Top 20 Global Companies in Data Center Networking Market (2025-2035): Competitive Analysis and Forecast

RELEASE DATE: Aug 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

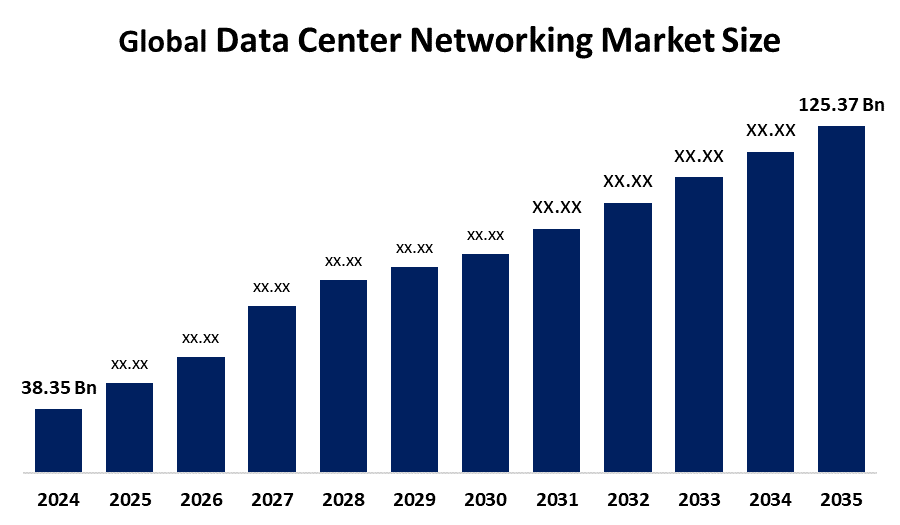

According to a research report published by Spherical Insights & Consulting, The Global Data Center Networking Market Size is Projected To Grow from USD 38.35 Billion in 2024 to USD 125.37 Billion by 2035, at a CAGR of 11.37% during the forecast period 2025-2035. The market for data center networking is expected to grow as a result of the growing popularity of cloud computing across various industrial verticals. This is due to the exponential expansion in data traffic around the globe, which is being driven by enterprise digital transformation, IoT devices, video streaming, and rising web consumption. Companies are quickly moving their workloads to cloud computing platforms like Google Cloud, Microsoft Azure, and AWS.

Introduction

The hardware, protocols, and systems that provide communication between servers, storage devices, and other resources within data centers are referred to as the global data center networking market. A well-designed data center network is crucial for cloud services, enterprise applications, and digital infrastructure, as it optimizes performance, ensures high availability, and facilitates seamless expansion. This comprises hardware that is essential to ensure smooth data flow, scalability, and security in today's digital environment, such as switches, routers, cabling, and software-defined networking (SDN) solutions. The market is driven by the rapid growth of cloud computing and the increasing demand for high-speed, low-latency connectivity in business and hyperscale data centers. The demand for intelligent and scalable data center networking solutions is also being driven by the growing usage of AI, IoT, and 5G technologies. Data center infrastructures will become more self-optimizing and efficient with AI-driven networks, requiring less manual intervention. Additionally, the growth of edge computing, fueled by technologies like analytics in real time, smart cities, and autonomous cars, is driving investments in scattered micro-data centers that require quick, flexible, and localized networking solutions.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download The Brochure now and dive deeper into the future of the Data Center Networking Market.

Data Center Networking Market Size & Statistics

- The Market Size for Data Center Networking Was Estimated To be worth USD 38.35 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 11.37% between 2025 and 2035.

- The Global Data Center Networking Market Size is anticipated to reach USD 125.37 Billion by 2035.

- North America is expected to generate the highest demand during the forecast period in the Data Center Networking Market.

- Asia Pacific is expected To Grow the fastest during the forecast period in the Data Center Networking Market.

Regional growth and demand

Asia Pacific is predicted to grow at the fastest CAGR over the forecast period in the Data Center Networking market.

In developing nations like China, Japan, and India, urbanization is accelerating, which could contribute to the growth of cloud use. Additionally, the region anticipates the demand for effective data centers, which opens the door for new manufacturers to enter the data center networking industry. The industry may expand as a result of developments like hybrid cloud computing and high-speed internet.

North America is anticipated to grow at the highest share during the forecast period in the Data Center Networking market.

The strong internet penetration and cloud usage have put nations like the US and Canada ahead of the competition. They prioritize expenditures that could support the development of new facilities and equipment for professionals. The region's economy is robust due to the presence of prominent corporations such as Juniper, Cisco, and IBM. The requirement for well-established infrastructure is growing as North America's metropolitan population consumes the most internet. Further, the United States Data Center Networking Market dominated the regional industrial revenue for this market place.

Top 10 trends in the Data Center Networking Market

- Adoption of AI-Driven Network Automation

- Shift to Software-Defined Networking (SDN)

- Rise of Edge Data Centers

- Adoption of 400G/800G Ethernet Technologies

- Increased Use of Network Function Virtualization (NFV)

- Integration of Cloud-Native Technologies (Containers, Kubernetes)

- Enhanced Cybersecurity and Zero Trust Networking

- Deployment of Optical Interconnects and Silicon Photonics

- Focus on Sustainability and Energy Efficiency

- Convergence of Storage and Networking (e.g., NVMe over Fabrics)

1. Adoption of AI-Driven Network Automation

One significant development that is changing the data center networking market is the use of AI-Driven Network Automation. Manual network management is no longer effective as data centers handle increasing amounts of traffic and become increasingly complicated. Intelligent, real-time decision-making for tasks like capacity planning, anomaly detection, traffic routing, and predictive maintenance is made possible by AI-driven automation. AI can find patterns, improve performance, and automatically fix problems by analyzing enormous volumes of network data, which lowers operating expenses and downtime.

2. Integration of Cloud-Native Technologies (Containers, Kubernetes)

The emergence of microservices, containers, and orchestration platforms such as Kubernetes has led to a significant development in the data center networking market: the integration of cloud-native technologies. More flexible, scalable, and dynamic network infrastructures are required by cloud-native architectures in order to provide quick application deployment and management. This change necessitates that data center networks facilitate enhanced load balancing, east-west traffic optimization, and service discovery. In order to facilitate smooth integration with DevOps operations, network functions are rapidly being virtualized and containerized.

3. Enhanced Cybersecurity and Zero Trust Networking

The increasingly sophisticated characteristics of cyberthreats and the dispersed structure of contemporary IT environments. The advent of edge computing, remote work, and hybrid cloud has made traditional perimeter-based security strategies insufficient. Zero Trust Networking enforces stringent identity verification and access constraints at every network node, taking the "never trust, always verify" stance. Microsegmentation, ongoing authentication, encryption, and real-time threat detection are all included in this.

4. Focus on Sustainability and Energy Efficiency

In data centers, networking infrastructure uses a lot of energy, along with servers and cooling systems. Consequently, businesses are investing in intelligent power management systems as well as energy-efficient switches, routers, and optical components. Green data center techniques like liquid cooling and AI-driven energy optimization are also becoming more popular, as is the use of renewable energy sources.

5. Increased Use of Network Function Virtualization (NFV)

NFV increases scalability, flexibility, and cost-effectiveness by allowing services like routers, load balancers, and firewalls to operate on regular servers. In addition to speeding up service launch and reducing dependency on proprietary hardware, this change enables dynamic resource allocation in response to current network demands. In contemporary data centers, NFV facilitates automation, optimizes processes, and improves the capacity to react rapidly to workload or traffic fluctuations.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Data Center Networking market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 20 Companies Leading the Data Center Networking Market

- Cisco Systems, Inc.

- Arista Networks, Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- Dell Technologies (Dell EMC)

- NVIDIA Corporation (via Mellanox & Spectrum-X)

- Broadcom Inc.

- Hewlett Packard Enterprise (HPE)

- Nokia (including acquisitions like Infinera)

- Intel Corporation

- Extreme Networks, Inc.

- Equinix, Inc.

- ALE International

- Fujitsu (and Hitachi Vantara)

- IBM

- Rahi Systems

- Microsoft (in networking context)

- VMware, Inc.

- F5 Networks, Inc.

- A10 Networks, Inc.

1. Cisco Systems, Inc

Headquarters: San Jose, United States

One of the top suppliers of data center networking solutions, Cisco Systems, Inc., is rapidly evolving to satisfy the needs of contemporary workloads involving AI, cloud, and edge computing. Cisco demonstrated advancements like the Cisco Nexus Dashboard 4.1 at Cisco Live 2025, which improves operational efficiency and scalability by consolidating data center operations into a single platform. High-performance switching and embedded Data Processing Units (DPUs) are combined in Cisco's new N9300 Smart Switch to improve security, telemetry, and network services while lowering complexity and latency. The launch of Cisco Hypershield transforms network security with distributed protection and autonomous policy enforcement by integrating hardware-accelerated, AI-native, zero-trust security right into the data center fabric.

2. Juniper Networks, Inc

Headquarters: California, United States

Juniper Networks, Inc. is a well-known pioneer in AI-native data center networking, valued for its creative solutions that streamline processes while providing excellent performance and dependability. Juniper, which focused on AI Ethernet fabric deployment and enterprise data center network build-outs, achieved the top spot in the Gartner Magic Quadrant for Data Center Switching in 2025. With a focus on AI-driven automation, intent-based networking, and sophisticated load balancing strategies, Juniper's data center platform optimizes network traffic and lowers latency—two essentials for AI and high-performance computing settings. Their solutions support various business, cloud, and AI customers globally, enabling up to 90% reductions in operating expenses, 85% faster deployments, and up to 10 times improved reliability.

3. Huawei Technologies Co., Ltd

Headquarters: Guangdong, China

Huawei Technologies Co., Ltd. is an established leader in data center networking, offering cutting-edge technologies created especially to help the AI era. The AI Brain, AI Connection, and AI Network Elements make up the three-layer architecture of their improved Xinghe Intelligent Fabric Solution, which offers intelligent load balancing, automated network management, high dependability, and strong security features. Huawei provides industry-leading data center switches that meet the scalability requirements of AI clusters, such as the liquid-cooled CloudEngine XH9230 and the high-density CloudEngine XH9330. Their StarryLink optical modules guarantee extremely dependable, secure, and long-range transmission.

4. IBM

Headquarters: New York, United States

IBM provides novel data center networking solutions with an emphasis on application-centric networking that improves connectivity, automation, and security, ideal for the hybrid cloud and artificial intelligence era. Their networking solutions help businesses streamline and automate the deployment of hybrid clouds, increasing operational effectiveness, speeding up the delivery of applications, and protecting network performance in dispersed locations. IBM places a strong emphasis on AI-driven automation and zero-trust security to maximize performance in hybrid multicloud setups and eliminate connectivity obstacles. IBM's data center solutions help digital transformation across sectors by addressing growing needs for bandwidth, virtualization, and security in cloud and AI applications.

5. Dell Technologies

Headquarters: Texas, United States

Dell Technologies offers modern data center networking solutions made to meet the needs of workloads related to digital transformation, hybrid cloud, and artificial intelligence. Among its offerings are high-performance PowerSwitch data center switches designed for AI fabrics and virtualized environments, which facilitate dense, low-latency, high-bandwidth communication. With a focus on disaggregated data center architecture, Dell offers flexibility, efficiency, and streamlined management by combining cloud-native automation with modular scalability. Advancements such as the PowerEdge servers enable enterprises to manage analytics, AI inferencing, and HPC workloads with improved scalability and energy efficiency. Additionally, Dell advances ransomware detection, sophisticated data protection, and expansive object storage systems that facilitate extensive AI deployments.

Are you ready to discover more about the Data Center Networking market?

The report provides an in-depth analysis of the leading companies operating in the global Data Center Networking market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Cisco Systems, Inc

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Arista Networks, Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- Dell Technologies (Dell EMC)

- NVIDIA Corporation (via Mellanox & Spectrum-X)

- Broadcom Inc

- Hewlett Packard Enterprise (HPE)

- Nokia (including acquisitions like Infinera)

- Intel Corporation

- Extreme Networks, Inc

- Equinix, Inc

- ALE International

- Fujitsu (and Hitachi Vantara)

- IBM

- Rahi Systems

- Microsoft (in networking context)

- VMware, Inc.

- F5 Networks, Inc.

- A10 Networks, Inc.

Conclusion

The Global Data Center Networking Market is experiencing robust growth fueled by the rapid adoption of cloud computing, AI, IoT, and 5G technologies, driving demand for high-speed, scalable, and secure network infrastructures. Major players such as Cisco, Juniper Networks, Huawei, IBM, and Dell Technologies lead innovation with powerful, intelligent, and energy-efficient data center networking products tailored for the evolving digital landscape. Asia Pacific and North America are seen as crucial global expansion centers, emphasizing the crucial part that data center networks play in facilitating enterprise and cloud applications in the future.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?