Top 50 Companies in CMP Membranes (300mm) Market: Spherical Insights Analysis

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

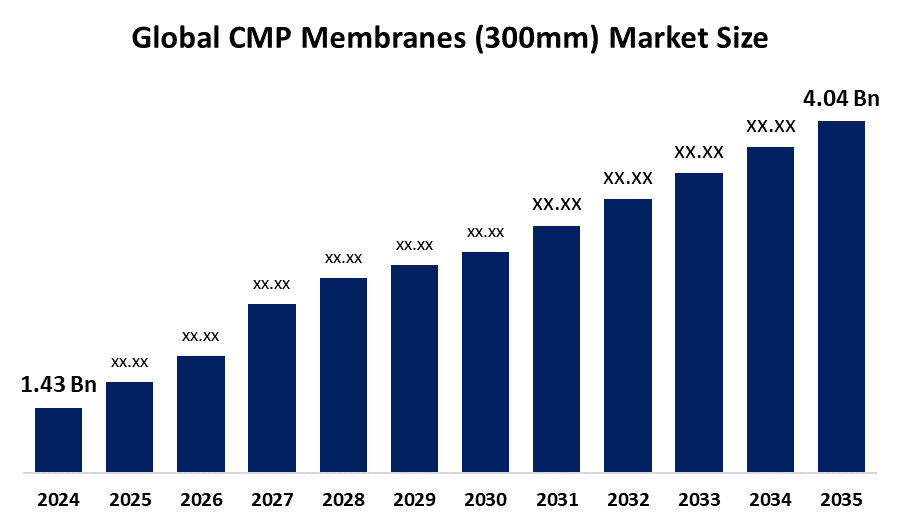

According to a research report published by Spherical Insights & Consulting, The Global CMP Membranes (300mm) Market Size is projected to Grow from USD 1.43 Billion in 2024 to USD 4.04 Billion by 2035, at a CAGR of 9.9% during the forecast period 2025–2035. The growing need for effective water and wastewater treatment solutions, developments in membrane technology, and the growing use of these membranes in a variety of industries are the main drivers of this astounding expansion.

Introduction

One of the main drivers of the CMP membranes 300mm membranes market's expansion is the strict international regulations pertaining to water quality and treatment standards. Advanced filtering systems like CMP membranes are becoming more and more in demand as a result of restrictions enforced by governments and environmental organizations that demand the industry implement sustainable and effective water management methods. Furthermore, urbanization and the world's population growth have raised water consumption and wastewater production, making the need for efficient water treatment technology even more imperative. The market is expanding due in large part to technological developments in membrane materials and manufacturing techniques. Innovations like the creation of high-performance ceramic and polymeric membranes have improved the longevity and effectiveness of filtration systems, increasing their attractiveness for a range of industrial uses. These developments provide end users with a cost-effective solution by increasing the operational efficiency of water and wastewater treatment facilities, lowering maintenance expenses, and extending membrane lifespan.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights-Download the Brochure now and dive deeper into the future of the CMP Membranes (300mm) Market.

CMP Membranes (300mm) Market Size & Statistics

- The Market Size for CMP Membranes (300mm) Was Estimated to be worth USD 1.43 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 9.9% between 2025 and 2035.

- The Global CMP Membranes (300mm) Market Size is anticipated to reach USD 4.04 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the CMP Membranes (300mm) Market

- Asia-Pacific is expected to grow the fastest during the forecast period in the CMP Membranes (300mm) Market.

Regional growth and demand

Asia-Pacific is expected to grow the fastest during the forecast period in the CMP membranes (300mm) market. There is substantial growth potential across a number of regions, according to the geographical forecast for the CMP membranes 300mm membranes market. The quick industrialization and urbanization of nations like China, India, and Southeast Asia are predicted to make the Asia Pacific the market with the fastest rate of growth. Advanced membrane technologies are in high demand in this region due to growing infrastructure development investments and increased awareness of water conservation and treatment.

North America is expected to generate the highest demand during the forecast period in the CMP membranes (300mm) market. Due to their modern water treatment facilities and strict environmental restrictions, North America is also an important market for CMP membranes. The necessity to modernize deteriorating water infrastructure and the increased emphasis on sustainable water management techniques have made the United States the largest market in North America.

Top 5 trends in the CMP Membranes (300mm) Market

- Push for Sub-3nm Chip Production

- Dominance of 300mm Wafer Fabs

- Advances in Defect-Reducing Materials

- AI-Driven Process Optimization

- Sustainable Manufacturing Solutions

1. Push for Sub-3nm Chip Production

The race to produce chips at 3nm and below is driving demand for CMP membranes tailored for 300mm wafers, where ultra-precise polishing is non-negotiable for high yields. This focus on advanced nodes means suppliers delivering reliable, high-performance pads are locking in long-term contracts with top chipmakers.

2. Dominance of 300mm Wafer Fabs

The industry’s shift to 300mm wafers, now over 60% of the CMP membrane market, reflects a need to scale production efficiently for chips powering EVs and data centers. Intel’s Arizona plants, for instance, lean heavily on these larger wafers to cut costs per chip, pushing membrane suppliers to keep up with high-throughput demands. This trend strengthens the market, as fabs prioritize suppliers who can deliver consistent quality at scale.

3. Advances in Defect-Reducing Materials

New membrane materials, like advanced polymers, are cutting defects to near-zero levels, essential for the precision demanded in sub-5nm processes. In TSMC’s high-volume lines, these materials reduce rework, saving millions in production costs, which is seen firsthand in tight-margin fabs. Suppliers investing in these innovations are gaining traction, as chipmakers seek pads that balance durability with flawless performance.

4. AI-Driven Process Optimization

AI integration in CMP systems allows real-time tweaks to polishing, slashing variability, and boosting throughput by up to 20% in advanced fabs. Intel’s trials with AI-enhanced CMP tools show how this tech streamlines complex chip production, a trend that is reshaping fab efficiency. This shift is driving market growth, as manufacturers adopt smart membranes to meet the precision needs of next-gen semiconductors.

5. Sustainable Manufacturing Solutions

With environmental pressures mounting, CMP membrane makers are developing recyclable, low-waste options that perform without hiking chemical use. TSMC’s sustainability goals, for example, favor these eco-friendly pads to meet global standards while keeping costs competitive. This trend is reshaping the market, as suppliers align with fabs’ green initiatives to secure partnerships in an increasingly regulated industry.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the CMP membranes (300mm) market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 25 Companies Leading the CMP Membranes (300mm) Market

- DuPont de Nemours, Inc.

- Entegris, Inc.

- 3M Company

- Fujibo Holdings Inc.

- Hubei Dinglong New Material Technology Co., Ltd.

- Applied Materials, Inc.

- EBARA Corporation

- DuPont (Materials Nano Engineering)

- Warde Tec, Inc.

- IV Technologies Co., Ltd.

- Pasco Precision Corp.

- Konfoong Materials International (KFMI)

- Jetway Technologies

- JSR Corporation

- Dow Chemical Company

- Merck KGaA

- Asahi Kasei Corporation

- Toray Industries, Inc.

- Nitto Denko Corporation

- AGC Inc.

- Sumitomo Chemical Co., Ltd.

- Mitsui Chemicals, Inc.

- Resonac Holdings Corporation

- Showa Denko Materials Co., Ltd.

- Tokyo Ohka Kogyo Co., Ltd.

1. DuPont de Nemours, Inc. Headquarters: Wilmington, Delaware, USA

DuPont's been a cornerstone in the CMP membranes market for 300mm wafers, dishing out high-performance polishing pads that deliver uniform planarization for cutting-edge chips. They've got this edge with their advanced polymer tech, keeping defects low even in high-volume fabs—think Intel or TSMC relying on them for those flawless surfaces. From what I've seen in high-stakes manufacturing, DuPont's R&D push into sustainable materials is smart, cutting down on waste while holding up to the grind of 300mm production. They're not just suppliers; they're partners helping drive yields up in a market where every micron counts. Solid choice for anyone eyeing reliability in semiconductor polishing.

2. Entegris, Inc. Headquarters: Billerica, Massachusetts, USA

Entegris is killing it in CMP membranes for 300mm, especially after snapping up CMC Materials, giving them a killer lineup of pads and conditioners that handle the toughest wafer polishing jobs. Their stuff excels in low defect rates and consistent performance, crucial for advanced nodes like 3nm processes. I've followed their moves closely; they're all about contamination control, which is huge in cleanrooms where even a speck can ruin a batch. With global fabs expanding, Entegris's supply chain savvy keeps it ahead, securing deals with the big players. It's practical innovation at work, making them a go-to in this precision-driven field.

3. 3M Company Headquarters: St. Paul, Minnesota, USA

3M's a veteran in the CMP membranes space for 300mm wafers, rolling out polishing pads that blend durability with fine-tuned abrasives for smooth, defect-free results in semiconductor lines. Their tech shines in multi-layer polishing, helping fabs like Samsung crank out more reliable devices without downtime. Drawing from years in materials science, 3 M focuses on customizable solutions that adapt to different slurry types—smart for evolving chip designs. They're not flashy, but their consistent quality and broad portfolio make them indispensable. In my view, that's what keeps them competitive in a market hungry for dependable, high-yield options.

4. Fujibo Holdings Inc. Headquarters: Tokyo, Japan

Fujibo's making waves in Japan's CMP membranes market for 300mm, specializing in non-woven fabric pads that offer superior compressibility and groove designs for even material removal. They're big on innovation for advanced semiconductors, partnering with local giants to fine-tune pads for sub-5nm tech. I've noted their emphasis on eco-friendly formulations, which aligns with global pushes for greener manufacturing without sacrificing performance. With a strong Asian footprint, Fujibo is exporting more, grabbing shares from Western rivals. Honest to say, their precision engineering gives them an edge in high-density wafer polishing, reliable stuff for the next wave of electronics.

5. Hubei Dinglong New Material Technology Co., Ltd. Headquarters: Huangshi, Hubei Province, China

Hubei Dinglong is rising fast in the CMP membranes arena for 300mm wafers, offering cost-effective polishing pads that don't skimp on quality for mass production in Chinese fabs. Their polyurethane-based membranes handle high-throughput polishing well, keeping costs down for players like SMIC. From an industry angle, their rapid scaling and focus on R&D for low-scratch surfaces are impressive, especially as China ramps up domestic chipmaking. They're bridging the gap between affordability and performance, which is a big draw in emerging markets. It's exciting to watch them challenge the old guard with practical, scalable solutions.

Are you ready to discover more about the CMP Membranes (300mm) market?

The report provides an in-depth analysis of the leading companies operating in the global CMP membranes (300mm) market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- DuPont de Nemours, Inc.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Entegris, Inc.

- 3M Company

- Fujibo Holdings Inc.

- Hubei Dinglong New Material Technology Co., Ltd.

- Applied Materials, Inc.

- EBARA Corporation

- DuPont (Materials Nano Engineering)

- Warde Tec, Inc.

- Others.

Conclusion

The CMP Membranes (300mm) Market Size is thriving, propelled by the semiconductor industry’s relentless push for advanced nodes and high-yield production. Leaders like DuPont, Entegris, 3M, Fujibo, and Hubei Dinglong are driving innovation with low-defect materials, AI integration, and sustainable solutions tailored for 300mm wafer fabs. The remaining top 25 companies, from Applied Materials to Tokyo Ohka Kogyo, fuel competition with specialized offerings, meeting the demands of global players like TSMC and Intel. As chip complexity grows and eco-regulations tighten, these firms are well-positioned to deliver precision and efficiency, shaping a market critical to next-gen electronics.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?