United States Data Center Networking Market Size, Share, and COVID-19 Impact Analysis, By Product (Ethernet Switches, Routers, Storage Area Network (SAN), By Application (Delivery Controller (ADC), and Others), By Services (Installation and Integration, Training and Consulting, and Support & Maintenance), and United States Data Center Networking Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Data Center Networking Market Insights Forecasts to 2035

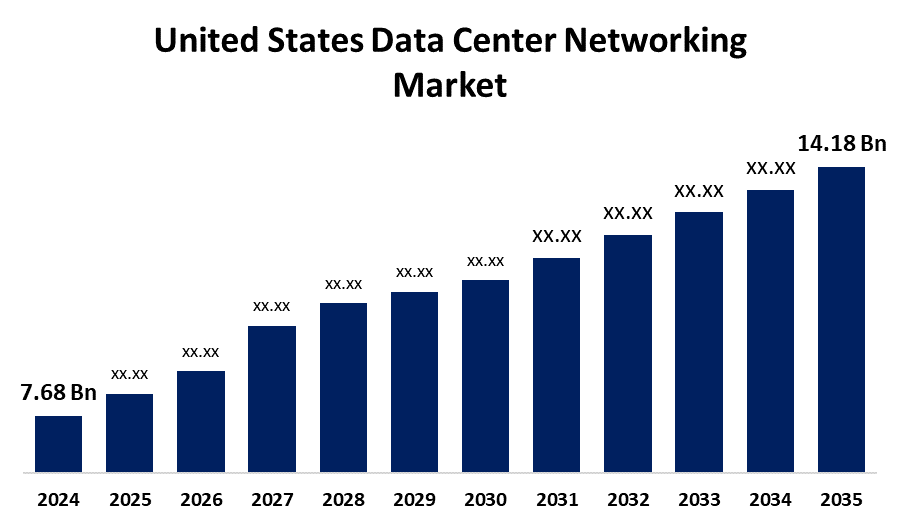

- The U.S. Data Center Networking Market Size was estimated at USD 7.68 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of 5.73% from 2025 to 2035

- The USA Data Center Networking Market Size is Expected to Reach USD 14.18 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The US Data Center Networking Market is anticipated to reach USD 14.18 Billion by 2035, growing at a CAGR of 5.73% from 2025 to 2035. The U.S. data center networking market is expanding steadily, driven by cloud adoption, edge computing, and advanced connectivity needs. Key innovations enhance scalability, security, and performance across diverse enterprise environments.

Market Overview

The United States data center networking market refers to the hardware, protocols, and systems that enable servers, storage devices, and other resources to communicate within data centers. This includes hardware such as switches, routers, cabling, and software-defined networking (SDN) solutions, which play a crucial role in ensuring seamless data flow, scalability, and security in today's digital space. Moreover, the U.S. data center network market is supported by the spiking need for edge computing, 5G infrastructure growth, and increased adoption of hybrid cloud solutions. More so, heightening cybersecurity awareness drives investments into emerging networking technology to secure the data and promote effortless connectivity amongst geographically spread-out data centers. Furthermore, major players such as Cisco, Arista, NVIDIA, and Dell are leading the U.S. data center networking market with innovations like AI-optimized switches, quantum networking chips, and high-performance routing platforms. These innovations improve scalability, lower latency, and enable AI workloads, driving demand in cloud, enterprise, and edge environments. Strategic investments and partnerships also speed up infrastructure modernization.

Report Coverage

This research report categorizes the market for the U.S. data center networking market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States data center networking market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA data center networking market.

United States Data Center Networking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.68 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.73% |

| 2035 Value Projection: | USD 14.18 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 263 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application and By Services |

| Companies covered:: | Cisco Systems Inc., Arista Networks Inc., VMware Inc., Huawei Technologies Co. Ltd., NVIDIA (Cumulus Networks Inc.), Dell Inc., IBM Corporation, HP Development Company, L.P., Intel Corporation, Schneider Electric, Eaton Corporation, Emerson Electric Co., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. data center networking market is being driven by the requirement for higher-speed, more reliable connections because of the growth in cloud services and the development of high-bandwidth applications such as video streaming and virtual reality. Also, growing emphasis on environmentally friendly data center practices, including energy-efficient networking devices and green technologies, is driving investment. The fast expansion of remote work and digitalization across sectors is also driving demand for resilient data center networking infrastructure.

Restraining Factors

Restraints in the U.S. data center networking market are high infrastructure expenses, complicated integration issues, cybersecurity threats, data privacy issues, and the requirement of skilled professionals to operate sophisticated networking technologies efficiently.

Market Segmentation

The United States data center networking market share is classified into product and services.

- The ethernet switches segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States data center networking market is segmented by product into ethernet switches, routers, storage area network (SAN), application deliver controller (ADC), and others. Among these, the ethernet switches segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their crucial role in ensuring efficient data flow within data centers. The increasing demand for high-speed, scalable connectivity and the rise of cloud services drive Ethernet switch adoption, making it a key market leader.

- The installation and integration segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States data center networking market is segmented by services into installation and integration, training and consulting, and support & maintenances. Among these, installation and integration segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is attributed to the critical need for professional setup and seamless integration of complex hardware and software components to ensure optimal performance and security in data center operations. As enterprises increasingly rely on data centers for their IT requirements, the demand for expert installation and integration services continues to grow.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US data center networking market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cisco Systems Inc.

- Arista Networks Inc.

- VMware Inc.

- Huawei Technologies Co. Ltd.

- NVIDIA (Cumulus Networks Inc.)

- Dell Inc.

- IBM Corporation

- HP Development Company, L.P.

- Intel Corporation

- Schneider Electric

- Eaton Corporation

- Emerson Electric Co.

- Others

Recent Developments:

- In October 2023, Arista Networks has announced a line of 25G Ethernet switches to handle mainly financial applications requiring high performance and low latency. The new 7130 25G Series boxes are a major power and feature boost compared to the vendor's current 7130 10G Ethernet series of devices and will cut link latency 2.5 times for data transmission by minimizing queuing, serialization delays and removing the need for latency-rich Forward Error Correction (FEC) normally needed by 25G Ethernet.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA data center metworking market based on the below-mentioned segments:

United States Data Center Networking Market, By Product

- Ethernet Switches

- Routers

- Storage Area Network (SAN)

- Application Delivery Controller (ADC)

- Others

United States Data Center Networking Market, By Services

- Installation and Integration

- Training and Consulting

- Support & Maintenance

Need help to buy this report?