Top 15 Companies in India Electric Vehicle In 2025 Watch List; Statistics Report (2024–2035)

RELEASE DATE: Jul 2025 Author: Spherical InsightsRequest Free Sample Speak to Analyst

Description

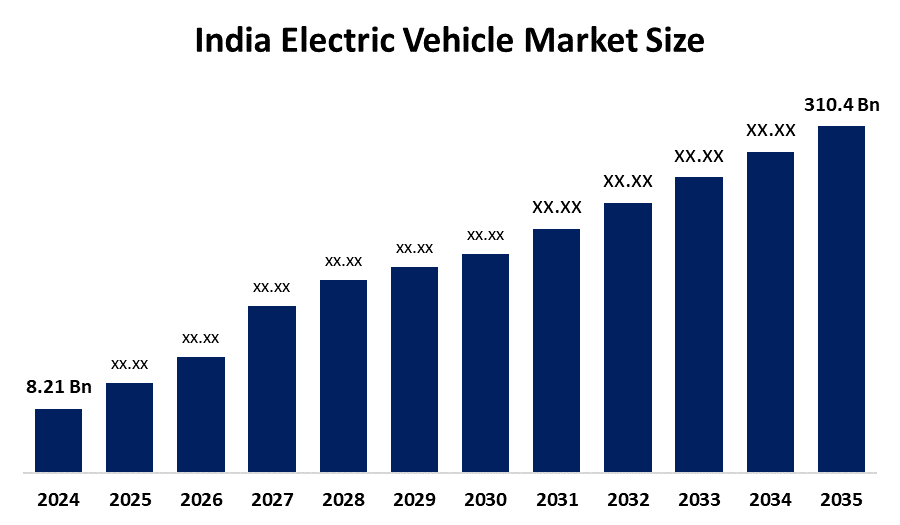

According to a research report published by Spherical Insights & Consulting, The India Electric Vehicle Market Size is Projected to Grow from USD 8.21 Billion in 2024 to USD 310.4 Billion by 2035, at a CAGR of 39.13% during the forecast period 2025–2035. Within the key factors boosting India's electric Vehicle Market share are the country's rapidly growing urbanization, expanding charging infrastructure, rising disposable incomes, growing demand for high-performance and fuel-efficient cars, growing public concerns about the environment, supportive government policies, and a strong desire for sustainable transportation options.

Introduction

distribution, and uptake of electric-powered vehicles throughout the nation is known as the India Electric Vehicle Market. Additionally, Innovation and market expansion are being fueled by rising investments from both domestic and foreign automakers. In addition, consumers' growing awareness of the long-term financial and environmental advantages of EVs is supporting the expansion of the electric vehicle market in India.

Navigate Future Markets with Confidence: Insights from Spherical Insights LLP

The insights presented in this blog are derived from comprehensive market research conducted by Spherical Insights LLP, a trusted advisory partner to leading global enterprises. Backed by in-depth data analysis, expert forecasting, and industry-specific intelligence, our reports empower decision-makers to identify strategic growth opportunities in fast-evolving sectors. Clients seeking detailed market segmentation, competitive landscapes, regional outlooks, and future investment trends will find immense value in the full report. By leveraging our research, businesses can make informed decisions, gain a competitive edge, and stay ahead in the transition toward sustainable and profitable solutions.

Unlock exclusive market insights—Download the Brochure now and dive deeper into the future of the India Electric Vehicle Market.

The Market for India Electric Vehicle was Estimated to be Worth USD 8.21 Billion in 2024.

The Market is Going to Expand at a CAGR 39.13% Between 2025 and 2035.

The India Electric Vehicle Market Size is anticipated to reach USD 310.4 Billion by 2035.

Uttar Pradesh is expected to generate the highest demand during the forecast period in the India electric vehicle market.

South India is expected to grow the fastest during the forecast period in the India electric vehicle market.

Regional growth and demand

South India is expected to grow the fastest during the forecast period in the India electric vehicle market. The integration of cutting-edge technologies, like integrated chargers in EVs, is one of the key factors driving the growth of the India electric vehicle market in South India, according to a report on the Indian electric vehicle market. The establishment of substantial operations by major manufacturers in the state has greatly aided in the growth of the local market.

Uttar Pradesh is expected to generate the highest demand during the forecast period in the India electric vehicle market. Growing interest in personal electric vehicles, extensive public transportation needs, and proactive government policies all support the state's drive toward cleaner mobility. From two-wheelers to commercial fleets, a mix of urban and semi-urban areas is encouraging adoption.

Top 10 India Electric Vehicle Trends

- Tax Incentives & Subsidies

- FAME II & PLI Scheme Impact

- Charging Infrastructure Growth

- Digital Integration via EV Super Apps

- Zero-Emission Freight Corridors

- State-Level EV Policies

- Rise of EV Manufacturing Hubs

- Affordable EV Models

- Safety & Regulation Enforcement

- PM E-DRIVE Scheme Expansion

- Tax Incentives & Subsidies

In India, tax breaks and subsidies are important factors in the uptake of EVs because they provide financial relief and increase accessibility. Under Section 80EEB, buyers can deduct up to RS 1.5 lakh from their income taxes for the interest paid on EV loans, and the GST rate on EVs is lowered to 5% from 28% for conventional cars. Many states also encourage adoption by waiving registration fees, reducing road taxes, and providing retrofit subsidies for cars that are already electric.

- FAME II & PLI Scheme Impact

The FAME II and Production Linked Incentive (PLI) programs, which provide financial incentives for EV purchases and domestic battery manufacturing, have greatly accelerated India's electric vehicle ecosystem. The PLI schemes encourage local production of advanced automotive components and battery cells, while FAME II supports demand creation through subsidies for electric buses, two-wheelers, three-wheelers, and public charging stations.

- Charging Infrastructure Growth

Strong central and state-level initiatives are driving the rapid expansion of India's EV charging infrastructure, with public charging stations increasing fivefold between FY22 and early FY25. To guarantee broad accessibility, government regulations require chargers every 3 km in cities and every 25 km along highways. Private investments, state EV policies, and programs like the Production Linked Incentive (PLI) for battery manufacturing all contribute to this growth by lowering the cost of EV ownership and reducing reliance on imports.

4. Digital Integration via EV Super Apps

India's electric mobility scene is undergoing a revolution thanks to digital integration through EV super apps, which provide a single platform for smooth user interaction. Under the PM E-Drive program, which is led by Bharat Heavy Electricals Limited (BHEL), the app allows for digital payments, real-time charger booking, energy usage tracking, and navigation support. It facilitates interoperability between various EV manufacturers and charging networks while improving accessibility, convenience, and transparency. This program speeds up the adoption of clean transportation, improves infrastructure deployment across the country, and makes EV ownership easier.

5. Zero-Emission Freight Corridors

India's Zero-Emission Freight Corridors are purposefully planned highway routes that use electric and hydrogen fuel cell trucks to decarbonize logistics. Battery swap stations and refueling facilities are installed in these corridors to facilitate smooth long-distance transportation with no tailpipe emissions.

Empower your strategic planning:

Stay informed with the latest industry insights and market trends to identify new opportunities and drive growth in the India electric vehicle market. To explore more in-depth trends, insights, and forecasts, please refer to our detailed report.

Top 16 Companies Leading the India Electric Vehicle Market

- Tata Motors

- Mahindra & Mahindra

- MG Motor India

- Hyundai Motor India

- BYD India

- Ola Electric Mobility

- Ather Energy

- Hero Electric

- TVS Motor Company

- Bajaj Auto

- Greaves Electric Mobility

- Okinawa Autotech

- Electrotherm India

- JBM Group

- Piaggio Vehicles

- Atul Auto

- Others

1. Tata Motors

Headquarters – Mumbai, Maharashtra, India

Automobiles are made and distributed by Tata Motors Ltd. Designing, producing, and marketing automobiles, trucks, buses, utility vehicles, and defense vehicles are among the company's primary operations. Indigo, Manza, Vista, Xenon, and Prima are some of Tata Motors' well-known brands. From individual use to business applications across multiple industries, the company's products meet a wide range of consumer needs. It also produces engines for use in ships and industry.

2. Mahindra & Mahindra

Headquarters – Worli, Mumbai, Maharashtra, India

The flagship business of the Mahindra Group, Mahindra & Mahindra Ltd. (M&M), is a multifaceted enterprise. Major industries that the company operates in include automotive, aerospace, agribusiness, aftermarket, information technology, consulting, components, clean energy, financial services, defense, real estate and infrastructure, industrial and construction equipment, two-wheelers, retail, steel, hospitality, IT services, automotive parts, aerostructures, boats, investments, and logistics. The United States, France, Finland, India, Japan, Africa, China, and Australia are among its manufacturing locations.

3.MG Motor India

Headquarters – Gurugram, Haryana, India

A joint venture between the JSW Group and SAIC Motor, MG Motor India is currently known as JSW MG Motor India Pvt Ltd. Its primary objective is to manufacture and market passenger cars under the British MG brand. The company prioritizes smart mobility, sustainability, and digital innovation while providing a range of internal combustion and electric vehicle models. A state-of-the-art production facility and an expanding lineup of hatchbacks and SUVs designed specifically for the Indian market are part of its operations. MG Motor India is strategically involved in the development of tech-enabled automotive solutions and clean transportation.

4.Hyundai Motor India

Headquarters – Kancheepuram District, Tamil Nadu, India.

The first of the leading producers of passenger cars in India is Hyundai Motor India, a fully owned subsidiary of Hyundai Motor Company, based in South Korea. For Indian customers, the company provides a wide range of hatchbacks, sedans, SUVs, and electric cars. It is essential to Hyundai's worldwide export strategy since it supplies automobiles to markets in South Asia, the Middle East, and Africa. Hyundai Motor India supports the nation's shift to smart mobility solutions by emphasizing customer-centric innovation, advanced automotive technologies, and sustainable manufacturing.

5.BYD India

Headquarters – Sriperumbudur Taluk, Kanchipuram District, Tamil Nadu, India

BYD Company Limited, a world leader in electric vehicles and renewable energy solutions, owns BYD India as a subsidiary. The company specializes in producing and assembling material handling equipment, commercial EVs, and electric passenger cars specifically for the Indian market. With innovations like the Blade Battery and e-platform 3.0, which improve safety, efficiency, and range, it strategically contributes to the advancement of clean mobility. In order to help the nation move toward more environmentally friendly modes of transportation and lower carbon emissions, BYD India also backs B2B fleet solutions and the electrification of public transportation.

Are you ready to discover more about the India electric vehicle market?

The report provides an in-depth analysis of the leading companies operating in the India electric vehicle market. It includes a comparative assessment based on their product portfolios, business overviews, geographical footprint, strategic initiatives, market segment share, and SWOT analysis. Each company is profiled using a standardized format that includes:

Company Profiles

- Tata Motors

- Business Overview

- Company Snapshot

- Products Overview

- Company Market Share Analysis

- Company Coverage Portfolio

- Financial Analysis

- Recent Developments

- Merger and Acquisitions

- SWOT Analysis

- Mahindra & Mahindra

- MG Motor India

- Hyundai Motor India

- BYD India

- Ola Electric Mobility

- Ather Energy

- Hero Electric

- TVS Motor Company

- Bajaj Auto

- Greaves Electric Mobility

- Okinawa Autotech

- Electrotherm India

- JBM Group

- Piaggio Vehicles

- Atul Auto

Conclusion

The market for electric vehicles in India is changing dramatically due to encouraging government regulations, advancements in technology, and growing consumer demand for environmentally friendly transportation. Adoption is accelerating across segments due to key trends like digital integration, tax incentives, and zero-emission freight corridors. To increase their market share, leading businesses are making investments in clean energy, smart infrastructure, and domestic manufacturing. State-level programs and growing EV hubs in Tamil Nadu, Maharashtra, and Haryana are driving regional growth. India is positioned to lead the world in electric mobility as the ecosystem develops.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter

Need help to buy this report?