Top 25 Global Online Life Insurance Companies (2025–2035): Spherical Insights Analysis

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

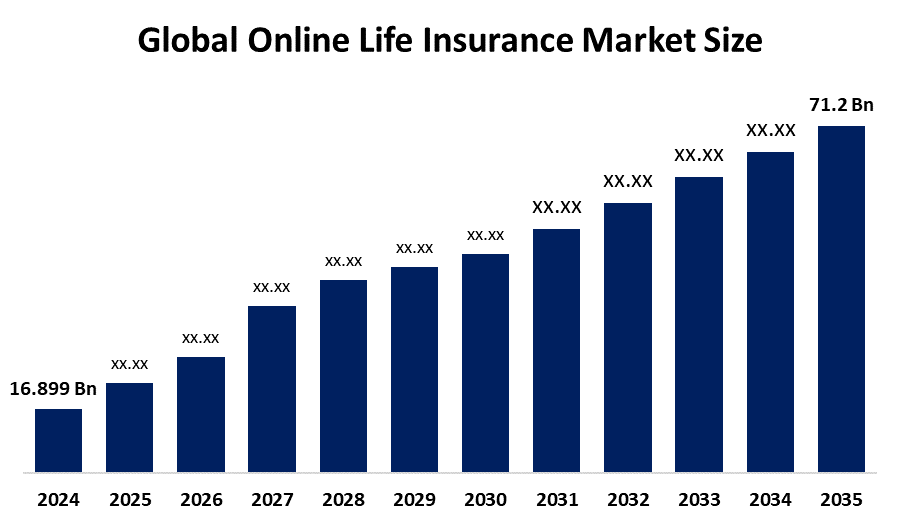

According to a research report published by Spherical Insights & Consulting, The Global Online Life Insurance Market Size is projected to Grow from USD 16.899 Billion in 2024 to USD 71.2 Billion by 2035, at a CAGR of 13.97% during the forecast period 2025–2035. The market for online life insurance is growing demand due to growing digital adoption, heightened financial protection awareness, low-cost distribution for insurers, AI-driven underwriting, favorable government policies, and the rise of insurtech startups providing quick, personalized, and convenient digital insurance solutions.

Introduction

The virtual environment is described in the online Life Insurance Market in which life insurance policies are investigated, on the contrary, purchased, purchased, and controlled by web-based platforms, such as the insurer's website, mobile phone apps and aggregators. This allows consumers to reach life insurance services without direct interaction, convenience, speed and often low prices. The online market for life insurance is expanding at a rapid pace with the widespread use of digital technology and increased access to internet and mobile phones worldwide. For consumers, it becomes easy to compare quickly between various life insurance pollution through online platforms, allowing them to make better suggested decisions. In addition, regulatory changes in countries are motivating the development of online life insurance market for the purpose of facilitating financial inclusion and protection of consumer interests. Regulators and governments are actively advocating the use of digital channels, which is as a means of bringing insurance offerings for maximum population. This initiative is forcing insurers to think creatively and improve their web offerings, so that they can rapidly keep with the digital market.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Online Life Insurance Market.

Online Life Insurance Market Size & Statistics

- The Market Size for Online Life Insurance Was estimated to be worth USD 16.899 Billion in 2024.

- The Market is going to Expand at a CAGR of 13.97% between 2025 and 2035.

- The Global Online Life Insurance Market Size is anticipated to reach USD 71.2 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Online Life Insurance Market

- Asia Pacific is expected to grow the fastest during the forecast period in the Online Life Insurance Market.

Regional growth and demand

Asia pacific America is expected to grow the fastest during the forecast period in the Online Life Insurance market.

Most APAC nations have experienced a growth in internet and smartphone penetration, particularly in urban and semi-urban regions. Mobile-first consumers in nations such as India, China, and Indonesia are increasingly at ease using digital channels for financial products, driving online insurance uptake growth. Governments in the region, such as India and China, are actively encouraging digital financial services and insurance penetration. Initiatives such as India's Jan Dhan-Aadhaar-Mobile (JAM) trinity and Digital India have provided a solid foundation for the distribution of insurance online, particularly in remote geographies.

North America is expected to generate the highest demand during the forecast period in the Online Life Insurance market.

North America has top insurtech companies such as Haven Life and Ethos that are focused on online life insurance. These players spur innovation through artificial intelligence-based underwriting, real-time quotes, and easy-to-use apps, making digital insurance affordable, quick, and desirable to a technology-savvy population. Regulators in the U.S. and Canada have kept pace with digital trends by permitting e-signatures, online disclosure, and electronic policy documents. These reforms provide a safe and compliant framework for insurers to conduct digital business, driving growth in online distribution of insurance.

Top 10 Trends in the Online Life Insurance Market

- AI-Driven Underwriting and Risk Assessment

- Embedded Insurance

- Digital Transformation and Customer Experience

- Personalization of Policies

- Telematics and Wearable Technology

- Blockchain for Security and Transparency

- Strategic Partnerships

- Advanced Analytics and Data Utilization

- Focus on Millennial and Gen Z Consumers

- Cloud-Based Systems

1. AI-Driven Underwriting and Risk Assessment

The use of artificial intelligence and machine learning is revolutionizing how insurers assess risk. By analyzing vast datasets, AI models can provide more accurate risk assessments and personalized pricing, leading to faster policy issuance and lower operational costs.

2. Embedded Insurance

This trend involves integrating life insurance coverage directly into the purchase of another product or service, such as a mortgage or a car. This approach makes securing coverage more convenient for consumers and allows insurers to reach new markets through non-traditional channels.

3. Digital Transformation and Customer Experience

Insurers are focusing on creating a seamless, customer-centric experience through digital platforms. This includes mobile apps, self-service portals, and AI-driven chatbots that allow policyholders to manage their accounts, make payments, and file claims with ease.

4. Personalization of Policies

With the help of data analytics and AI, insurers are moving away from a one-size-fits-all approach to offer highly customized policies. This allows them to tailor products to individual needs, preferences, and lifestyles.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the online life insurance market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 10 Companies Leading the Online Life Insurance Market

- MetLife

- Prudential Financial

- AXA

- Allianz

- China Life Insurance

- Berkshire Hathaway

- Manulife Financial

- AIA Group

- Zurich Insurance Group

- Generali Group

- Others

1. MetLife

Headquarters: U.S.

The company leverages AI and data analytics to forecast service requests. It uses AI with text analysis and visualization technologies to allow its case managers to review and reevaluate claims at a faster rate

2. Prudential plc

Headquarters: U.S.

Prudential plc focuses on life insurance, health insurance, and asset management in Asian and African growth markets, aiming to provide simple, accessible financial and health solutions. Prudential Financial, Inc., a separate but related entity, offers similar products in the U.S. and other regions, with a strong digital transformation initiative to improve customer experience. While Prudential Financial has a U.S.-focused digital strategy, prudential plc targets high-growth markets in Asia and Africa with a mission to be a trusted partner for long-term protection and savings.

3. AXA

Headquarters: France

Axa S.A. is a French multinational insurance corporation headquartered in the 8th arrondissement of Paris. It also provides investment management and other financial services via its subsidiaries. As of 2024, it is the fourth largest financial services company by revenue in France, and the 8th largest French company.

4. Allianz

Headquarters: Germany

The parent company, Allianz SE, is headquartered in Munich. Allianz has more than 100 million customers worldwide and its services include property and casualty insurance, life and health insurance and asset management.

Are you ready to discover more about the Online Life Insurance market?

The report provides an in-depth analysis of the leading companies operating in the global Online Life Insurance market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- MetLife

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Prudential Financial

- AXA

- Allianz

- China Life Insurance

- Berkshire Hathaway

- Manulife Financial

- AIA Group

- Zurich Insurance Group

- Generali Group

- Others

Conclusion

Online Life Insurance Market is experiencing significant expansion, inspired by increasing global adoption of digital technology and increasing preference for cost -effective financial products. Changes towards online platforms allow consumers to easily compare policies and make informed decisions, while regulatory initiatives in many countries are actively promoting digital financial services to improve insurance entry and consumer access. This growth is also caused by the development of innovative solutions by a new generation of technology consumers and prominent players in the market. While North America is a major center of demand and innovation, the Asia is expected to be the fastest growing market in the Pacific region and the fastest growing market due to rapid internet and smartphones and assistant government policies.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?