Global Air Defense System Market Size, Share, and COVID-19 Impact Analysis By Component (Weapon System, Fire Control System, Command and Control System), By Type (Missile Defense System, Anti-Aircraft System, C-Ram System), By Platform (Land, Naval, Airborne), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2024 - 2035

Industry: Aerospace & DefenseGlobal Air Defense System Market Insights Forecasts to 2032

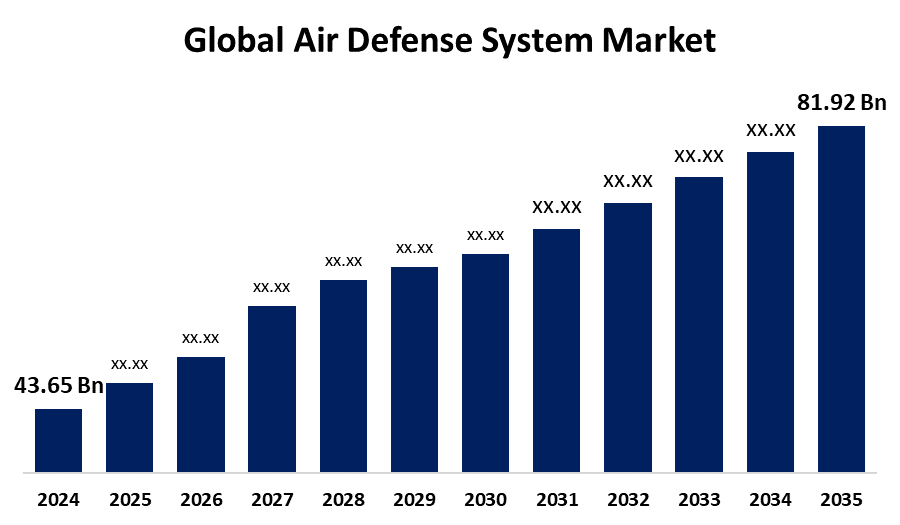

- The market for air defense systems was estimated to be worth USD 43.65 Billion in 2024.

- The market is going to expand at a CAGR of 5.27% between 2025 and 2035.

- The Global Air Defense System Market is anticipated to reach USD 81.92 Billion by 2035.

- North America & Europe is Expected to Grow the fastest during the forecast period.

- Asia Pacific is Expected to generate the highest demand during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Global Air Defense System Market Size is expected to grow from USD 46.55 Billion in 2024 to USD 81.92 Billion by 2035, at a CAGR of 5.27% during the forecast period 2025-2035. This growth is fueled by rising geopolitical conflicts, evolving security threats, and advancements in missile defense technologies. The air defense system sector is expanding as a result of countries all around the world implementing more Integrated Air Defense Systems (IADS). To protect against threats like stealth aircraft, hypersonic missiles, and unmanned aerial vehicles (UAVs), these systems integrate radar, sensors, and weaponry into a unified network. Countries are investing in cutting-edge air defense systems that can efficiently identify, intercept, and eliminate airspace threats as they become more complicated.

Market Overview

Air defense systems are systems used to take defensive measures against incoming goals such as missiles, enemy aircraft, and unmanned aerial vehicles. The air defense system operates as an anti-weapon system for all incoming air threats and is used for a variety of operations, including air space surveillance. Air defense systems include land-based, aerial-based, and marine-based techniques used by defense forces to counter a variety of missiles, including cruise and ballistic missiles. As the number of conflicts and war-like situations in various parts of the world has increased, so has the demand for air defense systems. Air defense systems protect national assets and citizens from missile attacks. The character of modern warfare has evolved as a result of the introduction of more lethal, covert, and nimble adversaries. As the nature of warfare has changed, countries have shifted their spending towards defense, resulting in the development of numerous air defense systems. Large defense corporations around the world are currently investing heavily in the development of missile defense systems.

Report Coverage

This research report categorizes the market for the global air defense system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the air defense system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the air defense system market.

Global Air Defense System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 43.65 Bn |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | 5.27% |

| 024 – 2035 Value Projection: | USD 81.92 Bn |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 145 |

| Segments covered: | By Component, By Type, By Platform, By Region. |

| Companies covered:: | Hanwha Corporation, Northrop Grumman Corporation, Raytheon Company, Saab AB, Lockheed Martin Corporation, Bae Systems PLC, Thales Group, Rheinmetall AG, MBDA, Kongsberg Gruppen, Aselsan A.S., General Dynamics, L3 Harris, Elibit Systems, The Boeing Company, Israel Aerospace Industries Ltd., Leonardo S.P.A., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The constant evolution of technology is a major driving force in the air defense system market. Radar system advancements, command and control system advancements, missile defense system advancements, and electronic warfare capabilities improve the overall effectiveness of air defense systems. These advancements allow defense forces to detect, track, and neutralize a wide variety of aerial threats, such as aircraft, missiles, drones, and unmanned aerial vehicles (UAVs). The geopolitical landscape and regional tensions are important market drivers for air defense systems. Growing regional conflicts, territorial disputes, and terrorism concerns have prompted countries to invest heavily in air defense capabilities. Countries all over the world are working hard to safeguard their airspace and strategic assets from potential threats such as ballistic missiles and stealth aircraft.

Restraining Factors

Air defense system procurement and modernization can be hampered by limited defense budgets. Governments may face competing priorities and financial constraints, resulting in lower defense spending, including air defense. Budget cuts can cause the acquisition of advanced air defense technologies to be delayed or limited, affecting the market's overall growth.

Market Segmentation

The Global Air Defense System Market share is classified into component, type, and platform.

- The weapon system segment is expected to grow at the fastest pace in the global air defense system market during the forecast period.

The global air defense system market is categorized by component into weapon system, fire control system, command and control system. Among these, the weapon system segment is expected to grow at the fastest pace in the global air defense system market during the forecast period. The air defense market's weapon system segment includes various types of interceptors, missiles, guns, and other weapon platforms. These systems are intended to detect, track, and neutralize incoming threats such as aircraft, missiles, drones, and unmanned aerial vehicles (UAVs). Depending on their engagement capabilities, weapon systems are classified as short-range, medium-range, or long-range defense systems. To effectively engage and destroy aerial threats, these systems frequently employ advanced technologies such as radar guidance, infrared seekers, and active/passive homing systems.

- The missile defense system segment is expected to grow at the highest rate in the global air defense system market during the forecast period.

Based on the type, the global air defense system market is divided into missile defense system, anti-aircraft system, c-ram system. Among these, the missile defense system segment is expected to grow at the highest rate in the global air defense system market during the forecast period. The Missile Defense System continues to grow rapidly. The main reasons for the segmental rapid expansion are the growing demand for missile defense in military uses and the increasing use of missiles during any battle.

- The land segment is expected to hold the largest share of the global air defense system market during the forecast period.

Based on the platform, the global air defense system market is divided into land, naval, and airborne. Among these, the land segment is expected to hold the largest share of the global air defense system market during the forecast period. Demand for land-based air defense systems has grown in response to the growing need to protect ground troops from any aerial threats. Developed countries are producing advanced air defense systems.

Regional Segment Analysis of the Global Air Defense System Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

The Asia-Pacific (APAC) region currently leads global demand for air defense systems.

Get more details on this report -

The Asia-Pacific (APAC) region currently leads global demand for air defense systems, driven by escalating geopolitical tensions, territorial disputes, and substantial defense budget increases. The continuous war between India and Pakistan is a major factor in this desire. Using cutting-edge air defense systems, including the S-400 Triumf, Akash, and Spyder, India successfully intercepted over 50 swarm drones during "Operation Sindoor" in May 2025 in response to Pakistani drone and missile strikes. India's dedication to strengthening its air defense capabilities was demonstrated by this mission. At the same time, tensions in the region have increased due to China's backing of Pakistan. Concerns have been raised by Pakistan's use of Chinese-made HQ-9 air defense systems and J-10C fighters in recent clashes with India.

Additionally, one of the major factors driving the Asia-Pacific air defense systems market is Japan's record-high defense budget of ¥7.95 trillion ($56 billion) for fiscal year 2024, which represents a 16% increase from the year before. In light of rising regional tensions, especially those involving China and North Korea, this significant investment demonstrates Japan's dedication to strengthening its military capabilities. A sizeable amount of this funding is set aside for the quicker deployment of long-range cruise missiles, including updated Type-12 missiles and American-made Tomahawks, to counter any North Korean and Chinese threats. To improve its defensive posture, Japan is also spending money on cutting-edge air and missile defense systems, like the Patriot Advanced Capability-3 (PAC-3) missile interceptors.

The market for air defense systems in North America is expanding significantly due to modernization efforts and large expenditures in cutting-edge technologies made by top aerospace companies. The purchase of Saab's RBS 70 NG short-range air defense system by Canada in February 2024 is a noteworthy example. With firing units, missiles, transport vehicles, training, and support, this contract, which is valued at about CAD 227 million (USD 168 million), would strengthen Canada's defenses against aerial threats and help it fulfill its NATO obligations in Latvia. Additionally, in April 2022, the U.S. government also suggested spending around USD 900 million to buy Guam a new missile defense system. In order to counter China's increasing missile threats, this project seeks to improve radar capacity, command and control capabilities, and missile defense. Furthermore, the market for air defense systems has been greatly impacted by the rise in European defense spending, which is being fed by the ongoing war between Russia and Ukraine as well as worries about decreased military assistance from the United States. The Readiness 2030 program of the European Commission intends to raise up to €800 billion for defense improvements, with a significant amount going toward air and missile defense capabilities.Europe is expected to grow at the fastest pace in the global air defense system market during the forecast period. The ongoing conflict between Ukraine and Russia has resulted in a rapid increase in demand for air defense systems among Russia's neighbors such as Sweden, Finland, and Poland. Because the Nordic countries in Europe see Russia as a potential threat, they are implements advanced air defense systems to defend their borders from Russian invasion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global air defense system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hanwha Corporation

- Northrop Grumman Corporation

- Raytheon Company

- Saab AB

- Lockheed Martin Corporation

- Bae Systems PLC

- Thales Group

- Rheinmetall AG

- MBDA

- Kongsberg Gruppen

- Aselsan A.S.

- General Dynamics

- L3 Harris

- Elibit Systems

- The Boeing Company

- Israel Aerospace Industries Ltd.

- Leonardo S.P.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2022, Lockheed Martin received a USD 4.7 billion contract to manufacture radar and THAAD air defense systems for the US and allied nations, providing a critical capability to defend against short- and medium-range ballistic missiles.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Air Defense System Market based on the below-mentioned segments:

Global Air Defense System Market, By Component

- Weapon System

- Fire Control System

- Command and Control System

Global Air Defense System Market, By Type

- Missile Defense System

- Anti-Aircraft System

- C-Ram System

Global Air Defense System Market, By Platform

- Land

- Naval

- Airborne

Global Air Defense System Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?