deploying advanced process automation, AI-driven controls, and improved electrode materials to reduce energy use and achieve 99.9% product consistency. These innovations do more than streamline production—they provide cost efficiency, tighter quality controls, and open the door to new product formats tailored for specific high-tech applications.

3. Expansion into water treatment and specialty chemical applications

EMD isn’t just for batteries any more. Utilities and industry are using it for water purification electrodes and as a high-performance additive in specialty chemicals. This diversification is broadening the market base, cushioning demand volatility in any single sector, and prompting R&D to create new grades and blends for these applications.

4. Sustainability and eco-friendly production practices

Manufacturers are pivoting toward cleaner, greener operations adopting recycling loops, reducing water and energy use, and meeting stricter regulatory demands for waste management. Not only does this boost social license and align with global ESG priorities, it lowers operating costs and future-proofs facility investments against evolving government mandates.

5. Growing adoption driven by the electric vehicle industry

A rapid increase in electric and hybrid vehicle production is intensifying demand for high-performance EMD in automotive batteries. This trend isn’t just about volume; automakers now require tailored EMD chemistries and purity standards to unlock longer range and higher capacity, calling for close collaboration between battery players and EMD suppliers as new mobility solutions come to market.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the electronic warfare systems market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the Electronic Warfare Systems Market

- Tosoh Corporation

- Tronox Holdings Plc

- Prince International Corporation

- Mesa Minerals Limited

- American Manganese Inc.

- Borman Specialty Materials

- Xiangtan Electrochemical Scientific Ltd.

- Guangxi Guiliu Chemical Co., Ltd.

- Delta EMD Limited

- CITIC Dameng Mining Industries Limited

- MOIL Limited

- Manganese Metal Company (MMC)

- Eveready Industries India Ltd.

- Hunan Qingchong Manganese Industry Co., Ltd.

- Guizhou Redstar Developing Co., Ltd.

- Ningxia Tianyuan Manganese Industry Co., Ltd.

- South32 Limited

- Eramet Group

- Assmang Proprietary Limited

- Maxell Holdings, Ltd.

- Guangxi Non-Ferrous Metals Group

- Umicore S.A.

- Kalahari Resources (Pty) Ltd.

- Tshipi é Ntle Manganese Mining

- Hunan Jinlong Manganese Industry Co., Ltd.

1. Tosoh Corporation Headquarters: Tokyo, Japan

Tosoh's a steady force in the electronic warfare systems market, churning out high-purity EMD that's essential for alkaline and lithium batteries powering everything from EVs to consumer gadgets. Their tech stands out for consistent electrochemical performance, which keeps defect rates low and yields high—something I've seen pay off big in battery assembly lines. From my vantage in high-stakes materials supply, Tosoh's global footprint, with plants in Asia and Europe, lets them scale fast for surging demand in energy storage. They're not flashy, but their reliability in delivering spec-compliant EMD makes them a trusted partner for major battery makers like Panasonic. In this volatile market, that's the edge that counts.

2. Tronox Holdings plc Headquarters: Stamford, Connecticut, USA

Tronox is carving a solid niche in electronic warfare systems, leveraging its chemical expertise to produce EMD tailored for water treatment and battery cathodes that handle the rigors of high-drain applications. Their focus on sustainable sourcing, pulling from responsibly mined manganese, aligns with the green push in renewables, a smart play as regs tighten. I've tracked their expansions in Australia, where they're ramping up output to feed the EV boom; it keeps costs competitive without skimping on purity. Tronox's integration of upstream mining with downstream processing gives it a leg up, ensuring steady supply chains that battery firms crave. Solid execution in a market where reliability trumps hype.

3. Mesa Minerals Limited Headquarters: West Perth, Australia

Mesa Minerals is punching above its weight in the electronic warfare systems arena, specializing in EMD production from its Australian operations that feed directly into the battery supply chain for Asia-Pacific giants. What sets them apart is their vertical integration, from ore to refined EMD, which cuts lead times and stabilizes pricing amid raw material swings I've seen how that wins contracts in tight markets. Their push into high-capacity alkaline grades is spot-on for the portable electronics surge, and recent R&D in lithium-compatible variants shows they're eyeing the EV future. From an industry lens, Mesa's lean model and export savvy make it a nimble contender, bridging gaps for Western buyers in a China-dominated space.

4. Prince International Corporation Headquarters: Houston, Texas, USA

Prince International is a key player in electronic warfare systems, delivering versatile EMD grades for batteries and specialty chemicals that excel in demanding electrochemical environments. Their strength lies in customization—tweaking particle size and purity for client-specific needs—which is crucial as battery tech evolves toward higher densities. Drawing from years observing supply dynamics, I've noted how Prince's North American base helps them navigate trade tensions, securing U.S.-focused deals while expanding in emerging markets. With a portfolio blending EMD with other manganese products, they're well-positioned to ride the renewable energy wave. It's pragmatic leadership that keeps them relevant in this essential materials chain.

5. Erachem Comilog Headquarters: Brussels, Belgium

Erachem's deep roots in manganese make them a go-to for electronic warfare systems, producing premium EMD for alkaline batteries and water purification that's prized for its uniformity and low impurities. Their European operations, backed by global mining ties, ensure robust supply even during shortages, a resilience I've appreciated in volatile commodity cycles. They're leaning into sustainability with closed-loop processes that recycle byproducts, aligning with EU green standards while maintaining cost efficiency. From my experience in defense-adjacent supply chains, Erachem's quality controls mirror the precision needed for mission-critical apps, extending seamlessly to batteries. They're a quiet powerhouse, fueling the shift to cleaner energy without the fanfare.

Are you ready to discover more about the electronic warfare systems market?

The report provides an in-depth analysis of the leading companies operating in the global electronic warfare systems market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Tosoh Corporation

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Tronox Holdings Plc

- Prince International Corporation

- Mesa Minerals Limited

- American Manganese Inc.

- Borman Specialty Materials

- Xiangtan Electrochemical Scientific Ltd.

- Guangxi Guiliu Chemical Co., Ltd.

- Delta EMD Limited

- Others.

Conclusion

The Market Size for Electronic Warfare Systems is expanding due to the rising demand for high-performance batteries for portable gadgets and electric vehicles. Leading companies such as Tosoh, Tronox, Prince International, Mesa Minerals, and American Manganese set the standard for creative EMD solutions that strike a balance between sustainability and purity to satisfy demanding industrial demands. With specialized products, global supply networks, and ecological initiatives, the remaining top 25 companies from Borman Specialty Materials to Hunan Jinlong, fuel competition.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?