Top 20 Companies in Global Smart Payments Market (2025–2035): Spherical Insights Analysis

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

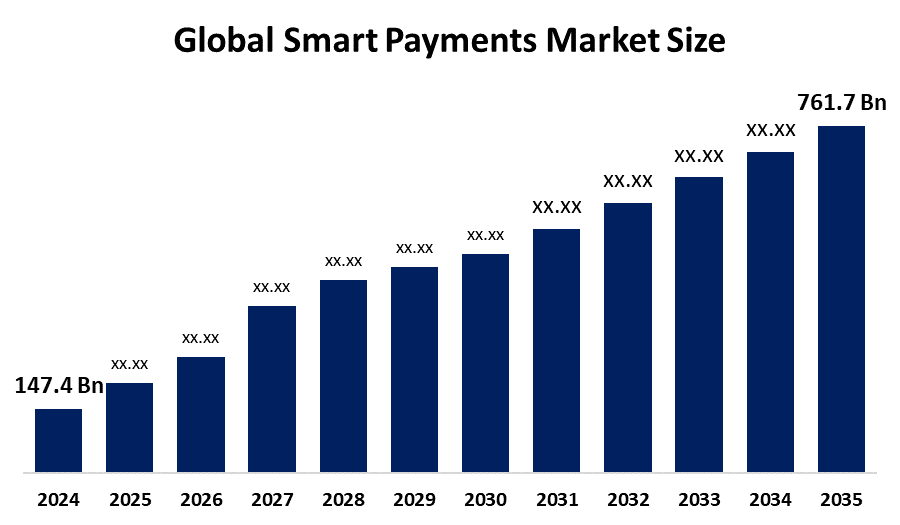

According to a research report published by Spherical Insights & Consulting, The Global Smart Payments Market Size is projected To Grow from USD 147.4 Billion in 2024 to USD 761.7 Billion by 2035, at a CAGR of 16.1% during the forecast period 2025–2035. The Global Smart Payments Market is growing due to rising smartphone penetration, electronic commerce growth, demand for contactless payments, fintech innovation, secure digital platforms, and government support for cashless and inclusive financial systems.

Introduction

The advanced digital payment solutions, such as mobile wallets, contactless cards, QR code payments, and biometric systems, figure in the smart payments market, providing secure, frictionless, and concurrent financial transactions. These systems find extensive application across retail, digital commerce, transport, banking, and healthcare for the convenience of payments and improved user experience. Some of the drivers in the market are smartphone and internet penetration growth, the speedy growth of electronic commerce, the need for more contactless solutions, and developments in technology such as AI, IoT, blockchain, and biometrics. The market strengths derive from improved transaction speed, security, transparency, and increased financial inclusion, particularly for the unbanked. Opportunities are increasing as embedded finance, open banking, and increased digitalization of emerging economies evolve. Governments around the globe are supporting this transition by implementing programs that promote cashless societies. India BHIM app and Unified Payments Interface (UPI), and Singapore Project Nexus, are indicative of the efforts being made to create interoperable, accessible, and secure payment infrastructures to fuel the global adoption of smart payments.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Smart Payments Market.

Smart Payments Market Size & Statistics

- The Market Size for Smart Payments Was Estimated to be worth USD 147.4 Billion in 2024.

- The Market Size is Going to Expand at a CAGR of 16.1% between 2025 and 2035.

- The Global Smart Payments Market Size is anticipated to reach USD 761.7 Billion by 2035.

- Asia Pacific is expected to generate the largest demand during the forecast period in the Smart Payments Market

- North America is expected to grow the fastest during the forecast period in the Smart Payments Market.

Regional growth and demand

North America is expected to grow the fastest during the forecast period in the smart payments market. North America is rapidly growing in the smart payments market, led by early adoption of new technologies. Growth in unmanned retail sites and the expansion of robust digital commerce in the U.S. have spurred the adoption of mobile payments, and smart payment systems are becoming increasingly popular throughout the region.

Asia Pacific is expected to generate the largest demand during the forecast period in the smart payments market. The Asia Pacific market for smart payments, driven by smartphone penetration, online shopping habits, and lifestyle changes, is becoming increasingly pronounced. Cashless drive programs initiated by governments, including India UPI and BHIM app, are driving growth. Fintech and banks are utilizing cellular technology to reach rural unbanked populations, driving digital payment acceptance in developing economies.

Top 10 trends in the Smart Payments Market

- Digital wallets and ecosystems

- Biometric authentication gains traction

- Real time payments (RTP) and A2A payments

- Web 3.0 and decentralized identity

- Buy now, pay later (BNPL) growth

- AI and machine learning

- Blockchain, cryptocurrencies & defi

- Tokenization & virtual cards

- Personalized payment experiences

- Wearable payment devices surge

1. Digital wallets and ecosystems

Digital wallets and their associated ecosystems simplify smart payments through the secure storage of payment information, facilitating contactless, concurrent transfers, and convenience through handheld devices. The trend increases security through tokenization and improves the customer experience by making checkout easier, ultimately revolutionizing financial payments and accelerating digital adoption worldwide.

2. Biometric authentication gains traction

Biometric verification is on the rise in smart payments, utilizing distinctive characteristics such as fingerprints for secure, quick, and easy transactions, thereby minimizing fraud and replacing conventional PINs and passwords. The trend is fueled by the widespread use of mobile devices and the increasing demand for contactless payments, providing a seamless and reliable payment experience for both consumers and businesses.

3. Real time payments (RTP) and A2A payments

Real-time payments (RTP) and A2A payments are popular due to the need for immediate, 24/7 transactions and lower expenses. They improve businesses cash flow and efficiency through instant money transfer and rich data for automated reconciliation, facilitating smarter, nimble financial operations and improved customer experiences.

4. Web 3.0 and decentralized identity

Web 3.0 decentralized identity (DID) facilitates self sovereign ownership of ones data, to build trustless smart payments through blockchain. This minimizes dependence on middlemen, decreases the cost of transactions, and provides more privacy and security through the transfer of data ownership from centralized platforms to the user.

5. Buy now, pay later (BNPL) growth

Buy now, pay later (BNPL) is gaining momentum as it provides customers with installments at their convenience. It contributes significantly to intelligent payments by making affordability better, increasing merchant transactions, and ensuring smooth checkout integration, hence making the digital payment process more efficient.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the smart payments market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 12 Companies Leading the Smart Payments Market

- PayPal Holdings Inc.

- Google LLC

- MasterCard

- American Express Company

- Apple Inc.

- Samsung

- Stripe & Adyen

- Fiserv & FIS

- Square. Inc.

- MobiKwik

- Amazon.com, Inc.

- One Communication Limited

1. PayPal Holdings Inc.

Headquarters: San Jose, California, USA

PayPal Holdings Inc. is a global digital payments leader that allows people and businesses to send and receive money online safely. In the smart payment market, PayPal provides instant checkout solutions, mobile wallets, QR code payments, and digital invoicing. It also owns renowned platforms such as Venmo and Braintree, widening its ground in networked and merchant services. With advances in AI based fraud protection and cryptocurrency support, PayPal continues to define the future of cashless, convenient, and secure financial transactions globally.

2. Google LLC

Headquarters: Mountain View, California, USA

Google LLC is active in the smart payments industry, operates mainly under Google Pay, a digital wallet and digital payment system. Google Pay allows users to make contactless payments, decentralized transfers, and online transactions easily with their smartphones or wearables. It is integrated into Android devices and accommodates loyalty programs, transit cards, and banking services. Google also utilizes its data and AI capabilities to improve payment security, user experience, and financial access across the world markets through strategic partnerships and innovations.

3. MasterCard

Headquarters: Purchase, New York, USA

Mastercard operates in the smart payments sector, offers innovative digital payment solutions such as contactless cards, mobile wallets, and tokenization services to boost security. It collaborates with fintech and banks to facilitate effortless internal, online, and retail transactions. By means of its Mastercard Digital Enablement Service (MDES), it enables secure digital payments. Mastercard also makes investments in biometric verification, AI based fraud prevention, and blockchain to enhance payment efficiency and trust, fuelling the world movement towards wiser, quicker, and more secure cashless payments.

4. American Express Company

Headquarters: New York City, New York, USA

American Express Company, in the market of smart payments, provides secure digital payment services through mobile applications, contactless cards, and digital purses such as Apple Pay and Google Pay. It concentrates on improved user experiences with simultaneous notifications, automated fraud alerts, and customized rewards. American Express even enables tokenization and biometric authentication for more secure transactions. By collaborating with fintechs and merchants, it grows its digital ecosystem, enabling faster, simpler, and more secure payments for consumers and businesses around the world.

5. Apple Inc.

Headquarters: Cupertino, California, USA

Apple Inc. operates in the smart payments market, doing business through Apple Pay, a secure and private mobile payment and digital wallet service. Apple Pay allows users to make payments without contact in stores, apps, and on the web using iPhones, Apple Watches, iPads, and Macs. It utilizes tokenization, Face ID or Touch ID, and appliance encryption to safeguard user information. Apple further introduced Apple Card and Apple Cash, expanding financial services. Through unified technology across devices, Apple is revolutionizing the way users spend and handle money digitally.

Are you ready to discover more about the smart payments market?

The report provides an in-depth analysis of the leading companies operating in the global smart payments market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- PayPal Holdings Inc.

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Google LLC

- MasterCard

- American Express Company

- Apple Inc.

- Samsung

- Stripe & Adyen

- Fiserv & FIS

- Square. Inc.

- Others.

Conclusion

The Smart Payments Market Size continues to advance solutions such as digital wallets, contactless cards, biometrics, concurrent payments, and decentralized identities, boosting security, speed, and convenience across sectors. Top players, PayPal, Google, Mastercard, American Express, and Apple, lead through mobile wallets, AI based fraud detection, tokenization, and seamless device integration. Supported by increasing smartphone adoption, electronic commerce, and government support, these technologies drive financial inclusion, improve transaction efficiency, and power the global transformation to secure, frictionless, and convenient cashless payments.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?