Top 25 Companies in Air Defense System Market in the World in 2025: Market Research Report (2024 –2035)

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

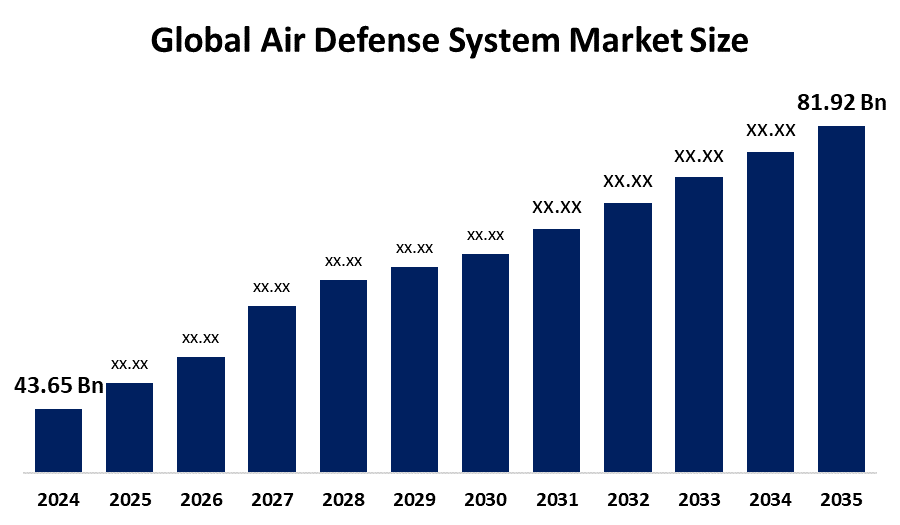

According to a research report published by Spherical Insights & Consulting, The Global Air Defense System Market Size is projected To Grow from USD 43.65 Billion in 2024 to USD 81.92 Billion by 2035, at a CAGR of 5.27 % during the forecast period 2025–2035. The Air Defense System market offers future opportunities through advancements in AI-driven threat detection, integration of hypersonic defense, increasing defense budgets, and rising demand for multi-layered protection systems across global military and homeland security sectors.

Introduction

The Air Defense System Market Size is experiencing significant growth, driven by rising geopolitical tensions, evolving aerial threats, and rapid advancements in defense technologies. These systems are designed to detect, track, intercept, and neutralize hostile targets, including aircraft, drones, missiles, and other airborne threats, ensuring national security and strategic defense capabilities. Increasing investments in next-generation technologies such as AI, radar modernization, and integrated command systems are transforming operational efficiency and response times. Furthermore, the rising adoption of mobile and network-centric air defense solutions by armed forces worldwide highlights the market’s critical role in strengthening global and regional defense infrastructures.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Air Defense System market.

Air Defense System Market Size & Statistics

- The Market Size for Air Defense System Was Estimated to be Worth USD 43.65 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 5.27 % Between 2025 and 2035.

- The Global Air Defense System Market Size is Anticipated to Reach USD 81.92 Billion by 2035.

- Asia Pacific is expected to generate the highest demand during the forecast period in the Air Defense System Market.

- North America is expected to grow the fastest during the forecast period in the Air Defense System Market.

Regional growth and demand

North America is expected to grow the fastest during the forecast period in the Air Defense System market. North America is experiencing substantial growth driven by modernization initiatives and major investments in advanced technologies by leading aerospace firms. In February 2024, Canada's acquisition of Saab's RBS 70 NG short-range air defense system stands out as a significant instance. This contract, valued at approximately CAD 227 million (USD 168 million), aims to enhance Canada's aerial defense capabilities through firing units, missiles, transport vehicles, training, and support, while assisting in its NATO commitments in Latvia. Furthermore, in April 2022, the U.S. government proposed allocating approximately USD 900 million for acquiring a new missile defense system for Guam.

Asia Pacific is expected to generate the highest demand during the forecast period in the Air Defense System market. This growth is driven by rising geopolitical conflicts, land disagreements, and significant increases in defense spending. The ongoing conflict between India and Pakistan significantly fuels this aspiration. Employing advanced air defense systems such as the S-400 Triumf, Akash, and Spyder, India effectively intercepted more than 50 swarm drones during "Operation Sindoor" in May 2025, reacting to Pakistani drone and missile attacks. This mission showcased India's commitment to enhancing its air defense capabilities. Simultaneously, regional tensions have risen because of China's support for Pakistan. Worries have emerged regarding Pakistan's employment of Chinese-manufactured HQ-9 air defense systems and J-10C fighter jets in recent confrontations with India

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Air Defense System market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 5 Trends in Air Defense System Market

1. AI and Automation Integration

Artificial Intelligence (AI) and automation are transforming air defense systems by enabling faster threat detection, accurate target identification, and real-time response. AI-powered algorithms analyze massive data from radars, sensors, and satellites to detect and prioritize threats, reducing human error and decision time. Automation supports seamless coordination between command centers and weapon systems for faster neutralization of high-speed aerial threats such as drones and hypersonic missiles. These advancements are making air defense networks more intelligent, reliable, and adaptive. Countries investing in AI-driven defense systems are gaining significant strategic advantages, ensuring superior situational awareness and operational readiness in modern combat environments.

2. Rise of Multi-Layered Defense Systems

The shift towards multi-layered air defense systems is a major trend, driven by the need to counter a wide range of aerial threats simultaneously. These systems integrate short, medium, and long-range defense layers, providing comprehensive protection for military and civilian assets. By combining radar networks, surface-to-air missile systems, and command-control platforms, multi-layered solutions ensure better interception accuracy and redundancy. They are particularly effective against saturation attacks involving drones, cruise missiles, and aircraft. Defense forces globally are investing heavily in such systems to enhance resilience, improve coverage, and ensure superior defense capabilities in increasingly complex and unpredictable conflict scenarios.

3. Increased Demand for Counter-Drone Solutions

The proliferation of drones for surveillance, reconnaissance, and even offensive operations has created a surge in demand for counter-drone technologies. Air defense systems are evolving to include advanced detection methods such as radio frequency analysis, radar tracking, and electro-optical systems. Counter-drone solutions employ methods like jamming, directed energy weapons, and interceptor drones to neutralize threats effectively. This trend is particularly relevant for protecting critical infrastructure, military installations, and urban areas. Governments and defense organizations worldwide are prioritizing investments in these technologies to address the growing risks posed by inexpensive, agile, and increasingly autonomous unmanned aerial vehicles.

4. Mobile and Modular Systems

Mobility and modularity are becoming essential in modern air defense systems to enhance operational flexibility and rapid deployment. Mobile systems can be quickly transported and set up in conflict zones, ensuring real-time defense in dynamic battlefield environments. Modular designs allow easy integration of new technologies, upgrades, and scalability based on mission requirements. This adaptability supports diverse operational scenarios, from protecting fixed installations to providing frontline air defense for military units on the move. Nations are increasingly adopting these systems to enhance tactical advantages, reduce deployment times, and respond effectively to evolving aerial threats in complex geographies.

5. Collaborative Defense Programs

Collaborative defense programs are shaping the air defense market, as countries partner to co-develop, share, and deploy advanced technologies. Such collaborations reduce costs, speed up innovation, and allow access to specialized expertise from multiple nations. Programs like NATO’s integrated air defense initiatives and bilateral partnerships are driving the development of next-generation missile defense systems and radar networks. These alliances enhance interoperability, allowing joint forces to operate seamlessly during multinational missions. The collaborative approach also strengthens geopolitical ties, enabling participants to collectively address emerging threats while maintaining technological superiority in a rapidly evolving global security landscape.

Top 18 Companies Leading the Air Defense System Market

- Hanwha Corporation

- Northrop Grumman Corporation

- Raytheon Company

- Saab AB

- Lockheed Martin Corporation

- Bae Systems PLC

- Thales Group

- Rheinmetall AG

- MBDA

- Kongsberg Gruppen

- Aselsan A.S.

- General Dynamics

- L3 Harris

- Elibit Systems

- The Boeing Company

- Israel Aerospace Industries Ltd.

- Leonardo S.P.A.

- Others

1. Hanwha Corporation

Headquarters: Seoul, South Korea

Hanwha Corporation—through its subsidiaries such as Hanwha Systems and Hanwha Aerospace—is a major player in air defense, offering solutions like the Hybrid Biho short-range air defense system and launcher technologies. The group integrates avionics, space systems, ISR, C5I, and electro-optics, serving fixed-wing, rotary-wing, and unmanned platforms. With foundational strengths in defense electronics and ICT, Hanwha delivers hyper-connected, intelligent defense systems that span ground, air, and space domains. Its diverse capabilities and strong R&D in smart technologies position it as a growing force in next-gen air defense markets.

2. Northrop Grumman Corporation

Headquarters: Falls Church, Virginia, United States

Northrop Grumman is a full-spectrum defense innovator, delivering integrated air and missile defense solutions such as the Integrated Battle Command System (IBCS), layered missile defense systems, and SHORAD capabilities. It offers comprehensive capabilities spanning sensors, command and control, interceptors, and real-time tracking for high-speed threats including hypersonics. A new Enhanced Production and Integration Center in Alabama boosts IBCS component manufacturing. The firm’s deep expertise in advanced systems architecture and digital integration solidifies its reputation as a trusted architect of modern, networked air defense.

3. Raytheon Company (RTX Corporation segment)

Headquarters: Arlington, Virginia, United States

As part of RTX Corporation, Raytheon specializes in integrated air and missile defense systems encompassing radar, sensors, command & control, and effectors from “mud to space.” Signature systems include the Patriot and NASAMS, serving both homeland and battlefield air defense. Recently, RTX delivered a GaN-enhanced AN/TPY-2 radar to bolster hypersonic defenses. The division remains at the forefront in providing comprehensive air defense solutions worldwide, combining cutting-edge sensor technologies with robust missile systems to counter evolving threats across multiple domains.

4. Saab AB

Headquarters: Stockholm, Sweden

Saab is a global leader in Ground-Based Air Defense (GBAD), offering integrated systems that include 60 years of experience in sensors, command and control, and interceptor missiles. Their RBS 70 NG man-portable system has a combat-proven legacy up to 9 km and strong adoption in Ukraine and across Europe. Complemented by the Giraffe Radar family, Saab provides comprehensive situational awareness and rapid response solutions. The company continues to push for European cooperative defense capabilities, emphasizing autonomy, AI, and interoperability in response to modern threats and geopolitical dynamics.

5. Lockheed Martin Corporation

Headquarters: Bethesda, Maryland, United States

Lockheed Martin delivers advanced air and missile defense capabilities, including the PAC-3 interceptor, THAAD system, MEADS 360-degree mobile defense platforms, and high-performance radars like the TPY-4 long-range AESA. The company also explores directed-energy weapons and space-based sensors to extend defense reach. Lockheed strategically partnerships in Europe and offers rapid-deploy solutions aligned with initiatives like the “Golden Dome.” By combining interceptor, radar, C2, and satellite technologies, Lockheed continues to shape robust, multi-tiered defenses adaptable to evolving threats and allied interoperability needs.

Are you ready to discover more about the Air Defense System market?

The report provides an in-depth analysis of the leading companies operating in the global Air Defense System market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Hanwha Corporation.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Northrop Grumman Corporation

- Raytheon Company

- Saab AB

- Lockheed Martin Corporation

- Bae Systems PLC

- Thales Group

- Rheinmetall AG

- MBDA

- Kongsberg Gruppen

Conclusion

The Global Air Defense System Market Size is rapidly evolving, driven by technological innovation, rising geopolitical tensions, and the growing complexity of aerial threats. Nations are increasingly investing in advanced, integrated solutions that combine AI, automation, and multi-layered defense systems to enhance operational readiness and strategic capabilities. Collaborations between global defense leaders and regional players are fostering innovation while improving interoperability and cost efficiency. As modernization and digital transformation reshape defense strategies, companies that prioritize agility, innovation, and collaborative development will remain at the forefront, enabling nations to build resilient, adaptive, and future-ready air defense infrastructures worldwide.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?