Top 15 Companies in Metals Market 2025: Strategic Overview and Future Trends (2024–2035)

RELEASE DATE: Sep 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

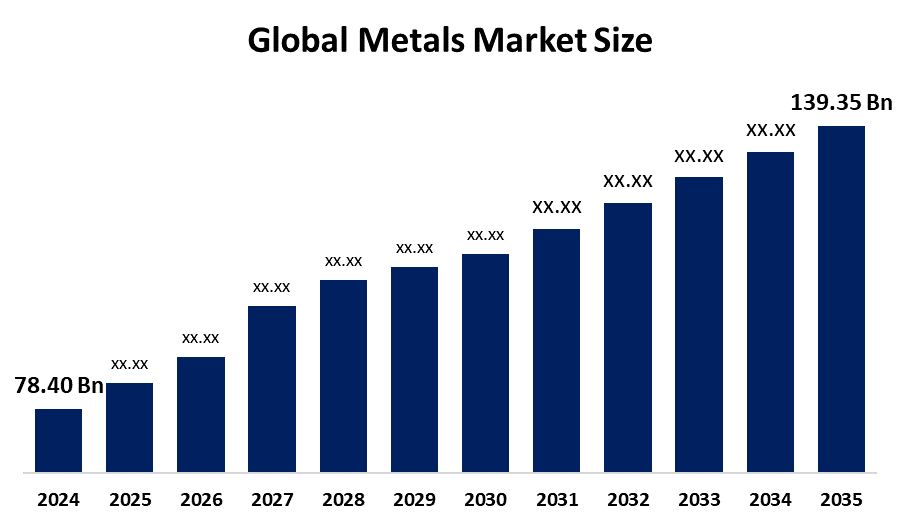

According to a research report published by Spherical Insights & Consulting, The Global Metals Market Size is projected To Grow from USD 78.40 Billion in 2024 to USD 139.35 Billion by 2035, at a CAGR of 5.37% during the forecast period 2025–2035. The market for Metals is growing demand due to supply chain optimization, technological improvements, growing investments in strategic and sustainable metal resources, and increasing demand from electric vehicles, renewable energy, and infrastructure development.

Introduction

The Global Market Size for extraction, manufacturing, trade and consumption of various metal items, including iron and non-Father metals, is known as metals market. Different types of industries have important raw materials, including manufacturing, electronics, aircraft, automobiles, construction and energy. The market is run through futures contracts on exchanges such as over-the-counter (OTC) deals, physical exchanges and Comex and London Metal Exchange (LME). The supply of global industries and the dynamics of demand is powered by many interconnected elements that run the market of metals. Metal efficiency and purposeness is promoted by manufacturing process innovations such as 3D printing and advanced metallurgy, which increase demand in high -tech industries such as electronics, aircraft and defense. Especially in emerging economies, industrialization and urbanization are the main drivers of manufacturing, infrastructure and demand for metals used in building.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights - Download the Brochure now and dive deeper into the future of the Metals Market.

Metals Market Size & Statistics

- The Market Size for Metals Was estimated to be worth USD 78.40 Billion in 2024.

- The Market Size is going to Expand at a CAGR of 5.37% between 2025 and 2035.

- The Global Metals Market Size is anticipated to reach USD 139.35 Billion by 2035.

- Asia Pacific is expected to generate the highest demand during the forecast period in the Metals Market

- North America Pacific is expected to grow the fastest during the forecast period in the Metals Market.

Regional growth and demand

North America is expected to grow the fastest during the forecast period in the Metals market.

Increased investments in car manufacturing, renewable energy projects and infrastructure upgrades in the US and Canada are the main drivers of North America's prosperity. The region's focus on technological development and the use of cutting-edge metal processing methods improves productivity and product quality, which helps to promote market growth.

Asia Pacific is expected to generate the highest demand during the forecast period in the Metals market.

Rapid urbanization, industrialization, and rising infrastructure spending are some of the forces propelling the Asia-Pacific area. Strong economic growth is being seen by nations like China, India, Japan, and Southeast Asia, which in turn is driving up demand for metals in a variety of industries, including manufacturing, electronics, automotive, and construction.

Top 10 Trends in the Metals Market

- Green Energy Transition

- AI and Digitalization

- Mergers & Acquisitions (M&A)

- Supply Chain Resilience

- Circular Economy and Recycling

- E-Waste Recycling

- Advanced Coatings

- Investment in Precious Metals

- Technological Advancements

- Deep-Sea Mining

1. Green Energy Transition

The push for renewable energy drives demand for critical metals such as copper, nickel, and cobalt for batteries, wind turbines, and other clean energy infrastructure.

2. AI and Digitalization

AI, machine learning, and cloud computing are being implemented to improve efficiency, reduce costs, enhance data analysis, and optimize processes in mining and metal production.

3. Mergers & Acquisitions (M&A)

The industry is seeing an increase in M&A activity, with the energy transition being a key motivator for consolidation.

4. Supply Chain Resilience

Geopolitical instability, commodity market volatility, and shortages are pushing companies to build more robust and resilient supply chains.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the Metals market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 10 Companies Leading the Metals Market

- Anglo American

- Hindalco

- Freeport-McMoRan Inc

- Tata Steel

- Glencore

- JSW Steel

- Newmont Corporation

- Jindal Steel

- Nmdc

- Others

1. Anglo American

Headquarters: U.K.

Anglo American is a British multinational mining and metals company, a major global producer of key "future-enabling" metals like platinum and copper, as well as iron ore and nickel, which are vital for decarbonization and economic development. With operations across six continents, the company focuses on responsible resource production, aiming to contribute to a sustainable future by meeting growing demand in sectors such as infrastructure, automotive, and electricity generation.

2. Hindalco

Headquarters: India

Hindalco is a major player in the global and Indian metals market, recognized as a leader in both aluminium and copper production and value-added products. As the flagship metals company of the Aditya Birla Group, Hindalco boasts a significant global footprint and a strong position across the integrated value chain, from mining to high-end rolling and recycling. The company is known for its sustainability leadership, particularly in the aluminium sector, and serves a wide array of industries including automotive, aerospace, packaging, and construction.

3. Freeport-Macmoran INC

Headquarters: U.S.

Freeport-McMoRan Inc. is a global mining company focused on copper, with significant operations in North America, South America, and Indonesia, also producing gold and molybdenum. It is the world's largest producer of molybdenum and operates the massive Grasberg mine in Indonesia, the largest gold mine globally. The company's business includes mining, smelting, and refining these metals, making it a major player in the global metals market, particularly for copper.

4. Tata Steel

Headquarters: India

Tata Steel is a top-tier, geographically diverse global steel producer with a 35 MTPA capacity across India, the Netherlands, the UK, and Thailand, and is the world's highest-valued brand in the Mining & Metals sector as per Brand Finance 2024. The company holds a major presence in India, with significant operations and captive mines, and aims for digital steel making and Net Zero Carbon by 2045. Tata Steel serves various market segments, including automotive, industrial products, and branded retail, and also handles logistics and supply chain management for raw materials like coal.

Are you ready to discover more about the Metals market?

The report provides an in-depth analysis of the leading companies operating in the global metals market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Anglo American

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Hindalco

- Freeport-McMoRan Inc

- Tata Steel

- Glencore

- JSW Steel

- Newmont Corporation

- Jindal Steel

- Nmdc

- Others

Conclusion

Based on the provided data, The Global Metals Market Size is a dynamic and expanding sector driven by several key factors. The market's growth is fueled by industrialization and urbanization, particularly in emerging economies, with significant contributions from sectors like manufacturing, electronics, and construction. Technological innovations, such as 3D printing and advanced metallurgy, are also increasing the utility and demand for metals in high-tech industries. The industry is currently undergoing a transformative period marked by major trends including the shift toward green energy, the integration of AI and digitalization, and a focus on building resilient supply chains. Regional growth patterns show that Asia Pacific is a major hub of demand, while North America is experiencing rapid expansion due to investments in key industries. The market is also seeing a rise in strategic activities like mergers and acquisitions, and an increased focus on the circular economy and recycling, all of which are shaping its future trajectory. Leading companies in the sector are adapting to these changes to capitalize on new opportunities.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Need help to buy this report?