Top 20 Companies in Alkylate and Isooctane Market: Statistics Report Till 2035

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

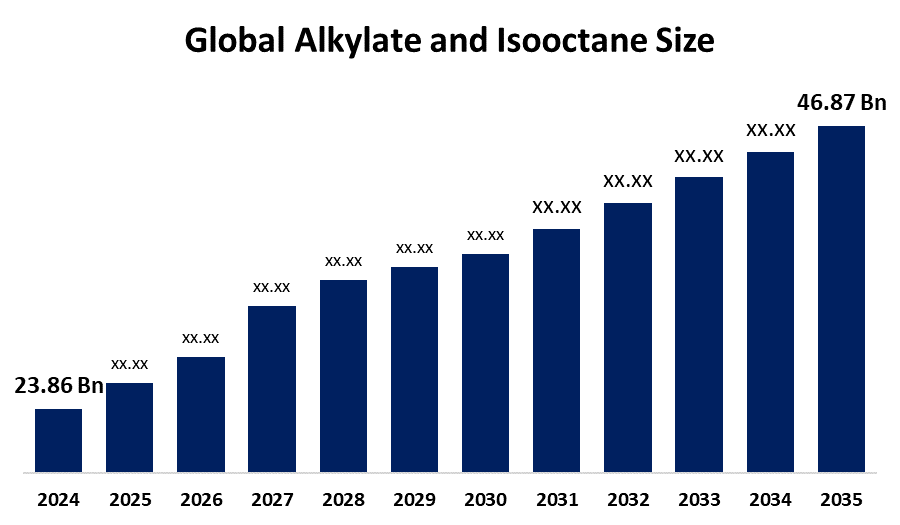

According to a research report published by Spherical Insights & Consulting, The Global Alkylate and Isooctane Market Size is projected To Grow from USD 23.86 Billion in 2024 to USD 46.87 Billion by 2035, at a CAGR of 6.33% during the forecast period 2025–2035. This notable expansion is due to the growing need for high-octane, low-emission fuels, spurred by strict environmental regulations and the heightened embrace of cleaner-burning fuel options. Moreover, the growing automotive and aviation sectors are driving the need for alkylate and isooctane, which are essential elements in the manufacture of high-performance fuels.

Introduction

The Alkylate and Isooctane Market Size refers to the global industry dedicated to the production, distribution, and utilization of alkylate and isooctane, two critical high-octane, low-emission fuel components used primarily in gasoline blending. Alkylate is produced via the acid-catalyzed reaction of light olefins (like butylene) with isoparaffins (such as isobutane) in refinery alkylation units, yielding a clean-burning, high-octane hydrocarbon that enhances fuel performance and reduces engine knocking. Isooctane, a key product derived from alkylation processes, is widely recognized for its anti-knock properties and serves as a reference standard for octane ratings in gasoline. The market is driven by rising demand for high-performance, low-emission fuels across the automotive and aviation sectors, supported by increasingly stringent global environmental regulations and the push for cleaner-burning gasoline. Growth in this market is propelled by ongoing innovations in refining technologies, integration of renewable feedstocks, and expansions in automotive and aviation fuel demand, especially in emerging economies.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Alkylate and Isooctane Market.

Alkylate and Isooctane Market Size & Statistics

- The Market Size for Alkylate and Isooctane Was Estimated to be worth USD 23.86 Billion in 2024.

- The Market is Going to Expand at a CAGR of 6.33% between 2025 and 2035.

- The Global Alkylate and Isooctane Market Size is anticipated to reach USD 46.87 Billion by 2035.

- Asia Pacific is expected to generate the highest demand during the forecast period in the alkylate and isooctane Market.

- Europe is projected to grow the fastest during the forecast period in the alkylate and isooctane Market.

Regional growth and demand

Europe is anticipated to grow at the fastest CAGR during the forecast period in the alkylate and isooctane market.

The regional market is boosted by strict environmental laws and the rising use of cleaner-burning fuels. The regions' established automotive sector and the increasing popularity of fuel-efficient cars are driving the market's expansion. Nations like Germany, France, and the United Kingdom play crucial roles, making substantial investments in refining capacities and technological innovations in fuel manufacturing.

Asia Pacific is expected to grow at the highest market share over the forecast period in the alkylate and isooctane market.

The market is driven by rapid industrial growth, urban expansion, and substantial funding in the automotive and aviation industries. The market's growth is being driven by the region's expanding middle class, higher disposable incomes, and surging demand for both vehicles and air travel. Nations like China, India, and Japan play crucial roles, making substantial investments in refining capabilities and innovations in fuel production.

Top 10 Trends in the Alkylate and Isooctane Market

- Cleaner Energy Programs and Emission Standards

- Increase in Demand for Automotive and Aviation

- Rise of Digitalization and Optimized Distribution Channels

- Advancement of Bio-derived and Artificial Isooctane

- Emergence of Digitalization and Enhanced Distribution Channels

- Growth into Specialty Chemicals and Industrial Applications

- Heightened Rivalry and Mergers & Acquisitions Activity

- Expansion of Refinery Capacity at the global level

- Alternative Fuels and Electrification

- Advancements in Technology for Production

1. Cleaner Energy Programs and Emission Standards

The worldwide implementation of more stringent fuel regulations and reduced emission requirements is prompting refineries and blenders to prioritize high octane, low sulfur alkylate and isooctane for gasoline mixing, particularly in areas affected by Euro VI, U.S. EPA Tier 3, and China VI standards.

2. Increase in Demand for Automotive and Aviation

The rise in global vehicle ownership and air travel is driving the demand for high-performance, premium fuels, increasing the need for isooctane and alkylate.

3. Advancement of Bio-derived and Artificial Isooctane

Advancements in bio-isooctane and synthetic manufacturing techniques indicate a future featuring more sustainable, low-carbon gasoline mixing elements.

4. Growth into Specialty Chemicals and Industrial Applications

Alkylate and isooctane are increasingly used as solvents in pharmaceuticals, cosmetics, and agrochemicals, broadening their market opportunities.

5. Advancements in Technology for Production

Enhancements in alkylation and catalytic reforming processes are boosting production efficiency, reducing expenses, and ensuring a more dependable supply of high-purity fuel components.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the alkylate and isooctane market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 20 Companies Leading the Alkylate and Isooctane Market

- Chevron Corporation

- ExxonMobil Corporation

- Royal Dutch Shell plc

- BP plc

- TotalEnergies SE

- Valero Energy Corporation

- Phillips 66

- Marathon Petroleum Corporation

- Honeywell International Inc.

- LyondellBasell Industries N.V.

- Neste Oyj

- PetroChina Company Limited

- Sinopec Limited

- Reliance Industries Limited

- SK Innovation Co., Ltd.

- Idemitsu Kosan Co., Ltd.

- Eni S.p.A.

- OMV Group

- Petrobras

- HollyFrontier Corporation

- Others

1. Chevron Corporation

Headquarters: Houston, Texas, USA

Chevron is a significant and impactful participant in the alkylate and isooctane industry. Its function is diverse, involving both the creation of these essential gasoline elements and the advancement of next-generation manufacturing technologies. Chevron's refineries, including those located in Salt Lake City, Utah, and Pascagoula, Mississippi, feature alkylation units as an essential component of their refining operations. Chevron's refinery in Salt Lake City was the first plant globally to implement this technology at a commercial scale, underscoring the company's dedication to innovation in this sector.

2. ExxonMobil Corporation

Headquarters: Spring, Texas, USA

ExxonMobil is a significant and impactful participant in the alkylate and isooctane industry. Its importance is strongly connected to its vast refining and chemical processes, alongside its rich background. ExxonMobil possesses a significant legacy of proficiency in alkylation technology. The firm possesses its established Sulfuric Acid Alkylation (SAA) technology, called ALKEMAX SAA, which it has been utilizing and enhancing. ExxonMobil has many refineries globally that include alkylation units. These units play an essential role in the downstream process, as light olefins react with isobutane to generate alkylate. Alkylate is a highly desirable gasoline blending ingredient due to its high-octane rating, low vapor pressure, and minimal sulfur and aromatic content.

3. Royal Dutch Shell plc

Headquarters: London, United Kingdom

Shell is a significant and impactful participant in the alkylate and isooctane industry. Its function is closely connected to its vast refining and chemical processes, along with its historical advancement of essential refining technologies. Shell has an extensive history of knowledge in refining and catalyst technologies. The Shell Catalysts & Technologies division within the company creates and supplies catalysts and process technologies for its own operations as well as for external clients. This encompasses catalysts for selective hydrogenation, a method utilized to produce feedstocks for alkylation units. The firm employs alkylation technology to transform light olefins and isobutane into this important fuel element, which is crucial for generating clean-burning, high-performance gasoline that complies with contemporary environmental regulations.

4. BP plc

Headquarters: St. James’s Square, England

BP's role in the alkylate and isooctane market is strengthened by its extensive refining capacity and its status as a key fuel supplier to worldwide markets. The company's emphasis on generating cleaner fuels, as an element of its wider energy transition approach, highlights the significance of alkylate in its product range. Its business model is vertically integrated, covering the full energy value chain from upstream (exploration and production) to downstream (refining and marketing) and petrochemicals. This unified setup enables BP to utilize its size and knowledge across different sectors.

5. TotalEnergies SE

Headquarters: Paris, France

TotalEnergies' refining system plays a vital role in the manufacture of alkylate. Alkylate is a prized gasoline blending component due to its high-octane rating, low vapor pressure, and minimal sulfur and aromatic content. This renders it a perfect element for creating clean-burning fuels that meet progressively stringent environmental standards. Isooctane is an essential element of alkylate and serves as a main reference fuel for octane ratings. TotalEnergies is a prominent European refiner, and its proficiency in refining is a fundamental aspect of its operations. The Additives and Fuels Solutions (AFS) division of the company specializes in creating high-performance additives and fuels, such as alkylate gasoline. TotalEnergies advocates alkylate gasoline as a more efficient, cleaner, and healthier option.

Are you ready to discover more about the alkylate and isooctane market?

The report provides an in-depth analysis of the leading companies operating in the global alkylate and isooctane market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Chevron Corporation

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- ExxonMobil Corporation

- Royal Dutch Shell plc

- BP plc

- TotalEnergies SE

- Valero Energy Corporation

- Phillips 66

- Marathon Petroleum Corporation

- Honeywell International Inc.

- LyondellBasell Industries N.V.

- Neste Oyj

- PetroChina Company Limited

- Sinopec Limited

- Reliance Industries Limited

- SK Innovation Co., Ltd.

- Idemitsu Kosan Co., Ltd.

- Eni S.p.A.

- OMV Group

- Petrobras

- HollyFrontier Corporation

- Others

Conclusion

The Alkylate and Isooctane Market Size is projected to nearly double in size from USD 23.86 billion in 2024 to USD 46.87 billion by 2035, driven by increasing demand for high-octane, cleaner fuels, and supported by environmental regulations and advancements in refining and fuel manufacturing technologies. The growth of the global automotive and aviation industries, along with stringent emission regulations, continues to propel the utilization of alkylate and isooctane as key components in fuel blending. The ongoing growth of the market will be influenced by efficiency advancements driven by technology, expansion into specialty chemicals and industrial uses, advancements in bio-based isooctane, and competitive conditions driven by mergers and acquisitions. Firms that emphasize innovation, adherence to regulations, and sustainable practices are most positioned to take advantage of the changing energy and mobility environment until 2035.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?