Top 30 Companies in Global Wedding Loans Market 2025: Strategic Overview And Future Trends (2024–2035)

RELEASE DATE: Oct 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

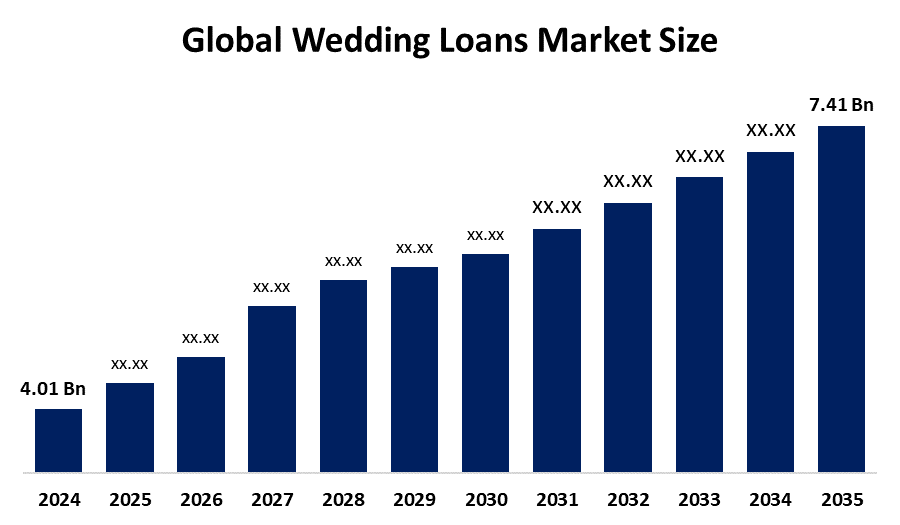

According to a research report published by Spherical Insights & Consulting, The Global Wedding Loans Market Size is projected to Grow from USD 4.01 billion in 2024 to USD 7.41 billion by 2035, at a CAGR of 5.74% during the forecast period 2025–2035. The global wedding loan market is inspired by increasing marriage costs, increasing influence of social media, developing consumer preferences and digitization of borrowing services. As marriages become more elaborate and personal, couples are turning to special loans to fund their "dream weddings" without reducing their savings.

Introduction

The Global Wedding Loan Market Size provides a particular form of unprotected personal financing, providing funds for marital costs and rising weddings, the popularity of ceremonies in distant places, and priority of young couples to finance their own nuptials. This market, which is looking at continuous expansion, is served by a mixture of traditional institutions, such as HDFC Bank, Discover Bank and American Express, Light stream, Landing Club, Sophie, Upstart, Prosart Marketplace and Bazzer Fintek witnh digital-fintech lenders. North America is currently dominating this section due to high expenditure associated with weddings and widespread acceptance of loan as a financial equipment. However, the Asia-Pacific region, especially India and China, estimated to achieve the fastest growth in the coming years, inspired by a huge consumer base, increased disposable income, and increasing desire for extraordinary function.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Global Wedding Loans Market.

Global Wedding Loans Market Size & Statistics

- The Market Size for Global Wedding Loans Market Was Estimated to be worth USD 4.01 Billion in 2024.

- The Market Size is going to expand at a CAGR of 5.74% between 2025 and 2035.

- The Global Wedding Loans Market Size is anticipated to reach USD 7.41 Billion by 2035.

- North America is estimated to hold the largest share of the market during the forecast period in the Global Wedding Loans Market

- Asia Pacific is expected to grow the fastest during the forecast period in the Global Wedding Loans Market.

Regional growth and demand

Asia Pacific is expected to grow the fastest during the forecast period in the Global Wedding Loans Market. Asia Pacific is projected to grow fastest due to market lenders' convenience for wedding loans in the area is increased as a result of fast and customized solutions. The couple now has an easy time receiving the money required to give them the funds and conditions flexibility to give them their ideal weddings. Stretch Loan has gained popularity as an alternative to traditional wedding finance as they provide a different view on the old issue of this age that can be adapted to the different financial objectives and mentality.

North America is estimated to hold the largest share of the market during the forecast period in the Global Wedding Loans Market. North America is projected to hold the largest share due to the wedding expenses are running the North American wedding loan market and intensifying the will of many couples for an ideal wedding. The cost of marriage increases as a large percentage of couple in North America are looking for brides and appropriate places for the ceremony. For example, the number of North Americans seeking loans to cover these fees has increased significantly.

Top 10 Trends in the Wedding Loans Market

- Digital lending platforms and simplified procedures

- Individual and flexible debt product

- Increase in demand from millennials and Gen Z

- Specialization for destination and theme weddings

- Strategic participation with sellers

- Extension in Asia-Pacific Region

- Rise of small and moderate debt

- Pay attention to moral and responsible borrowings

- Diversification towards secure credit

- Increasing interest in fixed-per loans

1. Digital Lending Platforms and Simplified Procedures

Digital lending platforms simplify the loan application and approval process by automatic evaluation, and fund disbursement through Digital Lending Platform Documentation, Credit Evaluation, and Fund Disbursement, transform traditional paperwork and branch tour with 24/7 with a spontaneous, online experience. This simplification greatly benefits borrowers through increased facilities, speed and financial inclusion, while enabled lenders to achieve more operational efficiency, comprehensive market access and increased risk evaluation. Addressing important concerns such as data secrecy and safety, biometric security, strict regulatory monitoring, and potentially adopting new technologies such as biometric safety and potentially blockchain continue to develop with trends.

2. Individual and flexible debt product

For the wedding loan market, individual and flexible loan products provide a collateral-free, unsafe option with adaptable repayment programs and tenure. Unlike traditional loans, they allow borrowers to tailor the loan amount and repayment scheme for their specific budget and needs, providing financial freedom for various wedding expenses such as school, catering and dress. Digital applications ensure quick approval and dispersal of money, often in a few clicks. This flexibility enables joints to manage its cash flow and spread costs over time, preserving its savings for other future goals. However, interest rates may vary depending on factors such as credit scores and income of the borrower. Finally, these flexible products provide a convenient, stress-free way to fund a dream marriage without compromising on financial security.

3. Increase in demand from millennials and Gen Z

The increasing demand for marriage loans from millennium and general Z is inspired by their parents' desire for financial freedom, which combines with the influence of social media, which normalizes and encourages the "Instagramable" wedding ceremony. Excessive cost associated with personal and destination weddings makes only it difficult for young couples to rely on savings, pushing them to financing options such as personal debt and "Now marry, pay later" (MNPL) plans. Digital lending platform fulfills this technique-loving demographic by providing quick and convenient access to money with minimal paperwork, uniftmning the financing of marriage as a major trend in the digital lending market. Despite the convenience, this trend increases concerns among financial experts about young couples, which potentially burns its long -term financial stability for single -day phenomenon.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Global Wedding Loans Market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 15 Companies Leading the Global Wedding Loans Market

- Light Stream

- Lending Club

- Discover Personal Loans

- Earnest

- SunTrust

- Prosper Marketplace

- Oportun

- Finance of America

- Marcus by Goldman Sachs

- American Express

- SoFi

- Upstart

- Avant

- HDFC Bank Ltd

- ICICI Bank

- Others

1. Light Stream

Headquarters: San Diego, California

Light stream is the national online lending division of the Trust Financial Corporation, which specializes in unsafe, fixed-per personal loans-known as "anything"-which ranges from USD 5,000 to 100,000 for consumers with good-to-un-credited credits. The platform is designed for a simple, faster and virtually paperless digital experience, which offers competitive rates, no fees or pre -payment penalty, and the house improvement, auto procurement, loan consolidation, and more directly to a borrower's bank account for a day -to -day financing.

2. Lending Club

Headquarters: San Francisco, California

Landing club, established in 2006, is a publicly traded Digital Marketplace Bank headquartered in San Francisco, California. Initially known as a colleague-to-pier (P2P) borrowing platform, it fell away from this model in 2020, which was after Radius Bank received for USD 185 million. Lending Club is now operated as a regulated online bank and offers a series of financial products and services, including individual loans (up to USD 60,000), auto refinance loans, patients and education finance, and product deposits such as high-ups, saving and testing accounts. It serves individual consumers and small businesses, who partnership with market investors such as banks, credit unions and asset managers to distribute their debt products. The company mainly generates revenue through the origin fee charged to borrowers and a service fee from investors.

3. Discover Personal Loans

Headquarters: Illinois 60015, U.S.A.

Discover Individual Debt is an important offering from Discover Financial Services, a major US financial services company is primarily recognized for its Discover card. The individual loan product offers a fixed-rate, unprotected installment loan, ranging from USD 2,500 to USD 40,000, with the terms of repayment usually extending 36 to 84 months (three to seven years). A significant advantage is "no fee." The policy, which means no generation fee, application fee, or pre -payment penalty, although a late fee may apply. The discover is often favored by borrowers with a good-to-interesting credit, which want to consolidate high-onion loans, fund home reforms, or cover major expenses, as the company offers options for direct payments to creditors for loan consolidation.

4. Earnest

Headquarters: San Francisco, California

Bayana is a San Fintech lender at San Francisco, acquired by the Naviant, which specializes in the funding of tertiary education, mainly offering private student loans and re -re -refinance. Established in 2013, the company is known for its "merit-based lending" approach, which is seen beyond the traditional credit score to evaluate the full financial profile of an applicant, including education, employment, income capacity, expenditure and savings habits, including habits, to offer competitive rates and flexible repay options with no hidden fees.

5. SunTrust

Headquarters: Charlotte, North Carolina

SunTrust Bank was a major American commercial bank, with the history of headquarters in 1891 at Atlanta, Georgia. It offered a full range of financial services including personal banking, commercial banking, money management and hostage, which was mainly serving the South -East United States. The company was present as an independent unit on December 6, 2019, when it completed an all-stock "merger" with the BB & T Corporation, a transaction was approximately USD 66 billion. The joint institution, which became the sixth largest American commercial bank, was re -designed as Trust Financial Corporation, was located in Charlotte, North Carolina with its new headquarters.

Are you ready to discover more about the Global Wedding Loans Market?

The report provides an in-depth analysis of the leading companies operating in the global wedding loans market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Light Stream

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Lending Club

- Discover Personal Loans

- Earnest

- SunTrust

- Prosper Marketplace

- Oportun

- Finance of America

- Marcus by Goldman Sachs

- American Express

- SoFi

- Upstart

- Avant

- HDFC Bank Ltd

- ICICI Bank

- Others

Conclusion

The wedding debt market has been expanding globally due to factors such as the cost of marriage, the wide and the popularity of destination weddings and the strong impact of social media on younger generations. Consumers, especially millennials and general jade, are rapidly financed by their parents to gain financial freedom and to create personal experiences, even some financial experts take precautions about the risk of long-term loans. The market is served by both traditional banks and increasing number of digital lenders, in which platforms offer accelerated, online approval and adaptable debt products. While North America currently leads the market in revenue, the Asia-Pacific region is estimated to experience the fastest development due to a large consumer base and rising disposable income. However, the expansion of the market is often somewhat angry with high interest rates associated with individual loans. Some of the top companies operating in this space include Lightstream, lending club, Trive Personal Loan, HDFC Bank and Bajaj Finserv.

Browse Related Reports:

Global Data Center Substation Market Size To Exceed USD 20.55 Billion by 2035 | CAGR of 7.89% : Market Study Report

Global Ethyl Levulinate Market Size To Exceed USD 18.2 Million by 2035 | CAGR of 4.1% : Market Study Report

Global Isaac Mertens Syndrome Market Size To Exceed USD 573.31 Million by 2035 CAGR 4.72%: Market Study Report

Global Music Tourism Market Size To Exceed USD 656372.2 Million by 2035 | CAGR of 19.01% : Market Study Report

Global Music Tourism Market Size To Exceed USD 656372.2 Million by 2035 | CAGR of 19.01% : Market Study Report

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?